Business Case - South Warwickshire NHS Foundation Trust

advertisement

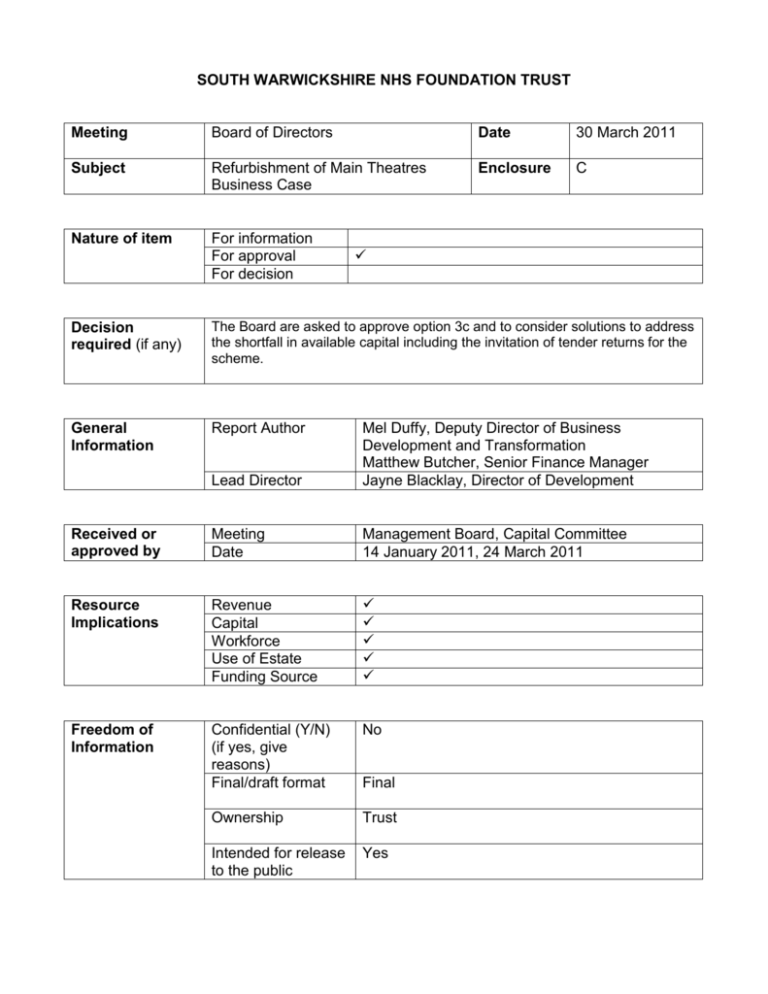

SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Meeting Board of Directors Date 30 March 2011 Subject Refurbishment of Main Theatres Business Case Enclosure C Nature of item For information For approval For decision Decision required (if any) The Board are asked to approve option 3c and to consider solutions to address the shortfall in available capital including the invitation of tender returns for the scheme. General Information Report Author Lead Director Mel Duffy, Deputy Director of Business Development and Transformation Matthew Butcher, Senior Finance Manager Jayne Blacklay, Director of Development Received or approved by Meeting Date Management Board, Capital Committee 14 January 2011, 24 March 2011 Resource Implications Revenue Capital Workforce Use of Estate Funding Source Freedom of Information Confidential (Y/N) (if yes, give reasons) Final/draft format No Ownership Trust Intended for release to the public Yes Final South Warwickshire NHS Foundation Trust Report to Board of Directors – 30 March 2011 Refurbishment of Main Theatres Business Case Executive Summary This business case proposes the refurbishment of the main theatres department. It is proposed that this includes the replacement of the air handling plant, an additional clean-air theatre and redevelopment of the main theatre department. This essential maintenance provides an opportunity for additional theatre developments to be undertaken concurrently which will enable the operating theatres and anaesthetic rooms to be updated, maximise storage space and provide a holding bay and additional changing facilities. It is also proposed that an Integrated Theatre to facilitate laparoscopic surgery delivery is installed as part of these developments to support patient choice, improved patient outcomes and experience and operational efficiencies. Although these additional developments may be viewed as less desirable on financial evaluation, from a quality and strategic perspective, they will enable us to deliver a futureproofed theatres design which will support us to respond flexibly to market opportunities driven by locality reconfigurations and also meet patient demand on a sustainable basis. 2 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Refurbishment of Main Theatres Business Case March 2011 South Warwickshire NHS Foundation Trust Outline Business Case Reference number: Directorate: Surgery Outline of Proposal: This business case proposes the refurbishment of the main theatres department. It is proposed that this includes the replacement of the air handling plant, an additional clean-air theatre and redevelopment of the main theatre department. The build would enable the operating theatres and anaesthetic rooms to be updated, maximise storage space and provide a holding bay and additional changing facilities. The upgrade would also include the addition of a Laparoscopic theatre and we have considered 3 different integrated operating theatre system packages. A detailed benefit appraisal of this option has been undertaken demonstrating the quality, efficiency and financial benefits of progressing this option. 3 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Proposal Background 1. Current Theatre Capacity: The Trust currently has five main theatres and four day surgery theatres. The main inpatient theatres are numbered 1 to 5. Theatres 1 to 4 were built 22 years ago and Theatre 5 was added 15 years ago. This additional theatre was squeezed into the existing theatre department footprint and although it has provided much needed additional capacity, the theatre does not conform to Hospital Technical Memorandum and Hospital Building Note requirements and has caused problems with storage space and work flow through the department. Surgical demand has increased significantly since Theatre 5 was built and the table below shows elective theatre session utilisation in Main Theatres between November 2009 and October 2010 assuming a 4 hour session duration. This demonstrates an overall utilisation rate of 92.3% and evidences our requirement for 5 main theatres to meet surgical demand. Suite \ Theatre Main Theatres Theatre 1 Theatre 2 Theatre 3 Theatre 4 Theatre 5 Number of Sessions 1,379 238 286 315 271 269 Number of Operations 3,862 676 986 817 780 603 Actual Hours Used 6,384 1,314 1,317 1,141 1,573 1,040 Avaliable Hours Utilisation 6,920 1,312 1,532 1,344 1,604 1,128 92.3% 100.1% 86.0% 84.9% 98.1% 92.2% 2. Current issues: Age and Condition of the Air Handling Units Due to their age, the replacement of the air handling units has been considered within the capital programme each year for the last 3 years. Health Technical Memorandum (HTM) 03-01: Specialised ventilation for healthcare premises recommends that critical ventilation systems over 20 years old be classed as having reached the “end of useful life” and that urgent replacement is indicated. Two years ago a full inspection was carried out by Clean Air Systems. The report stated that the ventilation plant was in a poor condition. One year ago a further risk assessment was carried out by the maintenance department. It was considered that with some on-going maintenance support the air handling units could continue to be used for a further 12 months but that the replacement would then be essential. During the past 12 months there have been 79 requests for maintenance work required to support the continued use of these units, requiring equivalent to 4 weeks’ labour from the estate team. Throughout the duration of the units’ problems, theatre teams have had to work in adverse conditions. The current configuration of the air handling units is not optimal. There are only two ventilation fans for the four theatres; one serves theatres 1 and 2, the second serves theatres 3 and 4. If any one of the fan sections develops a fault two theatres are affected. When the system is upgraded each theatre will have an independent unit to ensure maximum flexibility and resilience. Issues have also occurred with the current plant due to extreme weather conditions. The design at the time of installation was based on outside air temperatures of 28 Deg. C. in summer and 4 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST minus 3 Deg C in winter. In recent years we have seen summer temperatures exceeding 30 Deg C and winter temperatures as low as minus 14 Deg. C. The recent cold spell saw the temperature plummet to minus 8 Deg C over a prolonged period of time and weather forecasters predict that this increased range between summer and winter temperatures, as experienced in 2010, will be sustained over future years. The new ventilation system will be designed to reflect these conditions. Essential Maintenance The main theatres department is in need of redecoration and repair. In particular the flooring, walls and doors require repair or replacement. Department Design There are significant issues with the design of the current theatres’ environment particularly from an infection prevention and space perspective, conflicting with guidance detailed in Health Building Note (HBN) 26 on facilities required for surgical procedures. Theatre 5: HBN 26 recommends minimum space requirements for theatre environments, however, the additional Theatre 5, built in 1995, is non-compliant with these standards in both the theatre itself and its anaesthetic room. The space and layout of the anaesthetic room is particularly problematic for patients requiring ultrasound assisted anaesthesia as there is insufficient space for the patient, equipment and clinician to administer this type of block. There is no separate scrub room or preparation room, posing an infection risk with sterile instruments at risk of contamination from splashing water from scrub. The Theatre 5 development has also compromised the separate clean and dirty workflows planned for the 4 theatre environment, resulting in an infection transmission risk due to dirty items from Theatre 5 having to be transported along the same corridor as clean, pre-operative patients. Holding bay: The current department does not have a holding bay. This is an area where patients can be brought prior to their procedure providing an opportunity to prepare patients and have them ready for surgery as soon as the Theatre is available. This facility reduces delays between theatre cases and reduces transfer times for ward escorts. Internal and national audits have demonstrated that theatre productivity and utilisation can be improved with the availability of a holding bay. Storage: Increased theatre capacity, increased throughput and technological advances have all increased the storage requirements within the department beyond the available space. The current storage shortfalls have led to equipment being left in theatre corridors resulting in damage and causing congestion and issues with the accessibility of fire escape routes. The lack of a designated storage area has also led to delays to theatre lists and staff time wastage as they have had to hunt for the right equipment to match patients’ needs. This location problem is further evidenced by EBME records documenting nearly 240 occasions over the past 3 years when they have been unable to progress planned jobs or testing due to not being able to find devices within the theatres’ environment. Staff Facilities: When originally built, staff changing and storage facilities had been designed to accommodate up to 40 members of staff, however, due to increased theatre demand, evidenced by activity growth and extended operating hours, we now need changing and storage facilities for up to 80 members of staff. This includes facilities to appropriately store cleaned and soiled theatre wear to reduce infection transmission risks. 5 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST 3. Future Requirements: The main operating theatres are a key element of the Trust’s future plans. The Trust has an excellent reputation for elective surgery and the Board has previously considered the growth in market share within orthopaedics as part of previous business cases. As changes occur across the local health economy and in neighbouring Trusts, this organisation will require a modern and efficient theatre facility to ensure that we can Maintain and grow market share within specialties such as Orthopaedics and General Surgery Respond quickly to opportunities that may be available due to changes at other hospitals and consolidate facilities and expertise. The main theatres will need to be closed during the work to replace the air-handling units and carry out the essential maintenance. During this down time there is also an opportunity to make additional improvements that will support future developments. The project team have considered likely future developments in surgery and the Trust’s strategic direction. They have identified two key developments that would support the implementation of future plans: Increased clean air capacity There are currently only 2 clean air theatres in Main Theatres. As orthopaedic procedures can only be undertaken in a clean air theatre, our flexibility to schedule orthopaedic activity to meet demand and 18 weeks’ referral to treatment standards is restricted to current clean air theatre availability. The replacement of the air handling plant provides the opportunity for us to increase our clean air provision to improve our capacity to meet orthopaedic demand and access standards. We also anticipate that there may be equipment rationalisation benefits from colocating orthopaedic activity in adjacent theatres. Integrated Theatres: Integrated operating theatres provide an easy way of integrating and controlling theatre equipment, within an ergonomic and uncluttered environment, at the same time as improving visualisation and information available to the operating surgeons. It would be something that would be of benefit within all operating theatres but this redesign and re-development provides an opportunity to install one within the newly provided theatre 5, supporting the continued development of laparoscopic surgery within the Trust. Laparoscopic surgery is the best type of surgery for selected patients as it reduces tissue trauma, post-operative hospital stay and supports an overall improved experience for the patient. As such, it is a surgical option that we should be offering to our patients. For well informed patients, laparoscopic surgery will be the surgery of choice and will inform which providers both GPs and patients choose for referral. An integrated theatre will give us state of the art, upgradable and serviceable laparoscopic equipment which will reduce operating time, improve the quality of surgery, reduce risk for patients and staff and support our excellent reputation for training. The key benefits of laparoscopic surgery are detailed below; 1 Future planning: Across the world and nationally there is going to be a change in the way we perform major re-sectional bowel surgery. Currently we perform about 20% of our major cancer re-sectional surgery laparoscopically. Over the next 5 years there will be an expectation that we will be performing approximately 80% of this surgery laparoscopically. As this happens, standards will be developed for undertaking this type of surgery. This is evidenced by the recent Association of Laparoscopic Surgeons national grading of all hospitals providing laparoscopic surgery. Unfortunately Warwick Hospital was graded as a bronze (the lowest grade) because our equipment was deemed old and in some cases unsafe. These standards will include a requirement for an integrated laparoscopic theatre. Therefore, an integrated theatre will be an essential requirement to continue to 6 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST provide the best quality surgery and, without one, we shall rapidly fall behind competitors, lose prestige and business and inevitably the whole service. 2 Surgical staff: We expect that it will be difficult to attract and retain the best surgeons in the future without this equipment being available. 3 Efficiency: Set up times for integrated theatres are short and there is an opportunity to substantially reduce current down time for set up and improve the smooth running of operating lists with an integrated theatre. 4 Safety for patients and Staff: Automatic set up functionality available through integrated theatres reduces potential for operator errors and consequently improves safety for patients. 5 Training: As a premier surgical training unit we should be offering in-theatre laparoscopic training as well as training via video link in the hospital. Integrated theatres also offer the opportunity to deliver courses which are teleconferenced to other national and international centres of excellence. Proposal A project team has been in place since April 2010 to consider the options available for theatres’ refurbishment. There are three key options: Option 1 – Do nothing Option 2 – Replace air handling plant, additional clean air theatre and decoration of existing facility Option 3 – Replace air handling plant, additional clean-air theatre and redevelopment of main theatre department to include a laparoscopic theatre In Option 3, the refurbishment programme would enable the operating theatres and anaesthetic rooms to be updated, maximise storage space, provide a holding bay and provide additional changing facilities. The upgrade would also include the addition of a Laparoscopic theatre and steel reinforcements to support the installation of additional integrated operating rooms when existing theatres require replacement in the future. Three different integrated operating theatre packages, ranging from a basic to a full system, are considered within this option and evaluated from a differential cost and benefit perspective. The higher specification systems deliver enhanced functionality as described below. a) Basic System - Providing ceiling mounted pendants and equipment stacks, including camera and viewing monitors. b) Intermediate System - Providing ceiling mounted pendants and equipment stacks, including camera and viewing monitors and the additional functionality of a theatre control system to allow automatic, custom set up for individual operators c) Full System Providing ceiling mounted pendants and equipment stacks, including camera and viewing monitors and the additional functionality of a theatre control system to allow automatic, custom set up for individual operators a networked telemedicine facility to support training and demonstrations to a remote audience It is proposed that the Board approve option 3c and that we proceed to tender. 7 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Strategic fit This business case meets the following key objectives for the Trust: Meeting Trust 20010/11 objectives: 1 2 3 4 5 6 7 8 Deliver safer care Improve patients’ privacy and dignity Deliver care at the right time in the right place Create the capacity required to deliver our services Listen and respond to our members Develop our workforce Assure that the Trust is well governed Improve the integration of patient care across hospital and community settings Options appraisal Non financial appraisal Option appraisal Option number 1 Do nothing Benefits Consequences No capital costs No immediate disruption due to closure of theatres for refurbishment 2 Replace airhandling plant, additional clean-air theatre and minor refurbishment Theatres are made fit for use Additional clean air theatre available for orthopaedics Some improvement in the environment 3 –all options Replace air Provision of a theatre department that is fit for 8 Theatres become unfit for use within a short time. Significant loss of theatre capacity Trust will need to reduce surgical activity Loss of market share Risk to viability of Trust Theatres will be unavailable for 18 weeks Significant capital investment required Staff will need to work flexibly during period of scheme to enable activity to be maintained Opportunity to make further improvements during closure of theatres is lost Continued lack of storage and cluttered corridors Infection prevention risks due to storage in “dirty corridor” Capacity constraints due to lack of holding area Theatres will be unavailable for 20 weeks x x x x x SOUTH WARWICKSHIRE NHS FOUNDATION TRUST handling plant, additional clean-air theatre and redevelopment of main theatre department including laparoscopic theatre installation 3a 3c Significant capital investment required Staff will need to work flexibly during period of scheme to enable activity to be maintained Advantages of Laparoscopic theatre No need to close theatre 1 at a future date to install an integrated operating theatre Continuation of complex colorectal surgery Sustainable business continuity following the 20 week upgrade Minimised risk of loss of income Reduced theatre set-up times Staff cost reduction The Trust is committed to providing postgraduate medical and nursing training as part of an ongoing programme for surgical education and the full integrated operating system provides demonstration and training opportunities to a networked audience. Income generation opportunity 3b future use Additional clean air theatre available for orthopaedics Improved storage facilities resulting in improved environment, improved work flow and improved compliance with infection prevention policies. Improved facilities for staff Improved efficiency due to holding area for patients waiting for surgery As 3a As 3b Preferred option The preferred option is Option 3c. Affordability Financial Option Appraisal Option 1: Do nothing A true “do nothing” option would mean that we would need to close our main operating theatres by the end of 2012/13 (as a reasonable upper estimate) as the air handling plant would no longer be viable. 9 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST This would pose very significant restrictions on the type of healthcare that the Trust was able to provide. The range of surgery offered would need to be reduced and even if our largest specialty, orthopaedics was prioritised and maximum use made of the Day Surgery and other operating areas, we would need to stop providing general, breast, and colorectal surgery due to the reduction in capacity. We would lose the associated outpatient work as a consequence. A number of other services would also come under threat. A major part of our consultant-led maternity work would no longer be viable as it often uses main theatres. A&E would need to be downgraded, removing certain types of non-elective emergency activity from the hospital. These reductions in our scope of activity would have a knock-on effect on the range of services commissioned from our Trust and on the retention of medical staff. They would also expose the Trust to intervention from our commissioners and from Monitor for failing to provide services which are mandatory under our terms of authorisation as an NHS Foundation Trust. So while not all of these additional services that might be lost would be profitable, any decision to cease providing them could be blocked by legal means. There is therefore a very high likelihood that any attempt to close our main theatres would be prevented by commissioners seeking to safeguard healthcare capacity for the local population and could lead to de-regulation as an NHS Foundation Trust. The financial consequences of such a decision would also be undesirable. In the first three quarters of the current year, if national tariff had been applied in full, we would have earned £8.332m from general, breast and colorectal surgery, equating to income for the full year of £11.109m. This income would be lost if we were to close our main operating theatres. The associated cost would also be lost. The full cost over these services calculated as part of our in-year service line reporting for the first three quarters of 2010/11 is calculated at £8.140m, equating to a full year full cost of £10.853m. So if we closed our main theatres, ceased to provide general, breast, colorectal or oral surgery, and took out the full cost of these services, we would suffer a net loss of £0.256m per year. (We have not adjusted these figures for tariff and cost inflation as, over time, the impact of these would tend to be offset by CIPs, so as less income was lost due to tariff inflation, so the costs saved would fall.) However, taking out the full cost of these services would incur additional costs. The full cost of these services include costs of employed staff totalling £5.9m, which at a conservative estimate would equal around 100 WTE members of staff. Even if 10% staff turnover per year were to remove 20 of these from their posts without cost and a further 10% could be redeployed, we would expect to pay redundancy costs on 70 WTE staff members if we were to save the full cost of these services. This could total £2.2m as a one-off cost on the assumption of an average six months’ pay per employee. The second largest cost of taking out these services would be the costs of converting the space that they were provided in. These services carry capital charges of £1.1m per year and would continue to incur PDC dividend each year unless converted to another purpose. However, as demand for space is high, no assumption has been made as to whether it would be cheaper to construct new healthcare facilities in the space left by closing theatres or whether demolition and new construction elsewhere would be cost effective. Thirdly, we would lose the benefit from activity growth under our present maternity business case as we would not be able to expand our consultant led maternity service as planned, but would still incur additional costs to bring the maternity services up to desired quality standards. The net loss as a result of this would be of £0.3m in year 3 rising to of £0.4m in year 5 and assumed to stay at the same level thereafter. (These figures are taken from our maternity business case.) 10 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST The net present value of this option under these assumptions is shown in the table below. It would give a negative discounted cash flow of £10.5m, significantly worse than the other options considered in this business case. This, together with the fact that the “do nothing” option would probably be blocked by legal means, leads to the conclusion that this option is not worth pursuing further. This calculation is shown in the table below. 11 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Option 1: Do nothing All figures in £'000 Net present value of incremental costs and benefits 2011/12 Year Payments 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2026/27 2027/28 2029/30 2030/31 2031/32 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 1 2 3 4 5 Capital expenditure Loss of margin on general, breast and colorectal surgery Loss of margin on maternity services Redundancy costs PDC dividend 0 0 0 0 0 0 0 0 0 0 0 256 331 2200 0 0 256 373 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 0 256 414 0 0 TOTAL Discounted at 3.5% 0 0 0 0 2787 2595 629 565 670 581 670 581 670 561 670 541 670 522 670 504 670 486 670 469 670 453 670 437 670 422 670 407 670 353 670 340 670 329 670 317 Net cash inflow/ (outflow) Cumulative cash inflow / (outflow) 0 0 0 0 -2787 -2787 -629 -3416 -670 -4086 -670 -4756 -670 -5426 -670 -6096 -670 -6766 -670 -7436 -670 -8106 -670 -8776 -670 -9446 -670 -10116 -670 -10786 -670 -11456 -670 -12126 -670 -12796 -670 -13466 -670 -14136 Net cash inflow / (outflow) (discounted) Cumulative cash inflow / (outflow) (discounted) 0 0 0 0 -2595 -2595 -565 -3161 -581 -3742 -581 -4323 -561 -4883 -541 -5424 -522 -5946 -504 -6450 -486 -6936 -469 -7406 -453 -7858 -437 -8295 -422 -8717 -407 -9124 -353 -9477 -340 -9817 -329 -10146 -317 -10463 EBITDA Surplus 0 0 0 0 -2787 -2787 -629 -629 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 -670 Total capital spend 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Revenue impact Option 1: Do nothing, net present value and affordability calculations 12 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Options 2, 3a, 3b and 3c: Minimum refurbishment and Full upgrade with basic, intermediate and full integrated operating rooms The remaining options are therefore compared in terms of their return on investment over the 20 year life of the air handling works. Capital expenditure is presumed in this assessment to be depreciated over 20 years, except for the equipment in the integrated operating room, which would be depreciated over 7 years and then replaced. Capital expenditure is based on costings for Options 2 and 3 prepared by the Trust’s technical advisors. These costings include VAT, professional fees, in-house costs required to implement the works, the cost of temporary theatres accommodation, and 6% contingency, together with a cost estimates of the integrated operating room from the preferred supplier, Storz. (As Storz are a framework supplier, we would not need to go out to tender for the integrated operating room.) The costing for Option 3 includes the cost of steel reinforcements (£48,000), added to make the design suitable for further integrated operating rooms or other modern equipment to be added in future. The costing for Option 3 also includes some optional items which could be omitted if costs had to be reduced, including £72,000 for media bridges to three new theatres (taking electrical fittings off the floor and making operating safer and easier) and £36,000 for automatic doors. The cost of Option 2 is built up as follows (including VAT but excluding recoverable VAT): Replacement of air handling plant Rental of temporary theatres Other costs including fees and contingency Backlog maintenance on theatres £1,057,000 £ 559,000 £ 376,000 £ 400,000 TOTAL £2,392,000 The useful economic life of these works is assumed to be 20 years. The cost of Option 3 (apart from the integrated operating room) is built up as follows (including VAT but excluding recoverable VAT): Building project including air handling plant Rental of temporary theatres Other costs including fees and contingency Furniture and equipment (estimate) £2,760,000 £ 598,000 £ 662,000 £ 30,000 TOTAL £4,050,000 The useful economic life of these works is assumed to be 20 years. It has been assumed that 80% of the value of the capital expenditure under either option will be lost as an impairment when the asset is brought into use. This is because the works relate primarily to bringing the assets into their intended condition for use rather than enhancements of the type that would add value to a building. This assumption will be revisited when we have more information on the details of the project. In addition, Option 3 would involve buying an integrated operating room with costs as follows (including VAT): Option 3a (basic integrated operating room) £ 226,000 Option 3b (intermediate integrated operating room) £ 382,000 Option 3c (full integrated operating room) £ 443,000 13 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST The useful economic life of the integrated operating room is assumed to be 7 years and replacement is assumed after that period at the same cost. An option exists to purchase the integrated operating room under a managed service. The desirability of this is still being investigated and it could lead to small cost saving on the figures above. For this comparison, we have assumed purchase, as this is a prudent approach that does not materially distort the comparison. We have not built into these calculations any differences in maintenance or hotel services costs between the two options. Savings have been assumed under Option 3 compared to Option 2. The more efficient theatre layout and quicker setting-up times in the integrated operating room would enable the saving (assumed from 2012/13) of one band 6 member of staff as a result of reducing downtime and time not spent operating, thus enabling the same workload to be delivered in a shorter space of time. In addition, Option 3b would generate a small saving of 40 minutes a day on staff time due to enhanced theatre set up arrangements. This would relate to Band 2 nursing time and it has been assumed that this saving could be achieved through rearranging rotas to take account of this time saving. Finally, Option 3c would allow income to be generated by training others in the use of integrated operating room equipment. In year 2, “Lapco” funding could provide us with £800 per laparoscopic operation, or approximately £32,000 a year, to demonstrate new techniques to other NHS providers. After that, we have assumed that for 5 years we could run courses demonstrating the use of integrated operating rooms for colorectal and hernia surgery. We have assumed £35,000 of income per year for 5 years based on 2-3 courses in each area per year. We have assumed costs associated with this of two days’ consultant time per course and 0.25 WTEs of a band 3 admin worker to coordinate the courses. No other financial savings have been identified to set Option 3 apart from Option 2. The possible saving on duplication of equipment in stores has been considered, but is likely to be outweighed by the need to purchase more expensive equipment. Agency costs might have been saved by improving recruitment and retention, but theatres have already reduced their agency costs to nil through recruitment this year. Option 3 would enable us to avoid loss of more complex surgical work, particularly in the area of major bowel excisions, but it seems clear from comparing the costs of this work to the income earned under tariff that losing this work would have no significant impact on the Trust’s financial position and we might even gain a small amount financially by losing this work. (This is to a great extent because we are currently earning only 30% of the nonelective tariff on marginal increases or decreases in non-elective work, under the current Operating Framework.) Finally, a best practice tariff is likely to be extended to many types of laparoscopic work in future, but we have no information on the moment about what impact this could have. We have therefore not assumed any revenue savings in any of these areas as a result of Option 3. The tables on the following four pages summarise these savings into a calculation of return on investment for the Option 2 and all three versions of Option 3. In summary, the results are as follows: Option 2 3a 3b 3c Net present value (£2.53m) (£4.33m) (£4.73m) (£4.76m) 14 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Based on current information the case for Option 3 would need to be considered as an investment in quality and future-proofing of services, as from a financial point of view it would be less desirable than Option 2. The same can be said for Options 3b and 3c as compared to Option 3a. However, it is worth noting that Options 3b and 3c are very close in cost, whereas Option 3c is significantly better from a service point of view. 15 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Option 2: Minimum refurbishment All figures in £'000 Net present value of incremental costs and benefits 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2026/27 2027/28 2029/30 2030/31 2031/32 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Year Payments Capital expenditure PDC dividend 2392 8 0 16 0 15 0 14 0 14 0 13 0 12 0 11 0 10 0 9 0 9 0 8 0 7 0 6 0 5 0 4 0 4 0 3 0 2 0 1 TOTAL Discounted at 3.5% 2401 2401 16 16 15 14 14 13 14 12 13 11 12 10 11 9 10 8 9 7 9 6 8 5 7 5 6 4 5 3 4 3 4 2 3 1 2 1 1 1 Net cash inflow/ (outflow) Cumulative cash inflow / (outflow) -2401 -2401 -16 -2417 -15 -2432 -14 -2446 -14 -2460 -13 -2473 -12 -2485 -11 -2496 -10 -2506 -9 -2516 -9 -2524 -8 -2532 -7 -2539 -6 -2545 -5 -2550 -4 -2554 -4 -2558 -3 -2561 -2 -2563 -1 -2564 Net cash inflow / (outflow) (discounted) Cumulative cash inflow / (outflow) (discounted) -2401 -2401 -16 -2416 -14 -2430 -13 -2443 -12 -2455 -11 -2466 -10 -2476 -9 -2485 -8 -2493 -7 -2500 -6 -2507 -5 -2512 -5 -2517 -4 -2521 -3 -2524 -3 -2527 -2 -2528 -1 -2530 -1 -2531 -1 -2531 Capital Capital cost Impairment Depreciation Fixed asset value PDC dividend 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2026/27 2027/28 2029/30 2030/31 2031/32 2392 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1914 0 0 0 0 0 6 24 24 24 24 24 24 24 24 24 24 24 24 24 24 24 24 24 24 24 472 449 425 401 377 353 329 305 281 257 233 209 185 161 138 114 90 66 42 18 8 16 15 14 14 13 12 11 10 9 9 8 7 6 5 4 4 3 2 1 Revenue impact EBITDA Surplus Total capital spend 0 -14 0 -40 0 -39 0 -38 0 -38 0 -37 0 -36 0 -35 0 -34 0 -33 0 -33 0 -32 0 -31 0 -30 0 -29 0 -28 0 -27 0 -27 0 -26 0 -25 2392 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Option 2: Minimum refurbishment, net present value and affordability calculations 16 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Option 3a: Full refurbishment with basic integrated operating room All figures in £'000 Net present value of incremental costs and benefits 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2026/27 2027/28 2029/30 2030/31 2031/32 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Year Receipts and savings Band 6 post saved through efficiency gains Payments 0 42 42 42 42 42 42 42 42 42 42 42 42 42 42 42 42 42 42 42 TOTAL Discounted at 3.5% 0 0 42 41 42 39 42 38 42 36 42 36 42 35 42 34 42 33 42 32 42 30 42 29 42 28 42 27 42 26 42 26 42 22 42 21 42 20 42 20 Capital expenditure PDC dividend 4276 18 0 34 0 32 0 29 0 27 0 24 0 22 226 23 0 25 0 22 0 20 0 17 0 15 0 12 226 14 0 15 0 13 0 10 0 8 0 5 TOTAL Discounted at 3.5% 4294 4294 34 33 32 30 29 26 27 23 24 21 22 18 249 201 25 19 22 17 20 14 17 12 15 10 12 8 240 151 15 9 13 7 10 5 8 4 5 3 Net cash inflow/ (outflow) Cumulative cash inflow / (outflow) -4294 -4294 8 -4286 10 -4276 13 -4263 15 -4248 18 -4231 20 -4211 -207 -4418 17 -4401 20 -4381 22 -4359 25 -4335 27 -4307 30 -4278 -198 -4476 27 -4449 29 -4420 32 -4388 34 -4354 37 -4317 Net cash inflow / (outflow) (discounted) Cumulative cash inflow / (outflow) (discounted) -4294 -4294 7 -4286 9 -4277 11 -4266 13 -4253 15 -4237 17 -4221 -167 -4388 13 -4375 15 -4360 16 -4344 17 -4327 18 -4308 19 -4289 -124 -4413 16 -4397 15 -4382 16 -4366 16 -4350 17 -4332 2011/12 4050 226 3240 10 8 800 218 18 2012/13 0 0 0 40 31 760 187 34 2013/14 0 0 0 40 31 720 156 32 2014/15 0 0 0 40 31 680 124 29 2015/16 0 0 0 40 31 640 93 27 2016/17 0 0 0 40 31 600 62 24 2017/18 0 0 0 40 31 560 31 22 2018/19 0 226 0 40 31 520 226 23 2019/20 0 0 0 40 31 480 195 25 2020/21 0 0 0 40 31 440 164 22 2021/22 0 0 0 40 31 400 133 20 2022/23 0 0 0 40 31 360 101 17 2023/24 0 0 0 40 31 320 70 15 2024/25 0 0 0 40 31 280 39 12 2025/26 0 226 0 40 31 240 234 14 2026/27 0 0 0 40 31 200 203 15 2027/28 0 0 0 40 31 160 172 13 2029/30 0 0 0 40 31 120 141 10 2030/31 0 0 0 40 31 80 110 8 2031/32 0 0 0 40 31 40 78 5 0 -36 42 -63 42 -61 42 -59 42 -56 42 -54 42 -51 42 -53 42 -54 42 -51 42 -49 42 -47 42 -44 42 -42 42 -43 42 -44 42 -42 42 -39 42 -37 42 -35 4276 0 0 0 0 0 0 226 0 0 0 0 0 0 226 0 0 0 0 0 Capital Capital cost (20 year life) Capital cost (7 year life) Impairment Depreciation (20 year life) Depreciation (7 year life) Fixed asset value (20 year life) Fixed asset value (7 year life) PDC dividend Revenue impact EBITDA Surplus Total capital spend Option 3a: Full refurbishment with basic integrated operating room, net present value and affordability calculations 17 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Option 3b: Full refurbishment with intermediate integrated operating room All figures in £'000 Net present value of incremental costs and benefits 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2026/27 2027/28 2029/30 2030/31 2031/32 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Year Receipts and savings Band 6 post saved through efficiency gains Band 2 efficiency saving Payments 0 0 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 42 2 TOTAL Discounted at 3.5% 0 0 44 42 44 41 44 39 44 38 44 38 44 37 44 35 44 34 44 33 44 32 44 31 44 30 44 29 44 28 44 27 44 23 44 22 44 22 44 22 Capital expenditure PDC dividend 4432 20 0 39 0 36 0 33 0 30 0 26 0 23 382 26 0 30 0 27 0 23 0 20 0 17 0 14 382 17 0 21 0 17 0 14 0 11 0 8 TOTAL Discounted at 3.5% 4452 4452 39 38 36 34 33 29 30 26 26 23 23 19 408 330 30 23 27 20 23 17 20 14 17 11 14 9 399 251 21 13 17 9 14 7 11 5 8 4 Net cash inflow/ (outflow) Cumulative cash inflow / (outflow) -4452 -4452 5 -4447 8 -4440 11 -4428 14 -4414 18 -4396 21 -4376 -364 -4740 14 -4726 17 -4709 20 -4688 24 -4664 27 -4638 30 -4607 -355 -4962 23 -4939 27 -4912 30 -4883 33 -4850 36 -4813 Net cash inflow / (outflow) (discounted) Cumulative cash inflow / (outflow) (discounted) -4452 -4452 4 -4448 7 -4440 10 -4430 12 -4418 15 -4402 17 -4385 -294 -4679 11 -4668 13 -4655 15 -4640 17 -4624 18 -4606 20 -4586 -223 -4809 14 -4795 14 -4781 15 -4766 16 -4750 18 -4732 2011/12 4050 382 3240 10 14 800 368 20 2012/13 0 0 0 40 53 760 315 39 2013/14 0 0 0 40 53 720 263 36 2014/15 0 0 0 40 53 680 210 33 2015/16 0 0 0 40 53 640 158 30 2016/17 0 0 0 40 53 600 105 26 2017/18 0 0 0 40 53 560 53 23 2018/19 0 382 0 40 53 520 382 26 2019/20 0 0 0 40 53 480 329 30 2020/21 0 0 0 40 53 440 276 27 2021/22 0 0 0 40 53 400 224 23 2022/23 0 0 0 40 53 360 171 20 2023/24 0 0 0 40 53 320 119 17 2024/25 0 0 0 40 53 280 66 14 2025/26 0 382 0 40 53 240 395 17 2026/27 0 0 0 40 53 200 343 21 2027/28 0 0 0 40 53 160 290 17 2029/30 0 0 0 40 53 120 238 14 2030/31 0 0 0 40 53 80 185 11 2031/32 0 0 0 40 53 40 132 8 0 -44 44 -88 44 -85 44 -81 44 -78 44 -75 44 -72 44 -75 44 -79 44 -75 44 -72 44 -69 44 -66 44 -62 44 -66 44 -69 44 -66 44 -63 44 -60 44 -56 4432 0 0 0 0 0 0 382 0 0 0 0 0 0 382 0 0 0 0 0 Capital Capital cost (20 year life) Capital cost (7 year life) Impairment Depreciation (20 year life) Depreciation (7 year life) Fixed asset value (20 year life) Fixed asset value (7 year life) PDC dividend Revenue impact EBITDA Surplus Total capital spend Option 3b: Full refurbishment with intermediate integrated operating room, net present value and affordability calculations 18 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Option 3c: Full refurbishment with full integrated operating room All figures in £'000 Net present value of incremental costs and benefits 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2026/27 2027/28 2029/30 2030/31 2031/32 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Year Receipts and savings Band 6 post saved through efficiency gains Band 2 efficiency saving Course fees and training income 0 0 0 42 2 32 42 2 35 42 2 35 42 2 35 42 2 35 42 2 35 42 2 0 42 2 0 42 2 0 42 2 0 42 2 0 42 2 0 42 2 0 42 2 0 42 2 0 42 2 0 42 2 0 42 2 0 42 2 0 0 0 76 73 79 73 79 71 79 68 79 68 79 66 44 35 44 34 44 33 44 32 44 31 44 30 44 29 44 28 44 27 44 23 44 22 44 22 44 22 Capital expenditure Costs of delivering courses PDC dividend 4493 0 21 0 9 41 0 9 38 0 9 34 0 9 31 0 9 27 0 9 23 443 0 28 0 0 32 0 0 28 0 0 25 0 0 21 0 0 18 0 0 14 443 0 18 0 0 23 0 0 19 0 0 16 0 0 12 0 0 9 TOTAL Discounted at 3.5% 4514 4514 50 48 47 43 43 39 40 34 36 31 33 27 471 380 32 25 28 21 25 18 21 15 18 12 14 9 461 290 23 14 19 10 16 8 12 6 9 4 Net cash inflow/ (outflow) Cumulative cash inflow / (outflow) -4514 -4514 26 -4489 32 -4456 36 -4421 39 -4381 43 -4338 46 -4292 -427 -4719 12 -4707 16 -4691 19 -4672 23 -4649 26 -4623 30 -4594 -417 -5011 21 -4990 25 -4965 28 -4937 32 -4905 35 -4870 Net cash inflow / (outflow) (discounted) Cumulative cash inflow / (outflow) (discounted) -4514 -4514 25 -4489 30 -4459 32 -4427 34 -4393 37 -4356 39 -4317 -345 -4662 9 -4652 12 -4641 14 -4627 16 -4611 18 -4593 19 -4574 -263 -4837 13 -4824 13 -4811 14 -4796 16 -4781 18 -4763 2011/12 4050 443 3240 10 16 800 427 21 2012/13 0 0 0 40 61 760 366 41 2013/14 0 0 0 40 61 720 305 38 2014/15 0 0 0 40 61 680 244 34 2015/16 0 0 0 40 61 640 183 31 2016/17 0 0 0 40 61 600 122 27 2017/18 0 0 0 40 61 560 61 23 2018/19 0 443 0 40 61 520 443 28 2019/20 0 0 0 40 61 480 382 32 2020/21 0 0 0 40 61 440 321 28 2021/22 0 0 0 40 61 400 260 25 2022/23 0 0 0 40 61 360 199 21 2023/24 0 0 0 40 61 320 138 18 2024/25 0 0 0 40 61 280 77 14 2025/26 0 443 0 40 61 240 459 18 2026/27 0 0 0 40 61 200 398 23 2027/28 0 0 0 40 61 160 337 19 2029/30 0 0 0 40 61 120 276 16 2030/31 0 0 0 40 61 80 215 12 2031/32 0 0 0 40 61 40 154 9 0 -47 67 -75 70 -69 70 -65 70 -62 70 -58 70 -55 44 -85 44 -89 44 -85 44 -82 44 -78 44 -75 44 -71 44 -76 44 -80 44 -76 44 -73 44 -69 44 -66 4493 0 0 0 0 0 0 443 0 0 0 0 0 0 443 0 0 0 0 0 TOTAL Discounted at 3.5% Payments Capital Capital cost (20 year life) Capital cost (7 year life) Impairment Depreciation (20 year life) Depreciation (7 year life) Fixed asset value (20 year life) Fixed asset value (7 year life) PDC dividend Revenue impact EBITDA Surplus Total capital spend Option 3c: Full refurbishment with full integrated operating room, net present value and affordability calculations 19 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Affordability Affordability is an issue to be considered in relation to these proposals. The additional spend on theatres put forward in Option 3 would reduce the Trust’s liquidity by over 2 days in 2011/12, assuming that we have taken on Warwickshire Community Services by this point. The impact of this on the Trust’s risk ratings could be absorbed within our current base case (where there is forecast to be 5 days’ margin of safety on liquidity next year once additional loan repayments have been taken into account) but would leave the Trust more vulnerable to financial downsides. If the Trust was not willing to reduce its liquidity by this amount, it would need to consider alternative sources of funding for this development (for instance, additional surpluses or loans) if it was to go ahead. In terms of the revenue impact of these cases, all would have a negative impact on the Trust’s surplus through increased capital charges. However, an estimate of this has already been built into the Trust’s Long Term Financial Model and the 2011/12 impact has already been estimated as part of budget setting, so the increase in capital charges does not in itself make these options unaffordable. In addition, Options 3a to 3c (especially Option 3c) have a positive impact on the Trust’s EBITDA due to the savings and income that they generate. From a revenue point of view, these cases are therefore affordable within existing budgets. The real challenge on affordability relates to capital expenditure. We currently have £4.0m set aside in our capital programme for 2011/12 for this expenditure. Options 3a, 3b and 3c exceed this allocation and so would need an additional source of capital funding to be found in order to be affordable. 20 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Achievability This will be a highly complex and disruptive project for the organisation. If either option 2 or option 3 is approved, then main theatres will be unavailable for use for 18 to 20 weeks this year. The Trust has liased with other organisations that have undergone a major theatre refurbishment to benefit from their experience. All have confirmed the major disruption caused across the organisation as a result of the scheme. The project team have looked at the activity that may need to be provided during this time. It is proposed that temporary theatres are located within Car Park C to maintain business continuity during the refurbishment programme. The location of these theatres will significantly reduce car parking capacity during the period of this scheme. Costs for re-providing this capacity have been included. Access to the temporary theatres will be via the radiology department. This will result in increased traffic and disruption within this department. Additional storage will be required on-site for all the equipment currently within the main theatres department. Costs have been included for this. An Operational plan has been developed (see Appendix 2 for a summary) that will require the existing work force to work flexibly during this period to maximise utilisation of the reduced capacity available. The current costs assume that activity will be delivered within the same pay budget. The capital investment required to support this proposal is significant and would account for the majority of the capital programme during 2011/12. Approval sought for The Board are asked to approve option 3c and to consider solutions to address the shortfall in available capital including the invitation of tender returns for the scheme. Business case approval Approval sought from: Capital Committee Management Board Trust Board Comments: Included within capital programme for 2011/12 Option 3 supported by Management Board 14 January 2011 Business case approved by: ……………………………………………………….. Date: ……………………………………………………….. 21 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Business case monitoring 1. Risks that need to be added to the risk register: Is this included in the risk register? yes no If yes reference number Estates risk register Category of risk Score on risk register Responsible officer for monitoring: Name: Date: Follow-up 2. Equality Impact Assessment Has the proposal been assessed for any impact relating to Equality? yes no Details of the assessment and any issues or concerns: Details of any further Impact Assessment required 3: Privacy Impact Assessment (PIA) Where a project/proposal requires the use of personal and or sensitive information (staff or patient) a PIA may be required to be undertaken – for further help and guidance on this please contact the Information Governance Manager ext 4707 or email Sara.Owens@swh.nhs.uk The guidance document can be found here – Addressing Confidentiality within Projects Click here for an electronic copy of the assessment questions. Has the Privacy Impact Screening Assessment been undertaken? yes no What was the outcome? Full PIA Small PIA No PIA required. 22 SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Appendix 1 Theatres’ Development Business Case – Option 3 Benefit Appraisal Storage Quality Benefit Improved compliance with standards around sterile and nonsterile product storage Consequence Appropriate storage of sterile and nonsterile products. Fit for purpose storage facilities for equipment preventing; Uncongested storage areas with easy access to supplies/equipment. Improved Health and Safety in the Theatres’ working environment Reduced risk of equipment breakdown due to poor and inappropriate storage Equipment available and working ensuring reduced delays and increased productivity Improved Health and Safety environment and reduced risk of moving and handling injuries Easily and more quickly locatable equipment Reduced wastage of staff time and delays matching equipment to patient need Can store enough kit to provide back-up systems to proceed in event of breakdown Improved business continuity Space efficiency gains as equipment can be transported between theatre locations as needed. Opportunity for standardisation in all main theatre layouts resulting in subsequent process equipment being stored openly in corridors causing congestion of fire escape routes poor access to equipment and high risk of handling and moving injuries to staff. Mobile and durable storage facilities which is accessible for cleaning to the required Infection Prevention standards Efficiency Benefit Reduced theatre preparation times due to co-located, easily accessible kit Equipment stored in designated location. Reduced risk of infection transmission due to easily accessible storage environment 23 Consequence Released staff hours from theatre preparation to undertake other functions (NB: this is currently undertaken by on-call night staff so there is not an opportunity to reduce staff budget) Financial Benefit Reduced spend on equipment maintenance and repair due to breakdown following inappropriate storage Reduced expenditure on duplicate equipment as equipment can be stored and transported between theatres as required Consequence Potential revenue saving or reduced cost pressure SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Staff Change Holding Bay Integrated Theatre Quality Benefit Consequence Increased facilities for staff change /increased number of staff lockers to secure individual belongings as the current facilities were built to accommodate 40 people in 1987 but are now accommodating between 70 and 80. Appropriate storage for scrub suits clean and soiled and theatre footwear. Increased toilet facilities. Provision of a patient waiting area prior to surgery facilitates the timely sending of patients to theatre Improved staff facilities, security and morale. Reduction in infection risks due to appropriate clad staff. Deliver optimal outcomes for patients Reduced delays between theatre cases, and escorting ward staff are able to return to host ward reducing escorting times in the Anaesthetic room. Remain provider of choice for local patients Efficiency Benefit Consequence efficiency gains. Reduced delays between theatre cases Increased productivity (equivalent to X) Financial Benefit Ward staff able to dedicate increased time to ward activities Length of stay reductions for patients undergoing laparoscopic surgery 80% of LGI cancers to be operated upon 24 Reduced bed requirements in support of bed reduction/right-sizing plan (NB: laparoscopic surgery Maintain current caseload/case mix and income. Maintain competitive edge in Consequence SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Quality Benefit laparoscopically Consequence Efficiency Benefit Develop Laparoscopic Gynaecology which is a limited offer in this Trust at this time. We are laggards on this service Consequence will increase theatre time requirements) but this would be minised to due the set up and control advantages of an integrated theatre Financial Benefit local market Consequence UHCW will have challenges in implementing this type of theatre due to the potential constraints of a PFI, GEH’s plans and capcity unclear going forward Other New layout completely separates the clean and dirty corridors from each other reducing infection risk to patients (and complying with guidelines). Currently Theatre 5 dirty equipment, swabs, pus etc must be moved through Reduced risk of infection transmission due to separate clean and dirty work flows 25 Support staff recruitment/retentio n with modern facilities Reduced overtime/agency expenditure Potential development of best-practice tariff for laparoscopic work Trust eligibility for enhanced payments SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Quality Benefit the clean corridor Consequence The anaesthetic room in Theatre 5 is too small to allow the safe conduct of blocks requiring ultrasound guidance (i.e. there is not enough space for the patient, the anaesthetic machine and an ultrasound machine). It is anticipated that blocks of this kind will be used more frequently in future. In order to allow our patients to benefit from these new techniques, the anaesthetic room needs to be larger as proposed in option 3 Remain the provider of choice for local patients through the development and implementation of new technologies and techniques Efficiency Benefit 26 Consequence Financial Benefit Consequence SOUTH WARWICKSHIRE NHS FOUNDATION TRUST Appendix 2 Proposed Operational plans The Day Surgery Centre (DSC) will be required to continue to deliver all Emergency work including NCEPOD and Trauma, out of hour’s services and cancer services. The DSC plus three additional theatres will be available to the Trust. This space will be in the form of three Vanguard theatres onsite linked to the rear of radiology. The level of expected elective activity is currently very difficult to predict and the executive team are currently working with the PCT to establish agreed elective contracts. However, we will aim to deliver increased activity both prior to and after the closure period with the aim of minimising the effects for patients and GPs choosing to refer patients to SWFT. During the closure period two theatres each afternoon will be allocated to NCEPOD and Trauma to ensure emergency services can be maintained. These theatres will have ENT and Gynae sessions allocated to them in the mornings. In addition to this one theatre each day Monday to Friday will be allocated to the Cancer specialties (Colorectal, Breast and Urology) for a three session day 8am – 8pm. The remaining two / three theatres will be therefore be allocated to all the smaller specialties such as Dental and Oral Surgery and Orthopaedic elective work (joints and lower limb day case work). Theatre 7 which is mainly Opthalmology will continue as per current timetable as will Paediatric Friday’s and LSU sessions. Given the reduction of theatre space and the need to maintain essential cancer and emergency services, the usual weekly operating patterns for Surgeons and Anaesthetists will need to alter for the 20 week shutdown period. We will need to operate in a flexible way to ensure we are able to meet the activity requirements for all specialties, with reduced operating space. In order to achieve this we will need to undertake alternative operating sessions potentially Saturdays and evenings both prior to and during the close down period. Given that at times during the normal working week we will be unable to accommodate normal operating sessions we would look to secure agreement from clinical staff to vary their working days flexibly over this time, for no additional remuneration. It is intended that four hour week day sessions will be exchanged for 3 hour sessions out of hours and lists will be planned as such. If time is exchanged during normal working hours it will be exchanged as standard 4 hour sessions. It is appreciated that this is a temporary arrangement to enable this project to succeed and to ensure we are able to achieve this one off refurbishment project. If clinical staff wish to take unpaid leave during this time, or reduce PAs for a temporary period to enable them to have additional time, this will be considered on an individual basis with AGMs, as each specialty will have different service needs and considerations. It may also be possible for clinical staff to undertake additional sessions prior to the shutdown period to accumulate time which can then be taken in lieu. We fully appreciate these arrangements are unusual and are only being implemented to facilitate the refurbishment programme; they are not intended to create precedents, or changes to job plans. We do however need to achieve this flexibility without incurring any additional costs, therefore if this flexible way of working is not acceptable, the Trust may have to consider the less preferable option and more formal method of reducing temporary additional PAs for specialties during the shutdown period, if we have no space available to undertake elective operating procedures. 27