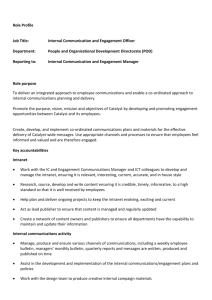

catalyst equity research report

advertisement

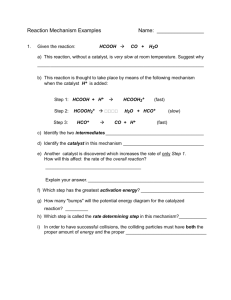

CATALYST EQUITY RESEARCH REPORT ™ Weekly Research Highlighting Activist Investments Subscribe to receive this FREE Report emailed weekly. www.hedgerelations.com/research.html HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ HIGHLIGHTING ACTIVIST INVESTMENTS Week Ending September 26, 2014 SYMBOL COMPANY INVESTOR AGN AGYS BOBE BXE DRI EPIQ EXA GUID LEI MYCC NGPC NOA OPLK PCLB PESAF RDC RDEN RIT RLOG RSH SFLY VABK VOLC YHOO Allergan, Inc. Agilysys Inc. Bob Evans Farms Bellatrix Exploration Ltd. Darden Restaurants EPIQ Systems, Inc. Exa Corp Guidance Software Lucas Energy ClubCorp Holdings NGP Capital Resources Co North America Energy Partners Oplink Communications Pinnacle Bancshares, Inc. Panoro Energy Rowan Companies Elizabeth Arden LMP Real Estate Fund Rand Logistics RadioShack Corp Shutterfly Inc. Virginia National Bancshares Volcano Corporation Yahoo! Pershing Square; Valeant Discovery Capital Sandell Asset Management Orange Capital Starboard Value P2 Capital; St. Denis Villere & Co Discovery Capital RGM Capital Condagua LLC Red Alder; ADW Capital Indaba Capital FrontFour Capital Engaged Capital; Voce Capital Joseph Stilwell Nanes Balkany Partners Blue Harbour Group Rhone Capital Bulldog Investors JWest, LLC Standard General Marathon Partners Swift Run Capital Engaged Capital Starboard Value HEDGE FUND SOLUTIONS (HFS) provides investment research, strategy and stakeholder communications consulting to companies and investors interested in, or involved with, shareholder activist campaigns. Since 2001 HFS has become the trusted advisor to numerous institutional investors, CEOs and board members worldwide. HFS also administers The Official Activist Investing Blog™, the definitive source for activist shareholder information. Catalyst Investment Research™ is a portfolio of activist investing research products that combine company-specific shareholder activism research with deep value investment analysis and access to industry insiders. To Learn More: Download a brochure http://www.hedgerelations.com/CIR/CIR%20Brochure.pdf Hedge Fund Solutions, LLC © 2003 – 2014 Page 2 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Allergan Inc. (AGN) Activist Investor: Pershing Square; Valeant Pharmaceuticals Investor Info Shares % Outstanding Cost Basis Catalyst Info 28,878,538 9.7% Not Avail Catalyst: Pershing Square is threatening to sue AGN if they go through with a deal to acquire Salix Pharma (SLXP) without a shareholder vote (which isn't required if AGN acquires SLXP with cash) http://www.sec.gov/Archives/edgar/data/850693/000119312514350092/d793817dex9938.htm Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 168.21 6.7B 53B 51B 1.6B 2.3B 88.34 – 180.54 22.8 Comment: We initially covered AGN on April 21 when Pershing Square announced it was teaming up with Valeant to purchase Allergan, offering $46B ($48.30 cash and 0.83 Valeant shares). On May 19 Pershing Square issued an open letter concerning AGN’s governance failures, including the CEO’s conflict of interest in supporting a merger with Valeant since he will likely lose his job as a result of the transaction. On May 13 Pershing Square called for a shareholder referendum on the merger proposal, requesting the company call a non-binding vote to hear what shareholders think about the deal. On May 12 Pershing Square submitted a 220 Demand to review AGN's stocklist materials On June 2 Pershing Square called for a special meeting of AGN shareholders in an effort to change six directors. In a statement, Bill Ackman from Pershing Square stated, “We believe the market has spoken, and that shareholders see substantial value in Valeant’s revised proposal,” adding, “to date, the board has refused to engage with Valeant in any way regarding a merger...” On May 27 Pershing Square/Valeant submitted a revised proposal to acquire AGN for 0.83 Valeant shares and $58.30 in cash per share (up from $48.30/share in cash). On May 30 Pershing Square/Valeant increased its offer for AGN a second time to $72/share in cash and 0.83 Valeant shares for a total consideration of $179.25/share based on Valeant’s closing price of May 29. The second offer was also rejected. Pershing filed a lawsuit in Delaware seeking confirmation that Allergan's poison pill will not be triggered by efforts to call a special meeting. The lawsuit was settled, confirming that the solicitation of proxies to call a special meeting does not trigger the company's poison pill. On July 7 Pershing Square announced a slate of 6 nominees for election to the board at a special meeting. On July 17 Pershing Square hosted a webcast to discuss Allergan (info about this can be found at the website www.advancingallergan.com) and issued a presentation it gave to ISS relating to its call for a special meeting to replace directors with those who will engage with Valeant on its acquisition offer. On July 30 Pershing Square sent a letter to ISS highlighting the Company's newly added onerous terms for calling a special meeting. On August 1 Allergan commenced a federal securities action against Pershing Square and Valeant, claiming insider trading violations when Valeant "tipped" Pershing to its intended offer for AGN. http://advancingallergan.com/app/uploads/2014/08/Exhibit-A.pdf Pershing responded saying the claims are baseless. http://www.sec.gov/Archives/edgar/data/850693/000119312514291813/d768543ddfan14a.htm On August 6 ISS and Glass Lewis recommended shareholders support Pershing's call for a special meeting. On August 22 Pershing/Valeant delivered a request from 31% of shareholders to call a special meeting, exceeding the requisite 25%. Allergan issued a press release announcing that it has received written requests from more than 25% of shareholders to call a special meeting. The special meeting is now scheduled for Dec 18. On 9/9 Pershing sent a letter to the board to stop wasting corporate assets and engage with Valeant. On September 12 Pershing Square submitted additional special meeting requests representing 35% of AGN Pershing, Valeant and Allergan settled the litigation to hold a special meeting on December 18 Hedge Fund Solutions, LLC © 2003 – 2014 Page 3 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Agilysys Inc. (AGYS) Activist Investor: Discovery Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info 1,196,031 5.2% 12.99 Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 11.89 101M 266M 178M 88M 0.5M 10.74 – 15.50 437.0 Catalyst: Discovery increased its ownership from 2.8% and disclosed a 5.2% "active" stake in AGYS. Comment: We initially covered AGYS in our June 6 2008 Catalyst Research Reports, highlighting AGYS’s appointment of one individual from MAK Capital (currently 30% shareholder) to the board and the formation of a committee to review strategic alternatives. On October 10, 2008 Ramius Capital (currently Starboard Value) criticized the board for creating undue uncertainty and significant unwarranted risk to shareholders and claimed they had breached their fiduciary duties by pre-announcing poor earnings figures. Ramius also demanded AGYS update shareholders on the sale process and reiterated their belief that AGYS could be sold for $10.80 to 17.27/share. On October 22, 2008 AGYS announced that the Board had completed its review of strategic alternatives and concluded that the best course of action to maximize shareholder value is to remain as an independent company, realign its cost and overhead structure, and drive value creation. On March 11, 2009 AGYS entered into a settlement agreement with Ramius. Under the terms of the agreement Ramius appointed two people to a board that will not exceed nine members. In early 2010 MAK Capital wanted to increase their ownership in AGYS above 30%. Under Ohio law investors are required to request shareholder approval to increase their ownership above 20%. As a result, MAK requested a special meeting to approve their increase in ownership to 33.3%. On January 22 2010 Ramius Capital (at the time Ramius owned 8.8% at an avg. cost of $8.21) announced their plans to vote against the special meeting shareholder proposal for MAK Capital to increase their ownership in AGYS above 20%. The reasons Ramius provide included: (i) the proposed Control Share Acquisition is not in the best interests of the Company’s shareholders and (ii) that this potential level of ownership by MAK would provide the firms with disproportional influence and control over the Board of Directors and corporate policy. On January 25, 2011 MAK Capital commenced their solicitation of proxies in connection with a special meeting scheduled for February 18, 2010. In a SEC filing on February 1, MAK clarified that they have no intention to seek to control the board. The special meeting was held on February 18 and MAK obtained the necessary approval. On May 31, 2011 AGYS announced plans to sell a portion of their business to OnX Enterprise Solutions; MAK Capital agreed to vote their shares in favor of the transaction. (In order to consummate the transaction the affirmative vote of 2/3rds of the shares must agree to the transaction). Following the transaction, AGYS will have in excess of $120M ($5.22/share) in net cash and announced plans to “focus on improving business performance and returning capital to shareholders.” AGYS also announced that Jim Dennedy, a Starboard nominee and existing board member, will assume the role of interim president and CEO. Legal counsel to Starboard Value Continue to Next Page Hedge Fund Solutions, LLC © 2003 – 2014 Page 4 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Bob Evans Farms, Inc. (BOBE) Activist Investor: Sandell Asset Management Investor Info Shares % Outstanding Cost Basis Catalyst Info 2,006,950 8.1% 38.74 Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 47.92 1.3B 1.1B 1.6B -458M 118M 42.28 – 58.99 13.5 Catalyst: Sandell announced that a private equity firm contacted it about purchasing BEF Foods. In addition, several other investment firms have expressed an interest in a transaction involving the Company’s real estate. Comment: We initially covered BOBE on September 23, 2013 when Sandell sent a letter to BOBE outlining its proposals for increasing value, consisting of (i) the separation of its packaged foods business, BEF Foods, through a sale or a spin-off to stockholders; (ii) the entry into a sale-leaseback transaction to realize the significant real estate value associated with the owned restaurant properties; and (iii) the launch of a large, one-time self-tender On November 11 Sandell sent a letter to the Board expressing its extreme concern at the Board’s inaction regarding their ideas to deliver increased shareholder value and indicating that they have retained a proxy solicitation firm to provide advice regarding options available to them, including a possible consent solicitation On December 6 Sandell increased its ownership from 5.1% to 6.5%; On December 9 Sandell announced its intent to commence a consent solicitation and issued a presentation to BOBE shareholders. On the same day BOBE responded saying it has thoroughly vetted Sandell’s ideas with the help of its financial advisor Lazard and concluded they are not in the best interest of shareholders. Sandell announced it is suing BOBE to repeal the Company's new bylaw amendment requiring 80% supermajority approval for shareholders to amend bylaws. Sandell also plans to commence a consent solicitation to expand the board and fill the vacancies with new Directors. On January 29 Sandell issued a press release applauding the board for reversing a new bylaw amendment requiring supermajority approval for shareholders to amend bylaws. Sandell also called for additional changes to spending and governance. On March 7, 2014 Sandell increased its ownership from 6.5% to 8.1%. On April 24 Sandell nominated 8 to BOBE’s board and issued a press release introducing its nominees. On April 28 BOBE announced the appointment of three new directors. One incumbent director is stepping down immediately and two directors will not seek re-election at the annual meeting. On May 29 Sandell issued a press release commenting on a letter sent by BOBE's lead independent director to each of Sandell's nominees regarding interviews for potential director nominees. Sandell says it is open to a constructive dialogue but the interview request is an attempt to subvert the nomination process. The Company responded on May 30 stating the interview request is a good-faith request to meet Sandell’s nominees. On June 30 Sandell issued a press release stating that BOBE's settlement offer of 2 director seats is a meaningless effort designed to be rejected. On July 7 Sandell issued a press release announcing its latest offer to settle the proxy contest was rejected by BOBE On the same day BOBE issued a letter to "correct the record" On July 28 Sandell issued its shareholder presentation titled, "The Case and Nominees For Change" On August 1 BOBE issued a press release calling Sandell’s proposals short-sighted and unsustainable On August 5 Sandell issued a letter to BOBE shareholders seeking support for its nominees. On August 8 Sandell announced ISS and Glass Lewis recommended a vote on its proxy card. ISS recommends 4 and Glass Lewis recommends 6 of Sandell's nominees to the 12-member board On August 20 Sandell announced no less than 5 of its 8 nominees have been elected to the 12-member board Legal counsel to Sandell Asset Management Proxy Solicitor to Sandell Asset Management Hedge Fund Solutions, LLC © 2003 – 2014 Page 5 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Bellatrix Exploration (BXE) Activist Investor: Orange Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info 17,495,013 9.2% 7.66 Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 6.25 352M 1.2B 1.5B -293M 184M 6.13 – 10.70 8.1 Catalyst: On September 25 Orange Capital increased its ownership from 7.4% to 9.2% Comment: We initially covered BXE on August 18 when Orange Capital disclosed a 5.3% ownership in BXE and announced its intention to discuss, among other things (i) hiring an independent financial advisor tasked to provide the Board with recommendations on strategic alternatives, capital allocation and improved investor communications; (ii) the size and composition of the Board; (iii) steps to raise the valuation to be in line with its intrinsic value, which current valuation is well below the intermediate sized company peers in the Canadian exploration and production sector (based on both price to proved-developed reserves and on enterprise value to debt adjusted cash flow); (iv) refraining from future dilutive equity issuances and outlining a clear use of proceeds for all newly raised capital; and (v) exploring alternatives to highlight the value of the infrastructure assets, including but not limited to improving disclosure on the cost and fair market value of the midstream infrastructure and / or exploring a possible joint venture, initial public offering or sale of the midstream assets. On September 4 Orange Capital increased its ownership from 5.3% to 6.4% On September 12 Orange Capital increased its ownership from 6.4% to 7.4% Legal counsel to Orange Capital Darden Restaurants, Inc. (DRI) Activist Investor: Starboard Value; Barington Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info See comment See comment See comment Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 51.90 6.4B 6.9B 8.1B -1.2B 638M 43.56 – 54.89 12.7 Catalyst: ISS and Glass Lewis recommend shareholders vote for all of Starboard's nominees http://www.sec.gov/Archives/edgar/data/940944/000092189514002124/dfan14a06297125_09262014.htm Comment: We initially covered DRI on October 9, 2013 when it was reported that Barington (~2%) began pressing the Company to separate into 2 business units. On October 17 Barington issued a press release publicizing its letter summarizing its recommendations, which include: (i) Forming 2 independently managed operating companies (one for the mature brands and one for its high-er growth brands), (ii) exploring all alternatives to monetize the value of the company’s real estate, including the creation of a publicly-traded REIT, and (iii) reduce operating expenses. On November 21 Barington announced it hired an investment bank and proxy solicitor as advisors. On December 20 Starboard disclosed a 6% “active” stake ON JANUARY 30 2014 HFS HOSTED A WEBCAST WITH BARINGTON CAPITAL RE: DARDEN To listen to a replay go to http://barington.com/pressreleases.html On January 13 Barington issued a press release stating that the Company’s recently announced plan to enhance shareholder value by selling the Red Lobster business is “incomplete and inadequate”. On January 21 Starboard sent a letter to DRI expressing concern about the Company's announcement to examine a sale of Red Lobster and called for an operational plan and to examine the real estate assets. On February 21 Starboard amended its SEC filing to include Brad Blum as part of its investment group. On February 24 Starboard filed preliminary proxy materials seeking support to call a special meeting to give shareholders a platform for voicing dissatisfaction with the proposed Red Lobster Separation. On February 28 Darden issued a presentation and addressed its priorities for value creation in a webcast saying the process to sell or spin-off Red Lobster is well underway On March 26 Barington sent a letter to DRI's independent directors calling for a new CEO On March 31 Hedge Fund Solutions, LLC © 2003 – 2014 Page 6 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Starboard issued an investor presentation on DRI. along with a presentation in conjunction with Green Street Capital called, "A Primer of Darden's Real Estate" On April 22 DRI announced Starboard has delivered enough consents (Starboard delivered consents from more than 55% of the shares outstanding) to force the Company to hold a special meeting On May 14 Starboard sent a letter to the board condemning them for delaying the annual meeting and expressing concern about forcing through a Red Lobster Spin-off. On May 15 DRI announced it is selling Red Lobster to a private equity group for $2.1B in cash, providing 1.6B in net cash. $1B will repay debt and $700M will be used for a stock buyback. On May 19 Barington announced its strong opposition to the Red Lobster transaction. On May 21 Starboard nominated 12 to the board and issued an open letter to shareholders On July 15 Starboard increased its ownership from 6.2% to 7.1% and sent a letter to the board seeking a change to management and a board that they can trust. On July 24 Starboard filed a Complaint against DRI seeking to compel the Company to provide the books and records relating to the analysis and rationale relating to the sale of Red Lobster. On July 28, Darden announced it will nominate 9 candidates to its 12-member board, ensuring Starboard will obtain 3 board seats. The company also announced the CEO will resign when a new CEO is found, but no later than Dec 31. On August 5 Barington withdrew its shareholder proposal that the Chairman be an independent director after the board adopted that policy. Barington also expressed strong support for Starboard's nominees. On August 5 Starboard increased its ownership from 8% to 8.8% and issued a press release responding to DRI's "latest misleading statements" saying it is committed to the $2.20 annual dividend On August 29 DRI moved its annual meeting from Sept 30 to Oct. 10. On September 2 DRI issued a press release announcing its director nominees would include 4 new independent nominees unaffiliated with the Company or Starboard, 4 incumbent nominees, and 4 Starboard nominees. On September 3 Starboard said the reconfigured slate of nominees remains suboptimal. On September 11 Starboard issued a presentation titled, "Transforming Darden Restaurants" and updated its proxy contest website for DRI www.shareholdersfordarden.com On September 19 Barington issued a press release announcing its plans to vote for Starboard's nominees. http://finance.yahoo.com/news/barington-capital-group-announces-intention-120000169.html On September 18 Starboard's director nominees issued a letter to Darden Shareholders. http://finance.yahoo.com/news/starboards-director-nominees-issue-letter-131200651.html Proxy Solicitor to Barington Legal counsel to Starboard Value Continue to Next Page Hedge Fund Solutions, LLC © 2003 – 2014 Page 7 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ EPIQ Systems, Inc. (EPIQ) Activist Investor: P2 Capital Partners; St. Denis Villere & Co Investor Info Shares % Outstanding Cost Basis Catalyst Info 6,099,088 16.9% 14.99 Catalyst: P2 and St. Denis formed a group with 16.9% ownership and offered to buy EPIQ for $20/share. The offer was rejected by the Board as inadequate Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 18.12 462M 648M 936M -283M 61M 11.68 – 19.59 15.3 Exa Corporation (EXA) Activist Investor: Discovery Group Investor Info Shares % Outstanding Cost Basis Catalyst Info 972,367 7.0% 8.85 In the letter Discovery suggests a takeover value in the http://www.sec.gov/Archives/edgar/data/890264/000157104914004775/ex1.htm Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA Catalyst: Discovery sent a letter to EXA recommending they hire a bank to examine strategic alternatives, including a sale. 11.91 58M 167M 138M 26M 0.5M 8.45 – 15.97 263.7 range of $16-$20/share Comment: We initially covered EXA on June 5 when Discovery increased its “active” stake in EXA to 6.8% at an average cost of $8.82/share Guidance Software, Inc. (GUID) Activist Investor: RGM Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info 4,057,309 13.87% 7.67 Catalyst: RGM changed its investment status from "passive" to "active" with 13.87% of the shares outstanding Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 6.94 109M 187M 168M 18M -10M 6.41 – 11.54 Negative Hedge Fund Solutions, LLC © 2003 – 2014 Page 8 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Lucas Energy, Inc. (LEI) Activist Investor: Condagua, LLC Investor Info Shares % Outstanding Cost Basis Catalyst Info 4,344,834 12.99% 0.81 Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA Catalyst: Condagua changed its filing status from "passive" to "active" and said the Company should explore strategic alternatives. Comment: We initially covered LEI on 10/8/2012 when two Meson Capital (2.8%) reps were added to board. 0.48 5M 16M 23M -6M -2M 0.39 – 1.31 Negative On October 16, 2012 Meson increased its ownership from 15% to18.2% and on January 8, 2013 Meson increased its ownership to 20.8% On July 25, 2014 meson reduced its ownership below 5% Legal counsel to Meson Capital ClubCorp Holdings (MYCC) Activist Investor: Red Alder; ADW Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info Not Avail Not Avail Not Avail Catalyst: Red Alder/ADW sent a letter to MYCC urging the company to immediately pursue a restructuring through a REIT conversion and spin-off of non-real estate assets that could value the company at $31-$36/share http://finance.yahoo.com/news/red-alder-group-delivers-letter-100000171.html Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 18.74 841M 1.3B 1.9B -650M 150M 13.51 – 19.76 12.4 Legal counsel to Red Alder Continue to Next Page Hedge Fund Solutions, LLC © 2003 – 2014 Page 9 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ NGP Capital Resources Company (NGPC) Activist Investor: Indaba Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info ~613,000 2.99% Not Avail Catalyst: Indaba sent a letter to NGPC's Chairman questioning (among other things) whether the Company's new investment advisor transaction with Oak Hill is in the best interests of shareholders. http://finance.yahoo.com/news/indaba-capital-issues-open-letter-120000304.html Company Info In its letter, Indaba, among other things: Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 6.32 28M 130M 199M -69M 13M 5.87 – 7.79 15.3 Questions the Board's lack of meaningful disclosure surrounding recent developments in the ATP/Bennu litigation, which Indaba believes removes a material overhang on the Company's valuation and the strategic review process conducted by the Board and, therefore, merits a reconsideration of potential value-maximizing alternatives available to the Company; Documents the Board's track record and 10-year history of value destruction (including its failure to return capital through a significant share repurchase), while the current investment advisor has received over $53 million in management and incentive fees; Questions whether the transaction with Oak Hill is in the best interests of shareholders; and Calls upon the Company and Oak Hill to honor management's promise to hold a joint conference call with Oak Hill management so that Oak Hill can elaborate on its strategy and plans for the Company and field shareholder questions. On September 29 the Company’s annual meeting was postponed until September 30 to allow more time to solicit votes with respect to the Oak Hill Advisory Agreement Legal counsel to Indaba Capital North American Energy Partners (NOA) Activist Investor: FrontFour Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info 3,241,519 9.2% 4.24 Catalyst: On September 23 FrontFour disclosed a 9.2% "active" stake in NOA and expressed its concern that despite management’s progress in the areas of expense reduction, fleet rationalization and balance sheet deleveraging, the shares trade at a material discount to their intrinsic value Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 6.09 404M 219M 321M -106 45M 4.99 – 8.50 7.2 Legal counsel to FrontFour Capital Hedge Fund Solutions, LLC © 2003 – 2014 Page 10 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Oplink Inc. (OPLK) Activist Investor: Engaged Capital; Voce Capital (Oplink Shareholders for Change; OSC) Investor Info Shares % Outstanding Cost Basis Catalyst Info 1,155,318 6.2% 16.86 Catalyst: Engaged/Voce filed its preliminary proxy statement seeking to elect 2 directors and released a Sept. 8 letter expressing its openness to negotiating a solution for shareholder representation. http://www.sec.gov/Archives/edgar/data/1022225/000141588914002894/ex991to13da209455007_092314.htm Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 16.79 205M 288M 158M 129M 9M 13.91 – 20.03 17.7 Comment: We initially covered OPLK on July 14 when Engaged/Voce disclosed a 6.2% group ownership and announced they are discussing (a) strategic alternatives for the Oplink Connected business, including a separation or a sale, (b) halting the earnings dilution from the Oplink Connected business (OPLK estimates spending on Oplink Connected will reduce the non-GAAP earnings per share by approximately $0.40 in Fiscal 2014), (c) improving the capital allocation discipline given the $161 million of cash and equivalents on the balance sheet (representing approximately 52% of the current market capitalization as of July 11, 2014); and (d) enhancing the corporate governance. On July 29 OPLK issued a press release announcing it is evaluating strategic alternatives for Oplink Connected, authorizing a $40M increase in its buyback program, initiating a $0.05 quarterly dividend and the retention of the National Association of Corporate Directors (NACD) to identify 2 new Directors to an expanded board. On July 31 Engaged Capital and Voce Capital formed Oplink Shareholders for Change (OSC) and nominated 2 to the board, stating that the company's recently announced initiatives appear to be a thinly veiled attempt to placate shareholders. A copy of OSC’s July 31 press release is available here: http://www.sec.gov/Archives/edgar/data/1022225/000092189514001659/ex991to13da109455007_073014.htm Engaged/Voce issued a press release calling on the board to refrain from setting a new strategic course until the board is reconstituted. A copy of the press release is available here: http://finance.yahoo.com/news/oplink-shareholders-change-osc-call-164200469.html Legal counsel to Engaged Capital Legal counsel to Voce Capital Pinnacle Bancshares (PCLB) Activist Investor: Joseph Stilwell Investor Info Shares % Outstanding Cost Basis Catalyst Info 115,750 9.6% 15.17 Catalyst: On September 23 Stilwell disclosed a 9.6% "active" stake in PCLB Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 15.30 8M 18M 11M 7M N/A 13.25 – 15.95 N/A Hedge Fund Solutions, LLC © 2003 – 2014 Page 11 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Panoro Energy ASA (PESAF) Activist Investor: Nanes Balkany Partners Investor Info Shares % Outstanding Cost Basis Catalyst Info ~3,062,020 ~1.5% Not Avail Catalyst: Rumors that Nanes Balkany is part of a 5%+ group seeking to hold an extraordinary general meeting to replace directors on Oct. 14 Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 0.43 44M 100M 41M -60M 19M 0.43 – 0.54 2.2 Rowan Companies (RDC) Activist Investor: Blue Harbour Group Investor Info Shares % Outstanding Cost Basis Catalyst Info 9,783,812 7.9% 31.18 Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 26.11 1.6B 3.1B 4.8B -1.6B 549M 24.96 – 37.81 8.8 Catalyst: On September 23 Blue Harbour disclosed it had increased its ownership from 6.5% to 7.9% Comment: We previously covered RDC in numerous Catalyst Research Reports highlighting Steel Partners’ steady increase in ownership from June 2007 to 2009 and its nomination of three individuals for election to the board at the 2008 annual meeting. On March 31 2008 Steel entered into a settlement agreement with RDC in order to avoid a proxy contest. Under the terms of the agreement RDC agreed to commit to pursue appropriate means to monetize its investment in its wholly-owned subsidiary, LeTourneau Technologies, through a sale or a spinoff into a separate publicly-traded company. In addition, under the terms of the agreement, if the monetization was not consummated on or before December 31, 2008, then RDC agreed to increase the size of its Board by one director and fill the vacancy with a person to be designated by Steel. On January 22, 2009 Steel appointed one individual to the board of RDC. On March 26, 2009 Steel sent a letter to RDC expressing their concern with certain disclosures contained in RDC’s annual report and proxy materials. Specifically, Steel expressed its concern over significant inventory write offs in the fourth quarter of 2008, excessive professional fees paid and to be paid in connection with the suspended LeTourneau Technologies monetization process and unusual and improper compensation and severance arrangements with the retiring CEO, the new CEO and other executive officers. Steel sold its position in 2009 and no longer owns any RDC stock. On July 22 Blue Harbour disclosed a 6.5% "active" stake in RDC Legal counsel to Blue Harbour Group Legal counsel to Steel Partners Hedge Fund Solutions, LLC © 2003 – 2014 Page 12 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Elizabeth Arden, Inc. (RDEN) Activist Investor: Rhone Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info 2,452,267 7.6% Not Avail Catalyst: Rhone extended its tender offer to acquire 20% of RDEN for $17/share Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 16.76 1.2B 498M 880M -381M 55M 14.65 – 40.40 15.9 LMP Real Estate Fund Inc. (RIT) Activist Investor: Bulldog Investors Investor Info Shares % Outstanding Cost Basis Catalyst Info 634,079 5.54% Not Avail Catalyst: Bulldog disclosed a 5.54% "active" stake in RIT and said the stock has traded at a double-digit discount to NAV for more than a year and the company should do a self-tender, open-end the fund, or liquidate Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 11.30 Not Avail Not Avail Not Avail Not Avail Not Avail 9.65 – 11.89 Not Avail Continue to Next Page Hedge Fund Solutions, LLC © 2003 – 2014 Page 13 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Rand Logistics (RLOG) Activist Investor: JWest, LLC Investor Info Shares % Outstanding Cost Basis Catalyst Info 1,412,877 7.88% 6.17 Comment: We initially covered RLOG on July 30, 2013 when JWest nominated 1 individual for election to the board. Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA Catalyst: RLOG and Jwest entered into a settlement agreement which will include 2 of Jwest's nominees on the Company's slate http://www.sec.gov/Archives/edgar/data/1294250/000119312514350976/d794134dex1.htm 5.53 151M 101M 302M -188M 28M 4.69 – 7.49 10.6 On July 1 Jonathan Evans (JWest) sent a letter to the Board announcing his intention to nominate 1 person for election unless several organizational and operational changes are met. On July 16 JWest sent a letter to RLOG informing the board of its intent to wage a proxy battle if they do not support JWest's 2 nominees. A copy of JWest’s July 16 letter is available here: http://www.sec.gov/Archives/edgar/data/1294250/000119312514270037/d758818dex1.htm On September 3 JWest issued a (very colorful) shareholder presentation outlining its case for change and seeking support for its 2 nominees A copy of JWest’s presentation is available here: http://www.sec.gov/Archives/edgar/data/1294250/000119312514330968/d784082ddfan14a.htm On September 5 JWest sent a letter to the Board demanding they explain the financial metrics the Company uses to demonstrate its performance track record. A copy of the September 5 letter is available here http://www.sec.gov/Archives/edgar/data/1294250/000119312514333930/d784490ddfan14a.htm Proxy Solicitor to Rand Logistics RadioShack Corp. (RSH) Activist Investor: Standard General Investor Info Shares % Outstanding Cost Basis Catalyst Info 10,130,928 9.8% Not Avail Catalyst: Standard General is in discussions with RSH about purchasing some of the Company's loans and about a business plan for the holiday season Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 0.99 3.4B 103M 727M 628M -226M 0.55 – 3.88 Negative Hedge Fund Solutions, LLC © 2003 – 2014 Page 14 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Shutterfly Inc. (SFLY) Activist Investor: Marathon Partners Investor Info Shares % Outstanding Cost Basis Catalyst Info 2,030,000 5.27% Not Avail Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 50.01 830M 1.9B 1.9B 30M 82M 36.30 – 58.22 23.14 Catalyst: Marathon sent a letter to SFLY stating that they would be willing to support the sale of SFLY, but only at a price that fairly compensates the shareholders for the upside they would forgo. They also indicated that the first quarter 2014 share repurchases at approximately $52 were viewed or should have been viewed by fiduciaries as having been made at well below fair value. This implies that the Board believes the current fair value of the common shares is significantly above $52 per share Comment: On July 2 SFLY announced it had hired an investment bank to examine a sale. On July 18 Marathon disclosed a 5.07% "active" stake in SFLY. Virginia National Bankshares (VABK) Activist Investor: Swift Run Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info 241,741 9.0% Not Avail Catalyst: Swift Run met with VABK's board and proposed "Five Steps to Maximize VABK Value" http://www.sec.gov/Archives/edgar/data/1411894/000091957414005391/d6106301_13d-a.htm Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 23.40 32M 63M 22M 42M N/A 17.00 – 23.75 N/A Comment: We initially covered VABK on March 14 when Swift Run announced it wants VABK to implement an annual dividend, repurchase shares, and examine a sale Continue to Next Page Hedge Fund Solutions, LLC © 2003 – 2014 Page 15 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ Volcano Corporation (VOLC) Activist Investor: Engaged Capital Investor Info Shares % Outstanding Cost Basis Catalyst Info 2,798,403 5.1% 21.68 Catalyst: Engaged sent a letter to VOLC's board highlighting the reasons for underperformance and demanding the board set a new course, add shareholders to the board, conduct a CEO search, and examine strategic alternatives http://www.sec.gov/Archives/edgar/data/1354217/000141588914002939/ex991to13da109455003_092914.pdf Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA 10.80 393M 565M 761M -200M 17M 10.70 – 24.62 45.8 Comment: We initially covered VOLC on November 4, 2013 when Engaged Capital disclosed a 5.1% "active" stake in VOLC and stated its belief that the shares ascribe minimal value to (a) the potential for sustained revenue growth from the fractional flow reserve (“FFR”) and peripheral intra-vascular ultrasound (“IVUS”) businesses as the penetration rates of these technologies increase, (b) the likelihood of material margin improvements and cash flow expansion as VOLC begins to generate operating leverage, (c) the opportunity to generate high rates of return through the disciplined allocation of its approximately $500 million cash balance, and (d) the attractiveness as an acquisition target given the advantaged and desirable position as the market leader in both FFR and IVUS. On February 18, 2013 VOLC announced it has changed its incentive compensation structure to better align management's pay with shareholder performance. Engaged says the valuation opportunity with VOLC is at least a 3:1 upside/downside ratio from current prices (at the time, VOLC was trading at $21.80/share). Legal counsel to Engaged Capital Yahoo! Inc. (YHOO) Activist Investor: Starboard Value Investor Info Shares % Outstanding Cost Basis Catalyst Info Not Avail Not Avail Not Avail Starboard’s ideas include: Company Info Share Price Revenue Market Cap Enterprise Value Net Cash EBITDA 52 wk. range EV/EBITDA Catalyst: Starboard sent a letter to YHOO's board highlighting several opportunities to create value, including merging with AOL http://finance.yahoo.com/news/starboard-delivers-letter-ceo-board-160700399.html 40.66 4.6B 40.26B 38.87B 1.56B 773M 31.70 – 44.01 50.3 1. 2. 3. 4. Unlocking the substantial value from Yahoo's non-core minority equity stakes in Alibaba Group Holding Limited ("Alibaba") and Yahoo Japan in a structure that delivers value directly to Yahoo shareholders in a tax-efficient manner; Realizing substantial cost efficiencies by reducing expenses throughout the Company, specifically with a goal of reducing losses in the Display business by between $250 and $500 million; Halting Yahoo's aggressive acquisition strategy which has resulted in $1.3 billion of capital spent since Q2 2012 while consolidated revenues have remained stagnant and EBITDA has materially decreased; and Exploring a strategic combination with AOL, Inc. – a company we know well – which could improve Yahoo's competitive position, deliver cost synergies of up to $1 billion, and potentially facilitate the realization of value from Yahoo's non-core equity stakes with minimal tax leakage. Comment: We initially covered YHOO on May 13, 2012 when Yahoo entered into a settlement agreement with Third Point. Under the terms of the agreement Third Point’s nominees held 3 board seats on a board of 11 directors (reduced from 14). On July 22, 2012 Third Point sold 66% of its ownership back to YHOO for $29.11/sh and gave up its 3 seats on the board Legal counsel to Starboard Value Hedge Fund Solutions, LLC © 2003 – 2014 Page 16 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ The Catalyst Equity Research Report™ is a general circulation weekly. Hedge Fund Solutions and/or its affiliates (the “Firm”) may have a consulting relationship with the companies featured in this report (the “Companies”). The Firm may also actively trade in the securities of the Companies for its own account. At any time, the Firm, funds it manages and/or its employees or their family members may have a long or short position in registered or non-registered securities or in options on any such security of any company mentioned in this report. CONTACT INFORMATION: Hedge Fund Solutions, LLC Damien J. Park Tel. +1 215.325.0514 dpark@hedgerelations.com FREE Subscription to the weekly report: http://www.hedgerelations.com/research.html or Email: research@hedgerelations.com The information contained in this report is not a complete analysis of every material fact with respect to the company, industry, or security and is not an offer or solicitation to buy or sell any security. Although opinions and estimates expressed in this report reflect the current judgment of the Firm, the information upon which such opinions and estimates are based is not necessarily updated on a regular basis. In addition, opinions are subject to change without notice. The Firm from time to time may perform consulting services for companies mentioned in this report and may occasionally possess material, nonpublic information regarding such companies. This information is not used in the preparation of this report. Facts and other information contained in this report have been obtained from the public sources considered reliable but are not guaranteed in any way. Hedge Fund Solutions’ Portfolio of Activist Investing Products Catalyst Investment Research™ Daily: Email Alerts Specific Activist Target Catalyst Investment Research™ Weekly: Catalyst Equity Research Report™ Special Reports Quarterly Buying Analysis Top 50 Activist Investors Shareholder Activism Report & Resource Portal Download a Brochure http://www.hedgerelations.com/CIR/CIR%20Brochure.pdf Hedge Fund Solutions, LLC © 2003 – 2014 Page 17 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ PLATINUM SPONSORS – Broker-Dealer APB Financial Group is a Special Situations Brokerage Firm tailored to investors seeking fundamental value and catalyst-driven activist investments. www.apbfinancialgroup.com Contact: Steven Abernathy, Principal Email: sabernathy@abbygroup.com Tel: +1 212.293.3469 PLATINUM SPONSORS – Legal Advisers Olshan Frome Wolosky LLP is a law firm dedicated to providing personal service tailored to the specific requirements and concerns of the firm’s clients. Olshan is widely recognized as a preeminent law firm in the activist strategy area, and represents experienced activist investors, funds new to the activist area, as well as other investment and hedge funds. Olshan has extensive experience advising clients in a wide range of activist strategies, from private negotiations with management to public, high profile proxy contests, including expertly and efficiently handling litigation relating to activist matters. We also specialize in mergers and acquisitions and hostile takeovers, with extensive expertise in these matters. Olshan’s highly regarded attorneys provide a full range of legal services and are uniquely positioned to provide expert advice regarding the complicated and nuanced legal issues facing activist investors today. Contact: Steve Wolosky, Partner Email: swolosky@olshanlaw.com Tel: +1 212.451.2333 Schulte Roth and Zabel LLP, one of the leading law firms in the activist investing area, has been involved in some of the highest-profile campaigns facing the business world in recent years. Serving both activist-only and occasional activists, the firm advises on federal securities law, state corporate law, Hart-Scott-Rodino, proxy rules and related matters, as well as handling investigations and litigations arising out of clients' activist activity. The firm, with over 375 lawyers in offices in New York, Washington, D.C., and London, has a long history of serving private equity and hedge fund clients. Contact: Marc Weingarten, Partner Email: marc.weingarten@srz.com Tel: +1 212.756.2280 David Rosewater, Partner Email: david.rosewater@srz.com Tel: +1 212.756.2208 Hedge Fund Solutions, LLC © 2003 – 2014 Page 18 of 19 HEDGE FUND SOLUTIONS CATALYST EQUITY RESEARCH REPORT ™ PLATINUM SPONSORS – Proxy Advisors Alliance Advisors LLC is a multi-faceted shareholder communications firm specializing in proxy solicitation, corporate governance consulting, and information agent services. Our in-depth view of the investor communities and governance environment allows us to prepare for successful outcomes. Alliance Advisors’ “fight team” has built a distinguished reputation by successfully completing countless contested assignments. The team will complete a comprehensive analysis of the shareholder base and build a calculated battle plan accordingly. We will assist in the crafting and delivery of your message to the target audience, ensuring the message is heard and understood. Alliance Advisors consistently delivers successful outcomes to our clients. Contact: Peter Casey, Executive Vice President Email: pcasey@allianceadvisorsllc.com Tel: +1 973.873.7710 Innisfree M&A Incorporated is a full service proxy solicitation/investor relations firm providing clients with sound tactical and strategic advice and results-oriented implementation in proxy and consent solicitations (whether friendly or contested), tender and exchange offers, mergers, rights offerings, strategic restructurings and other domestic and cross-border transactions requiring action by public security-holders. We provide expert consulting services on a wide range of matters, including executive compensation proposals, corporate governance issues and investor relations. Innisfree’s reputation derives from our success in complex and/or contested situations. Key to that success is our ability to track, identify and understand the shifting dynamics of a company’s security-holder base and provide battle-tested advice based on that information. We are convinced, and our unrivaled record demonstrates, that this refined, analytical based approach enables us to deliver the extraordinary results our clients expect. Contact: Arthur Crozier, Co-Chairman Email: acrozier@innisfreema.com Tel: +1 212.750.5837 MacKenzie Partners, Inc. is a full-service proxy solicitation, investor relations and corporate governance consulting firm specializing in mergers-and-acquisitions related transactions. The firm has offices in New York City, Los Angeles, Palo Alto and London. MacKenzie's services include corporate governance consulting, security holder solicitations, information agent services for tender and exchange offers, beneficial ownership identification, market surveillance and associated financial, investor and media relations services. We work in close partnership with our client's attorneys, investment bankers and other consultants, providing advice and counsel at each stage of the transaction. Contact: Mark Harnett, President Email: mharnett@mackenziepartners.com Tel: +1 212.929.5877 Hedge Fund Solutions, LLC © 2003 – 2014 Page 19 of 19