UBS uses IBM technology for convenient

security in e-banking

Reference survey UBS Access Key

The customer: UBS

Drawing on its 150-year-heritage, UBS serves private, institutional and corporate clients worldwide, as well as retail

clients in Switzerland. UBS combines its wealth management, asset management and investment banking businesses as

well as its retail banking in Switzerland to deliver superior financial solutions to its customers.

UBS has its headquarters in Zurich and Basel and is represented in more than 50 countries, including all major financial

centers, and employs approximately 65,000 people world-wide. UBS is quoted on the Zurich and New York stock

exchange. In the year 2010, the bank achieved an operating income of 32 billion Swiss francs and a result before tax of

7.5 billion Swiss francs.

In Switzerland, UBS is the largest banking institution and has more than 300 offices. Every third Swiss household, every

third pension fund and more than 40 percent of the companies are customers of UBS. The bank carries out one million

payments per day for its customers.

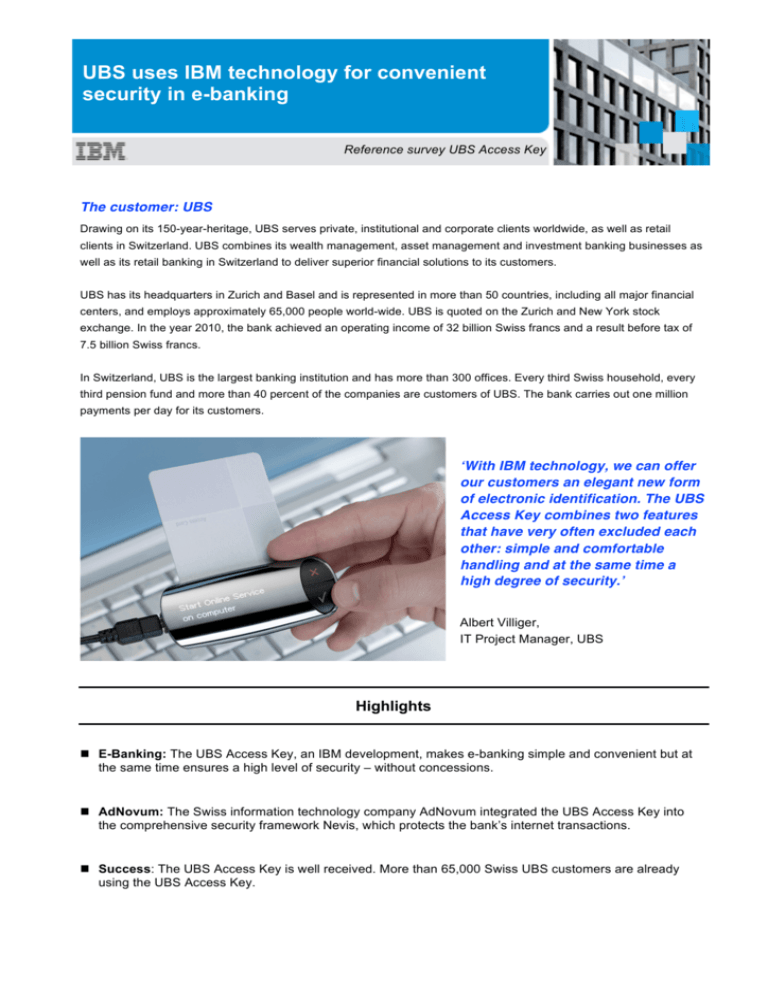

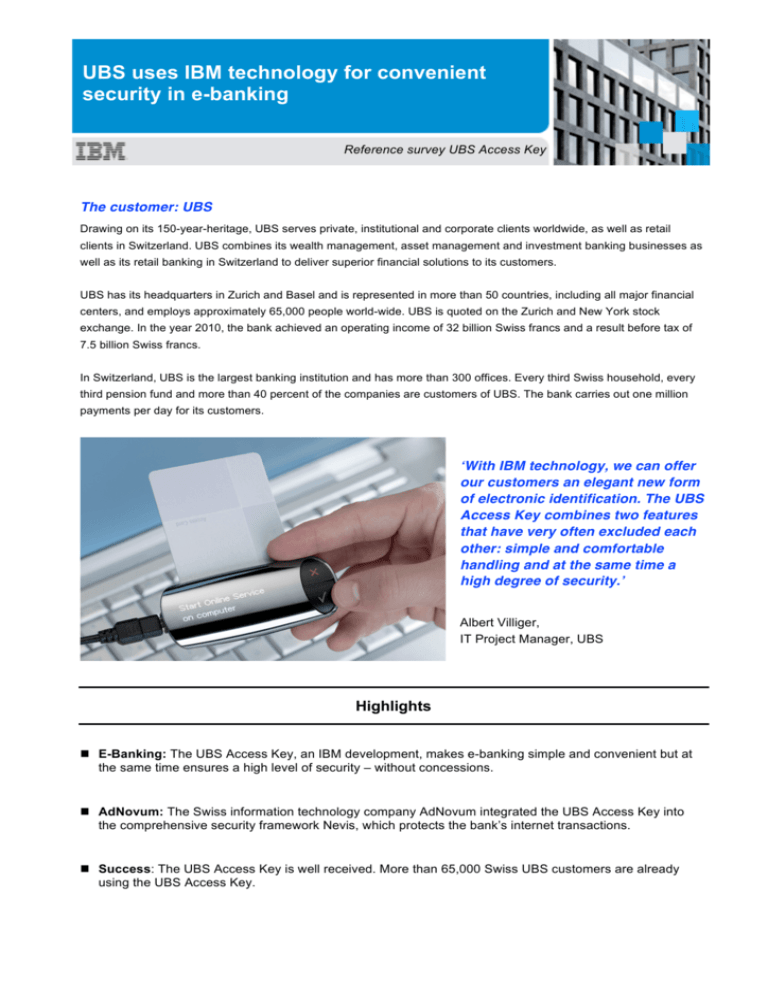

ʻWith IBM technology, we can offer

our customers an elegant new form

of electronic identification. The UBS

Access Key combines two features

that have very often excluded each

other: simple and comfortable

handling and at the same time a

high degree of security.ʼ

Albert Villiger,

IT Project Manager, UBS

Foto:

Highlights

n E-Banking: The UBS Access Key, an IBM development, makes e-banking simple and convenient but at

the same time ensures a high level of security – without concessions.

n AdNovum: The Swiss information technology company AdNovum integrated the UBS Access Key into

the comprehensive security framework Nevis, which protects the bank’s internet transactions.

n Success: The UBS Access Key is well received. More than 65,000 Swiss UBS customers are already

using the UBS Access Key.

The Challenge

The solution

UBS aspires to offer its customers the highest possible

level of security in e-banking. Banks are generally

confronted with more and more elaborate hacker and

phishing attacks. That is why already ten years ago,

UBS Switzerland developed a very safe procedure in

cooperation with the IBM research laboratory

Rüschlikon, replacing the TAN lists.

IBM developed a new, innovative card reader named

ZTIC: Zone Trusted Information Channel. The device

is attached to the computer via USB cable and then

controls the secure internet connection (SSL). The

IBM laboratory Rüschlikon already had a prototype,

which was now adapted to the requirements of UBS.

UBS especially demanded high performance in order

to offer fast response times.

This new procedure by UBS was based on ‘challengeresponse’, which means the authentication by question

and answer. The e-banking system poses a question,

the customer gives the right answer and thereby

identifies him- or herself. The ‘question’ is a number.

Now the customer needs his or her personal UBS

Access Card (a chip card) and a card reader with

numeric keys, resembling a pocket calculator. The

customer inserts the Access Card into the card reader

and enters the number. The device calculates a new

number: the ‘answer’. The customer then enters this

response on the website and is authenticated.

Furthermore, ZTIC required additional protocols in the

e-banking system. That is why UBS had the software

adapted by AdNovum. AdNovum, a Swiss IBM

business partner, is responsible for the security

framework Nevis which protects UBS’ internet

transactions.

The procedure reaches a high level of security, but has

one disadvantage: It needs a lot of manual intervention,

numbers need to be entered several times. Especially

for business customers, who often need to carry out

bank transfers, the handling is rather cumbersome. That

is why UBS searched for a solution that maintains the

high security level, but offers more convenience.

The bank introduced the new device to its Swiss

customers under the name of UBS Access Key. The

UBS Access Key considerably simplifies e-banking,

no numbers need to be entered. The customer can

read important details such as an account number on

the UBS Access Key and confirm or cancel the

process by one single push of a button. At the same

time, a high security level is maintained, the UBS

Access Key protects the SSL connection. More than

65,000 Swiss UBS customers are already using this

innovative solution.

Advantages of the IBM Zone Trusted Information Channel ZTIC

§

ZTIC establishes a secure SSL connection for the internet banking and protects it. The user has full control of

the secure internet connection.

§

Hacker and phishing attacks are disclosed and prevented. ZTIC makes malware and man-in-the-middleattacks ineffective.

§

The handling of ZTIC is easy and requires no training. Simply watch the video on YouTube!

§

High comfort yet high security in e-banking.

§

The user does not need to install any software. Simply plug in the device!

§

Innovative IBM technology.

Contact:

®

IBM Research - Zurich

Dr. Michael Baentsch

BlueZ Business Computing

Tel. +41-44-724-8620

E-Mail: ztic@zurich.ibm.com

Säumerstr. 4

CH-8803 Rüschlikon

© Copyright IBM Corporation 2012. All rights reserved.

IBM and the IBM logo are registered trademarks of the International Business Machines Corporation

in the USA and/or other countries.

Trademarks of other companies/producers are acknowledged. Terms of contract and prices are

available at IBM branch offices and the IBM business partners. The product information represents

the current status. Content and scope of services are determined exclusively according to the

respective contracts.

This publication exclusively serves as general information.