updated 2011

advertisement

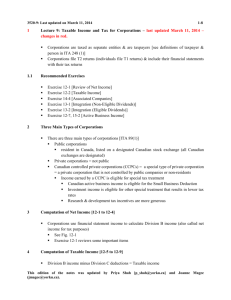

3520-9: Last updated on 9/13/2011 1 Lecture 9: Taxable Income and Tax for Corporations 1.1 There are three main types of corporations [ITA 89(1)] Public corporations resident in Canada, listed on a designated Canadian stock exchange (all Canadian exchanges are designated) Private corporations = not public Canadian controlled private corporations (CCPCs) = a special type of private corporation = a private corporation that is not controlled by public companies or non-residents Income earned by a CCPC is eligible for special tax treatment Canadian active business income is eligible for the Small Business Deduction Investment income is eligible for other special treatment that results in lower tax rates Research & development tax incentives are more generous Computation of Net Income 4 Exercise 12-1 [Review of Net Income] Exercise 12-2 [Taxable Income] Exercise 14-4 [Associated Companies] Exercise 13-1 [Integration (Non-Eligible Dividends)] Exercise 13-2 [Integration (Eligible Dividends)] Exercise 12-7, 15-2 [Active Business Income] Three Main Types of Corporations 3 Corporations are taxed as separate entities & are taxpayers [see definitions of taxpayer & person in ITA 248 (1)] Corporations file T2 returns (individuals file T1 returns) & include their financial statements with their tax returns Recommended Exercises 2 1-8 Corporations use financial statement income to calculate Division B income (also called net income for tax purposes) See Fig. 12-1 Exercise 12-1 reviews some important items see CTP 12-1 to 12-4 Computation of Taxable Income Division B income minus Division C deductions = Taxable income The 3 major Division C deductions for corporations earning income in Canada are: 3520-9: Last updated on 9/13/2011 4.1 ITA 112 This deduction means that dividends between Canadian corporations are essentially tax-free and this prevents double taxation see CTP 12-10 to 12-12 Loss Carryovers 5 ITA 110.1(1): limited to 75% of net income The rules are the same as for individuals except that donations by a corporation are eligible for a taxable income (division C) deduction rather than a tax credit This is because corporations are subject to a flat tax rate rather than progressive tax rates All unclaimed donations can be carried forward 5 years Dividends from Taxable Canadian Corporations 4.3 Charitable donations [ITA 110.1(1)] Dividends from taxable Canadian corporations [ITA 112] Loss carryovers [ITA 111] See Fig. 12-2 see CTP 12-5 to 12-9 Charitable Donations 4.2 2-8 ITA 111: the rules are the same as for individuals the two most important carryovers are Non capital losses carry back 3 years, carry forward 20 years Net capital losses carry back 3 years, carry forward indefinitely. Can only be used to offset taxable capital gains see CTP 12-28 to 12-34 Federal Tax Payable The following table sets out the general corporate tax rate for business income in 2011 and the lower rate for the first $500,000 of active business income earned by Canadian controlled private corporations (CCPCs). The actual provincial rates vary depending on the province see CTP 12-49 to 12-78 see tables and example especially at 12-54, 12-56, 12-71 3520-9: Last updated on 9/13/2011 3-8 For $100 of income General Eligible for rate for Small Business business Deduction income Basic or general corporate rate [ITA 123] 38 Federal abatement (for income subject to provincial taxes) (10) [ITA 124, Reg. 400-402] 28 Small Business Deduction 38 (10) 28 (17) General rate reduction (11.5) Non-business or business foreign tax credit (FTC) (FTC) Political contributions credit [ITA 127(3)] (PTC) (PTC) Investment tax credit [ITA 127(5)] (ITC) (ITC) 16.5 11 Note: Ontario’s general corporate tax rate is scheduled to decline as follows: 11.5 11% on July 1, 2012; and 10% on July 1, 2013 4.5 Provincial tax (assumed to be Ontario, on or after July 1, 2011); see http://www.rev.gov.on.ca/english/taxes/cit/index.html A daily pro-ration must be done for year-ends that straddle July 1, 2010 Total tax 5.1 28 15.5 Basic Corporate Rate under ITA 123 and General Rate Reduction under ITA 123.4(2) Basic rate = 38% x taxable income Tax rates have been reduced federally to make Canadian taxes more competitive. This reduction has been accomplished by subtracting from the basic tax rate the general rate reduction 3520-9: Last updated on 9/13/2011 4-8 5.2 Federal Abatement 5.3 = a reduction = 10% of taxable income “earned in a province” [ITA 124] Reason the 10% makes room for provincial income taxes which apply to this income the formula for calculating “taxable income earned in a province” is in Part IV of the Regulations (Reg. 400-402) For the purposes of this course all of the company’s taxable income is assumed to be earned in a province Small Business Deduction (SBD) 6 The general rate reduction is 11.5% in 2011. The general rate reduction is scheduled to increase to 13% effective Jan. 1, 2012 CCPCs earn 2 types of income that do not qualify for the 11.5% general rate reduction because they already benefit from other preferential corporate tax treatment Active business income eligible for the 17% small business deduction (discussed later) Investment income (e.g. interest income, rental income and taxable capital gains) earned by a CCPC and subject to refundable tax provisions (not covered in this course; covered in ADMS 4562) ITA 125 the small business deduction = 17% of the first $500,000 of Canadian active business income earned by a CCPC. Prior to January 1, 2009 the business limit was $400,000 The logic is that incorporated small businesses have a hard time getting bank loans to finance their businesses Therefore, the income tax rate is lower to allow more retained earnings to be reinvested in the business The Small Business Deduction is 17% of the least of the following 3 amounts: (1) Canadian active business income (ABI) Objective = Only Canadian ABI is eligible, not foreign ABI, not incorporated employment income (“personal services business”), not investment income (2) Taxable income (with an adjustment for foreign income, not covered in this course) Objective = Limited to taxable income (which will only be < Canadian active business income if there are non-capital losses claimed) (3) Business limit, which is $500,000 (and which must be shared by associated corporations) The small business deduction is also restricted to small CCPCs (small based on their balance sheet, discussed in ADMS 4562) Association Rules 3520-9: Last updated on 9/13/2011 6.1 It is important to determine whether CCPCs are “associated” because associated CCPCs must share the $500,000 annual business limit [ITA 125(3)] This means that taxpayers cannot set up > 1 corporation to multiply your access to the small business deduction see CTP 14-35 to 14-46 Related Persons under ITA 251 6.2 5-8 ITA 251(2)(a) Related = individuals connected by blood, marriage, adoption Related by blood = horizontal (i.e., parents, grandparents, children, grandchildren etc.) or vertical relationship (i.e., brothers and sisters) (not aunts, uncles, nieces, nephews, cousins) [ITA 251(6)(a)] Related by marriage = spouse (or common law partner), parents-in-law, siblings-in-law, children in law, etc. [ITA 251(6)(b)] ITA 251(2)(b) A corporation & a person are related if the person controls the corporation ITA 251(2)(c)(i) Two corporations are related if they are controlled by the same person or group of persons Associated Corporations: Corporations are Associated If 6.2.1 One corporation controls the other see Figure 14-1 [ITA 256(1)(a)] Example in text: If a taxpayer owns A Ltd. and A Ltd. owns 75% of B Ltd. then A Ltd. and B Ltd. are associated Control typically means ownership of more than 50% of the voting shares of the corporation 6.2.2 Two companies are controlled by the same person or group of persons see Figure 14-2 [ITA 256(1)(b)] Example in text (control by same person): If Mr. A owns 75% of A Ltd. and 75% of B Ltd, the two corporations are associated Another example (control by a group of persons): The group of Mike and Ken controls 2 companies. M Ltd. is owned 10% by Mike and 45% by Ken. K Ltd. is owned 20% by Mike and 35% by Ken. Note how the group of Mike and Ken together own more than 50% of the shares of M Ltd and K Ltd. You may wish to draw a diagram to assist you (corporations are typically drawn as rectangles) for group definition (= 2 or more people who own shares in the corporation) see ITA 256(1.2)(a) 3520-9: Last updated on 9/13/2011 6-8 6.2.3 Two related persons control two different corporations. One person owns 25% or more of each corporation see Figure 14-3 [ITA 256(1)(c)] Example in text: Mr. A and Mrs. A each control their own company. The husband also owns 30% of the shares of the wife's company The “25% or more” cross-ownership rule is just an arbitrary rule that can make corporations controlled by related persons associated If there had been < 25% cross ownership, Mr. and Mrs. A’s corporations would have still been related, but they would not have been associated and therefore would each have a $500,000 annual business limit available (for the small business deduction) 6.2.4 Shares owned by a minor child are deemed to be owned by the parent(s) ITA 256(1.3) Example: Mr. A owns a company. His 14 year old daughter owns another company. Mr. A is deemed by ITA 256(1.3) to own all of his daughter’s shares (for purposes of the associated corporation rules) This rule was introduced to close a loophole (taxpayers using their children to own shares to get around the association rules) 6.2.5 Anti-avoidance rule 7 Two companies are deemed to be associated if one of the main reasons for their separate existence was to reduce tax (e.g., by accessing another small business deduction) [ITA 256(2.1)] Example: Mr. A owns a company that owns retail stores. The operations of the newest store are put in a separate company owned by Mrs. A. The main reason for doing this is to be able to access another small business deduction. The companies can be deemed to be associated if they are not already associated Integration and Business Income The term “integration” means that you pay the same amount of income tax whether you incorporate or not It also means that you pay the same amount of income tax if you pay yourself with salary or dividends Corporate tax rates that will make integration effective depend on whether the dividends are eligible or non-eligible For eligible dividend with a 41 percent gross up, the required rate is approximately 29 percent For non-eligible dividend with a 25-percent gross up, the required rate is 20 percent Discussed in ADMS 4562 3520-9: Last updated on 9/13/2011 8 Limited liability for shareholders of a corporation If the income is eligible for the 17% small business deduction, there is a big deferral of tax. If not, the deferral is small Availability of $750,000 QSBC lifetime capital gains exemption for shares of a qualified small business corporation Remuneration options if shareholder = employee (tax-free benefits, accrued bonus, pension, company cars, etc.) Possible income splitting with family members as shareholders and employees payment of reasonable salaries to employees payment of dividends to shareholders who may pay tax at lower rates (dividends are subject to kiddie tax if shareholders are minors) Anonymity of investors on kiddie tax see CTP 11-116 to 11-130 Disadvantages (Tax and Non-Tax) 9 see CTP 15-1 to 15-11 Advantages (Tax and Non-Tax) 8.2 see CTP 13-1 to 13-20 Incorporating a Small Business 8.1 7-8 Losses are trapped in the corporations and cannot be used by the shareholders. Can only be carried forward or back against the corporation’s taxable income Cost to set up and maintain (incorporation costs, ongoing annual legal, accounting and other costs) Bonusing Down (Active Business Income) pay a bonus to reduce corporate taxable income to amount eligible for SBD (i.e., $500,000) but gives rise to payroll taxes (since a bonus is employment income for the employee who receives the bonus) employee can loan back amount of bonus (on a secured basis) if the money is needed in the corporation payment of some salary makes individual eligible for CPP and RRSP contributions RRSPs are important: tax-free compounding, $2,000 pension credit on RRSP annuity income/RRIF (if 65 or older) salaries and bonuses must be reasonable [ITA 67] given the responsibilities assumed and duties performed - therefore income-splitting with family members is limited by the reasonability test 3520-9: Last updated on 9/13/2011 8-8 accrued bonuses must be legal obligations to be deductible and must be paid within 180 days of the company’s year-end [ITA 78(4)] The kiddie tax was introduced in 1999 to stop people from saving tax by using minor children as shareholders in their incorporated small businesses Each family member can still use the CG exemption to shelter any CG when they sell the shares (if the shares are QSBC shares) see CTP 15-49 to 15-54, especially example at 15-50