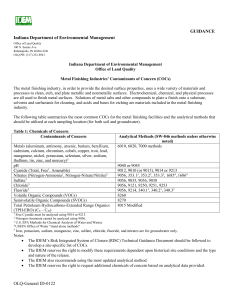

The Future of Finishing - National Metal Finishing Resource Center

advertisement