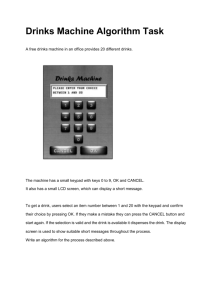

A Guide to the soft drink industry

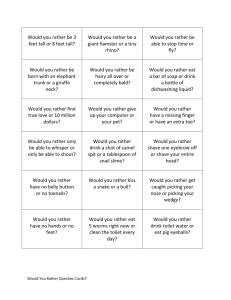

advertisement