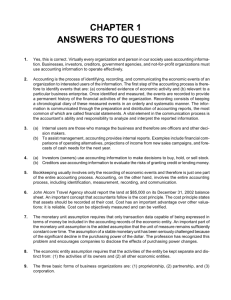

Accounting in Business - McGraw Hill Learning Solutions

advertisement