Joint Marketing Strategy of Business Clusters: Newcomers In Search

advertisement

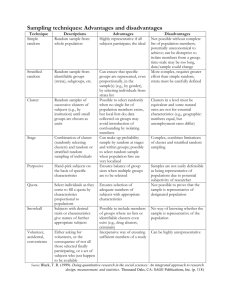

Joint Marketing Strategy of Business Clusters: Newcomers In Search of Competitive Advantages on the World Market Marina Sheresheva Dr. Prof., Department of Marketing, State University-Higher School of Economics, 20 Myasnitskaya str. 101100 Moscow, Russia tel. +7 910 401 29 45 / fax +7 495 772 95 69 e-mail: m.sheresheva@mail.ru, Abstract The purpose of the paper is to analyze the role of business clusters and their marketing policy in gaining competitive advantage on the world market. The paper takes network paradigm as a main basis of investigation looking at the development of clusters. In line with this paradigm, the market can be described as networks of multidimensional exchange relationships between business actors. These actors control heterogeneous, interdependent resources and conduct interlinked activities. Collaborative relationship management and procurement practices are of crucial importance. The research context is presented by transitional economies, empirical research being conducted on example of Russia. Keywords: business cluster, network, relationship marketing Joint Marketing Strategy of Business Clusters: Newcomers In Search of Competitive Advantages on the World Market Abstract The purpose of the paper is to analyze the role of business clusters and their marketing policy in gaining competitive advantage on the world market. The paper takes network paradigm as a main basis of investigation looking at the development of clusters. In line with this paradigm, the market can be described as networks of multidimensional exchange relationships between business actors. These actors control heterogeneous, interdependent resources and conduct interlinked activities. Collaborative relationship management and procurement practices are of crucial importance. The research context is presented by transitional economies, empirical research being conducted on example of Russia. Keywords: business cluster, network, relationship marketing 1.Introduction Nowadays, emerging clusters play an important role in regional development all over the world. The purpose of the paper is to analyze the role of business clusters and their marketing policy in gaining competitive advantage on the world market. Based on review of the literature on relationship marketing and inter-firm networking (Fabien et al, 2009; Ford et al., 2003; Gummesson, 1999; Wensley, 2009), the paper focuses on investigating the role of joint marketing strategy in gaining competitive advantages of clustering companies. Despite the importance to managers and policy makers of how clusters speed up regional development, there is uncertainty and debate about what we know and don’t know about interorganizational interactions within clusters as an issue of competitive advantage on the world markets. So, there is a need in more research, especially concerning clusters of newcomers from emerging ecocnomies. In the paper results of exploratory research are presented. We employ a qualitative approach by conducting in-depth interviews with top-managers and experts showing collaborative behaviour of toys producers in China and Rusiia. 2.Theory 2.1. Business Cluster as a Form of Quasi-Integration It is not a trivial task to define a cluster, in spite of the fact that the initial definition of a business cluster as a geographic concentration of interconnected businesses and associated institutions in a particular field made by M.Porter is widely accepted. There is considerable debate regarding the actual definition of a business cluster (also known as an industry cluster or competitive cluster). Some experts argue that the geographic concentration of SMEs is the only criteria to define business cluster, others look at the whole industry as cluster. Having network paradigm as a main basis of investigation, we consider business cluster as a system of close long-term relationships causing synergy is not to be ignored when defining business cluster.Actually, there are lots of industrial districts - localized geographical “urban areas” where enterprises are concentrated and benefit from having their place within such an area where large aggregate demand for a whole range of products and services is a norm. Still, to be at the same territory does not always means to interact closely. Even enterprises from the same (or closely related) industries located in the same place may be far from forming a network where close interactions become one of the main issues of competitiveness. Thus, business cluster should be defined as a specific type of network, “bargaining configuration” of quasi-integrated actors (Badot, 2001; Blois, 1972; Dietrich, 1994; Fernandez, Arrunada, Gonzalez, 2000; Jarillo, 1988; Ruigrok, van Tulder, 1995; Tretyak, 2007). Defining business cluster as an inter-organizational network presumes that the cluster effect is by its nature the network effect (Ditter, 2005; Sheresheva, 2010; Villarreal Lizzarraga, 2006). Once established, a cluster tends to grow through a process of cumulative, self-reinforcing development based on elaborating of internal norms, regulations, and routines. All the members are embedded in some sustainable framework “examples of interaction” (Doerre, 1997). Collaborative relationship management and procurement practices are of crucial importance (Håkansson, Ford, 2002; Håkansson, Snehota, 1995; Gadde, Huemer, Håkansson, 2003; Gemünden, Ritter, Walter, 1997; Ritter, Ford, 2004). 2.2. Joint Marketing Strategy of Business Cluster on the World Markets: Success Stories Joint marketing efforts of clustering companies attractts now attention of many researchers. Recently published results show the importance of such efforts. New World Wines may be considered as one of the most impressive examples of successful joint marketing strategy of clustering newcomers on the world markets. In servicing international markets, New World firms quickly realized that the most effective way to compete with their Old World counterparts was to produce and market a consistently high-quality product, at reasonable price points, to the world. This required a coordinated approach to research and development, a well-developed supply chain, sustainable alliances between growers and producers, significant public and private sector infrastructure and a unified marketing strategy (Aylward, Glynn, 2006; Ditter, 2005). To a very large extent, the strategy has worked, and clusters have evolved which have followed the model of geographic proximity (Porter, 1998). There is a high degree of vertical integration with suppliers, wine makers, growers, marketers, numerous related industries, and the national research, funding, regulatory, education and infrastructure bodies helping to provide the framework within which these firms compete and cooperate so effectively. Another well known example of a dazzling success model of how to break into world markets is China. It is also to a large extent due to clustering that Chinese companies have.gained considerable market share in many sectors. In the paper the case of toys producers is considered, with special attaention paid to the case of Guang Dong region (Kolkova, Lingjing Wang, 2010), namely Guan Yao toys cluster (see ex.1). Russian companies are not so active in using positive effects of clustering, in some industries there is almost no sigh of collaborative efforts, in other sectors motivation to build clusters is more obvious (Golovanova et al, 2010). Russian toys & baby-goods market is one of the examples. Local industry was heavily damaged in post-Soviet period. At the beginning of the decade Russian producers seemed to have little, if any, competitive advantages. The situation in the market began to change recently: the most active firms of the industry started to build intensive relationships aiming to raise competitiveness in Russia and abroad. 3.Research Methodology The first stage of our empirical study draws on the case method (Eisenhardt, 1989; Eisenhardt & Graebner 2007; Flyvbjerg 2006; Yin 1984). From our point of view, cases often provide valuable theoretical insights, since the case study approach implies the detailed examination of every single example of a class of phenomena (Dyer, Wilkins, 1991). It allows an investigation to retain the holistic and meaningful characteristics of real-life events, such as organizational and managerial processes. Rubber wheels Remote control Raw materials Ads & PR Delivery Metal body Gears R & D Center (new technologies) Design schools Advanced training centers Toy cars with remote control Hua Xuan E x p o rt Batteries Exhibitions Branded retail stores Ex.1. Guan Yao toys cluster, China In order to highlight the structure and quality of relationships within the industry and to emphasize the importance of long-term network interactions, an initial case study was carried in the form of in-depth interviews. So, the emphasis was on the qualitative methods which are the most appropriate if understanding and explanation are the main target of research. Additional data were obtained by means of observation and analyzing documents. A convenience sampling approach was used. A sample included an amount of small and medium producers from different segments of the Russian toys & baby-goods industry as well as the main specialized retailers and wholesalers working on the market and some industry associations leaders. In total, twelve in-depth interviews were conducted: 4.Preliminary Results We have gained a lot of primarily information, some information is still to be analysed. At the moment preliminary results are as follows. All the respondents pointed out the decrease of actors’ number in their supply chains. A reduction in the number of suppliers results now not from implementing a specific supply chain strategy but mainly due to bankruptcy of firms. At the same time, most respondents are sure that such development leads to improving mutual relationships between Russian toys & baby-goods supply chain members and thus delivering appropriate value to customers. Incentives to collaborate appeared to be quite strong. In the industry one can now observe a lot of mutually oriented interactions between two reciprocally committed parties tending to become multilateral. At the same time, the flow of information in the supply chain is far from easy. Many respondents underline the fact that they often regard the information from their partners as something needed additional analysis and examination. Our study registered intensive mutual relationships in Moscow region supported by the Russian National Toy Association (RNTA) and guided step by step towards system of explicit and implicit contracts between local actors dealing with toys production or related and supporting industries (see ex.2). RNTA and Association of Children’s Goods Industry (ACGI) are public non-commercial organizations which unite the professional industrial communities of manufacturers, retailers, and distributors in the Russian children goods market. Actually RNTA and ACGI make up the second level of Moscow toys cluster structure. Components Production Market and Nonmarket Support Services: Development support Design & package Certification services Warehousing logistics Transport logistics Customs logistics Marketing & PR Research institutions Specialized mass media (13) Exhibitions & fairs supporting services (8) Tech consulting Financial consulting Law consulting Equipment Production Raw Materials Industry and Professional Associations: Toy Producers (divided by kinds of raw materials used): RNTA (1) ACGI (1) 1. Plush & Fabric toys (30). 2. Plastic toys (25). 3. Paper & Cardboard toys (25). 4. Wooden toys, papier-mâché toys (22). 5. Rubber toys (6). Specialised education: College of games and toys (1) Industrial handicraft Colleges (5) Higher edication: No (0) Museums: State toys museum (1) Private toys museum (1) Doll's and puppets (3) 6. Metal toys (3). 7. Ceramic, Porcelain & Faience toys (3). Firm-level competitiveness: Market knowledge Innovation Factor availability National brand 8. New Synthetic toys (3). Selling & Export Agents: 1500 firms Ex.2. Emerging Toys Cluster in Moscow Region State Government Strustures: Moscow Local Department of SME Problems Moscow Local Department of Production Chamber of Commerce and Industry Main mission of both assotiations is to encourage business relationships on the Russian toys & baby-goods market. They represent the interests of the industry as a whole when dealing with public institutions to define the common strategies for the entities. For example, they demand the outright and immediate abolition of the tax on children's goods, fight for the recognition of the industry on the state level as a single whole. There are also RNTA and ACGI successful efforts to develop national brand “Russian Toy”, the all-Russia action “Year of Russian goods for children” supported by government, International Week of Quality, RNTA Inventors Club, and so on. They are very active in assisting companies in their search for suppliers and customers, supply potential partners with adequate information about each other. The main field where joint marketing efforts considered as very important both by companiews and associations are marketing research and brand promotion, as well as exhibitions abroad. Conclusions In this paper we proposed a framework of cluster as a market-oriented network of firms based on review of contributions from literature on relationship marketing and inter-firm networking as well as preliminary results of exploratory study conducted by means of in-depth interviews with managers and industry expperts. Our main conclusions are as follows. Joint marketing efforts of clusters may serve as an issue of competitive advantage. There are clear incentives for cluster members to elaborate joint marketing strategy and to collaborate in different ways including joint marketing research, cobranding, exchanging experiences, taking part in exhibitons, developing and marketing complementary products in order to strengthen the access to new customers looking for special whole product, gaining consolidated image, “sizing up” when approaching new international customers. As to Russian toys producers, wholesalers and retailers, they are now trategically committed to building long-term relationships within supply chain. Problems caused by crisis raised incentives to collaboration: we observed growing incentives of actors to develop mutually oriented interactions as well as some hybrid forms of trilateral relationships and intensive processes of clustering. Relational assets built by actors help them to strengthen their consolidated position and to gain governmental support of their initiatives as well as to create new value by combining complementary assets and key competencies, and thus to gain competitive advantages. The results of this exploratory study contribute to understanding the formal and informal connections of industry actors and can be used as a first step leading to further research of marketing strategy of emerging business clusters within the industry which is now being planned and will be conducted in 2011-2012. On the next stage of the research priority will be placed on identifying a research context suitable for testing our hypotheses and exploring our research questions. We are therefore going to collect data in form of in-depth interviews as well as in form of survey using structured questionnaire. References Aylward, D.K., Glynn, J. (2006). SME Innovation within the Australian Wine Industry: A Cluster Analysis. University of Wollongong, Faculty of Commerce. Ditter, J.-G. (2005). Reforming the French Wine Industry: Could Clusters Work? Cahiers du CEREN, 13, 39-54. Doerre, K. (1997). Globalisierung – eine strategische Option. Internationalisierung von Unternehmen und industrielle Beziehungen in der Bundesrepublik. Industrielle Beziehungen, 4, 265-290. Dyer, W. G., & Wilkins, A. (1991). Better stories, not better constructs, to generate better theory: A rejoinder to Eisenhardt. Academy of Management Review, 16, 613–619. Golovanova, S.V., Avdasheva, S.B., & Kadochnikov, S.M. (2010). Miezhfirmennaya Kooperatsiya: Analiz Razvitiya Klasterov v Rossii. Russian Journal of Marketing, 8, 41-66. Eisenhardt, K.M., and Graebner, M.E. (2007). Theory building from cases: opportunities and challenges. Academy of Management Journal, 50, 25-32. Fabien D., Graf R., & Ricard L. (2009). Twenty-Five Years After Berry, Where Does Relationship Marketing Stand? Paper presented at the 38th EMAC Conference, Audencia Nantes. Felzensztein, C., & Gimmon, E. (2008). Industrial clusters and social networking for enhancing inter-firm cooperation: The case of natural resources-based industries in Chile. Journal of Business Market Management, 4, 187-202. Flyvbjerg B. (2006). Five misunderstandings about case-study research. Qualitative Inquiry, 12, 219-245. Ford, D., Gadde L.-E., Håkansson, H., & Snehota, I. (2003). Managing Business Relationships. (2nd ed.). John Wiley, Chichester. Gadde, L.-E., Hümer, L., & Håkansson, H. (2003). Strategizing in Industrial Networks. Industrial Marketing Management, 32, 357-364. Gemünden, H. G., Ritter, T., Walter, A. (1997). Relationships and Networks in International Markets. Pergamon, Oxford. Gordon, I.R., & McCann, P. (2000). Industrial Clusters: Complexes, Agglomeration and /or Social Networks. Urban Studies, 37, 513-532. Gummesson, E. (1999). Total Relationship Marketing: From the 4Ps – product, price, promotion, place – of traditional marketing management to the 30Rs – the thirty relationships – of the new marketing paradigm, Butterworth-Heinemann, Oxford. Håkansson, H., & Ford, D. (2002). How should companies interact in business networks. Journal of Business Research, 55,.133-139. Håkansson, H., Snehota, I. (1995). Developing Relationships in Business Networks. Routledge, London. Kolkova K., Lingjing Wang (2010). Marketingovye initsiativy kak istochnik miezhdunarodnoi konkurentosposobnisti klasterov predpriyatii. In Sovremenniy menedzment^ voprosy teorii i praktiki. SU-HSE, Moscow. Morosini, P. (2002). Competing on social capabilities: a defining strategic challenge of the new millenium. IMD Working Paper 2002-1. IMD, Lausanne, Switzerland. Porter, M. (1998). Competitive Advantage. Creating and Sustaining Superior Performance. The Free Press, New York. Sheresheva, M. (2010). Formy Sietevogo Vzaimodeistviya kompanyi. SU-HSE, Moscow. Tretyak, O., Sheresheva, M. (2008).. Business Cluster as a Network of Relationships: An Empirical Study of Russian Industrial Sector. Proceedings of the 24th IMP Conference, Uppsala. Tretyak, V. (2005). Klastery priedpriaty, August Borg, Moscow. Villarreal Lizzarraga, C.L. (2006). Contribution au pilotage des projets partagés par des PME en groupement basée sur la gestion des risques. L’Institut National Polytechnique de Toulouse. Wensley R. (2009). The Relationship Between Theory, Discipline And Practice In Management And Marketing: What Gets Lost in Translation And Why. Paper presented at the 38th EMAC Conference, Audencia Nantes. Yin, R. K. (1994). Case study research: Design and methods. Sage Publications, London.