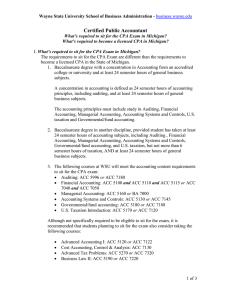

Accounting The Major Degree: BS Requirements: ACC 111, 311

Accounting

The Major

Degree: BS

Requirements: ACC 111, 311, 312, 335, 341, 342, 402, 403, 411, 421, 431

BUS 101, 231, 315

ECO 101, 202

Plus 1 of the following: ACC/BUS 481, BUS 316, BUS 451

Things Advisors Need to Know:

1.

GRADUATION CHECKLIST: A graduation checklist and suggested course planner, both in Excel format, may be obtained from Dr. Kelli Schutte, Chair of the Business and Leadership Department at schuttek@william.jewell.edu

.

2.

CTI: Students are advised to take CTI 105 (or CTI 109) during the Fall semester of their first year.

3.

MATHEMATICS REQUIREMENTS: CTI 105 or CTI 109

4.

ACC 111: It is strongly recommended that accounting majors take ACC 111

Fundamentals of Financial Accounting during the Spring semester of their first year.

5.

COURSE PREREQUISITES: Students and advisors are asked to pay close attention to the prerequisite structures for all classes offered by the Department of Business and

Leadership. Students who do not have the course prerequisites should contact the instructor of the course before enrolling in the course. Instructors may withdraw students from a course if the course prerequisites have not been successfully completed and instructor approval for course was not obtained before enrolling in the course.

6.

CPA EXAM: Most states require exam candidates to have completed 150 semester hours of college credit to qualify to take the CPA exam. Students who desire to take the CPA exam should research the requirements of the state in which they plan to qualify as each state determines its specific requirements. Some states may require graduate credit hours in addition to the undergraduate degree. For students who plan to complete 150 undergraduate semester hours at Jewell for taking the CPA exam, a

College policy allows a ninth semester at reduced tuition by adhering to the following: Students are advised to complete 17 hours each semester, an accumulation of 136 hours after eight (8) semesters. The remaining fourteen (14) credit hours can be completed in summer sessions, inter-terms (January and May), and/or in an additional semester. The student must have made application for the reduced tuition rate through the department prior to the ninth semester and be eligible to sit for the

CPA examination at the end of the 9 th semester. Special dispensation will be given to allow students to take advantage of overseas studies or special internship opportunities.

Department of Business and Leadership

Revised 5/15