Navy College Progrm Distance Learning Partnership Degree

advertisement

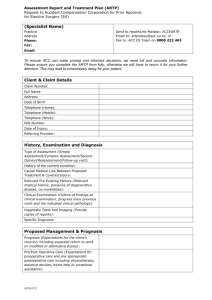

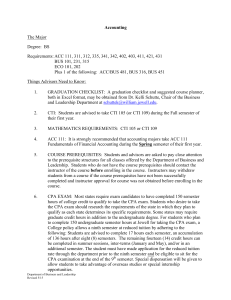

Navy College Progrm Distance Learning Partnership Degree Program Two Year Degree Comple:on Schedule Business Technology: Accounting Associate of Applied Science Degree: • Accoun:ng (203) The Accounting program offers three levels of programs, all built on the solid foundation of courses in the Career Studies Certificate program. The programs prepare students for entry-level positions or help students update their skills and knowledge if they are already working in the accounting field. The Career Studies Certificate program prepares students for employment as a bookkeeper or as an accounting or auditing clerk. The same hours meet some of the accounting educational requirements for students who have already earned a baccalaureate degree and wish to sit for the Certified Public Accountant (CPA) exam. These classes also serve as a unique review mechanism for CPA candidates. Additionally, they meet federal government guidelines for accounting coursework to qualify for positions or promotion in the government workforce. Twenty-six credit hours of accounting coursework give a student the necessary accounting skills to sit for the Accountancy and Taxation Exam (ACAT), which is administered twice a year. Successful completion of the exam enables students to use the description: “Accredited in Accountancy.” A cooperative education course enables students to earn academic credit while gaining work experience at local sites. SEMESTER 1 (BASED ON A FALL SEMESTER START) Course Number Course Title Credits ACC 211 Principles of Accounting I 3 BUS 100 Introduction to Business 3 ENG 111 College Composition I 3 ITE 115 Introduction to Computer Applications and Concepts 4 MTH 121 or higher SDV 100 Fundamentals of Mathematics 3 College Success Skills 1 SEMESTER TOTAL Prerequisite Schedule Notes 16 Weeks Placement 2nd 8 Weeks 6 1st 8 Weeks 5 Waived 2 16 Weeks 5 Waived 2 Placement 17 SEMESTER 2 Course Number Course Title Credits Prerequisite Schedule ACC 212 Principles of Accounting II 3 ACC 211 16 Weeks ACC 215 Computerized Accounting 3 ACC 211 1st 8 Weeks BUS 125 Applied Business Mathematics 3 MTH 121 or higher 1st 8 Weeks BUS 200 Principles of Management 3 BUS 100 2nd 8 Weeks ECO 120 Survey of Economics (or ECO 201 or ECO 202) 3 2nd 8 Weeks Humanities Elective 3 2nd 8 Weeks Notes 4 6 2,5 SEMESTER TOTAL 18 SEMESTER 3 Course Number Course Title Credits Prerequisite Schedule BUS 241 Business Law I 3 ACC 221 Intermediate Accounting I 4 ACC 212 16 Weeks ACC 231 Cost Accounting I 3 ACC 212 1st 8 Weeks ACC 261 Principles of Federal Taxation I 3 2nd 8 Weeks Business Elective 3 2nd 8 Weeks SEMESTER TOTAL Notes 1st 8 Weeks 3,6 16 SEMESTER 4 Course Number Course Title Credits Prerequisite Schedule ACC 222 Intermediate Accounting II 4 ACC 212 16 Weeks ACC 241 Auditing I 3 ACC 212 1st 8 Weeks ACC 297 3 Cooperative Education in Accounting (or Business Elective ) 3 BUS 220 Introduction to Business Statistics 3 Health/Physical Education Elective2 SEMESTER TOTAL 2 TOTAL MINIMUM CREDITS 2nd 8 Weeks MTH 121 or higher Notes 3,6 16 Weeks Waived 2 15 66 NOTES 1 ITE 115 satisfies the college’s computer competency requirement for graduation. 2 Eligible courses are listed in the current TCC catalog. Students should consult an academic advisor or counselor to choose the appropriate course(s). 3 Business electives include courses which have the following prefix: ACC, ACQ, AST, BUS, ECO, FIN, GIS, HRI, ITD, ITE, ITN, ITP, LGL, MKT, and REA. 4 Students with a baccalaureate degree who wish to complete requirements to sit for the Certified Public Accountant (CPA) examination must take BUS 241. Those who are employed in government positions who require college credit in accounting for promotion or those seeking government employment and other students should take ACC 215. 5 CLEP or DSST credit may be applied, with appropriate documentation. 6 Credit for completion of "A" or "C" school may be applied, with appropriate SMART documentation. 7 All students must complete a minimum of 17 credits through TCC to meet residency requirements. 2