Private and public limited companies hw sheet.doc

advertisement

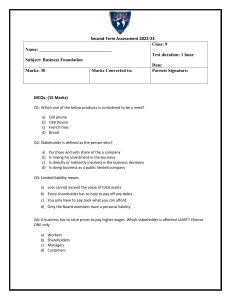

Private and Public Limited Companies Homework Sheet 1. Each of the following phrases below relates to either shares or dividends. Copy the outline table into your books and write each phrase in the appropriate column: Gives the owner voting rights Issued as a way of raising finance for the business A payment made to shareholders The amount can vary from year to year depending on the success of the business The value can go up or down over time Allows the owner to attend the annual general meeting of the company Gives the owner part ownership of the business Is usually paid twice a year Dividend Share Exam practice questions 1. Gerald Marsh and his wife are concerned about their farm’s future as a partnership and are thinking of forming a private limited company. a) Explain why Gerald and his wife may wish to change the business from a partnership to a private limited company. (4 marks) b) Explain how the owners of the partnership could be affected if a private limited company were formed. (4 marks) 2. Many retailers of chocolates are small independent sole traders whilst the companies which make chocolates are large public limited companies. Are these appropriate forms of ownership for these different businesses? Give reasons for your answers. (7 marks) Advice on how to answer the exam questions 1. a) You will need to provide reasons explaining the advantages of changing the business to a private limited company. Your answer will be improved if you explain why and how the change to private limited company overcomes some of the disadvantages of partnerships. b) This question requires you to provide an answer which concentrates on who owns the business and the way in which these owners will be affected by the change of company organisation. 2. To answer this question successfully you will need to consider and explain why there are so many sole trader-type businesses which are reasonably small in size. You should also consider the advantages of this particular form of business organisation. An explanation of why the plc form of business organisation is particularly suited to a very large business will also be required