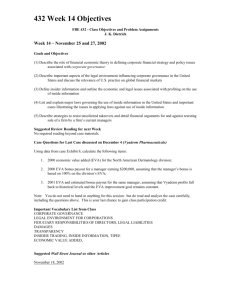

Worldcom mini-case

Worldcom mini-case

(capitalization of expenses)

Following is the August, 2002 press release of WorldCom announcing the $7.6 billion reduction of previously-reported income. Also attached is an article announcing the arrest of Worldcom’s CFO, Scott Sullivan, and its controller, David Myers. This mini-case is designed to give you a better feel for accruals and their effect on financial statements.

Please answer the following questions:

1.

Describe the central issue in WorldCom’s accounting irregularities.

2.

What effect did WorldCom’s accounting actions have on its financial statements.

3.

Examine the spreadsheet of WorldCom’s historical 10-Qs. As an analyst, what trends might have tipped you off to these irregularities and prompted some questions in conference calls?

August 2002 press release

WorldCom Announces Additional Changes To

Reported Income For Prior Periods

CLINTON, Miss., August 8, 2002 - WorldCom, Inc. today announced that its ongoing internal review of its financial statements has discovered an additional $3.3 billion in improperly reported earnings before interest, taxes, depreciation and amortization (EBITDA) for 1999, 2000, 2001 and first quarter 2002. This amount is in addition to the previously reported $3.8 billion in overstated EBITDA in the year 2001 and first quarter 2002. As a result, WorldCom intends to restate its financial statements for 2000. Previously the company announced that it intends to restate its financial statements for 2001 and first quarter 2002.

The resulting changes are summarized in a financial chart below.

WorldCom is continuing its internal financial investigation. Investors and creditors should be aware that additional amounts of improperly reported EBITDA and pretax income may be discovered and announced.

Until KPMG LLP, the company's newly appointed external auditors, is able to complete an audit of 2000,

2001 and 2002, the total impact on previously reported financial statements cannot be known.

The company intends to continue to expeditiously announce unaudited changes to previously reported financial statements if it discovers additional issues. The amounts disclosed today have previously been disclosed to the SEC and other investigative authorities.

WorldCom also announced it expects to record further write-offs of assets previously reported, including the likelihood that it may determine all existing goodwill and other intangible assets, currently recorded as

$50.6 billion, should be written off when restated 2000, 2001 and 2002 financials are released. The company will also reevaluate the carrying value of existing property, plant and equipment as to possible impairment of historic values previously reported. However, until the company's audit of previously reported asset values is complete it cannot determine with certainty the amount of its ultimate write-offs.

WorldCom has notified Andersen LLP, which audited the company's financial statements until May 2002, of the results of this review. WorldCom will issue unaudited financial statements for 2000, 2001 and the first quarter of 2002 as soon as practicable.

In Millions of Dollars

June 25, 2002 reported EBITDA reductions

August 8, 2002 EBITDA reductions

1999 2000 2001 1Q 2002 Total

$ - $ - $ 3,055 $ 797 $ 3,852

$ 217 $ 2,864 $ 161 $ 88 $ 3,330

Total reduction in EBITDA $ 217 $ 2,864 $ 3,216 $ 885 $ 7,182

August 8, 2002 non-EBITDA pre tax adjustments $ (8) $ 393 $ 166 $ (50) $ 501

Total pre tax income reductions $ 209 $ 3,257 $ 3,382 $ 835 $ 7,683

WorldCom Executives Arrested for Fraudulent

Accounting

668 words

14 August 2002

Securities Litigation & Regulation Reporter

Volume 08; Issue 05

English

Copyright (c) 2002 Andrews Publications. All rights reserved.

Federal authorities have arrested WorldCom CFO Scott Sullivan and controller David Myers for allegedly conspiring to alter the telecommunications giant's financial statements to meet analysts' expectations. The executives are accused of cooking the books so the company would not show a loss for 2001 and the first quarter of this year.

United States v. Sullivan et al., No. 02-1511, complaint unsealed

(S.D.N.Y., 8/1/2002).

Although Sullivan and Myers were allowed to surrender, it wasn't long before federal investigators hauled Sullivan away in handcuffs - apparently to show that white-collar crime at the top level of corporate America will not be tolerated.

Both Sullivan and Myers were fired after WorldCom announced that its financial statements could not be relied on due to a $3.8 billion accounting error. Shortly thereafter, the company filed for bankruptcy protection.

According to the criminal complaint, starting in April 2001, WorldCom failed to generate enough revenue to offset its line cost expenses. These costs are fees charged by third-party telecommunications companies for access to their networks and allowed WorldCom to enlarge its service area. Many of these leases required WorldCom to pay a fixed sum to the outside network regardless of whether WorldCom actually made use of all or part of the capacity agreed upon.

WorldCom obtained these leases in anticipation of an increase in Internetrelated business that did not materialize. Rather than show the loss, the executives allegedly masked the problem by shifting the operating costs to their capital expenditures account. By capitalizing the expense (or moving it from the income statement to the balance sheet) they were able to disguise the direct cost as an asset.

When questioned by internal auditors about the accounting treatment,

Sullivan allegedly said the costs were "pre-paid capacity" associated with underutilized lines, which is why they had been capitalized.

Contrary to WorldCom's usual practices and prevailing accounting principles, no support existed for any of these entries, says FBI Special

Agent Paul Higgins, and other officials within the organization expressed concerns regarding the propriety of the adjustments to no avail.

Myers admitted that the amounts were booked based on what the margins

(i.e., the ratio of line costs to revenues) had been historically, and he acknowledged there was no support for the treatment. In addition, Myers said he was uncomfortable with the treatment, but that once it started it was difficult to stop.

Federal prosecutors also assert that in June 2002, Sullivan requested that

WorldCom's vice president for internal audit delay a review of its capital expenditure accounts, stating that the company expected to take a restructuring charge in the second quarter of the year.

WorldCom used Arthur Andersen LLP as its outside auditor until the accounting firm was implicated in Enron's demise. WorldCom then fired

Andersen and hired KPMG for auditing services. Andersen has not been accused of any wrongdoing regarding WorldCom, which did not inform the auditors that it had changed its accounting practices when asked.

Sullivan and Myers are charged with conspiracy to commit securities fraud, securities fraud and five charges of making false statements in the company's filings with the Securities and Exchange Commission between

May 2001 and May 2002.

Sullivan was freed after posting a $10 million personal bond secured by his mansion in Boca Raton, Fla. Myers was also released after posting a $2 million bond secured by two properties he owns in Mississippi, where

WorldCom is based. They face up to 10 years in prison.

Sullivan is represented by Irv Nathan and Craig Stewart of Arnold & Porter in New York. Myers is represented by Richard Janis and Lawrence

Wechsler of Janis, Schuelke & Wechsler in Washington, D.C.