Accounting Problems: Costing & CVP Analysis

advertisement

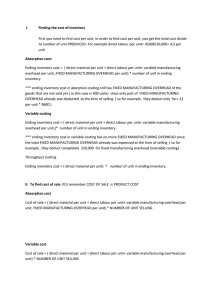

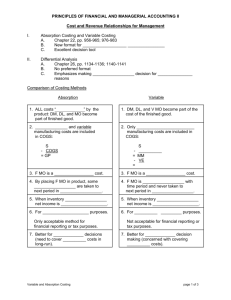

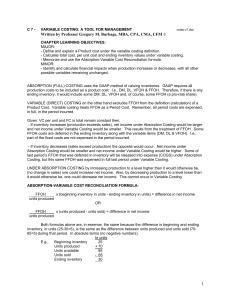

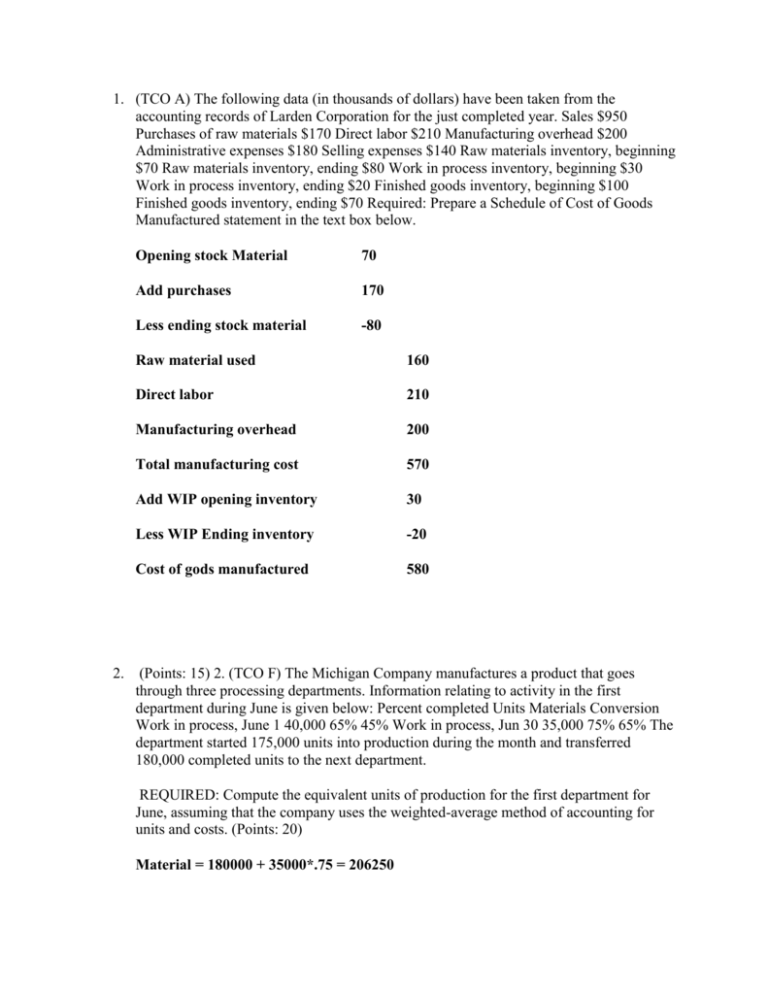

1. (TCO A) The following data (in thousands of dollars) have been taken from the accounting records of Larden Corporation for the just completed year. Sales $950 Purchases of raw materials $170 Direct labor $210 Manufacturing overhead $200 Administrative expenses $180 Selling expenses $140 Raw materials inventory, beginning $70 Raw materials inventory, ending $80 Work in process inventory, beginning $30 Work in process inventory, ending $20 Finished goods inventory, beginning $100 Finished goods inventory, ending $70 Required: Prepare a Schedule of Cost of Goods Manufactured statement in the text box below. Opening stock Material 70 Add purchases 170 Less ending stock material -80 Raw material used 160 Direct labor 210 Manufacturing overhead 200 Total manufacturing cost 570 Add WIP opening inventory 30 Less WIP Ending inventory -20 Cost of gods manufactured 580 2. (Points: 15) 2. (TCO F) The Michigan Company manufactures a product that goes through three processing departments. Information relating to activity in the first department during June is given below: Percent completed Units Materials Conversion Work in process, June 1 40,000 65% 45% Work in process, Jun 30 35,000 75% 65% The department started 175,000 units into production during the month and transferred 180,000 completed units to the next department. REQUIRED: Compute the equivalent units of production for the first department for June, assuming that the company uses the weighted-average method of accounting for units and costs. (Points: 20) Material = 180000 + 35000*.75 = 206250 Conversion = 180000+35000*.65 =202750 3. (TCO B) A cement manufacturer has supplied the following data: Tons of cement produced and sold 220,000 Sales revenue $924,000 Variable manufacturing expense $297,000 Fixed manufacturing expense $280,000 Variable selling and admin expense $165,000 Fixed selling and admin expense $82,000 Net operating income $100,000 Required: a. Calculate the company's unit contribution margin 924000-297000-165000 = 462000/220000 = $2.1 b. Calculate the company's unit contribution ratio 2.1/4.2 = .5 or 50% c. If the company increases its unit sales volume by 5% without increasing its fixed expenses, what would the company's net operating income be? (Points: 25) 924000*.05*.5 = $23100 4. (TCO E) The Dean Company produces and sells a single product. The following data refer to the year just completed: Selling Price $ 350 Units in beginning Inventory 0 Units Produced 20000 Units sold 19000 Variable Costs per unit: Direct materials $ 190 Direct labor $ 40 Variable manufacturing overhead $ 25 Variable selling and admin $ 10 Fixed Costs: Fixed manufacturing overhead $ 250,000 Fixed selling and admin $ 225,000 Assume that direct labor is a variable cost. Required: a. Compute the cost of a single unit of product under both the absorption costing and variable costing approaches. Absorption costing = 190+40+25 + (250000/20000) $267.50 product cost +10+(225000/19000) =$289.34 total cost Variable costing = 190+40+25 = 255 product cost + 10 = 265 total cost b. Prepare an income statement for the year using absorption costing. Sales 6650000 Less cost of goods sold Variable manufacturing cost 5100000 Fixed manufacturing 250000 Less ending inventory 5350000/20000 x 1000 -267500 Cost of goods sold 5082500 Gross profit 1567500 Less operating expense Variable 19000x 10 190000 Fixed 225000 -415000 Net income 1152500 c. Prepare an income statement for the year using variable costing. Sales 6650000 Less cost of viable cost of production Variable manufacturing cost 5100000 Less ending inventory 5100000/20000 x 1000 -255000 4845000 Gross contribution margin 1805000 Less Variable Selling and admin 19000x 10 -190000 Net contribution margin 1615000 Less Fixed cost 250000+225000 -475000 Net income 1140000