2015 annual report - SCOTT® Technology Ltd.

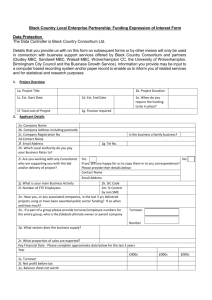

advertisement