Tax Policy Competition and Awards 2015

advertisement

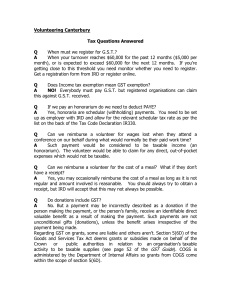

Tax Policy Competition and Awards 2015 Tax Policy Scholarship Charitable Trust A schedular tax base for personal income Proposal for reform of the personal income tax base and rate structure Jeremy Beckham Introduction What do we mean by a schedular tax base for personal income? • Personal income tax base is an important component of government revenue. • Tax system currently imposes tax on comprehensive income (one rate structure applied to all income regardless of type). • Could instead adopt a schedular tax base where tax system recognises there are different types of receipts and applies separate tax treatment. Composition of tax revenue (year end 31 March 2015) 13% Individual income tax 40% 32% Company income tax Goods and services tax Other 15% Source: Treasury (Tax Outturn data) © 2013 Deloitte 4 Footer © 2013 Deloitte Tax system currently operates on progressive taxation Combination of progressive taxation and comprehensive income Progressive taxation provides for income redistribution between low income and high income earners based on taxable income. Complex regimes are needed to prevent income diversion and to support taxation at an individual’s marginal rates. Proportionate taxation provides one fixed rate for income tax. Offers significant potential over a progressive rate structure in terms of reducing complexity and improving coherence by removing incentives to split or shift income. Can we reach a middle ground between progressive and proportionate rate structures using a schedular approach to the tax base? 5 © 2013 Deloitte Design for a schedular tax base – active income Progressive rate structure retained for active income Tax rates applicable to schedular earned income: Schedular earned income Income tax rate up to $14,000 10.5% from $14,001 to $48,000 17.5% from $48,001 to $70,000 28.0% $70,000 and over 33.0% • Will include mostly amounts received from business, employment or personal exertion. • Progressive taxation remains an equitable mechanism for income redistribution as earned income is not associated with the accumulation of wealth. • Earned income is more difficult to shift between persons or entities. • Quasi-alignment of second-from-top rate with company rate selected as good fit under a schedular approach. 6 © 2013 Deloitte Design for a schedular tax base – passive income Proportionate taxation of savings income Flat tax rate applicable to schedular savings income: Schedular savings income All income Income tax rate 28.0% • Will apply to most interest and dividend income derived by individuals or trustees of any amount from domestic sources. • A flat 28% savings rate will apply which is less than the top personal income tax rate and aligned with the company tax rate. PIE income will also be taxed at the 28% savings rate. • RWT rules will be simplified so that tax is withheld from all payments at 28% adjusted for the amount of imputation credits attached to dividends. Amounts withheld will represent a final tax for non-filing taxpayers. • Dividends received from companies that are not widely held and interest derived from associated parties will be excluded. 7 © 2013 Deloitte Design for a schedular tax base – passive income 28% savings rate selected as a deliberate savings incentive Concessionary rate for high income earners 8 © 2013 Deloitte Design for a schedular tax base – passive income Taxation of other passive sources of income Two-step rate applicable to schedular other income: Schedular other income Income tax rate up to $70,000 28.0% $70,000 and over 33.0% • Defined prescriptively to include other sources of passive income e.g. rents, royalties, attributed income from interests in foreign equity. • Will include other types of passive income that are not eligible to be treated as schedular savings income. • Two-step rate is aligned with top two rates of the progressive rate structure applicable to schedular earned income and shared quantum of income with schedular earned income. • Important integrity measure – it retains the top personal income tax rate while ensuring minimum taxation of all passive income at 28%. 9 © 2013 Deloitte Better targeting of taxpayer behaviour using the tax system Persons at or near the age of retirement – less distortionary 10 © 2013 Deloitte Achieving better redistributive outcomes Use schedular approach to shift emphasis from imposition of taxes 11 © 2013 Deloitte Questions? 12 © 2013 Deloitte Tax Policy Competition and Awards 2015 Tax Policy Scholarship Charitable Trust