Chapter 2

advertisement

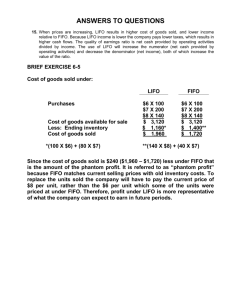

CHECKLIST OF KEY FIGURES For Exercises and Problems in Kimmel, Weygandt, Kieso FINANCIAL ACCOUNTING: TOOLS FOR BUSINESS DECISION MAKING, SEVENTH EDITION Chapter 1 Exer. No. 1-4 1-5 1-6 1-8 1-9 1-10 1-11 1-12 1-13 1-14 1-15 1-16 Net income $13,400. Net income $12,901.3. Ending retained earnings $290,000. (b) Net income $34,286. Common stock $30,000; Cost of goods sold $55,000. (b) Ending retained earnings $27,000; total assets $128,000. (b) Net income $1,208. (a) Net increase in cash $18,000. (a) Net increase in cash $823. Total assets $79,500. (b) Total assets $13,249.6; total liabilities $4,556.5. (c) Dividends $30,000. (f) Total revenues $140,000. P1-3A Net income $3,800, Retained earnings $2,400, Total assets, $37,000 P1-4A Net cash provided by operating activities $28,000 P1-5A (b) Total assets $85,000 P1-3B Net income $4,200, Retained earnings $2,600, Total assets $78,000 P1-4B Net cash provided by operating activities $8,000 P1-5B (b) Net income $30,000 BYP 1-1 (e) Decrease in net income $9,125,000 BYP 1-2 Hershey’s net income $628,962; Tootsie Roll’s net income $43,938 BYP 1-7 Total assets $34,000 Chapter 2 Exer. No. 2-3 2-4 2-5 2-6 Total current assets $34,309. Total current assets $2,908,320. Total assets $212,720. Total assets $12,119. 2-7 2-8 2-9 2-10 2-11 (a) 2014 earnings per share $1.01. (a) Net loss $(2,500). (b) Total assets $51,480. (a) Ending current ratio 2.01:1. (b) Current ratio 2.0:1. (b) 2014 Free cash flow ($45,536). P2-1A Total assets $13,690 P2-2A Net income $21,400, Retained earnings $40,400, Total assets $73,700 P2-3A Net income $2,230, Retained earnings $3,505 Total assets $9,157 P2-4A (a) Earnings per share, Bosch $3.10, (c) Free cash flow: Fielder $1,000 P2-5A (ii) Current ratio 2.35:1 (iii) Free cash flow $67,800 P2-6A (b) 2014 Working capital $113,000 (e) 2014 Free cash flow $17,000 P2-7A (b) Current ratio: Target 1.66:1 Wal-Mart .88:1 (d) Free cash flow: Target $418 Wal-Mart $7,902 P2-1B Total assets $5,344 P2-2B Net income $6,200, Retained earnings $17,600, Total assets $33,800 P2-3B Net income $9,700, Retained earnings $20,860, Total assets $49,135 P2-4B (a) Earnings per share: Wise $.43 (c) Free cash flow: Omaz $26,000 P2-5B (i) Current ratio 2.0:1, (iv) Free cash flow $9,300 P2-6B (b) 2014 Working capital $116,000 (e) 2014 Free cash flow $60,000 P2-7B (b) Current ratio: Home Depot 1.2:1 Lowes .1.1:1 (d) Free cash flow: Home Depot $460 Lowes ($91) BYP 2-1 (a) 2011 current assets $212,201,000 BYP 2-2 (a) Hershey Tootsie Roll 2. Current ratio 1.7:1 3.6:1 4. Free cash flow ($47,177) $15,632 BYP 2-4 (a) Percentage decrease in total assets 17.3% Chapter 3 Exer. No. 3-2 Ending cash $15,000 3-3 Ending cash $56,800 3-4 (b) Stockholders’ equity increase $23,400. (c) Net income $5,400. 3-5 Net income $5,400; Total assets $26,200. 3-10 (b) Totals $44,040. 3-11 (a) Total assets $38,300. 3-12 (b) Totals $21,700. 3-13 (b) Totals $18,100. 3-14 (b) Totals $21,200. 3-16 (a) Totals $98,370. (b) Net income $5,214; Total assets $87,384. P3-1A (a) Ending cash balance: $34,800; (b) Net income $9,100 P3-2A (a) Ending cash balance: $18,270; (b) Net income $2,170 P3-3A (a) Ending cash balance: $7,150; (b) Net income $2,570 P3-5A (b) Ending balances: Cash $18,800, Accounts Payable $1,000 (c) Trial balance totals $24,400 P3-6A (c) Ending balances: Cash $17,300 (d) Trial balance totals $35,700 P3-7A Trial balance totals $16,900 P3-8A (c) Ending balances: Cash $32,750, Accounts Payable $9,100 (d) Trial balance totals $128,800 P3-1B (a) Ending cash balance: $26,360; (b) Net income $7,410 P3-2B (a) Ending cash balance: $17,430; (b) Net income $2,770 P3-3B (a) Ending cash balance: $10,250; (b) Net income $8,130 P3-5B (b) Ending balances: Cash $103,200, Accounts Payable $400 (c) Trial balance totals $110,400 P3-6B (c) Ending balances: Cash $20,464, Accounts Payable $11,710 (d) Trial balance totals $63,540 P3-7B Trial balance totals $25,220 P3-8B (c) Ending balances: Cash $6,660 Accounts Payable $1,850 (d) Trial balance totals $86,890 CCC3 (c) Trial Balance totals $3,910 BYP 3-6 (c) Correct net income $5,900 Chapter 4 Exer. No. 4-4 Accrual basis earnings $34,180. 4-5 (a) Cash basis income $7,600. 4-6 (a) Net income $16,125. (b) Total assets $36,545. 4-12 Net income $2,040. 4-13 (a) $1,350; (c) $1,760. 4-17 Net income $14,100; Total assets $34,500. P4-1A (b) Cash received $199,000 P4-2A (b) Ending balances: Prepaid Insurance $2,640, Salaries and Wages Expense $5,250 (c) Adjusted trial balance totals $45,310 P4-3A (b) Ending balances: Prepaid Insurance $1,350, Salaries and Wages Expense $900 (c) Adjusted trial balance totals $114,630; (d) Net income $3,570, Total assets $106,150 P4-4A (b) Net income $2,510, Retained earnings $1,910, Total assets $23,430 P4-6A (b) Net income $33,285 P4-7A (e) Ending balances: Cash $3,840, Salaries and Wages Expense $480 (f) Adjusted trial balance totals $24,680; (g) Net Income $970, Total assets $19,800 P4-8A (e) Ending balances: Cash $5,410, Retained Earnings $3,700 (f) Adjusted trial balance totals $25,880 (g) Net income $4,300, Total assets $21,500 P4-1B (b) Cash received $199,000 P4-2B (b) Ending balances: Prepaid Insurance $3,500, Salaries and Wages Expense $4,480 (c) Adjusted trial balance totals $36,580 P4-3B (b) Ending balances: Prepaid Insurance 3,900, Salaries and Wages Expense $53,600 (c) Adjusted trial balance totals $318,750; (d) Net income 10,850, Total assets $236,350 P4-4B (b) Net income $38,810, Retained earnings $34,310, Total assets $68,790 P4-6B (b) Net income $28,190 P4-7B (e) Ending balances: Cash $2,420, Salaries and Wages Expense $6,140 (f) Adjusted trial balance totals $27,990; (g) Net loss ($1,040), Total assets $19,300 P4-8B (e) Ending balances: Cash $6,200, Retained Earnings $1,650 (f) Adjusted trial balance totals $29,430 (g) Net income $2,550, Total assets $22,730 CCC4 (e) Adjusted trial balance totals $8,804 BYP 4-6 (a) Net income $16,790 BYP 4-9 Total assets $15,350 Chapter 5 Exer. No. 5-1 5-3 5-4 5-5 5-6 5-7 5-8 5-9 5-10 5-11 5-13 (a) (5) Cash paid $23,912. (a) (3) Cash received $ 470,250. (a) Cash paid (June 19) $8,148. Net sales $864,500. (a) Net income $14,250. (b) Profit margin -Yanik 14%; Gross profit rate- Nunez 40%. (a) Net income $63,500. (a) Net income $535. Cost of goods sold $154,700. (b) $1,550, (d) $40, (f) $120, (h) $640, (j) $5,000, (l) $44,530. (a) (5) Cash paid $22,932. P5-1A (b) Ending balances: Cash $3,496, Inventory $5,952 (c) Gross profit $2,828 P5-3A (b) Ending balances: Cash $1,587, Inventory $4,263 (c) Trial balance totals $8,150; (d) Gross profit $700 P5-4A (a) Net income $32,900, Retained earnings $35,100, Total assets $146,400 P5-5A Net income $67,500 P5-6A (b) Ending balances: Accumulated Depreciation- Equipment $47,500 (c) Adjusted trial balance totals $1,365,500 (d) Net income $81,100, Retained earnings $138,300, Total assets $399,000 P5-7A Gross profit $272,600 P5-8A (g) Purchases $32,960; (h) Cash payments $34,860 P5-9A (b) Ending balances: Cash $1,587; Accounts Receivable $850, (c) Trial balance totals $8,427; (d) Gross profit $700 P5-1B (b) Ending balances: Cash $3,596, Inventory $8,544 (c) Gross profit $6,320 P5-3B (b) Ending balances: Cash $2,086, Inventory $3,244 (c) Trial balance totals $6,610; (d) Gross profit $460 P5-4B (a) Net income $28,300, Retained earnings $32,500, Total assets $313,800 P5-5B Net income $145,000 P5-6B (b) Ending balances: Accumulated Depreciation- Equipment $61,000 (c) Adjusted trial balance totals $1,015,400 (d) Net income $15,200, Retained earnings $33,200, Total assets $200,400 P5-7B Gross profit $257,000 P5-8B (b) Gross profit-2013, $78,100; 2015-$78,600 P5-9B (b) Ending balances: Cash $2,994; Accounts Receivable $280 (c) Trial balance totals $10,759; (d) Gross profit $470 CP (b) Ending balances: Cash $12,820, Inventory $8,720 (d) Adjusted trial balance totals $65,500 (e) Net income $540, Total assets $45,340 BYP 5-1 (a) 2010 to 2011 sales increased 2.1% (c) 2011 gross profit rate 30.9% BYP 5-2 (a) Tootsie Roll Hershey (1) Profit margin 8.3% 10.3% (3) Gross profit rate 30.9% 41.6% BYP 5-4 (a) Gross profit rate: Carrefour 22.5%, Wal-Mart 22.5% (b) Profit margin: Carrefour 2.5%, Wal-Mart 3.5% BYP 5-6 (a) (1) Net income $62,000 (c) Net income $93,440 Chapter 6 Exer. No. 6-1 6-2 6-4 6-5 6-7 6-8 6-9 6-10 Correct inventory $309,000. Correct inventory $558,000. Cost of goods sold: FIFO $10,515; LIFO $10,596. (a) $729; (b) $767;(c) $746.36. (a) Cost of goods sold: FIFO $2,640; LIFO $2,960; Average $2,813. (a) LIFO Net income $14,700; (b) FIFO Net cash provided $28,000. Total LCM $4,373. 2013: Inventory turnover 8.5; Gross profit rate 52.9%. 6-11 6-12 6-13 6-14 6-15 (a) Inventory turnover 5.98. (b) Adjusted current ratio 2.53:1. (a) Ending inventory: FIFO $1,580; LIFO $1,450; Moving average $1,528. (a) FIFO $2,620; LIFO $2,596; Average $2,607. 2014 Cost of goods sold $161,000. (a) 2014 Gross profit $71,000. P6-2A (a) Cost of goods available for sale $137,000 (b) Ending inventory: FIFO $32,000, LIFO $21,500, Average cost $27,399 P6-3A (a) Cost of goods available for sale $16,800 (b) Ending inventory; FIFO $2,300, LIFO $1,700, Average cost $1,976 P6-4A Net income FIFO $183,456, LIFO $172,008 P6-5A Gross profit: LIFO $2,970, FIFO $3,310, Average cost $3,133 P6-6A (a) (1) Gross profit $162,500 (b) Cost of goods sold: FIFO $199,000, LIFO $206,150 P6-7A (a) Inventory turnover 11.5, (c) Current ratio .86:1 P6-8A (a) Ending Inventory: LIFO $1,500, FIFO $1,875, Moving average $1,773 P6-9A Ending inventory: FIFO $213, Moving average $207, LIFO $195 P6-2B (a) Cost of goods available for sale $77,100 (b) Ending inventory: FIFO $35,000 LIFO $20,600 Average cost $28,625 P6-3B (a) Cost of goods available for sale $18,900 (b) Ending inventory: FIFO $4,400, LIFO $2,950, Average cost $3,619 P6-4B Net income FIFO $189,735, LIFO $185,885 P6-5B Gross profit: LIFO $2,250, FIFO $2,570, Average cost $2,420 P6-6B (b) Gross profit: FIFO $174,000, LIFO $167,400 P6-7B (a) Inventory turnover 13.0 (c) Current ratio 1.10:1 P6-8B (a) Ending inventory: LIFO $1,625, FIFO $2,255, Moving average $2,017 P6-9B (a) Ending inventory: FIFO $1,428, Moving average $1,381, LIFO $1,318 CP (b) Ending balances: Inventory $2,342, Cost of Goods Sold $4,098 (c) Adjusted trial balance totals $41,055 (d) Net income $767, Total assets $34,262 (e) Ending inventory: FIFO $2,336, LIFO $1,800 BYP 6-1 (b) Percentage increase in inventories 26.7% BYP 6-2 (a) Tootsie Roll days in inventory: 64.0 days BYP 6-4 (c) 2014 Days in inventory: 93.6 BYP 6-6 (a) Inventory turnover–2014: 7.5, Days in inventory–2013: 45.1 Chapter 7 Exer. No. 7-6 7-7 7-8 7-9 (a) Adj. cash bal. $3,497.20. Total $1,560. (a) Adj. cash bal. $9,342. (a) Adj. cash bal. $18,855. 7-10 7-11 7-12 7-14 7-15 7-16 (a) $1,880; (b) $2,040. (c) $1,700; (d) $2,600. (c)Adj. cash bal. $18,740. (a) Total $17,620. End. cash bal. Jan. $24,000. Cash over and short $1.30. Cash over and short $3.40. P7-3A P7-4A P7-5A P7-6A P7-7A (a) Adjusted cash balance $7,024 (a) Adjusted cash balance $13,176.80 (a) Adjusted cash balance $8,931.90 Borrowings $1,800 January expected collections from customers $326,000, January expected payments for purchases $110,000, January: total receipts $341,000, total disbursements $344,000 P7-8A (a) Adjusted cash balance $21,018.72 P7-3B (a) Adjusted cash balance $6,163 P7-4B (a) Adjusted cash balance $7,141 P7-5B (a) Adjusted cash balance $5,330 P7-6B Repayments $600 P7-7B January expected collections from customers $279,500, January expected payments for purchases $106,000, January: total receipts $287,000, total disbursements $299,000 P7-8B (a) Adjusted cash balance $5,681.00 CP (b) Ending balances: Cash $27,420, Accounts Receivable $1,880 (f) Adjusted trial balance totals $89,925 (g) Net income $2,455, Total assets $73,180 BYP 7-2 (b) Cash as % of total assets – 2011: Tootsie Roll 9.2% Chapter 8 Exer. No. 8-1 8-2 8-3 8-4 8-5 8-6 8-7 8-8 8-9 8-11 8-13 Sales discounts $92. Interest revenue $6. (e) Accounts Receivable $229,700. (b) $6,700; (c) $6,740. (b) $6,575. Bad debt exp. $9,500. Interest revenue $761. Interest revenue 2014 $100. Net receivables $4,400. (a) Accounts receivable turnover 9.2. Service charge expense $28,400. 8-15 8-16 8-17 Service charge expense $152. Service charge expense $10. Collections $227,000. P8-1A (a) Total estimated bad debts $10,120 P8-2A (b) Balance in Accounts Receivable $809,000 P8-3A (a) Bad Debt Expense $34,400 P8-4A (c) Bad Debt Expense $34,600 P8-5A (b) Bad Debt Expense $11,700 P8-8A (c) Total receivables $14,550 P8-9A (a) Nike: Average collection period 53.7 days P8-1B (a) Total estimated bad debts $25,190 P8-2B (b) Balance in Accounts Receivable $1,218,000 P8-3B (c) Bad Debt Expense $33,400 P8-4B (c) Bad Debt Expense $22,000 P8-5B (b) Bad Debt Expense $10,100 P8-8B (c) Total receivables $14,449 P8-9B (a) Redbird: Average collection period 89.0 days CP (b) Adjusted trial balance totals $70,447 (c) Net income $2,011, Total assets $45,253 BYP8-1 Accounts receivable turnover ratio: 13.3, average collection period, 27.4 days BYP 8-2 (a) (2) Hershey average collection period 27.4 days BYP 8-4 (a) Accounts receivable turnover 11.7 BYP 8-6 (a) 2014: Total expenses as a percentage of net credit sales 3.8% 2014: Net expenses as a percentage of net sales 4.3% Chapter 9 Exer. No. 9-3 9-5 9-6 9-7 9-8 9-10 9-11 9-12 9-13 9-14 9-17 9-18 (a) $93,600. 2014 depreciation $2,562.50. (a) Building $13,375; Warehouse $6,227. (b) $11,000 gain. (c) $6,000 loss. June 30 loss $1,000. (a) 1.42. (a) Return on assets-with 8%. (a) Return on assets 6.2%. Amort. Exp.-Patent $11,250. Amort. Exp.-Patent $56,000; Amort. Exp.-Franchise $30,000. Net income (15-year) $102,000. (a) $.575 per mile. 9-19 (b) 2015 depr. expense $29,900. (a) 2015 depreciation $21,093.75. (b) Depreciation $4,563. P9-1A Land $302,170 P9-2A (a) May 1 Gain on disposal $10,000; (c) Total plant assets $50,037,500 P9-3A June 30 Gain on disposal $3,000 P9-4A (c) Total intangible assets $315,300 P9-6A (a) Danner (1) Return on assets 7.5%, (3) Asset turnover ratio .36 times P9-7A (a) Machine 2 2013 $17,000; (b) 2013 $25,500 P9-8A (a) Straight-line depreciation expense $55,000 (all years) 2015 double-declining-balance depreciation $62,500 P9-1B Land $302,000 P9-2B (a) May 1 Gain on disposal $17,000; (c) Total plant assets $61,072,000 P9-3B March 31 Gain on disposal $1,750 P9-4B (c) Total intangible assets $260,850 P9-6B (a) Quiver (1) Return on assets 26.7%, (3) Asset turnover ratio .80 times P9-7B (a) Machine 2 2013 $24,000; (b) 2013 $5,333 P9-8B (a) Straight-line depreciation expense $72,000 (all years) 2015 double-declining-balance depreciation $91,200 CP (a) 2. Gain on disposal $1,125 (b) Trial balance totals $1,205,775 (c) Net income $51,150, Total assets $247,850 BYP9-2 (a) Hershey (1) Return on assets 14.5%, (3) Asset turnover ratio 1.40 BYP 9-4 2011 Return on assets 7.1% BYP 9-6 (a) Return on assets–proposed without .135 Asset turnover–proposed with .50 BYP 9-8 (c) Income before income taxes increase $155,000 Chapter 10 Exer. No. 10-1 10-2 10-3 10-4 10-5 10-6 10-7 10-8 10-9 (c) $700. (a) $18,000. (d) $2,400. Sales taxes pay.-Crystal $780. (a) Salaries and wages payable $48,104. (b) 11 games. (b) $14,700. (c) $44,100. (b) Interest expense $17,500. (b) Interest expense $24,000. 10-10 10-11 10-13 10-14 10-15 10-16 10-17 10-18 10-20 10-21 10-22 10-23 10-24 10-25 (b) $610,800. (b) $488,000. (b) Interest expense $28,000. (a) Loss $14,900. (b) Gain $17,400. (b) Total long-term liab. $10,158.7. (a) 2. 1.14:1; 4. 14.71. (b) 2.28. (b) 1.58:1. (b) Interest expense $29,500. (b) Interest expense $24,800. (b) Interest expense $28,858. (b) Interest expense $24,478. First install. interest $8,400; Second install. interest $8,223. Reduction of principal $3,137. P10-1A (c) Total current liabilities $146,724 P10-2A (b) Balance in Notes Payable $42,500; (d) Total interest expense $770 P10-5A (b) Long-term liabilities $5,888,000 P10-6A (a) 2014 Free cash flow ($2,457); 2014 times interest earned 3.14 P10-7A (c) Loss on bond redemption $11,600 P10-8A (c) Premium case: Total long-term liabilities $2,032,000 P10-9A (d) (1) Long-term liabilities $3,081,000 P10-10A (b) Bond carrying value $1,699,516 P10-11A (b) Bond carrying value $2,124,196 P10-12A (c) Total liabilities $296,141 P10-13A (a) June 30, 2017 Balance 34,188 P10-1B (c) Total current liabilities $133,901 P10-2B (b) Balance in Notes Payable $55,000; (d) Total interest expense $1,336 P10-5B (b) Long-term liabilities $5,135,000 P10-6B (a) 2014 Free cash flow $556; 2014 Debt to assets 78% P10-7B (c) Gain on bond redemption $90,000 P10-8B (c) Premium case: Total long-term liabilities $2,235,200 P10-9B (d) (1) Long-term liabilities $3,078,750 P10-10B (b) Bond carrying value $2,115,727 P10-11B (b) Bond carrying value $1,699,357 P10-12B (c) Total liabilities $326,008 P10-13B (a) June 30, 2017 Balance $32,466 CP (b) Trial balance totals $687,695 (c) Net income $72,905, Total assets $271,600 BYP10-2 (a) Tootsie Roll: Current ratio 3.64:1 (b) Tootsie Roll: Debt to assets 22.4% BYP10-4 (a) Home Depot working capital $2,076 (in millions), Current ratio 1.73:1 (b) Debt to assets 35%, Times interest earned 72.7 times BYP10-5 (a) Borders current ratio 1.07:1 (b) Barnes debt to assets 76% BYP10-7 (a) 1. Gain on redemption $446,000 BYP10-11 Total tax $24,454 Chapter 11 Exer. No. 11-1 11-3 11-4 11-6 11-7 11-8 11-9 11-10 11-11 11-12 11-13 11-14 11-15 11-16 (b) Total paid-in cap. in excess of stated value $480,000. (b) Paid-in capital in excess of par value $400,000. (a) 574,000; (c) $100; (e) $1,158,000. (b) Dividends declared $220,300. Outstanding shares: after stock div. 85,050; After stock split 162,000. Total stock. equity $109,219. Total stock. equity $4,557,000. Total stock. equity $3,030,000. 2014 payout ratio 59.1%. 2014 payout ratio 23.5%. (a) 2014 return 17.4%.. (a) Earnings per share $4.00. (a) 2014 $4.20 (b) Stock Dividends dr. $324,000. P11-1A (b) Preferred Stock $750,000, Paid-in Capital in Excess of Par Value - Preferred Stock $54,000; (c) Total paid-in capital $1,829,000 P11-2A (b) Common Stock $1,020,000, Paid-in Capital in Excess of Stated Value - Common Stock $490,000; (c) Total stockholders’ equity $2,600,500 P11-3A Total stockholders’ equity $23,153,000 P11-4A (a) Retained Earnings balance $2,860,000 (b) Total stockholders’ equity $7,160,000 P11-5A (b) Total paid-in capital $3,690,000, Total stockholders’ equity $3,736,000 P11-6A Total stockholders’ equity $3,317,000 P11-7A 2014 Return on assets 14.3%, 2014 Payout ratio 39.7%, 2014 Times interest earned 6.8 P11-8A (c) Total paid-in capital $1,298,000, Total stockholders’ equity $2,138,800; (d) Payout ratio 20.3%, Return on common stockholders’ equity 20.2% P11-1B (b) Preferred Stock $900,000, Paid-in Capital in Excess of Par Value - Preferred Stock $22,000; (c) Total paid-in capital $1,470,000 P11-2B (b) Common Stock $1,020,000, Paid-in Capital in Excess of Stated Value – Common Stock $1,540,000; (c) Total stockholders’ equity $4,543,600 P11-3B Total stockholders’ equity $21,260,000 P11-4B (a) Retained Earnings balance $720,000; (b) Total stockholders’ equity $5,290,000 P11-5B Total paid-in capital $9,452,000, Total stockholders’ equity $12,402,000 P11-6B Total stockholders’ equity $7,181,000 P11-7B (a) 2014 Return on assets 15.1%, 2014 Payout ratio 33.8%, 2014 Times interest earned 9.1 P11-8B (c) Total paid-in capital $2,140,000, Total stockholders equity $2,918,000; (d) Payout ratio 34.4%, Return on common stockholders’ equity 18.2% CP (b) Adjusted trial balance totals $740,690 (c) Net income $81,970, Total assets $421,000 BYP 11-1 (d) Return on common stockholders’ equity 6.6% BYP 11-2 Hershey: Return on common stockholders’ equity 69.5% BYP 11-5 (b) Host Marriott: Debt to assets ratio 81.4% (c) Host Marriott: Return on assets (.7%) BYP 11-7 (a) Return on assets 9.6%; (b) Payout ratio 13.8%; (c) Times interest earned 11.2 times Chapter 12 Exer. No. 12-4 12-5 12-6 12-7 12-8 12-9 12-10 12-11 12-12 12-13 12-14 12-15 Net cash provided $228,000. Net cash provided $191,000. Net cash provided $427,900. Net cash provided $108,000. (a) Net cash provided $133,000. (a) PepsiCo. .77 times. (b) Coca-Cola .38 times. (a) Patton 1.6 times. (b) Sager 0.40 times. Net cash provided $78,000. (a) $5,157.1; (b) $9,351.9. Net cash provided $61,000. Net cash provided $88,600. Rent $31,500; Receipts from customers $169,000. P12-2A (a) Net income $58,800 P12-3A Net cash provided by operating activities $1,940,000 P12-4A Net cash provided by operating activities $1,940,000 P12-5A Net cash provided by operating activities $305,000 P12-6A Net cash provided by operating activities $305,000 P12-7A Net cash provided by operating activities $38,500, Net cash used by financing activities ($32,000) P12-8A Net cash provided by operating activities $38,500, Net cash used by financing activities ($32,000) P12-9A Net cash provided by operating activities $176,930, Net cash used by financing activities ($17,030) P12-10A Net cash provided by operating activities $176,930, Net cash used by financing activities ($17,030) P12-11A Net cash provided by operating activities $94,000, Net cash used by investing activities ($12,000) P12-2B (a) Cash proceeds $5,000 P12-3B Net cash provided by operating activities $1,548,000 P12-4B Net cash provided by operating activities $1,548,000 P12-5B Net cash provided by operating activities $254,000 P12-6B Net cash provided by operating activities $254,000 P12-7B Net cash provided by operating activities $8,000, Net cash used by financing activities ($18,000) P12-8B Net cash provided by operating activities $8,000, Net cash used by financing activities ($18,000) P12-9B Net cash provided by operating activities $179,000, Net cash used by financing activities ($55,000) P12-10B Net cash provided by operating activities $179,000, Net cash used by financing activities ($55,000) P12-11B Net cash provided by operating activities $75,000, Net cash used by investing activities ($45,000) BYP 12-2 (a) Hershey: 1. Current cash debt coverage .47, 2. Cash debt coverage .17 BYP 12-5 (a) Current ratio 1.31, Current cash debt coverage (.13) BYP 12-7 (b) Net cash provided by operating activities $15,000 Chapter 13 Exer. No. 13-1 13-2 13-3 13-4 13-5 13-6 13-7 13-8 13-9 13-10 13-11 13-12 13-13 Net income $289,000. (e) 75,514,706. Total assets increase 15.0%. Net income: 2013, 8.0%; 2014, 8.8%. (a) Total assets increase 6.5%. (b) Current assets 73.5%. (a) Net income increase 13.9%. (b) Net income-2014 6.8%. Current cash debt .69; Accounts receivable turnover 4.2; Inventory turnover 5.9. Feb. 7, 2.43; Feb. 18, 2.66. (b) 5.4; (d) 3.6; (f) .31. (b) 1.64; (d) 7.6%. (a) $1.86; (c) 22.2%. (a) $722,000; (c) $111,595. (b) 2014 2.28; (e) 2014 24.2%. P13-1A (a) King Company: Income from operations as a percent of sales 32.1%, Net income as a percent of sales 26.3% P13-2A (a) Earnings per share $3.69; (c) Return on assets 23.2%; (e) Accounts receivable turnover 17.1 times (i) Times interest earned 15.1 times P13-3A (a) 2014 Profit margin 13.6%, Price-earnings ratio 2.8 times, Debt to assets 32% P13-4A (a) 2014: Current ratio 1.76, Inventory turnover 3.2 times, Profit margin 5.9%, Earnings per share $2.60 P13-5A (a) Target: Current ratio 1.63:1, Asset turnover 1.5, Times interest earned 6.5 P13-1B (a) Gerald Company: Income from operations as a percent of sales 23.8%, Net income as a percent of sales 18.5% P13-2B (a) Earnings per share $8.51; (c) Return on assets 16.7%; (e) Accounts receivable turnover 8.2 times; (i) Times interest earned 16.4 times P13-3B (a) 2014 Profit margin 14.5%, Price-earnings ratio 0.94 times, Debt to assets 28% P13-4B (a) 2014: Current ratio 2.03:1, Inventory turnover 1.86 times, Profit margin 12.4%, Earnings per share $1.30 P13-5B (a) Ritter: Current ratio 2.83:1, Asset turnover 1.7, Times interest earned 598.1 BYP 13-1 (a) 2011 (1) Net sales trend 107% of base year; (b) (1) 2011 debt to assets 22% BYP 13-2 (a) Tootsie Roll: (1) Percentage increase in net sales 2.2%, (2) Percentage increase in total assets 0.0% BYP13-5 (a) Coca-Cola: Current ratio 1.28:1, Accounts receivable turnover 9.1 times; (b) Times interest earned 26.0 times; (c) Return on assets 15.3% Appendix D Exer. No. D-1 D-4 D-5 D-8 D-11 D-13 D-15 D-16 D-19 D-21 D-23 (b) $14,366,88. $981,075.42. $37,800.33. (b) $125,605.76. $467,084.70. Present value of interest $183,469.45. Present value of interest $17,751.86. Present value of bonds $2,459,105. $105,169.42. 12 years. 8 payments. Appendix E Exer. No. E-1 (a) Gain on sale $2,000. E-2 E-3 E-4 E-5 E-6 E-7 E-8 (a) Gain on sale $1,900. Gain on sale $2,800. (b) $225,000. (a) Unrealized gain $72,000. (a) Unrealized loss $4,800. (a) Unrealized loss $4,800. (a) Unrealized gain-income $12,000. PE-1 (a) Gain on sale $30,000 PE-2 (a) Stock Investments balance $61,500 (c) Short-term investments, at fair value $54,000 PE-3 (a) Stock Investments balance $86,400 (c) Investments in stock of less than 20% owned companies, at fair value $89,700 PE-4 (c) Revenue from stock investments under equity method $240,000 PE-5 (d) Investments in stock of less than 20% owned companies, at fair value $155,000 PE-6 Total current assets $461,000, Total assets $2,644,000