Accounting for Leases Accounting for Leases

advertisement

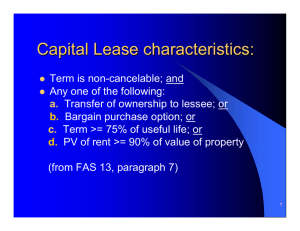

Basics Basics of of Leasing Leasing Accounting Accounting for for Leases Leases AALease Leaseisisaacontractual contractualagreement agreementbetween betweenaalessor lessorand andaalessee lessee that thatgives givesthe thelessee lesseethe theright rightto touse usespecific specificproperty, property,owned ownedby by the lessor, for a specified period of time in return for stipulated, the lessor, for a specified period of time in return for stipulated, and generally periodic, cash payments (rents).. and generally periodic, cash payments (rents).. Lease Leaseterm term Rental Rentalpayments payments Chapter Chapter Lease Contract 21 21 Executory ExecutoryCosts Costs Restrictions Restrictions Noncancelable Noncancelable Early Earlytermination termination Default Default Slide 21-1 Slide 21-2 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB Advantages Advantages of of Leasing Leasing Accounting Accounting by by Lessee Lessee The issue of how to report leases is the case of substance versus versus form. Although technically legal title does not pass in lease transactions, the benefits from the use of the property do. 100% Financing at Fixed Rates Protection against Obsolescence Capital Lease Operating Lease Flexibility Journal Entry: Rent expense Cash Less Costly Financing Alternative Minimum Tax Problems xxx xxx Journal Entry: Leased equipment Lease obligation xxx xxx A lease that transfers substantially all of the benefits and risks risks of property ownership should be capitalized (only noncancellable leases may be capitalized). OffOff-Balance SheetSheet-Financing Statement of Financial Accounting Standard No. 13, “Accounting for Leases,” Leases,” 1980 Slide 21-3 Slide 21-4 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB Compare Compare capital capital vs. vs. operating operating lease lease Mechanics Mechanics The The expense expense recorded recorded on on aa capital capital lease lease and and an an operating operating lease lease are are THE THE SAME SAME over over the the life life of of the the asset. asset. In In aa capital capital lease lease it it hits hits the the P&L P&L via via interest interest expense expense and and depreciation depreciation expense expense VS VS operating, operating, itit all all goes goes into into rent rent expense. expense. In In aa capital capital lease, lease, think think of of itit as as aa sale. sale. The The commitment commitment to to the the lessor lessor is is aa debt debt and and should should be be treated treated like like any any other other debt debt (current (current vs. vs. noncurrent, noncurrent, accrue accrue interest interest etc.) etc.) The The asset asset gets gets depreciated depreciated just just like like if if it it were were owned/purchased. owned/purchased. Slide 21-5 FACTS Lease a computer worth Lease term Annual payment Estimated life of a computer Effective borrowing rate 3,000 3 yrs 1,143 4 yrs 7% PRESENT VALUE OF PAYMENTS ANNUAL DEPRECIATION CAPITAL LEASE Equipment Cap lease obligation Cash Interest expense Capital lease obligation Depreciation expense Accumulated depreciation $3,000 $750 OPENING 3,000 3,000 YEAR ONE YEAR TWO 1,143 210 933 750 YEAR THREE 1,143 145 998 750 750 1,143 75 1,068 750 NO OPENING ENTRY! 1,143 750 1,143 750 1,143 1,143 1,143 CAPITAL LEASE Interest expense Depreciation expense OPERATING LEASE 429 Rent expense 3,000 3,429 DIFFERENCE BETWEEN THE TWO OVERALL: NONE!!!! Slide 21-6 3,429 Bob AndersonAnderson- UCSB Capitalization Capitalization Criteria Criteria Leases that DO NOT meet any of the four criteria are accounted for as Operating Leases No Bargain Purchase Lease Term >= 75% PV of Payments >= 90% Yes Yes Yes Yes The lease transfers ownership of the property to the lessee. Lease Agreement No Transfer of Ownership Capital Lease 750 1,143 COMPARE EXPENSE OF THE TWO: Capitalization Capitalization Criteria Criteria No 0 (0) 750 OPERATING LEASE Rent expense Cash Bob AndersonAnderson- UCSB Lease Agreement YEAR FOUR No O p e r a t i n g No No Bargain Purchase Lease Term >= 75% PV of Payments >= 90% Yes Yes Yes Yes L e a s e Slide 21-7 No Transfer of Ownership Capital Lease No O p e r a t i n g L e a s e Slide 21-8 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB Capitalization Capitalization Criteria Criteria Capitalization Capitalization Criteria Criteria Lease Agreement No Lease term can be extended by a bargain renewal option. option. Lease Agreement No No Transfer of Ownership Bargain Purchase Lease Term >= 75% PV of Payments >= 90% Yes Yes Yes Yes No O p e r a t i n g No Slide 21-9 No Bargain Purchase Lease Term >= 75% PV of Payments >= 90% Yes Yes Yes Yes L e a s e Capital Lease No Transfer of Ownership No O p e r a t i n g L e a s e Capital Lease Slide 21-10 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB Capitalization Capitalization Criteria Criteria Three important concepts: Lease Agreement No No Transfer of Ownership Bargain Purchase Lease Term >= 75% PV of Payments >= 90% Yes Yes Yes Yes Capital Lease Minimum lease payments: Lease Agreement Minimum lease payments Executory costs Discount rate No Capitalization Capitalization Criteria Criteria No O p e r a t i n g No No No Transfer of Ownership Bargain Purchase Lease Term >= 75% PV of Payments >= 90% Yes Yes Yes Yes L e a s e Slide 21-11 Guaranteed residual value Penalty for failure to renew Bargain purchase option Capital Lease No O p e r a t i n g L e a s e Slide 21-12 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB Capitalization Capitalization Criteria Criteria Executory Costs: Lease Agreement No No Transfer of Ownership Bargain Purchase Lease Term >= 75% PV of Payments >= 90% Yes Yes Yes Yes Capital Lease Discount Rate: Lease Agreement Insurance Maintenance Taxes No Capitalization Capitalization Criteria Criteria No O p e r a t i n g No No No Transfer of Ownership Bargain Purchase Lease Term >= 75% PV of Payments >= 90% Yes Yes Yes Yes L e a s e Slide 21-13 Lessee computes the PV of the minimum lease payments using the lessee’s incremental borrowing rate. (one exception) No O p e r a t i n g L e a s e Capital Lease Slide 21-14 Bob AndersonAnderson- UCSB REAL REAL WORLD WORLD Bob AndersonAnderson- UCSB TEXT TEXT example example from from p.1097 p.1097 The The leasing leasing companies companies are are hip hip to to these these criteria criteria and and go go out out with with aa lease lease that that they they believe believe satisfies satisfies the the requirements. requirements. They They usually usually run run really really tight tight (i.e (i.e PV PV of of payments payments is is 89.9% 89.9% of of the the fair fair value value of of the the asset). asset). Just Just because because the the leasing leasing company company says says itit works works as as an an operating operating lease, lease, doesn’t doesn’t make make itit so!! so!! Lessor and Lessee sign a lease agreement dated January 1, 2005 which requires Lessor to lease equipment to lessee beginning January 1, 2005. Terms are: 5 year, noncancelable lease term, equal annual payments at beginning of year of $25,981.62 Fair value of equipment is $100,000 at inception and has 5 yr. Life and no residual value Lessee pays all executory costs directly, except property tax which is $2,000 per year and part of the annual payment of $25,981.62 No renewal options and equipment reverts to Lessor at termination Lessee borrowing rate is 11%, Lessor implicit rate is 10% and known to Lessor Lessee depreciates on a straight line basis. Instructions Prepare the journal entries on the books of the Lessee that relate Slide 21-16 to the lease agreement through December 31, 2009. Slide 21-15 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB p. p. 1097 1097 SOLUTION SOLUTION Payment Property tax Lease portion Rate Period PV Life of asset 25,981.62 (2,000.00) 23,981.62 10% * 5 100,000 5 RESIDUAL - LESSEE VALUE RESIDUAL VALUEVALUELESSEE OPENING ENTRY: Equipment 100,000 Capital lease obligation 1/1/05 ENTRY: Lease liability Property tax expense Cash 100,000 23,982 2,000 12/31/05 ENTRY: Interest expense 7,602 20,000 IS THIS A CAPITAL LEASE? YES- 100% OF LIFE IS>75% AND Pv of Payments>90% Depreciation expense accum dep LEASE AMORTIZATION SCHEDULE Accrued interest LEASE LEASE LEASE PMT INTEREST REDUX LIABILITY 1/1/06 PAYMNT: 1/1/05- OPENING 100,000.00 Property tax expense 2,000 1/1/05 PAYMENT 23,981.62 23,981.62 76,018.38 Lease liability 16,380 1/1/06 PAYMENT 23,981.62 7,601.84 16,379.78 59,638.60 Interest payable 7,602 1/1/07 PAYMENT 23,981.62 5,963.86 18,017.76 41,620.84 Cash 1/1/08 PAYMENT 23,981.62 4,162.08 19,819.54 21,801.30 1/1/09 PAYMENT 23,981.62 2,180.13 21,801.49 ETC. 25,982 - * smaller of lessee borrowing rate or lessor implicit rate 20,000 7,602 - Accounting Accounting depends depends on on whether whether the the residual residual is is guaranteed guaranteed or or not: not: Not Not Guaranteed: Guaranteed: As As if if it it did did not not exist exist Guaranteed: Guaranteed: As As if if the the guaranteed guaranteed amount amount is is aa final final payment payment (gain/ (gain/ loss loss results results on on final final payment payment depending depending on on what what the the value value of of the the property property is) is) 25,982 - Slide 21-17 Slide 21-18 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB BARGAIN BARGAIN PURCHASE PURCHASE OPTION OPTION Illustration Illustration DISCOUNT DISCOUNT THE THE BARGAIN! BARGAIN! (if (if get get 10 10 for for 2, 2, then then what what is is the the PV PV of of the the cost cost of of the the $8 $8 bargain?? bargain?? The The cost= cost= PV PV of of the the $2 $2 payment)) payment)) If If there there is is aa bargain bargain purchase purchase option, option, then then you you assume assume it it will will be be paid paid and and the the asset asset transferred transferred at at the the end end of the term. Think of it as a final lease payment. of the term. Think of it as a final lease payment. For For instanceinstance- 33 year year lease lease at at $100 $100 per per year, year, 10% 10% implicit implicit rate. rate. Can Can buy buy the the item item for for $75 $75 at at the the end end of of the the term term when when it’s it’s fair fair value value would would be be $150. $150. Then Then the the PV PV of of the the payments payments is: is: PV PV of of lease lease payment payment PLUS PLUS PV PV of of $75 $75 in in the the future future PV PV of of the the lease lease $250 $250 $$ 56 56 $306 $306 Slide 21-19 E21E21-2 Pat Delaney Company leases an automobile with a fair value of $8,725 from John Simon Motors, Inc., on the following terms: 1. Noncancelable term of 50 months 2. Rental of $200 per month (at end of each month; present value at 1% per month is $7,840). 3. Estimated residual value after 50 months is $1,180 (the present value at 1% per month is $715). Delaney Company guarantees the residual value of $1,180. 4. Estimated economic life of the automobile is 60 months. 5. Delaney Company’s incremental borrowing rate is 12% a year (1% a month). Simon’s implicit rate is unknown. Instructions Prepare the journal entries on the books of Delaney Company for the first month of the lease. Slide 21-20 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB Solution -2 E21 Solution E21E21-2 FACTS Term of lease Monthly rent Rate Guaranteed res. Value Life of asset Benefits Benefits Available Available To To The The Lessor Lessor 50 months 200 12% 1,180 60 months Interest Revenue Tax Incentives This is a capital lease because two of the criteria are met (only need one met) Lease term Life of asset High Residual Value 50 60 83% > 75% requirement PV of payments (since residual is guaranteed, it is included) PV of payments $7,839.22 PV of residual $717 $8,556.71 ENTRY TO RECORD: Leased equip under cap lease Lease liability Slide 21-21 1st Month Entry: Depreciation expense Accum. Dep Lease liability Interest expense Cash $ 8,556.71 $ 8,556.71 $ 147.53 $ 147.53 $ 114.43 $ 85.57 Slide 21-22 $ 200.00 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB Capitalization Lessor)) ((Lessor) Capitalization Criteria Criteria (Lessor LESSOR: LESSOR: DIRECT DIRECT FINANCING FINANCING VS. VS. SALES SALES TYPE TYPE LEASES LEASES Group Group II Transfer Transferof ofownership ownership Bargain Bargainpurchase purchaseoption option Lease Leaseterm term=> =>75% 75%of ofeconomic economiclife lifeof ofleased leasedproperty property Present Presentvalue valueof ofminimum minimumlease leasepayments payments=> =>90% 90%of ofFMV FMVof ofproperty property IF IF ALL ALL THE THE CRITERIA CRITERIA ARE ARE MET, MET, THEN THEN IT IT IS IS EITHER EITHER AA DIRECT DIRECT FINANCING FINANCING OR OR SALES-TYPE SALES-TYPE LEASE LEASE TO TO THE THE LESSOR: LESSOR: Group Group II II Collectibility Collectibilityof ofthe thepayments paymentsrequired requiredfrom fromthe thelessee lesseeisisreasonably reasonably predictable. predictable. No important uncertainties surround the amount of unreimbursable No important uncertainties surround the amount of unreimbursablecosts costs yet yetto tobe beincurred incurredby bythe thelessor lessorunder underthe thelease lease(lessor’s (lessor’sperformance performanceisis substantially substantiallycomplete completeor orfuture futurecosts costsare arereasonably reasonablypredictable). predictable). Why Group II Requirements? Slide 21-23 Direct Direct Financing: Financing: Lessor Lessor isis not not making making money money from from selling selling the the product, product, they they are are inin itit for for the the financing financing aspect aspect (more (more like like aa lender). lender). It It works works just just like like the the capital capital lease lease we we just just spoke spoke of of for for lessee, lessee, but but in in reverse reverse (interest (interest income, income, lease lease receivable receivable VS VS interest interest expense expense ,, interest interest receivable receivable )) Sales-Type: Sales-Type: Lessor Lessor isis getting getting aa financing financing fee, fee, but but ALSO ALSO isis making making money money from from the the product product itself itself as as well well (they (they may may be be aa manufacturer manufacturer or or retailer). retailer). More More complicatedcomplicated- need need to to deal deal with with any any profit profit the the lessor lessor isis making making from from selling selling the the asset. asset. Slide 21-24 Bob AndersonAnderson- UCSB Bob AndersonAnderson- UCSB Payment period rate PV FV Cost Capitalization Lessor)) ((Lessor) Capitalization Criteria Criteria (Lessor Group 1 criteria are the four criteria that must be considered for capitalization of a lease by a lessee. Lease Agreement Yes Any Group 1 Criteria Met? Collectibility of Payments Reasonably Certain? Yes Lessor’s Performance Substantially Complete? UPON "SALE" Cap lease receivable Asset YR 1 Cash Interest income Cap lease receivable Yes Is Asset FMV > Bookvalue? Yes Both No No No YR 2 Cash SalesSales-Type Lease No Slide 21-25 LESSOR- DIRECT FINANCING 258 258 100 21 79 100 Interest income Cap lease receivable Direct Financing Lease Operating Lease 100 3 8% 258 258 258 YR 3 Cash Slide 21-26 14 86 100 Interest income Interest income Bob AndersonAnderson- UCSB Payment period rate PV FV Cost 100 3 8% 258 258 200 UPON "SALE" Cap lease receivable Asset Gain YR 1 Cash Interest income Cap lease receivable YR 2 Cash Bob AndersonAnderson- UCSB LESSOR: SALES TYPE Capitalization Lessor)) ((Lessor) Capitalization Criteria Criteria (Lessor Is Isititpossible possiblethat thataalessor lessorhaving havingnot notmet metboth bothcriteria criteriawill willclassify classifyaa lease leaseas asan anoperating operatinglease leasebut butthe thelessee lesseewill willclassify classifythe thesame same lease leaseas asaacapital capitallease? lease? In Insuch suchan anevent, event,who whowill willhave havethe theasset asseton ontheir theirbooks? books? 258 200 58 100 21 79 100 Interest income Cap lease receivable YR 3 Cash Slide 21-27 7 93 14 86 100 Interest income Interest income 7 93 Bob AndersonAnderson- UCSB Slide 21-28 Bob AndersonAnderson- UCSB Capitalization Capitalization Criteria Criteria Discount Rate: Lease Agreement No Lesse e comput es th e PV of th e minimum lease payments using the lessee’s increme ntal borrowing rate. (one exce ption) No No Transfer of Ow nership Bargain Purchase Lease Term >= 75% PV of Pay ments >= 9 0% Yes Yes Yes Yes Capital Lease No O p e r a t i n g L e a s e Sl ide 22-13 Copyright © 2000 by Coby Harmon Slide 21-29 Bob AndersonAnderson- UCSB