WORLDCOM/MCI CASE

advertisement

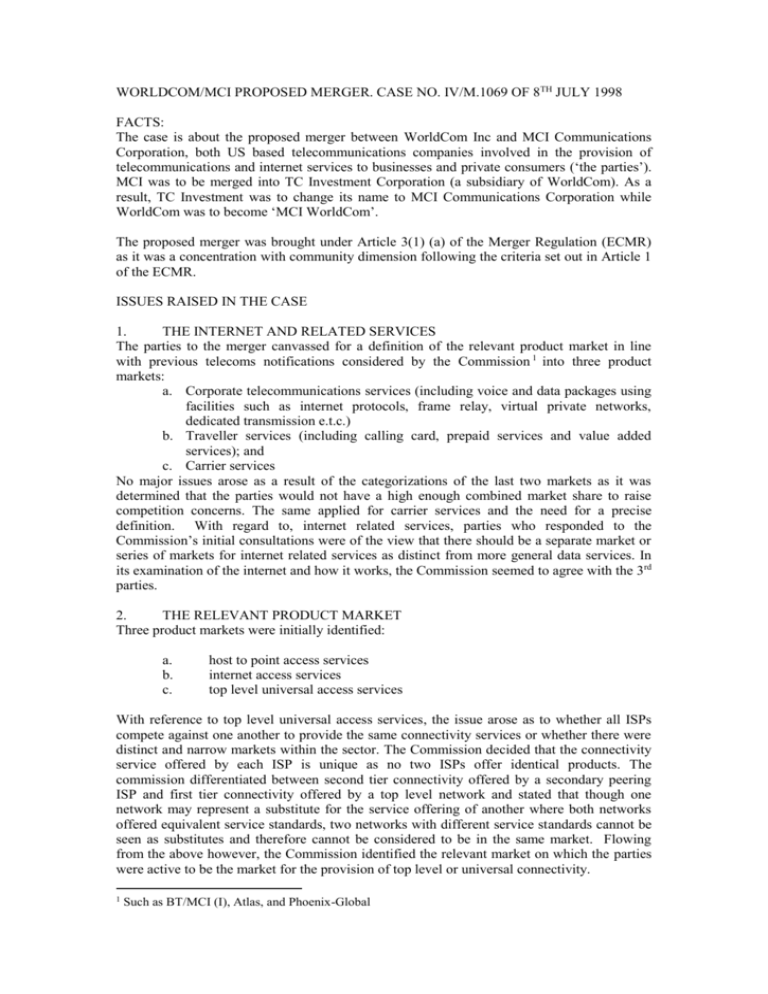

WORLDCOM/MCI PROPOSED MERGER. CASE NO. IV/M.1069 OF 8TH JULY 1998 FACTS: The case is about the proposed merger between WorldCom Inc and MCI Communications Corporation, both US based telecommunications companies involved in the provision of telecommunications and internet services to businesses and private consumers (‘the parties’). MCI was to be merged into TC Investment Corporation (a subsidiary of WorldCom). As a result, TC Investment was to change its name to MCI Communications Corporation while WorldCom was to become ‘MCI WorldCom’. The proposed merger was brought under Article 3(1) (a) of the Merger Regulation (ECMR) as it was a concentration with community dimension following the criteria set out in Article 1 of the ECMR. ISSUES RAISED IN THE CASE 1. THE INTERNET AND RELATED SERVICES The parties to the merger canvassed for a definition of the relevant product market in line with previous telecoms notifications considered by the Commission 1 into three product markets: a. Corporate telecommunications services (including voice and data packages using facilities such as internet protocols, frame relay, virtual private networks, dedicated transmission e.t.c.) b. Traveller services (including calling card, prepaid services and value added services); and c. Carrier services No major issues arose as a result of the categorizations of the last two markets as it was determined that the parties would not have a high enough combined market share to raise competition concerns. The same applied for carrier services and the need for a precise definition. With regard to, internet related services, parties who responded to the Commission’s initial consultations were of the view that there should be a separate market or series of markets for internet related services as distinct from more general data services. In its examination of the internet and how it works, the Commission seemed to agree with the 3rd parties. 2. THE RELEVANT PRODUCT MARKET Three product markets were initially identified: a. b. c. host to point access services internet access services top level universal access services With reference to top level universal access services, the issue arose as to whether all ISPs compete against one another to provide the same connectivity services or whether there were distinct and narrow markets within the sector. The Commission decided that the connectivity service offered by each ISP is unique as no two ISPs offer identical products. The commission differentiated between second tier connectivity offered by a secondary peering ISP and first tier connectivity offered by a top level network and stated that though one network may represent a substitute for the service offering of another where both networks offered equivalent service standards, two networks with different service standards cannot be seen as substitutes and therefore cannot be considered to be in the same market. Flowing from the above however, the Commission identified the relevant market on which the parties were active to be the market for the provision of top level or universal connectivity. 1 Such as BT/MCI (I), Atlas, and Phoenix-Global The parties also argued that other data transmission services were substitutable for internet services and that the internet did not have a hierarchical structure as any ISP could render a price increase by a monopolist ineffective by diverting traffic through secondary peering agreements. The 3rd parties responded to the contrary that as an ISP customer seeking top level universal connectivity could not avoid such a price increase as there were no other transit sources available and a secondary peering option involves substantial costs and even if an ISP succeeds in establishing a secondary peering connection, it would still not be able to reach directly connected customers of the monopolist thereby defeating the purpose of establishing universal internet connectivity as access to the monopolist’s customers is an essential element if the ISP’s infrastructure is to provide an economic substitute to the connection provided by existing top level networks. The Commission was of the view that the 3rd parties were right and went on to point out that even the parties themselves appear to recognise the validity of the argument. 3. THE RELEVANT GEOGRAPHIC MARKET With reference to carrier services, the commission stated that supply and demand for carrier services are at the least, cross border-regional as geographic proximity was not relevant for switched transit which carriers use as substitutes for operating their international lines or dealing with peak traffic on such lines. Following this, the relevant markets for the purpose of accessing the concentration are in Europe and the United States. For internet services the commission looked at the fact that the geographical extent would depend on the level being considered. However, considering that the international nature of the internet and the presence of ISPs who operate on a national and international level, a rise in the price of access to the top-level networks would affect consumers worldwide, therefore the market is effectively one global market. THE DECISION OF TH COMMISSION 1. The Carrier Services Market: Though WorldCom has been building city to city networks, MCI does not have a substantial presence as a capacity holder in the EC and as a result, no competitive concerns would be raised by the proposed merger. Though their joint market share in the US amounts to 23% making them bigger capacity holders than all other operators except AT & T, who hold 29%, any advantage that they might have will be quickly eroded by the appearance of other competitors in the market for cables as there were indications that other players were planning to emerge in the market. 2. Internet Access Services: it was noted that there was substantial competition in the retail ISP level and barriers to entry were sufficiently low to ensure the protection of competition in the market. 3. The top level or universal internet connectivity market: Based on the Commissions independent enquiries to determine the market size and share of the parties, it was established that: a. the parties were among the ‘big four’ i.e. 4 ISPs having stronger position than all others b. Based on their total aggregate connections with customers and peers the parties had a large market share of the top level networks c. Based on estimates of market size and share as indicated by revenue the proposed merger would give the parties a combined market share of 45% – 55%, far above that of its nearest competitors which was 15% - 25%. d. Their joint traffic flow was measured at between 42 and 52%. As a result, the Commission was of the view that the proposed merger if not altered, would put the parties in a position of dominance as a result of its ability to behave independently of competitors and customers2. As a result of that dominance the parties would be able to: a. b. c. d. Control market entry and raise entry barriers by denying peering requests, foreclosing or threatening to foreclose peering agreements and replacing them with interconnection agreements, the nature of which they could change at will. As a result, despite the rapid growth of the internet, dominance will be ensured as other ISP resellers will still need to rely on them for universal internet connectivity. Engage in selective or predatory pricing to attract customers away from competitors Raise costs and decrease quality of service at will. Guarantee a position to benefit from the snowball effect of capturing future customers through the promise of direct connection with the largest network as against that of its competitors which it can control or degrade at will. Based on the above, findings the parties undertook alter their position to protect competition in the market. The undertakings given by the parties include: a. MCI’s internet businesses and services related to access to public interconnected networks, existing peering arrangements (including the peering arrangement with WorldCom), contracts representing access and web hosting services and the intellectual property rights necessary for the operation of the businesses were to be transferred to a single independent purchaser who would appoint an independent auditor to review all relevant documents. b. MCI will negotiate in good faith with the purchaser for an appropriate noncompete agreement with respect to web hosting and firewall services. c. MCI will transfer some employees from its internet businesses to support the purchaser in the businesses transferred to it. The employees will be mutually agreed upon by both MCI and the purchaser based on a list provided by MCI classifying the functions of the employees. The transferred employees will not be hired or solicited by MCI and WorldCom for a specified period post closing d. The Commission may mandate the parties to appoint a trustee approved by it to monitor the discharge of the obligations entered into by the parties to the undertaking, provide written report on his progress and ability to discharge his mandate or carry out additional functions as directed by the commission. e. f. Except for internet customers of WorldCom at the closing date, MCIWorldCom will not solicit or contract to provide internet services to: i. ISPs for at least 24months post closing ii. retail internet access customers whose contracts are assigned to the purchaser for at least 18 months post closing iii. retail internet access customers whose contracts are not assigned to the purchaser for at least 18 months post closing or until after the termination of the contracts, whichever one is sooner. FINAL DECISION OF THE COMMISSION Subject to the condition of full compliance with the above undertakings by the parties, the Commission declared the proposed merger compatible with the common market. 2 cf. Art. 14 Framework Directive