Name of the course MANAGERIAL ACCOUNTING Objectives of the

advertisement

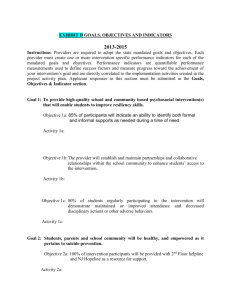

Name of the course Status of the course: MANAGERIAL ACCOUNTING Obligatory Year: 3 (V.semester) ECTS: 5 Number of hours in a semester: 60 Objectives of the course The objective of the course is to enable the students to use the data from financial accounting. After adopting the teaching material from this course, a student should acquire basic knowledge and necessary tools for the analysis of financial reports in order to be able not only to present financial reports to the management of a company but also to suggest certain accounting alternatives and financial advice which could result in tax saving, better efficiency of operations, better financial result, etc. Contents of the course Concept, contents and importance of management accounting; Profit and loss account in the terms of management accounting. Balance sheet in the terms of management accounting; the structure of assets and liabilities. The cash flow statement and management of the cash. Value added report. Analysis of financial reports ; Indicators of profitability, indicators of liquidity, indicators of solvency, indicators of activity, indicators of productivity, indicators of indicators of business efficiency, indicators of the efficiency of shareholders’ investing. Vertical and horizontal analysis of financial statements. Reports BON 1 and BON 2. Cost allocation in management accounting and cost management; Cost division to the fix and variable (classic approach). Absorbed and non-absorbed costs. Cost distribution according to the locations and carriers – classic models. Monitoring and distribution of costs according to activities ( Activity Based Casting). Cost division to controllable and non-controllable. Cost division from the point of view of making specific manager decisions. Methods of division of fix and variable costs. Financial planning and budgeting; Concept and purpose of budgeting. Budget and responsibility of a manager, kinds of budget, main budget and its component parts. Preparing operative budgets. Preparing of financial budgets (budget of cash and budgetary balance sheet), investment budget. Role of budgeting within control system; Static and flexible budget. Budget starting with zero ( zero based budget). Contemporary trends in budgeting and financial operations. Standard costs in planning and control; Definition of standard costs and their use in practice. Role of standard costs in budgeting. Cost control based on the analysis of departing the realistic from the standard costs. Analysis of the ratio between costs, volume and profit: Marginal access to costs and contribution network. Effect of the change of activity volume on results. Analysis of the ratio of costs, volume and profit (business leverage). Calculation of the minimum of activities to cover total costs in various activities. Calculation of the volume of activities for a targeted profit in various activities. Use of the model of contribution network in making managerial decisions.