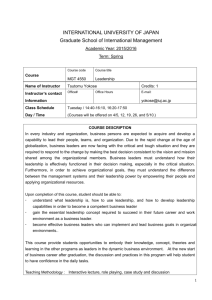

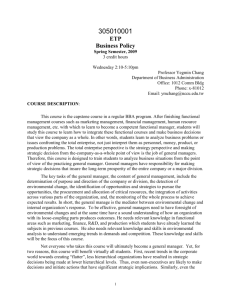

Case Map for Foundations of Finance, 7/e

advertisement

Case Map for Foundations of Finance, 7/e By Arthur J. Keown, Jr., John D. Martin, and J. William Petty This case map was created by textbook authors Keown, Jr., Martin, and Petty. It was designed to aid you in choosing relevant cases and articles related to the topics covered in each chapter of the book. Part 1 The Scope and Environment of Financial Management Part 2 Valuation of Financial Assets Chapter 5 The Time Value of Money Chapter 1 An Introduction to the Foundations of Financial Management 5863BC The Time Value of Money: Calculating the Real Value of Your Investment, HBS 9-406-028 Veridian: Putting a Value on Values, HBS UVA-F-1517 Interest Rates, Market Pricing, and Compounding, DARDEN Chapter 2 The Financial Markets and Interest Rates Chapter 6 9B08N014 The 2007–2008 Financial Crisis: Causes, Impacts and the Need for New Regulations, IVEY The Meaning and Measurement of Risk and Return 9B08N020 Alex Sharpe’s Portfolio, IVEY Chapter 7 Chapter 3 Understanding Financial Statements and Cash flows The Valuation and Characteristics of Bonds 9-201-101 Bond Math, HBS 9-205-008 Note on Bond Valuation and Returns, HBS 3215 Lyons Document Storage Corporation: Bond Accounting, HBS UVA-C-2255 An Overview of Financial Statement Analysis: The Mechanics, DARDEN 9-195-177 Financial Statement Analysis, HBS Chapter 4 Evaluating a Firm’s Financial Performance Chapter 8 The Valuation and Characteristics of Stock R0910L The Five Traps of Performance Measurement, HBR 9B06N009 Valuing Wal-Mart Stock, IVEY 9-100-002 Measuring Interim Period Performance, HBS Chapter 9 The Cost of Capital 9-298-101 Marriott Corporation: The Cost of Capital, HBS 4129 Midland Energy Resources, Inc.: Cost of Capital, HBS 9-292-011 Pioneer Petroleum, HBS PEARSON CUSTOM LIBRARY BUSINESS Case Map for Foundations of Finance, 7/e, continued Part 3 Investment in Long-Term Assets Part 5 Chapter 10 Capital-Budgeting Techniques and Practice Working-Capital Management and International Business Finance 9-208-046 Stryker Corporation: Capital Budgeting, HBS Chapter 14 Short-Term Financial Planning 9-292-140 Arundel Partners: The Sequel Project, HBS 92106 Emerson Electric: Consistent Profits, Consistently, HBR Chapter 11 Cash Flows and Other Topics in Capital Budgeting 9-187-038 Hanson Ski Products, HBS 9-206-028 Calculating Free Cash Flows, HBS Chapter 15 Working-Capital Management 9-291-028 Valuation and Discounted Cash Flows, HBS 9-201-029 Part 4 Capital Structure and Dividend Policy Chapter 16 Current Asset Management Chapter 12 Determining the Financing Mix 4040 Blaine Kitchenware, Inc.: Capital Structure, HBS KEL082 Bed Bath & Beyond: The Capital Structure Decision, KELLOGG 9-893-003 Dell’s Working Capital, HBS L.L. Bean, Inc., HBS Chapter 17 International Business Finance 9-709-050 The Rejuvenated International Monetary Fund, HBS Chapter 13 Dividend Policy and Internal Financing 9-295-059 Dividend Policy at FPL Group, Inc. (A), HBS 9-209-004 Progressive Corporation: Variable Dividends, HBS PEARSON CUSTOM LIBRARY BUSINESS