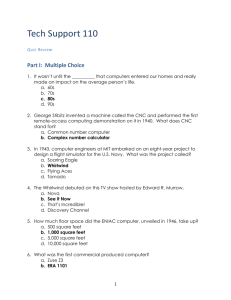

Apple Case Study

advertisement