Case Study

Nielsen Insights in Action:

Beer Launch Achieves

Refreshing Outcome

Anheuser-Busch taps Nielsen to understand

new demand - results in Anheuser-Busch’s

most successful new product in years

Company

Anheuser-Busch

As the maker of the world’s two biggest-selling beers, Budweiser

and Bud Light, St. Louis-based Anheuser-Busch is a true pioneer in

the brewing industry. The 150-year-old company is not only the

largest brewer in the United States, but the largest subsidiary of

Anheuser-Busch InBev, the world’s leading beer entity.

Historically, the adult beverage giant has built market share by

introducing valuable and innovative new products that brought

new customers to the beer category. However, by 2007, A-B

sales growth had flattened and price competition was fierce.

The company began looking for a new approach to growing the

category. Then-CEO August Busch IV brought in The Cambridge

Group, a division of Nielsen, to develop the best-in-class consumer

insights and analytics that he believed would be the basis of his

organization’s future success.

The Business

Issue

Company Facts

Anheuser-Busch

• U.S. subsidiary of Anheuser-

Busch InBev, the world’s

largest brewing company

• Produces more than 100 beers, flavored alcohol

beverages and

nonalcohol brews

• Brands include Budweiser, Bud Light, Michelob and Stella Artois

When Anheuser-Busch began its partnership with The Cambridge Group in 2006, growth had begun to

stall. Mainstream competitors were aggressively competing on price, and A-B had responded – impacting

profit growth. Furthermore, imports and small-volume beers were showing solid, consistent growth.

Company executives looked to develop a new business model to focus the portfolio and identify innovation

opportunities to fuel long-term growth. In partnering with Cambridge, the company sought to gain a clearer

understanding of demand to develop and market products that would truly meet the needs of

their consumers.

Cambridge’s initial focus was identifying the key drivers shaping demand for beer. Forces and Factors™

analysis, leveraging secondary research and focus groups, identified various hypotheses about what

consumers were looking for when it came to beer. This work demonstrated that most of the growth in spirits

was coming from flavored vodkas. Was sweeter-tasting beer a similar growth opportunity? A-B had already

launched ULTRA Fruit and was seeing positive results. Was the opportunity much larger than originally

anticipated?

Cambridge’s next step was to complete an extensive quantitative study in which the team outlined several

Demand Profit Pools™, groups of consumers with distinct needs and demand for beer. The team further

identified multiple unique “beer palates” and uncovered that a sizeable number of beer drinkers had demand

for “sweeter tasting” beer that was not being met by existing products. There appeared to be demand for a

larger, more mainstream product introduction.

Nielsen Insights in Action:

New Markets, Beefed Up Sales

The Solution

Case Study

“

Drawing on Cambridge’s Palate Map™ analysis, the brew masters

at Anheuser-Busch created a novel formula that – with a splash

of natural lime – offered a refreshing, citrus-infused alternative

to traditional light beers. A competitor had recently introduced

a similar product, but instead used artificial lime flavoring and a

pinch of salt. Anheuser-Busch believed its unique brew would win

over beer drinkers.

Field taste tests convinced Anheuser-Busch that it had a winner

on its hands. Consumers preferred its lighter, more natural

sweetness to the competitor’s lime-salt combination. While

the new Bud Light product proved enormously popular during

initial product testing, A-B wanted to confirm the economics

to justify the investment of a major new product launch.

Cambridge leveraged its proprietary Customer Demand Analysis

to demonstrate that the new beer was likely to not only increase

consumption among light beer drinkers, but also bring new

consumers to the category. Also, the product could be sold at

a price premium, thereby generating enhanced profit margins.

More importantly, the work also showed that the new beer would

positively impact its iconic Bud Light brand, not detract from it.

“Even the loudest

naysayers were

convinced once the

data came back. Not

only would Bud Light

Lime add incremental

volume, it would

broaden and strengthen

the perception of

Bud Light.”

”

Dave Peacock,

president of Anheuser-Busch

“Even the loudest naysayers were convinced once the data came back,” said Dave Peacock, president of

Anheuser-Busch. “Not only would Bud Light Lime add incremental volume, it would broaden and strengthen

the perception of Bud Light.”

A Win-win

Outcome

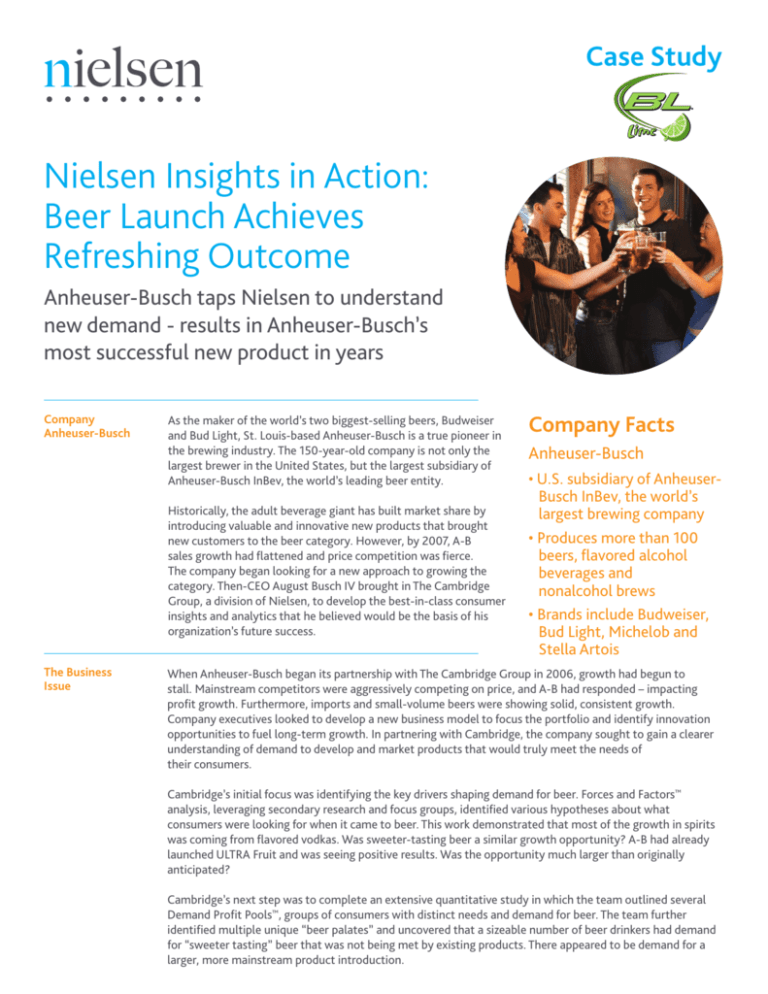

From the beginning, the introduction of Bud Light Lime was a tremendous success. Launched in May of

2008, the product exceeded all expectations, generating strong trial, repeat and volumes. Additionally,

cannibalization of traditional Bud Light was less than expected. More welcome news: roughly 8 percent of

Bud Light Lime drinkers turned out to be non-beer drinkers, suggesting that the product was able to bring a

more ethnically diverse young adult demographic to the category, as Cambridge’s initial research

had predicted.

Just as importantly, consumers were impressed by the unique appeal of the beverage and demonstrated a

willingness to pay slightly more per unit, as was forecasted. “Not only did Bud Light Lime create a unique

product for a new pool of demand – as well as broaden the perception of the brand – it also proved to be

a bigger financial success than we ever imagined,” Peacock said. Bud Light Lime was ultimately ranked the

number-one product launch in the consumer goods industry for 2008.

To learn more about how Nielsen can help with your promotional

strategies, contact sales.us@nielsen.com or visit www.nielsen.com

Copyright © 2011 Nielsen. All rights reserved. Printed in the USA. Nielsen and the Nielsen

logo are trademarks or registered trademarks of CZT/ACN Trademarks, LLC. 10/1686