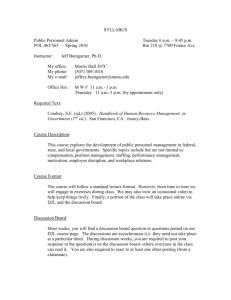

FCSC 302 Course Proposal

advertisement

Proposed Tier II course FCSC 302 Family and Consumer Personal Finance Web-Delivered Home Department Information: Norton School of Family and Consumer Sciences (FCSC) 520-621-3346 Family and Consumer Sciences Bldg Rm 123 For majors offered by FCSC (FSHD, FACS Ed, or RCSC), please check http://ag.arizona.edu/fcs/ Instructor Information: Richard Serlin Phone: 520-792-2181 Email: serlin@email.arizona.edu Office Hours: TBA Class location: Online through D2L Catalog Course Description A study of personal and family financial issues that affect people’s quality of life; an analysis of personal financial information resources, the concept of the time-value of money, and discussion of personal financial issues concerning the economic environment, financial statements, college planning, career planning, tax, credit, housing, insurance, retirement planning, and investment. Course background Today in the US, many families and consumers are facing personal finance crises that lead to serious societal problems, including an increasing incidence of personal bankruptcy, low household savings rates, and high household debt. Family and individual financial well-being is critical to the developing of healthy communities and a stable, strong economy. Research has shown that financial education leads to improved financial literacy and financial security for families and consumers. In this course, students will explore the personal and family financial issues that affect people’s quality of life. Students will study and analyze various personal financial information resources available on the Internet, the concept of the time-value of money, and discuss personal financial issues concerning the economic environment, financial statements, college planning, career planning, tax, credit, housing, insurance, retirement planning, and investment. In addition, the course will introduce career opportunities in retail financial services and family social services. Cognitive decision-making skills, goal-setting skills, and financial skills learned from this class will be helpful for enhancing individual wellbeing and personal lives as well as in the setting of retail financial services and family social services. Course Objectives and Learning Outcomes 1. To develop the knowledge and skills necessary to take advantage of favorable financial opportunities, to resolve personal financial challenges, to achieve self-satisfaction, and ultimately to strive toward financial security. 2. To develop a solid base and framework for making personal and the family financial decisions that will lead to improving the quality of life and individual and family wellbeing. 3. To understand the social and economic contexts of personal and family financial issues 4. To be able to understand and apply complex financial concepts, knowledge and skills to making personal financial decisions 5. To understand the time-value of money and how to use a financial calculator to compute present value, future value and periodic payments 6. To use a variety of calculating tools to plan and manage finances in following areas: budgeting, college planning, career planning, tax, credit, housing, insurance, retirement planning, and investment 7. To evaluate and analyze information recourses on the internet and use other materials for the purpose of personal financial planning 8. To use basic financial functions on computer software to solve personal financial problems and make short- and long-term financial plans 9. To understand career opportunities in retail financial services and family social services 10. To become knowledgeable consumers, savers, investors, users of credit, money managers, citizens and members of a global workforce and society. Honors Option Students electing to take the honors option are required to undertake a more advanced and longer version of the assignment-1 research paper. Interested students must contact the instructor concerning their topics. The instructor will then assign advanced reading, research and/or other requirements, which must be incorporated into the paper. The length requirement is 20 – 25 pages, double spaced, plus bibliography. Preliminary Knowledge There is no official prerequisite to this course. However, because RCSC 202 builds on the concepts of INDV 102, Money, Consumers, and Family, it is strongly suggested that students take INDV 102 first http://tcainstitute.org/resources/indv102online.htm . 2 Students who haven’t take INDV 102, will be nevertheless be responsible for information from that course, information which can be acquired by reading the following books: The Two Income Trap, by Elizabeth Warren and Amelia Warren Tyagi, and All Your Worth: The Ultimate Lifetime Money Plan, by Elizabeth Warren and Amelia Warren Tyagi. Textbooks, Software, and Calculator Required textbooks Bejtelsmit, V. (2006). Personal Finance: Skills for Life. Hoboken, NJ: Wiley. Hacker, J. S. (2006). The Great Risk Shift. Oxford: Oxford University Press. Frank, R. H. (2000). Luxury Fever: Money and Happiness in an Era of Excess. Princeton, NJ: Princeton University Press. Additional readings will be posted on the course website at: http://help.d2l.arizona.edu/ Software: Microsoft Money 2007 Deluxe, Cost: $30-$50 depending on current promotions Financial Calculator: HP-10B II, Cost: $30-$35. Course Methodology The course will be taught online via the learning software Desire2Learn (D2L). Students unfamiliar with D2L can learn the software via the Help service at: http://help.d2l.arizona.edu/forstudents.htm . Online Discussion The course will employ a D2L discussion board on which students can post comments and reply to the comments of others. Please see the D2L Help service for further details. For each of the assigned discussions, topics and/or questions will be provided to get the discussion started. The instructor will also monitor the postings and occasionally participate. Discussion is essentially graded as credit/no credit. A student will receive credit if for each discussion the student has posted at least 5 paragraphs of reasonable length and adequate content. An acceptable paragraph must develop a controlling idea, providing informed and thoughtful elaboration showing that the student has been keeping up with the reading. A student who does not achieve acceptable paragraphs will receive some level of no credit, meaning that the student will lose 1 to 10 points from his or her end-of-semester total, depending on how much the submitted paragraph falls short of what is deemed adequate. Essentially, if a student keeps up with the reading and simply makes a good 3 effort, the student need not worry; credit will be given, no points deducted from the total possible. The Discussion questions/topics will be posted at 12:00 AM on the first day of the week in which the discussion is assigned. Students may begin at that time, and have until the last day of that week at 11:59 PM to complete their input. Students who have trouble getting into the discussion, can complete their five paragraphs by writing a short essay in response to the discussion questions/topics. The essay (of fiveparagraphs at least) can reply to one or several of the discussion questions/topics. It is not necessary to reply to all of them. The five paragraphs can also reply partly or completely to the resources that others post on the board. As a convenient way to view the input of others, and view the entire discussion laid out on a single scrolling screen, hit the print view button. That will provide the clearest view. Also, regarding readability, please do not submit your discussion input in the form of an attachment. Your classmates cannot see an attachment displayed on the same page with the input of the others, and so viewing your input will require extra keystrokes. Assignments The course includes two assignments to be submitted via the D2L Dropbox. Assignment 1. An In-depth Research Paper on a Personal Financial Topic Each student is required to conduct in-depth research on a personal finance subject of the student’s choice and submit a research paper (10–15 pages, double-spaced, plus bibliography). Any standard format for a formal research paper is acceptable. Examples of topics include: Financing a College Education, including 529 plans, prepaid tuition plans, federal and state financial aid programs, and more; Retirement Saving, including IRAs, 401(k)s, traditional pensions, and more; and The Fringe Economy, including payday loan shops, check cashing shops, equity stripping operations, and more. The paper should focus on the most important aspects of the subject with regard to society as a whole and to individuals and individual families. Footnotes are not strictly required, but all facts presented must reference sources. Students have the option to revise and resubmit their papers for a re-grading. Papers can be re-submitted any time before the first day of final exam week. Assignment 2. Microsoft Money Personal Budgeting, Analysis, and Future Planning Using the program Microsoft Money, students are required to engage in in-depth personal financial planning. Students will enter all current cost and income information, and then perform a series of analyses. They will then construct a financial plan for the period until graduation. Next, students will estimate their income and expenses after completing their educations. With this information they again perform a series of analyses and construct a financial plan. 4 Exams The midterm and final will both contain a combination of multiple-choice, fill-in-theblank, and essay questions. There will typically be two essay questions per exam requiring responses of 1-2 double spaced pages. Course Schedule Weekly Class # Due Date Item Due 1 Video: Time Value of Money, Using a Financial Calculator and Microsoft Excel, by Richard Serlin, (using Camtasia technology for perfect video of the computer screen -- the camera is wired directly to the computer) Goals and Budgeting (Ch. 3, Personal Finance: Skills for life) 2 Video: Microsoft Money I, by Richard Serlin (using Camtasia) Income Tax Planning (Ch. 4, Personal Finance: Skills for life) 3 4 Video: Microsoft Money II, by Richard Serlin Cash Management, Purchase, & Credit Decision (Chs. 5 and 6, Personal Finance: Skills for life) The Costs of Prestige to Society (the Prestige Arms Race), The Recent Prestige Spending Boom (Ch.s 1-4, Luxury Fever) Consumer Loans (Ch. 7, Personal Finance: Skills for life) 5 6 7 Topics and Assigned Material Financial Planning, Financial Statements (Chs. 1 and 2, Personal Finance: Skills for life), Time Value of Money (Ch. 2, Personal Finance: Skills for life) TBA Midterm Exam Cognitive Models of Human Happiness, (Ch.s 5-6, Luxury Fever) Economic Externalities (Chs. 7-10, Luxury Fever) 5 Weekly Class # Due Date Item Due Article: Making Smart Housing Decisions, by Richard Serlin Property and Liability Insurance (Ch. 9, Personal Finance: Skills for life) 8 The New Economic Insecurity (Chs. 1 and 2, The Great Risk Shift) Employee Benefits (Ch. 10, Personal Finance: Skills for life) 9 10 11 Topics and Assigned Material Housing and Auto Decisions (Ch. 8, Personal Finance: Skills for life) Risky Jobs (Ch. 3, The Great Risk Shift) Investing Basics (Ch. 11, Personal Finance: Skills for life) TBA Assignment 1 12 Risky Families (Ch. 4, The Great Risk Shift) Stock Investing (Ch. 12, Personal Finance: Skills for life) Risky Retirement (Ch. 5, The Great Risk Shift) Bonds (Ch. 13, Personal Finance: Skills for life) 13 14 TBA Assignment 2 15 TBA Final Exam Risky Health Care (Ch. 6, The Great Risk Shift) Mutual Funds (Ch. 14, Personal Finance: Skills for life) Retirement and College Funding (Ch. 15, Personal Finance: Skills for life) Careers in Personal Finance and Retail Financial Services Grading Requirement Points 6 Assignment 1: Research Paper 20 Assignment 2: Microsoft Money Personal Budgeting, Analysis, and Future Planning 20 Midterm 25 Final 35 Total 100 Scale: Points Grade 90 – 100 A 80 – 89.99 B 70 – 79.99 C 60 – 69.99 D 59.99 or less E Academic Dishonesty All students are expected to take the exams on their own, with no help whatsoever from others. For assignments, students are allowed to ask questions and receive advice from others, so long as the bulk of the work is their own. Academic dishonesty is an extremely serious infraction. Any evidence of such will be turned over to the Dean’s office and may result in expulsion and a permanent mark on the student's records. Due Dates If assignments are turned in late, they will still be accepted, but points will be deducted depending on how late; however, if a student has a legitimate excuse for late completion, such as a serious illness or accident, then she will not be penalized. Course Policies 1) The course abides by university policies against plagiarism, etc., within the Student Code of Academic Conduct: http://studpubs.web.arizona.edu/policies/cacaint.htm . 7 2) Students registered with the Disability Resource Center should submit appropriate documentation if the student requests reasonable accommodations, per university policy: http:/drc.arizona.edu/instructor/syllabus-statement.shtml . 3) This course will follow university guidelines regarding the confidentiality of student records. For details, please see http://www.registrar.arizona.edu/ferpa/default.htm 4) Subject-to-change statement: Information contained in the course syllabus, other than the grade and absence policy, may be subject to change with advance notice, as deemed appropriate by the instructor. 5) This course abides by university policies against threatening behavior exhibited by students, as detailed at: http://policy.web.arizona.edu/~policy/threaten.shtml . 6) Attendance will not be taken in this course. Grades will be based on mastery of the material as demonstrated by the items in the grading scheme. 7) Student Code of Academic Integrity: Students are encouraged to share intellectual views and discuss freely the principles and applications of course materials. However, graded work/exercises must be the product of independent effort unless otherwise instructed. Students are expected to adhere to the UA Code of Academic Integrity as described in the UA General Catalog: http://dos.web.arizona.edu/uapolicies/cai2.html 8) This course abides by university policies regarding the confidentiality of student records, as detailed at: http://www.registrar.arizona.edu/ferpa/default.htm . 8