Embezzlement

advertisement

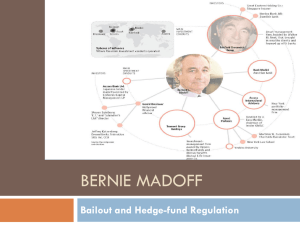

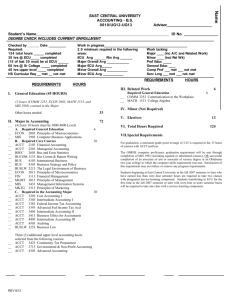

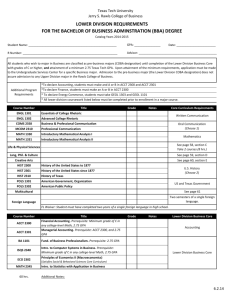

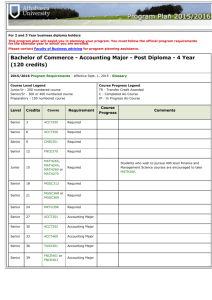

9/24/2015 What you don’t know about will hurt you!!! GREATEST RISK OF SUBSTANTIAL & MATERIAL LOSS 1. 2. 3. Suspects are familiar with systems and procedures Suspects have abundant opportunity Many already may have a need The misuse or misappropriation of funds or property entrusted to an employee Employee trust provides the crutch for supporting internal theft 1 9/24/2015 • Accounts for 30% of US business failures • Average US business loses about 6% of gross revenue to internal fraud ($400 billion annually) • 41% of inventory shrinkage attributed to employee theft vs. 35% attributed to shoplifting • Banking ranks 3rd nationwide in the number of unemployed of US industries ◦ Drugs ◦ Sex ◦ Gambling ◦ Expensive living standards ◦ Recover sudden loss of income ◦ Growing Family Company owes them (Seniority, Performance) Arrogance (Don’t believe they will get caught) Company can afford it 2 9/24/2015 Employees irritated or angry ◦ Current situation or employment status ◦ Company policies ◦ Fellow employees ◦ Management Lax controls Acting in the moment (Impulsive) • Excitement (Adrenaline Rush) • Mental superiority • Gamesmanship • No need for what they steal • 19 to 30 years of age • Mid-level management or lower • Divorced or husband unemployed • Typically begin by borrowing from cash drawer $1000 - $2,500 • Account for 40% of reported cases 3 9/24/2015 • 25 to 30 years of age • Executive or administrator • Upscale lifestyle or habit (gambling, drugs, pornography) • Feels challenged by the system feels the need to defeat it • $10,000 to $25,000 • Account for 60% of reported cases • • • • • • Heavily in debt Significant behavior changes Lavish Lifestyle Put in a lot of hours (overtime) Avoid vacations Assume responsibilities that are not normally theirs (Control of area) 4 9/24/2015 • Fraudulent investment operation that pays returns to its investors from their own money or the money paid by subsequent investors, rather than from the profit earned by the return on the initial investment. • The scheme uses the promise of abnormally high, short term returns to entice investors. • Named After Charles Ponzi who used the scheme in 1920. • The fraudulent securities operation stole so much money it became famous and known throughout the United States as the Ponzi scheme. • Stole $10-17 Billion Dollars from Investors • Conducted over Twenty (20) Years • Scheme Offered Modest Returns • Madoff Conducted Legitimate Business Simultaneously with Ponzi Scheme 5 9/24/2015 • Founded Bernard L. Madoff Investment Securities LLC in 1960 as a penny stock trader • Started the firm with $5,000 • Began using innovative computer technology to disseminate quotes The technology Madoff used helped develop and became the National Association of Securities Dealers Automated Quotations (NASDAQ) The NASDAQ is the 2nd largest stock exchange in the world with a total capitalization of over $4.5 trillion • Chairman of the Board for the National Association of Securities Dealers • Board of Directors Securities Industry Association along with his brother (SIFMA) • Madoff’s niece was active on the Executive Committee of SIFMA’s Compliance & Legal Division 6 9/24/2015 • Contributed approximately $240,000 to Democratic federal candidates, parties and committees • Prominent Philanthropist who served on the boards of nonprofit institutions • Donated millions of dollars to charities such as Leukemia/Lymphoma and bone marrow research along with hospitals and theaters Investigated by SEC in 2004 but the investigation was quashed due to “other priorities”. During that time, an assistant director of the investigating dept. married Madoff’s niece. • While awaiting sentencing, Madoff told an SEC Inspector that he should have been caught in 2004 but investigators never examined his stock records or asked the right questions. • Madoff also admitted his longtime friendship with the SEC Chairman and the SEC Commissioner may have played a role. 7 9/24/2015 • Geek • Administrator of Credit Union’s Loan Origination Software • Well Known and Long Time Associate • Random Review of Member Accounts by Finance on Interest Payments • (3) Loans in Question • Unusually Low Interest on Payments 8 9/24/2015 • Using the Test Area of the Loan Application System to Make Changes and Uploading the Changes to Production • Re-opening Closed Loans on Acct and Funding with Small Amts. • Transferring Funds to Deposit Acct using Home Banking • Siphoned off approximately $90k during a 3 year period • Forthcoming and Honest in the Investigation • Incarcerated and Released • Repaid Approximately $2k in last 4 years 9 9/24/2015 • Recent New Hire for a Branch that was Under Producing • Branch Manager from Another Local FI • Personable, Charming, Poster Child for Community • Re-Staffed Branch/Recommended other Associates • Complaint from Elderly Member of $43k Unauthorized Cash Withdrawal • Member Rarely Appeared at the Branch • Member Known to be Forgetful 10 9/24/2015 • Initial Complaint made by Member Reported to Telebranch and Referred to Tiffany Look • Look Reported Complaint to Loss Prevention • Acct Research Revealed Evidence that Look conducted Transaction and Performed Other File Maintenance • Signatures on Withdrawal Receipts Materially Different from Normal Signatures • Withdrawal Occurred Nearly (5) Months Prior to Discovery by Victim • Look Used Associate Trust to Circumvent Basic Controls and Policy 11 9/24/2015 • Not a Member • Customer of FI where Look was formally was Employed • Used Victim’s Information to open new acct and secure $25k Unsecured Loan • Notified of Possible Victim by Another FI • Acct and Loan were unknown to the Victim • All Acct Setup and Loan Documents completed and Processed by Look 12 9/24/2015 • Siphon Small Amounts of Funds from Acct that would go Unnoticed by Victim • Redirected $6k in Social Security Payments over a 5 month period using official check withdrawals from Member Acct • Look offered information during subsequent interview Kenneth Gutshall Age: 92 • Decedent’s parents appeared at branch office to settle affairs. • Parents unaware of all assets of acct. • Look created several official checks for funeral expenses, etc., including a check for $62k made payable to another FI that she kept and deposited 13 9/24/2015 • Approximately $136k stolen from Member Accts • Look used her personality to steal $$$ right in front of people • Exposed weaknesses in controls • Look plead guilty to Mail Fraud and Theft by Deception in Federal Court and Sentenced to Federal Prison Term. • • • • • • Heavily in debt Significant behavior changes Lavish Lifestyle Put in a lot of hours (overtime) Avoid vacations Assume responsibilities that are not normally theirs (Control of area) 14 9/24/2015 • Adverse Publicity • Damaged Public Image • Loss of Morale • Trauma to Co-Workers • Create, implement and communicate procedures for treatment of employee unethical and criminal conduct • Know your employee • Due diligence in hiring (background checks, check references) • Be mindful of red flag behavior • Create a Culture of Honesty • Build awareness • Loss Prevention and internal fraud employee training • Define and communicate unethical behavior • Provide communication channel to report unethical or illegal behavior 15 9/24/2015 • Integrate Technology • Camera surveillance (Deterrent) • Access Control (Limit opportunity) • Limit employee awareness of system capabilities • Target asset protection based on risk • Monitoring • Dual Control • Heighten awareness of changes in employee baseline behavior (All levels) 16