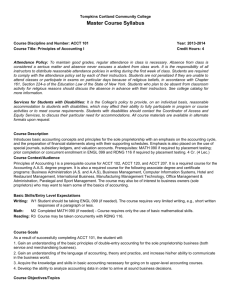

EAST CENTRAL UNIVERSITY ACCOUNTING

advertisement

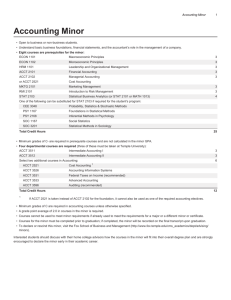

Name EAST CENTRAL UNIVERSITY ACCOUNTING - B.S. 0010/UG12-UG13 Advisor________________________ Student's Name DEGREE CHECK INCLUDES CURRENT ENROLLMENT Checked by Date __________ Required: 124 total hours ______ completed 30 hrs @ ECU_____ completed (15 of last 30 must be at ECU) ______ 60 hrs @ Sr College _____ completed 40 hrs upper level _____ completed HS Curricular Req __ met __ not met ID No. __________________ Work in progress_________________________________________________ 2.0 minimum required in the following Work lacking: areas: Major ____ (inc A/C and Related Work) ECU Avg Rtn Avg _______ Minor ____ (incl Rel Wk) Major Overall Avg _____________ Prof Educ _____ Major ECU Avg______ General Educ ____ Minor Overall Avg ____________ Comp Prof ___ met ___ not met Minor ECU Avg ____________ Serv Lrng ___ met ___ not met REQUIREMENTS REQUIREMENTS HOURS HOURS III. Related Work I. General Education (45 HOURS) __ __ 12 hours (COMM 2253, ECON 2003, MATH 1513, and MIS 1903) counted in the Major Required General Education COMM 2253 Communication in the Workplace MATH 1513 College Algebra IV. Minor (Not Required) Other hours needed 33 II. Major in Accounting 72 V. Electives __ __ __ __ __ __ __ __ __ __ (At least 18 hours must be 3000-4000 Level) A. Required General Education ECON 2003 Principles of Macroeconomics MIS 1903 Computer Business Applications B. Required Core Courses ACCT 2103 Financial Accounting ACCT 2203 Managerial Accounting BSEC 2603 Bus and Econ Statistics BUCOM 3133 Bus Comm & Report Writing BUS 4103 International Business BUS 4303 Business Strategy and Policy BUSLW 3213 The Legal Environment of Business ECON 2013 Principles of Microeconomics FIN 3113 Financial Management MGMT 3013 Principles of Management MIS 3433 Management Information Systems MKTG 3313 Principles of Marketing C. Required in the Accounting Major ACCT 3203 Cost Accounting I ACCT 3303 Intermediate Accounting I ACCT 3383 Federal Income Tax Accounting ACCT 3393 Advanced Fed Income Tax Acct ACCT 3403 Intermediate Accounting II ACCT 3413 Business Ethics for Accountants ACCT 4403 Intermediate Accounting III ACCT 4503 Auditing BUSLW 3253 Business Law __ __ __ Three (3) additional upper level accounting hours selected from the following courses: ACCT 3423 Community Tax Preparation ACCT 3713 Governmental & Non-Profit Accounting ACCT 4303 Advanced Accounting __ __ __ __ __ __ __ __ __ __ __ __ __ __ REV 8/12 6 6 6 VI. Total Hours Required 13 124 VII. Special Requirements 36 For graduation, a minimum grade point average of 2.25 is required in the 33 hours of courses with ACCT prefixes. The OSRHE computer proficiency graduation requirement will be met through completion of MIS 1903 (including equated or substituted courses), OR successful completion of an associate of arts or associate of science degree at an Oklahoma two-year college in which the computer skills requirement was met. Satisfaction of this requirement may not reduce or remove any program requirements. Students beginning at East Central University in the fall 2007 semester or later who have earned less than sixty-four semester hours are required to take two classes with designated service-learning component. Students transferring to ECU for the first time in the fall 2007 semester or later with sixty-four or more semester hours will be required to take one class with a service-learning component. 30