Market Assessment & Analysis

advertisement

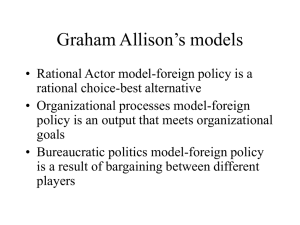

ENTHRONE Market Environment A presentation on the Market Assessment & Analysis Vassiliki Apostolopoulou (Telecompare) 0 Digital Distribution Market What is all about ……… Multimedia Market Convergence Enabling Technologies & State of the Art Multimedia Services – value chain battlefield Trends & Opportunities – Future Vision A highly complex playground for big established players, emerging key players and also other future players entering the market 1 Multimedia Market Convergence What are the drivers …. Broadband • The Triple Play and Quadruple Play / Service Bundling • Already there .. • Need to build multi-play offerings that provide different combinations of services • Market Growth • The strongest growth is occurring in Eastern Europe, where improving market conditions coupled with rapidly growing demand and developing infrastructure are driving growth. Growth will average 33% per year until 20101 • The number of worldwide broadband subscribers will double over the next five years, reports In-Stat (http://www.in-stat.com). By year-end 2010, worldwide broadband subscribers will reach 413 million 2 Multimedia Market Convergence What are the drivers …. Broadband • Peer-to-peer Content Distribution • The amount of data now exchanged on P2P networks is about equivalent to a full third of all present Internet traffic. • With legitimate P2P services forecast to increase significantly in number over the next few years, this is of great concern to the telecoms industry • QoS aware Networks • Broadband operators hoping to generate revenues from content delivery need to offer improved services that content providers will buy. • They need to deliver end-to-end QOS for IP voice, streaming video, highdefinition services, and rich-media capability for the busiest Websites. • They need to deliver effective caching and load-balancing services. They must enable content providers to deliver content irrespective of how busy the Internet is at any given moment. 3 Multimedia Market Convergence What are the drivers …. Networked Home The multi-faceted nature of the digital home, means that no single player has all the competencies required to control the digital home. The various players should therefore focus on their strengths, and form partnerships with and/or acquire others where necessary 4 Multimedia Market Convergence What are the drivers …. Fixed-Mobile Convergence Combining forecasts indicates that by 2011 some 250 million users will be in service over FMC networks and access points. This equates to around 10% of households and 8% of enterprises using some form of FMC access point on the premises. 5 Enabling Technologies & State of the Art Multimedia Services Management • MPEG-21 is a standard that describe s the combination and interactions of multiple elements throughout the multimedia delivery chain • The IP Multimedia Subsystem (IMS) defines a generic architecture for offering Voice over IP (VoIP) and multimedia services. Metadata Management • metadata storage, context-related metadata generation, content related metadata generation, and metadata management Audio-visual content generation & adaptation • H264 Encoding Systems & Applications • Content Encoding for Mobile TV networks Market • Content Encoding for IP TV networks Market Content Protection • TV conditional access and pay-per-view • Internet media streaming • Internet download shops • Media on mobile networks • Content Protection Architectures • Content Protection Systems (MPEG-21 IPMP, DMP, etc.) End-to-end QoS across heterogeneous networks • Access QoS provisioning: xDSL, cable 6 Multimedia Services – Value chain battlefield 1 • IPTV and the Triple Play • IPTV refers to a group of related technologies delivering television programming using a broadband connection over the Internet Most of the industry research estimates between 15 million and 37 million global IPTV subscribers by the end of the decade; Alcatel's forecast of 70 million to 100 million seems high by comparison. Light Reading forecasts for broadband and IPTV penetration in the major markets worldwide arrive at a figure of about 65 million. 7 Multimedia Services – Value chain battlefield 2 • Mobile Entertainment 1. Vodafone Casa FASTWEB, Vodafone (Italy) 2. SMS, O2 (UK) 3. Mobile TV and Video Streaming, 3 (UK) 4. BlackBerry Email and IM, T-Mobile (USA) 5. Mobile Broadband, Sprint Nextel (USA) 6. Mobile TV Broadcasting, 3 (Italy) 9. DCMX Mobile Payment, NTT DoCoMo (Japan) 10. MiniCall ‘Voice SMS’, Vodafone (Egypt) 8 Multimedia Services – Value chain battlefield 1 • Communities and User Generated Content Year 2010 Expected Optimistic Pessimistic Views/Downloads 65,006,344.1 112,098,202.0 27,267,383.8 Size (TB) 1,127,654.1 1,944,548.6 483,083.3 Uploads 1,116,602.8 1,925,491.6 252,128.0 Size (TB) 9,158.7 15,793.5 2,076.7 Revenue $852.3 $1,390.4 $583.2 The User Generated Content (UGC) space is vast, far more than the two largest players alone, YouTube and MySpace, who together with the other large companies, like Yahoo!, Google and AOL, capture many of the headlines. Forecasts for downloads/uploads (size, number of files, and revenues directly tied to videos), expects by 2010 the volume of downloads/views to reach over 65 billion, with 1 billion uploads supplying the Creative Content 9 DIGITAL DISTRIBUTION MARKET INSIGHT Service Provision Service Delivery all these actors that enable the end user to access and interact with content and applications over digital delivery channels the technology and infrastructure required to transport the data comprising the content or service to the end customer, Digital Distribution Market Content & Applications concerns the product for which the customer is paying - either directly or indirectly and concerned with those who create and provide content and applications targeted at users 10 Enabling Technologies concerns the provision of the background software and IT service processes that underpin the functions of the other three segments SWOT – Service Provisioning STRENGTHS WEAKNESSES Key Market Players involved and ready to exploit new services / products Users especially mobile ones are more familiar with audio visual services and ready to pay for content and QoS Market Players willing to provide value to services and customers Technology is mature enough and highly innovative New rich content increase consumer’s trust New business models are investigated by market players OPPORTUNITIES Key market players insists on their monopolist approach High costs of integration Big players have tendency to smother growth of smaller players Fixed Internet users still want content for free Information Society is a reality (e-business, eeconomy) New business models shall drive market growth Need for content and delivery is still strong, consumers are willing to pay Market is open for new entries and players Content is the main demand from consumers Increased customer value and QoS New more sophisticated devices enabling content retrieval and displaying Standardization activities and security issues are now mature Key market Players insist on maintaining their strong market share, acting as a barrier to the new emerging economy Business roles and models appear could restrict some actors (Content providers versus service providers) Universal Service is still not a reality for a majority of consumers Content owners (records / media firms) are sceptical in adopting new business models DRM developments, security and protection issues are slowing the exploitation of the market. 11 THREATS SWOT – Service Delivery STRENGTHS WEAKNESSES High Broadband bandwidth in place New infrastructure from operators for delivery of data (Wi-max, WLANs, fiber), all IP networks Digital and mobile TV is a reality for market Devices much more capable and customisable , Gadgets are accepted by the users Consumers are trained to web based services, mobile content delivery OPPORTUNITIES Devices too complex for some users to use or configure Open roaming an issue – both within technologies (3G – 2G) and between them (3G – WLAN), interoperability and End-to-end QoS still unsolved. Delivery is a commodity Recession/debt has slowed investment THREATS Content is opportunity to fill network capacity Delivery can expand into Services Industry players are big and powerful and critical to the success of the industry Device manufacturers have the opportunity of diversifying further as they cater for user requirements according to context (i.e. different devices dependent on location). Home networking provides opportunities for delivery players to expand into service provision Delivery could get squeezed by Content and Service Will customers pay more, or will they cannibalise? Device shelf-life (fashion and technological) could have a detrimental impact on the take-up of services. New roll-outs & upgrades need careful management Customers access high-bandwidth networks, find no use for the higher bandwidth 12 SWOT – Content & Applications STRENGTHS WEAKNESSES Availability of content Portals have been widely accepted and user’s are seeking new channels and devices Mobile users are willing to pay for content, fixed internet users increasingly Movement from purely text-based content has increased number of users willing to pay OPPORTUNITIES High-bandwidth infrastructure in place (Broadband, GPRS) Customers want access to content Partnerships are evolving Increased customer recognition of value Devices now more capable of displaying complex content 13 Many fixed Internet customers still expect to pay little/nothing for content Understanding how to optimise new and existing content for multi-channels still a challenge. Usability of services, content and applications still an issue Standards issues still not fully addressed THREATS Partnerships to date not covered in glory Major corporations could undermine SMEs Lack of mainstream customer awareness – they don’t know they want it! In many ways this perpetuates the Digital divide/universal access to content issue User Security worries – Viruses, Privacy, Spam – not so much about fraud now more about data safety DRM, copyright, micropayment etc. issues make this sector unstable and unpredictable SWOT – Enabling technologies STRENGTHS WEAKNESSES Technology is mature enough and highly innovative Standardization activities and security issues are mature (DRM, MPEG-21 etc.) Research cooperation in European and international level will strengthen exploitation opportunities OPPORTUNITIES High costs of integration and switching from proprietary closed platforms End-to-end delivery platforms require mass adoption by all market actors before delivering value All actors are investigating convergence and alternative business models that require enabling technologies such as QoS provisioning, content adaptation etc. Key Market Players involved and ready to exploit new services / products Scalability considerations are ignored – the technology should be increasingly invisible to the end customer, and if services are not easy to use, take-up will be hindered Absence of recognisable, profitable business models incorporating partnerships and standards – if players cannot see significant revenues, they will remain risk averse and not drive the market forward Suppliers misunderstand the market – “build and they will come” is not a viable strategy; awareness building, marketing and customer relationship management are required Regulation and lack of standards hold back development THREATS 14 Future Vision – Key Findings Service Provision Service Delivery • Evaluation of user’s needs and requirement to understand where the value is • New business models towards the convergence of the different market segments • Provisioning of value and Quality of Service to the consumers • Adoption of the appropriate technology and platforms so as to ease the integration and enable all the actors to participate in the new economy. • Earn consumers confidence and trigger demand for new services • NO’s new business approach and models • Different network technologies roaming, interoperability and security • End-to-end QoS and DRM constraints to be overcome. 15 Future Vision – Key Findings Content & Applications Enabling technologies • Investments should be triggered and not be limited to capital rationing of the firms and big brands • Business models for content delivery need to be developed • Added value services should emerge and QoS should be guaranteed to consumers • DRM standardisation and copyright protection required • Business synergies and partnerships are required • Strong cooperation with all market actors to ensure that market requirements and business plans are sufficiently supported by the enabling technologies developed • Standardisation is the key to enable the wide adoption of the technologies • Strong cooperation in researching solutions for enabling technologies to provide better exploitation potential • In new business models towards the convergence of the different market segments • Dissemination and training of relevant actors to promote the technologies 16 THANK YOU 17