Chapter 12

advertisement

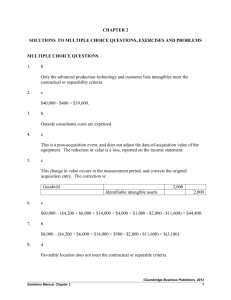

Chapter 12 - SFAS Nos. 141 and 142 Chapter 12 End-of-Chapter Material Relating to SFAS Nos. 141 and 142 QUESTIONS: 1. In general, how is the cost of internally-generated intangibles accounted for? 2. What are the five general categories of intangible assets? 3. What two approaches are used in estimating fair values using present value computations? Briefly explain the difference between the two approaches. 4. (a) Under what conditions may goodwill be reported as an asset? (b) The Roper Company engages in a widespread advertising campaign on behalf of new products, charging abovenormal expenditures to goodwill. Do you approve of this practice? Why or why not? 5. What intangible assets are recognized in a basket purchase but are not recognized when acquired as part of a business combination? PRACTICE 1 ACCOUNTING FOR THE ACQUISITION OF AN ENTIRE COMPANY James Company purchased Thomas Manufacturing for $1,000,000 cash on January 1. The book value and fair value of the assets of Thomas as of the date of the acquisition are listed below: Book Market Value Value Cash $ 10,000 $ 10,000 Accounts receivable 100,000 100,000 Inventory 200,000 300,000 Patent 0 50,000 Property, plant, and equipment 400,000 600,000 Totals $710,000 $1,060,000 In addition, Thomas had liabilities totaling $400,000 at the time of the acquisition. Thomas has no other separately-identifiable intangible assets. Make the journal entry necessary on the books of James Company to record the acquisition. PRACTICE 2 ACCOUNTING FOR NEGATIVE GOODWILL Refer to Practice 12-14. Assume that the cash acquisition price is $500,000 instead of $1,000,000. Make the journal entry necessary on the books of James Company to record the acquisition. PRACTICE 3 INTANGIBLES AND A BASKET PURCHASE The company paid $500,000 to purchase the following: a building with an appraised value of $200,000, an operating permit valued at $100,000, and ongoing research and development projects valued at $150,000. In addition, it is estimated that the fair value of the assembled work force currently operating in the building is $100,000. Make the journal entry necessary to record this cash purchase. PRACTICE 4 INTANGIBLES AND A BUSINESS ACQUISITION 1 Chapter 12 - SFAS Nos. 141 and 142 Buyer Company purchased Target Company for $800,000 cash. Target Company had total liabilities of $300,000. Buyer Company’s assessment of the fair values it obtained when it purchased Target Company is as follows: Cash Inventory In-process R&D Assembled work force $100,000 50,000 500,000 120,000 Make the journal entry necessary to record this business acquisition. EXERCISE 1 PURCHASE OF A COMPANY Hull Company purchased Heaston Company for $750,000 cash. A schedule of the market values of Heaston’s assets and liabilities as of the purchase date is given below. Heaston Company Schedule of Asset and Liability Market Values Assets Cash ............................................................................................................................... $ 5,000 Receivables ................................................................................................................. 78,000 Inventory ....................................................................................................................... 136,000 Land, buildings, and equipment ......................................................................... 436,000 $655,000 Liabilities Current liabilities ........................................................................................................ $ 80,000 Long-term debt........................................................................................................... 120,000 200,000 Net asset market value .......................................................................................... 1. 2. EXERCISE 2 $455,000 Make the journal entry necessary for Hull Company to record the purchase. Assume that the purchase price is $385,000 cash. Make the journal entry necessary to record the purchase. PURCHASE OF A COMPANY Caruthers Inc. is considering purchasing K&M Properties, which has the following assets and liabilities. Cost Fair Market Value Accounts receivable ........................................................................ Inventory ............................................................................................... Prepaid insurance............................................................................. Buildings and equipment (net) .................................................... Accounts payable ............................................................................. $240,000 240,000 10,000 70,000 (160,000) $220,000 250,000 10,000 200,000 (160,000) Net assets ............................................................................................ $400,000 $520,000 2 Chapter 12 - SFAS Nos. 141 and 142 1. 2. EXERCISE 3 Make the journal entry necessary for Caruthers Inc. to record the purchase if the purchase price is $630,000 cash. Assume that the purchase price is $300,000 cash. Make the journal entry necessary to record the purchase. BASKET PURCHASE OF INTANGIBLE ASSETS Taraz Compan paid $500,000 to purchase the following portfolio of intangibles with estimated fair values as indicated: Internet domain name Order backlog In-process research and development Operating permit Estimated Fair Value $150,000 100,000 200,000 80,000 In addition, Taraz spent $300,000 to run an advertising campaign to boost its image in the local community. Make the journal entries necessary to record the purchase of the intangibles and the payment for the advertising. EXERCISE 4 ACQUISITION PURCHASE OF INTANGIBLE ASSETS IN A BUSINESS Cossack Company purchased Village Enterprises. The following fair values were associated with the items acquired in this business acquisition: Cost Fair Value Accounts receivable ........................................................................ Inventory ............................................................................................... Government contacts ...................................................................... Equipment (net) ................................................................................. Short-term loan payable ................................................................ $200,000 100,000 0 40,000 (200,000) $200,000 50,000 100,000 50,000 (200,000) Net assets ............................................................................................ $140,000 $200,000 The fair value associated with Village Enterprises’ government contacts is not based on any legal or contractual relationship. In addition, for obvious reasons, there is no open market trading for intangibles of this sort. 1. 2. PROBLEM 1 Make the journal entry necessary for Cossack Company to record the purchase if the purchase price is $900,000 cash. Assume that the purchase price is $35,000 cash. Make the journal entry necessary to record the purchase. RECORDING GOODWILL The Aurora Corp. acquired Payette Company on December 31, 2005. The following information concerning Payette’s assets and liabilities was assembled on the acquisition date. 3 Chapter 12 - SFAS Nos. 141 and 142 Per Company’s Books As Adjusted by Appraisal and Audit $307,000 179,200 $340,000 260,000 $486,200 $600,000 Current liabilities .................................................................... Long-term liabilities .............................................................. (25,000) (160,000) (25,000) (160,000) Net assets ................................................................................ $301,200 $415,000 Assets Current assets ........................................................................ Land, buildings, and equipment (net) .......................... Liabilities Instructions: 1. 2. 3. 4. PROBLEM 2 Make the journal entry necessary for Aurora Corp. to record the purchase assuming the purchase price was $1,500,000 in cash. Why might Aurora be willing to pay such a high price for Payette? Repeat (1), assuming the purchase price is $350,000. Repeat (1), assuming the purchase price is $150,000. ACQUISITION AND VALUATION OF INTANGIBLES Derrald Divine Company purchased a customer list and an on-going research project for a total of $400,000. Derrald uses the expected cash flow approach for estimating the fair value of these two intangibles. The appropriate interest rate is 7 percent. The potential future cash flows from the two intangibles, and their associated probabilities, are as follows: Customer list Outcome 1 20% probability of cash flows of $50,000 at the end of each year for 5 years. Outcome 2 30% probability of cash flows of $30,000 at the end of each year for 4 years. Outcome 3 50% probability of cash flows of $10,000 at the end of each year for 3 years. On-going research project Outcome 1 10% probability of cash flows of $500,000 at the end of each year for 10 years. Outcome 2 10% probability of cash flows of $10,000 at the end of each year for 4 years. Outcome 3 80% probability of cash flows of $100 at the end of each year for 3 years. Instructions: Prepare the journal entry necessary to record the purchase of the two intangibles. 4 Chapter 12 - SFAS Nos. 141 and 142 5