ACCT 495 Case Studies in Accounting Syllabus

advertisement

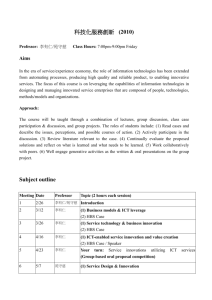

ACCT 495 – Case Studies in Accounting Class: Winter 2016 Instructor: Dr. NJ Kim, CPA Office Hours: T&R 9:00-9:40 am, R 4:40 – 6:00 pm Office: STF 505 E-Mail: nkim2@calstatela.edu Web: http://instructional1.calstatela.edu/nkim2/ Texts: Required: Note: 1. Intermediate accounting textbook, Spiceland 7th ed. 2. Deloitte and Touche (D&T): The Robert M. Trueblood Accounting and Auditing Case Study Series.* 3. Harvard Business School (HBS) Cases* 4. AICPA Professor/Practitioner Cases* * Cases and reading materials are available at the Student Bookmart on Eastern Ave. Reference: Accounting Standards Codification http://www2.aaahq.org/ascLogin.cfm Username: AAA51950 Password: 6FCbv9T Class Objectives: Through the use of high quality real-world cases involving current topics in financial accounting, students are expected to be trained to identify issues, weigh relevant factors, make informed decisions, and defend their positions. Learning Objectives: 1. Learn to do research on accounting cases. 2. Analyze accounting cases. 3. Apply appropriate accounting principles and concepts to cases. 4. Learn how to write case reports. 5. Write case reports 6. Discuss cases in class 7. Present cases in class Grading: Group Case Presentation & Paper Mid-Term Exam Class Participation Case assignments Total 20% 40 20 20 100% Tentative Schedule Week 1: Introduction Assignment: Read Ch. 5 Do Ch.5 Cases: 1, 3 & 4 Week 2 : Revenue Recognition Principle I Assignment: Read Staff Accounting Bulletin No. 101. (SAB 101 available at WWW.SEC.GOV) Read FASB Accounting Standards Update No. 2014-09 (Available at WWW.FABS.ORG) Do Ch. 5 Cases 11 & 12, CPA/CMA questions Week 3: Revenue Recognition Principle II Assignment: Read Ch. 15 Do Ch. 15 Cases 1 & 6, CPA/CMA questions Do D & T Case 15 Week 4: Accounting for Leases Week 5: Midterm Exam and Group Meeting Week 6: Revenue Recognition Assignment: 1. Read HBS Case: Accounting for iPhone at Apple Inc. Write a 2-5 pages (single space) on the followings: i. What is subscription accounting? ii. Why did Jobs want to provide non-GAAP accounting data? iii. Under the new ASC 606, how should Apple recognize the revenue of iPhone sales? iv. Do all questions asked at the end of the case. Week 7: Revenue recognition Assignment: 1-1. Read HBS Case: Microsoft’s Financial Reporting Strategy Write a 2-5 pages report on the followings: i. Why did Microsoft want to measure revenue conservatively? ii. Why did the SEC investigate the accounting practice of Microsoft? iii. Under the new ASC 606, how should Microsoft recognize the revenue of its software sales? iv. Do all question asked at the end of the case. 1-2. Read D&T Case 99-7 and write your solution on the question. Assignment: 2-1. Read IVEY Case: Groupon and the SEC Write 2-5 pages report on the questions asked at the end of the case. 2-2.Read D&T Case 96-1 and write your solution on the questions. Week 8: Depreciation Policies Assignment: 1-1. Read HBS Case: Depreciation at Delta Air Lines and Singapore Airlines. Write a 2-5 pages response to the questions of the case. 1-2. Read D&T Case 22 and write your solution on the questions. Week 9: Fraudulent Financial Reporting and Ethics Assignments: 2-1. Read HBS Case: Accounting Fraud at WorldCom Write a 2-5 pages report on the followings: i. What went wrong with the financial reporting of WorldCom? ii. What could be done to prevent similar occurrences in the future? 2-2. Read AICPA Case 96-07 and write your solution on the questions of the case. Week 10: Fraudulent Financial Reporting and Ethics-continued Week 11: Final exam