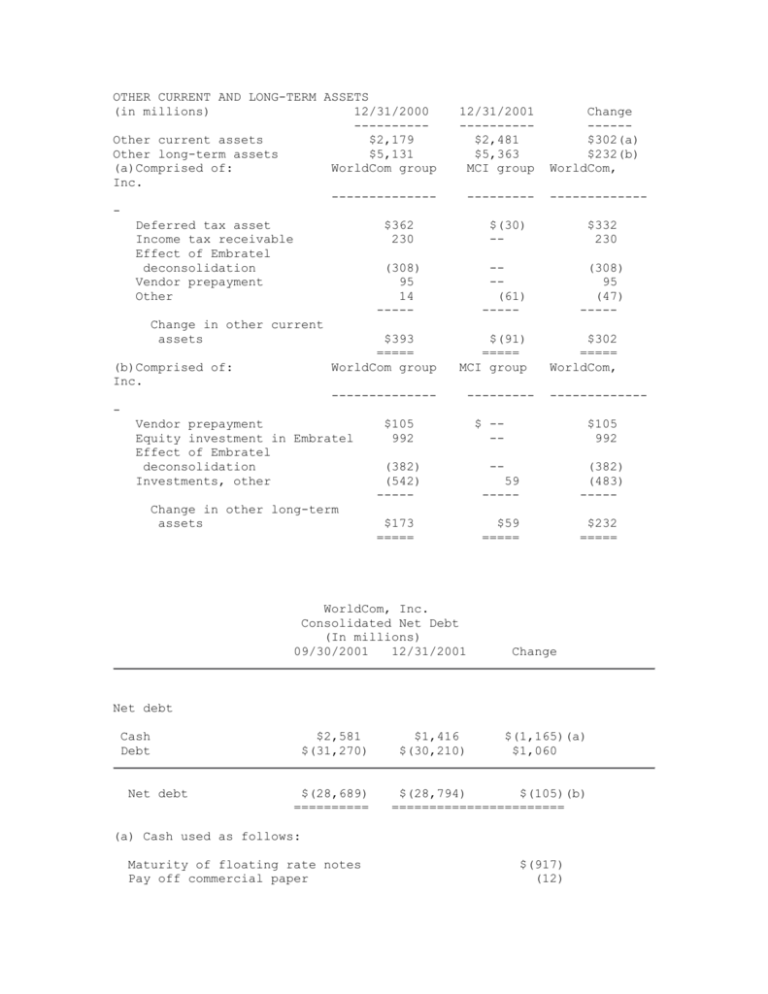

other current and long-term assets

advertisement

OTHER CURRENT AND LONG-TERM ASSETS (in millions) 12/31/2000 ---------Other current assets $2,179 Other long-term assets $5,131 (a)Comprised of: WorldCom group Inc. -------------Deferred tax asset $362 Income tax receivable 230 Effect of Embratel deconsolidation (308) Vendor prepayment 95 Other 14 ----Change in other current assets $393 ===== (b)Comprised of: WorldCom group Inc. -------------Vendor prepayment $105 Equity investment in Embratel 992 Effect of Embratel deconsolidation (382) Investments, other (542) ----Change in other long-term assets $173 ===== 12/31/2001 ---------$2,481 $5,363 MCI group --------- Change -----$302(a) $232(b) WorldCom, ------------- $(30) -- $332 230 --(61) ----$(91) ===== MCI group WorldCom, Inc. Consolidated Net Debt (In millions) 09/30/2001 12/31/2001 --------- (308) 95 (47) ----$302 ===== WorldCom, ------------- $ --- $105 992 -59 ----- (382) (483) ----- $59 ===== $232 ===== Change Net debt Cash Debt Net debt $2,581 $(31,270) $(28,689) ========== $1,416 $(30,210) $(1,165)(a) $1,060 $(28,794) $(105)(b) ======================= (a) Cash used as follows: Maturity of floating rate notes Pay off commercial paper $(917) (12) Open market purchases of Intermedia outstanding debt Purchase Rhythms assets Vendor prepayment Other (70) (32) (200) 66 $(1,165) ======= (b) Comprised of: Foreign currency effect on foreign denominated debt and cash Debt accretion on senior discount notes Purchase Rhythms assets Vendor prepayment Other $18 (10) (32) (200) 119 $(105) ===== WORLDCOM GROUP COMBINED STATEMENTS OF OPERATIONS (Unaudited. In Millions, Except Per Share Data) Excluding Charges and Embratel Three Months Ended Year Ended December 31, December 31, ----------------- ----------------2001 2000 2001 2000 -------- -------- -------- -------Revenues: Voice Data International Internet dedicated and other Total revenues $1,570 $1,708 $6,591 $7,036 2,139 1,927 8,620 7,389 768 625 2,977 2,367 824 688 3,160 2,455 -------- -------- -------- -------5,301 4,948 21,348 19,247 -------- -------- -------- -------- Operating expenses: Line costs: Attributed costs 1,983 1,904 8,019 7,031 26 23 101 87 Intergroup allocated expenses Selling, general and administrative: Attributed costs Shared corporate services 775 490 838 339 3,164 1,981 2,752 1,575 Depreciation and amortization: Attributed costs Intergroup allocated expenses Total Operating income 1,350 931 4,841 3,420 (179) (163) (720) (627) -------- -------- -------- -------4,445 3,872 17,386 14,238 -------- -------- -------- -------856 1,076 3,962 5,009 Other income (expense): Interest expense Miscellaneous (312) (152) (1,029) (502) 130 87 520 468 -------- -------- -------- -------- Income before income taxes and minority interests Provision for income taxes 674 1,011 3,453 4,975 263 410 1,315 2,050 -------- -------- -------- -------- Income before minority interests Minority interests 411 601 2,138 2,925 15 -35 --------- -------- -------- -------- Net income before distributions on mandatorily redeemable preferred securities 426 601 2,173 2,925 Distributions on mandatorily redeemable preferred securities and other preferred dividend requirements 42 16 117 65 -------- -------- -------- -------Net income $384 $585 $2,056 $2,860 ======== ======== ======== ======== PRO FORMA Diluted earnings per common share(1) $0.13 $0.20 $0.70 $0.98 ======== ======== ======== ======== Diluted weighted average WorldCom group shares outstanding(1) 2,965 2,893 2,933 2,912 ======== ======== ======== ======== (1) On June 7, 2001, WorldCom, Inc. recapitalized its common shares into two separate stocks - WorldCom group stock and MCI group stock - and each share of WorldCom, Inc. stock was changed into one share of WorldCom group stock and 1/25 of a share of MCI group stock. The above pro forma information was used as the basis to compute diluted earnings per common share and assumes the recapitalization occurred at the beginning of 2000 and the WorldCom group stock and MCI group stock existed for all periods presented. WORLDCOM GROUP COMBINED STATEMENTS OF OPERATIONS (Unaudited. In Millions, Except Per Share Data) Financial Reporting Three Months Ended Year Ended December 31, December 31, ----------------- ----------------2001 2000(1) 2001 2000(1) -------- -------- -------- -------Revenues: Voice Data International Internet dedicated and other Total revenues $1,570 $1,708 $6,591 $7,036 2,139 1,927 8,620 7,389 768 1,538 2,977 5,875 824 688 3,160 2,455 -------- -------- -------- -------5,301 5,861 21,348 22,755 -------- -------- -------- -------- Operating expenses: Line costs: Attributed costs Intergroup allocated expenses 1,983 26 2,315 23 8,019 101 8,658 87 857 490 1,144 339 4,052 2,006 3,682 2,007 Selling, general and administrative: Attributed costs Shared corporate services Depreciation and amortization: Attributed costs Intergroup allocated expenses Total Operating income 1,350 1,055 4,841 3,907 (179) (163) (720) (627) -------- -------- -------- -------4,527 4,713 18,299 17,714 -------- -------- -------- -------774 1,148 3,049 5,041 Other income (expense): Interest expense Miscellaneous (312) 82 (140) 58 (1,029) 412 (458) 385 -------- -------- -------- -------Income before income taxes, minority interests and cumulative effect of accounting change Provision for income taxes 544 1,066 2,432 4,968 212 385 943 1,990 -------- -------- -------- -------- Income before minority interests and cumulative effect of accounting change Minority interests 332 681 1,489 2,978 15 (80) 35 (305) -------- -------- -------- -------- Income before cumulative effect of accounting change 347 601 1,524 2,673 Cumulative effect of accounting change (net of income tax of $43 in 2000) ---(75) -------- -------- -------- -------- Net income before distributions on mandatorily redeemable preferred securities 347 601 Distributions on mandatorily redeemable preferred preferred dividend requirements 42 16 -------- -------Net income $305 $585 ======== ======== PRO 1,524 2,598 securities and other 117 65 -------- -------$1,407 $2,533 ======== ======== FORMA Diluted earnings per common share(2) $0.10 $0.20 $0.48 $0.87 ======== ======== ======== ======== Diluted weighted average WorldCom group shares outstanding(2) 2,965 2,893 2,933 2,912 ======== ======== ======== ======== (1) In the second quarter of 2001, WorldCom made a strategic decision to restructure its investment in Embratel. As a result of actions taken in the second quarter of 2001, the accounting principles generally accepted in the United States prohibit the continued consolidation of Embratel's results. Accordingly, WorldCom deconsolidated this investment as of January 1, 2001. The operating results for 2000 reflect the consolidation of Embratel and the results for 2001 reflect the deconsolidation. (2) On June 7, 2001, WorldCom, Inc. recapitalized its common shares into two separate stocks - WorldCom group stock and MCI group stock and each share of WorldCom, Inc. stock was changed into one share of WorldCom group stock and 1/25 of a share of MCI group stock. The above pro forma information was used as the basis to compute diluted earnings per common share and assumes the recapitalization occurred at the beginning of 2000 and the WorldCom group stock and MCI group stock existed for all periods presented. WORLDCOM GROUP CONDENSED COMBINED BALANCE SHEETS (Unaudited. In Millions) Dec. 31, 2001 ------- Dec. 31, 2000 ------- ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Receivable from MCI group, net Other current assets $1,409 $720 3,734 4,980 900 649 2,136 1,743 ------------Total current assets 8,179 8,092 ------------Property and equipment, net 36,792 35,177 Goodwill and other intangibles, net 40,818 36,685 Long-term receivable from MCI group, net 976 976 Other assets 5,136 4,963 ------------$91,901 $85,893 ======= ======= LIABILITIES AND ALLOCATED NET WORTH Current liabilities: Short-term debt and current maturities of long-term debt $172 $7,200 Accounts payable and accrued line costs 2,751 3,584 Other current liabilities 2,992 3,429 ------------Total current liabilities 5,915 14,213 ------------Long-term debt 24,533 11,696 Other liabilities 3,742 3,648 Minority interests 101 2,592 Mandatorily redeemable and other preferred securities 1,993 798 Allocated net worth 55,617 52,946 ------------$91,901 $85,893 ======= ======= Note: In the second quarter of 2001, WorldCom made a strategic decision to restructure its investment in Embratel. As a result of actions taken in the second quarter of 2001, the accounting principles generally accepted in the United States prohibit the continued consolidation of Embratel's results. Accordingly, WorldCom deconsolidated this investment as of January 1, 2001. The balance sheet as of December 31, 2000 includes the effects of the Embratel consolidation. WORLDCOM GROUP COMBINED STATEMENTS OF CASH FLOWS (Unaudited. In Millions) Year Ended Dec. 31, 2001 2000(1) ----------Cash flows from operating activities: Net income before distributions on mandatorily redeemable preferred securities $1,524 $2,598 Adjustments to reconcile net income before distributions on mandatorily redeemable preferred securities to net cash provided by operating activities: Cumulative effect of accounting change -75 Minority interests (35) 305 Depreciation and amortization 4,121 3,280 Provision for deferred income taxes 1,131 1,410 Change in assets and liabilities, net of effect of business combinations: Accounts receivable, net 104 (1,300) Receivable from MCI group, net (251) (649) Other current assets 104 (582) Accounts payable and other current liabilities (200) 624 All other operating activities 107 (431) -------- -------Net cash provided by operating activities 6,605 5,330 -------- -------Cash flows from investing activities: Capital expenditures Acquisitions and related costs Increase in intangible assets Decrease in other liabilities All other investing activities Net cash used in investing activities (7,619) (10,984) (206) (14) (367) (771) (351) (823) (275) (1,020) -------- -------(8,818) (13,612) -------- -------- Cash flows from financing activities: Principal borrowings on debt, net Attributed stock activity of WorldCom, Inc. 3,526 124 6,377 585 Distributions on mandatorily redeemable preferred securities and dividends paid on preferred stock (83) (65) Redemption of Series C preferred stock Advances from (to) MCI group, net All other financing activities (200) (190) (15) 1,592 (272) (84) -------- -------Net cash provided by financing activities 3,080 8,215 Effect of exchange rate changes on cash 38 (19) -------- -------Net increase (decrease) in cash and cash equivalents 905 (86) Cash and cash equivalents at beginning of period 720 806 Deconsolidation of Embratel (216) --------- -------Cash and cash equivalents at end of period $1,409 $720 ======== ======== (1) In the second quarter of 2001, WorldCom made a strategic decision to restructure its investment in Embratel. As a result of actions taken in the second quarter of 2001, the accounting principles generally accepted in the United States prohibit the continued consolidation of Embratel's results. Accordingly, WorldCom deconsolidated this investment as of January 1, 2001. The statement of cash flows for 2000 reflects the consolidation of Embratel and the statement of cash flows for 2001 reflects the deconsolidation. WORLDCOM, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited. In Millions, Except Per Share Data) Excluding Charges and Embratel Three Months Ended Year Ended December 31, December 31, ------------------ ----------------2001 2000 2001 2000 -------- -------- -------- -------Revenues: Voice Data International Internet dedicated and other Commercial services Consumer Wholesale $1,570 2,139 768 824 -------5,301 1,711 591 $1,708 $6,591 $7,036 1,927 8,620 7,389 625 2,977 2,367 688 3,160 2,455 -------- -------- -------4,948 21,348 19,247 1,888 7,227 7,778 733 2,641 3,388 531 344 -------8,478 -------- 749 2,427 3,541 403 1,536 1,628 -------- -------- -------8,721 35,179 35,582 -------- -------- -------- Alternative channels and small business Dial-up Internet Total revenues Operating expenses: Line costs 3,568 3,675 14,739 13,835 Selling, general and administrative Depreciation and amortization Total Operating income 2,461 1,614 -------7,643 -------835 2,444 9,951 8,890 1,184 5,880 4,391 -------- -------- -------7,303 30,570 27,116 -------- -------- -------1,418 4,609 8,466 Other income (expense): Interest expense Miscellaneous (438) (283) (1,533) (1,014) 130 87 520 468 -------- -------- -------- -------- Income before income taxes and minority interests Provision for income taxes 527 205 -------- 1,222 3,596 7,920 496 1,374 3,222 -------- -------- -------- Income before minority interests Minority interests 322 726 2,222 4,698 15 -35 --------- -------- -------- -------Net income 337 726 2,257 4,698 Distributions on mandatorily redeemable preferred securities and other preferred dividend requirements 42 16 117 65 -------- -------- -------- -------Net income applicable to common shareholders $295 ======== $710 $2,140 $4,633 ======== ======== ======== $384 ======== $585 $2,056 $2,860 ======== ======== ======== Net income attributed to WorldCom group Net income (loss) attributed to MCI group $(89) $125 $84 $1,773 ======== ======== ======== ======== Diluted earnings (loss) per common share: WorldCom group stock(1) PRO FORMA $0.13 $0.20 $0.70 $0.98 MCI group stock(1) ======== ======== ======== ======== $(0.75) $1.09 $0.72 $15.42 ======== ======== ======== ======== Diluted weighted average common shares outstanding: WorldCom group stock(1) 2,965 2,893 2,933 2,912 ======== ======== ======== ======== MCI group stock(1) 119 115 117 115 ======== ======== ======== ======== (1) On June 7, 2001, WorldCom, Inc. recapitalized its common shares into two separate stocks - WorldCom group stock and MCI group stock and each share of WorldCom, Inc. stock was changed into one share of WorldCom group stock and 1/25 of a share of MCI group stock. The above pro forma information was used as the basis to compute diluted earnings per common share and assumes the recapitalization occurred at the beginning of 2000 and the WorldCom group stock and MCI group stock existed for all periods presented. WORLDCOM, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited. In Millions, Except Per Share Data) Financial Reporting Three Months Ended Year Ended December 31, December 31, ----------------- ----------------2001 2000(1) 2001 2000(1) -------- -------- -------- -------Revenues: Voice Data International Internet dedicated and other Commercial services Consumer Wholesale $1,570 $1,708 $6,591 $7,036 2,139 1,927 8,620 7,389 768 1,538 2,977 5,875 824 688 3,160 2,455 -------- -------- -------- -------5,301 5,861 21,348 22,755 1,711 1,888 7,227 7,778 591 733 2,641 3,388 Alternative channels and small business Dial-up Internet Total revenues 531 749 2,427 3,541 344 403 1,536 1,628 -------- -------- -------- -------8,478 9,634 35,179 39,090 -------- -------- -------- -------- Operating expenses: Line costs 3,568 4,086 14,739 15,462 Selling, general and administrative Depreciation and amortization Total Operating income 2,543 2,750 11,046 10,597 1,614 1,308 5,880 4,878 -------- -------- -------- -------7,725 8,144 31,665 30,937 -------- -------- -------- -------753 1,490 3,514 8,153 Other income (expense): Interest expense Miscellaneous (438) (271) (1,533) (970) 82 58 412 385 -------- -------- -------- -------- Income before income taxes, minority interests and cumulative effect of accounting change Provision for income taxes 397 1,277 2,393 7,568 154 471 927 3,025 -------- -------- -------- -------- Income before minority interests and cumulative effect of accounting change Minority interests 243 806 1,466 4,543 15 (80) 35 (305) -------- -------- -------- -------- Income before cumulative effect of accounting change 258 726 1,501 4,238 Cumulative effect of accounting change (net of income tax of $50 in 2000) ---(85) -------- -------- -------- -------Net income 258 726 1,501 4,153 Distributions on mandatorily redeemable preferred securities and other preferred dividend requirements 42 16 117 65 -------- -------- -------- -------Net income applicable to common shareholders $216 $710 $1,384 $4,088 ======== ======== ======== ======== Net income attributed to WorldCom Group Net income (loss) attributed $305 $585 $1,407 $2,533 ======== ======== ======== ======== to MCI Group $(89) $125 $(23) $1,555 ======== ======== ======== ======== Diluted earnings (loss) per common share: PRO FORMA WorldCom group stock(2) MCI group stock(2) $0.10 $0.20 $0.48 $0.87 ======== ======== ======== ======== ($0.75) $1.09 $(0.20) $13.52 ======== ======== ======== ======== Diluted weighted average common shares outstanding: WorldCom Group stock(2) 2,965 2,893 2,933 2,912 ======== ======== ======== ======== MCI Group stock(2) 119 115 117 115 ======== ======== ======== ======== (1) In the second quarter of 2001, WorldCom made a strategic decision to restructure its investment in Embratel. As a result of actions taken in the second quarter of 2001, the accounting principles generally accepted in the United States prohibit the continued consolidation of Embratel's results. Accordingly, WorldCom deconsolidated this investment as of January 1, 2001. The operating results for 2000 reflect the consolidation of Embratel and the results for 2001 reflect the deconsolidation. (2) On June 7, 2001, WorldCom, Inc. recapitalized its common shares into two separate stocks - WorldCom group stock and MCI group stock and each share of WorldCom, Inc. stock was changed into one share of WorldCom group stock and 1/25 of a share of MCI group stock. The above pro forma information was used as the basis to compute diluted earnings per common share and assumes the recapitalization occurred at the beginning of 2000 and the WorldCom group stock and MCI group stock existed for all periods presented. WORLDCOM, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited. In Millions) Dec. 31, Dec. 31, 2001 2000 -------- -------ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Other current assets Total current assets $1,416 $761 5,308 6,815 2,481 2,179 -------- -------9,205 9,755 -------38,809 50,537 5,363 -------$103,914 ======== LIABILITIES AND SHAREHOLDERS' INVESTMENT Current liabilities: term debt and current maturities of long-term debt $172 Accounts payable and accrued line costs 4,844 Other current liabilities 4,194 -------Total current liabilities 9,210 -------Long-term debt 30,038 Other liabilities 4,642 Minority interests 101 Mandatorily redeemable and other preferred securities 1,993 Total shareholders' investment 57,930 -------$103,914 ======== Property and equipment, net Goodwill and other intangibles, net Other assets -------37,423 46,594 5,131 -------$98,903 ======== Short$7,200 6,022 4,451 -------17,673 -------17,696 4,735 2,592 798 55,409 -------$98,903 ======== Note: In the second quarter of 2001, WorldCom made a strategic decision to restructure its investment in Embratel. As a result of actions taken in the second quarter of 2001, the accounting principles generally accepted in the United States prohibit the continued consolidation of Embratel's results. Accordingly, WorldCom deconsolidated this investment as of January 1, 2001. The balance sheet as of December 31, 2000 includes the effects of the Embratel consolidation. WORLDCOM, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited. In Millions) Year Ended Dec. 31, 2001 2000(1) -------- -------Cash flows from operating activities: Net income $1,501 $4,153 Adjustments to reconcile net income to net cash provided by operating activities: Cumulative effect of accounting change -85 Minority interests (35) 305 Depreciation and amortization 5,880 4,878 Provision for deferred income taxes 1,104 1,649 Change in assets and liabilities, net of effect of business combinations: Accounts receivable, net 281 (1,126) Other current assets 164 (797) Accounts payable and other current liabilities (1,154) (1,050) All other operating activities 253 (431) -------- -------Net cash provided by operating activities 7,994 7,666 -------- -------Cash flows from investing activities: Capital expenditures Acquisitions and related costs Increase in intangible assets Decrease in other liabilities All other investing activities Net cash used in investing activities (7,886) (11,484) (206) (14) (694) (938) (480) (839) (424) (1,110) -------- -------(9,690) (14,385) -------- -------- Cash flows from financing activities: Principal borrowings on debt, net Common stock issuance 3,031 124 6,377 585 Distributions on mandatorily redeemable preferred securities and dividends paid on preferred stock Redemption of preferred stock All other financing activities (154) (65) (200) (190) (272) (84) -------- -------Net cash provided by financing activities 2,529 6,623 Effect of exchange rate changes on cash 38 (19) -------- -------Net increase (decrease) in cash and cash equivalents 871 (115) Cash and cash equivalents at beginning of period 761 876 Deconsolidation of Embratel (216) --------- -------Cash and cash equivalents at end of period $1,416 $761 ======== ======== (1) In the second quarter of 2001, WorldCom made a strategic decision to restructure its investment in Embratel. As a result of actions taken in the second quarter of 2001, the accounting principles generally accepted in the United States prohibit the continued consolidation of Embratel's results. Accordingly, WorldCom deconsolidated this investment as of January 1, 2001. The statement of cash flows for 2000 reflects the consolidation of Embratel and the statement of cash flows for 2001 reflects the deconsolidation.