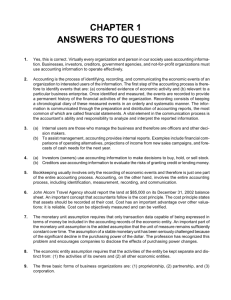

Accounting in Business - McGraw Hill Learning Solutions

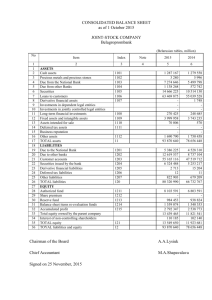

advertisement