DCBA2015Plan - Destination Cape Breton Association

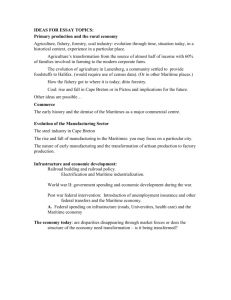

advertisement