to full article

advertisement

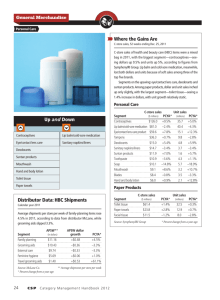

General Merchandise By Samantha Strong Murphey Loyalty Gets Personal Vibrant loyalty programs are a crucial part of another prepaid trend: customers increasingly Tre nd h s to Watc purchasing gift cards for personal use. If you have a rewards program in place, “a customer who needs to buy a new window for their house will come in and buy a $300 Home Depot gift to buy the window for them- $155.43 selves,” says Frank Squilla, The average total amount senior vice president of sales shoppers will spend on gift for Atlanta-based InComm. cards in 2012, representing They get points toward free a 6.7% increase, according gas and you get a high gift- to a National Sales Federa- card sale. tion survey. Shared by Mintel card from you and then use it “If you, as a retailer, can cre- International, the survey says ate a reason why people would men will spend an average of buy a product for personal use,” $164.24, while women are GPRs are H-O-T Squilla says, “you’ve changed expected to spend an average New banking rules are paving the way for general-purpose the entire model.” of $147.06. reloadable (GPR) market expansion. “All the major banks and even the government is getting involved,” Squilla says. “And PayPal has developed a GPR pro- Taking It Online gram launching this year that allows people to access their There’s been some talk about prepaid- PayPal account and now pay for offline goods in retail stores.” wireless customers migrating online, but But with hundreds of new products in the marketplace, how according to Squilla, that’s not quite right. do c-store owners take best advantage of the opportunity? “It’s not that customers are migrating Retailers need to have their POS systems equipped with swipe online,” he says. “It’s that there’s a new reload technology that allows customers to reload variable prepaid customer developing. Former post-paid, credit-worthy customers are now converting because the deals and offers are becoming so compelling [that] it’s worth it to not have a long- 62% term commitment with a contract.” This new online customer base is opening up an opportunity for retailers to create a Web presence around their loyalty programs. “You’ve got to give online customers incentive to connect to you online,” Squilla says. “Loyalty points are the way to do that.” 10 CSP C a t e g o ry M a n a g e m e n t H a n d b o o k 2012 denominations—any amount to any card. The percentage of general-purpose reloads that are estimated to originate from retail-store locations, according to Mercator Advisory Group. This can translate to upsell opportunities and increased foot traffic for retailers who focus on this segment. 6 in 10 Bad Allergies = Sales Opportunity Going Private With an unseasonably mild winter behind us, many doctors are In the past two years, product predicting the worst allergy season in more than 10 years. recalls and supply/shipping The number of respondents “Proactive retailers and wholesalers will want to be prepared issues have been rampant, to a 2010 Mintel survey who and increase their inventory of allergy-related products to include leaving c-stores and other have suffered with a cough, counter displays, clip strips and recommended allergy over-the- retailers with empty shelves cold or sore throat who agree counter (OTC) medication within their health and beauty care and lost sales. Looking for- with the claim that “national (HBC) set to optimize sales,” says Tom LaManna, director of mar- ward, category mangers must brands are not worth the extra find ways to protect them- expense when private label selves against such losses. works just as well.” Nearly six keting for Convenience Valet, Melrose Park, Ill. Beth Noteman of Lil’ Drug Store Products, Cedar Rapids, Iowa, reminds retailers that in Convenience Valet’s execu- in 10 respondents agree that cases like this, secondary displays are a great tive vice president of sales, national allergy brands are also way of generating incremental business. Jim Blosser, emphasizes that not worth the extra expense, national OTC brands are pow- when private label works as erful and worth the hassle. well, Mintel reports. “Whenever anyone says ‘secondary display’ to a c-store owner, they all cringe and say, ‘I don’t have space!’ ” Noteman says. “But there “We’re still very hopeful are compact solutions out there.” that the manufacturers are going to come through,” he says. “They are reviewing operating procedures and making necessary changes to processes to ensure they’ve done everything possible One to six times to avoid supply interruptions in the future.” Noteman says keeping in close contact with suppliers may According to a consumer survey by Mintel, most respon- seem like elementary advice, but it’s also extremely important. dents who take allergy, sinus, cold and flu remedies say they “Certainly, it’s best to have information from the source about an have used them one to six times in the past 12 months. out-of-stock or recall situation,” she says. Nearly one-third of respondents say they use allergy remedies She also points out that these supply issues, compounded 13 or more times a year. by the economic recession, are creating an opportunity for private-label growth. “When the right national brands are available, as a category Energy’s Growth Spurt manager, certainly that’s the way to go,” Noteman says. “But By all accounts, the energy category is explod- in the absence of those brands, something has to fill the void.” ing, and c-store owners need to be ready for it. Step one? Consider alternative formats, in addition to shots. Sheets Energy Strips (much Condoms’ Continued Growth like Listerine PocketPaks), which are distributed C-store unit sales of male contracep- by Convenience Valet, and energy inhalers are tives rose 5% in the 52 weeks ending emerging alternatives. Dec. 25, 2011, according to figures from SymphonyIRI, while Nielsen shows sales up 1.7% “Savvy retailers follow these new item trends and aid in creating excitement at the in the 52 weeks ending Dec. 24. Much of this is being retail level,” LaManna says. driven by new products; according to Dave Harrington, vice 14.6% president of special markets for Ansell Sexual Wellness Division USA, Red Bank, N.J., non-latex products are a growth area for Increase in c-store unit sales of energy the segment. Consumer research firm Mintel reports that more shots in the 52 weeks ending Dec. 25, 2011, according to than 30% of condom users say they would like to try new or SymphonyIRI figures. different types, with men and younger respondents the most likely to make this claim. CSP C ategory M anagement H andbook 2012 11