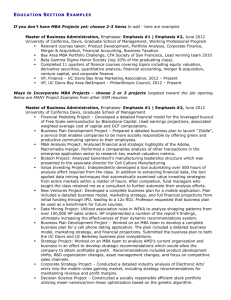

Way`s to Incorporate MBA Projects

advertisement

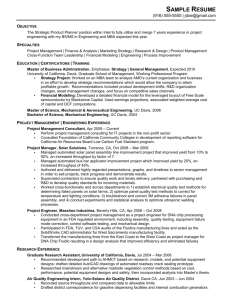

Way’s to Incorporate MBA Projects: Master of Business Administration, Finance | Strategy University of California, Davis, CA, March 2009 MBA Finance and Strategy Projects: Financial Modeling – Developed a detailed financial model for the leveraged buyout of Free Scale semiconductor by Blackstone Capital. Used earnings projections, associated weighted average cost of capital and DCF computations. Business Plan Development – Prepared a detailed business plan to launch “Ziddle”, a service that enables companies to be more socially responsible by offering green and productive commuting options to their employees. M&A analysis: Analyzed financial and strategic highlights of the Adobe, Macromedia merger. Also performed a comparables analysis of other transactions in the enterprise application sector to research key market valuation metrics Master of Business Administration, Emphasis: General Management, Expected June 2011 University of California Davis, Graduate School of Management Analyzed Genentech’s manufacturing leadership structure which was presented to the associate director for Cell Culture Manufacturing MBA STRATEGY EXPERIENCE Worked on an MBA team to develop a complete business plan for a cell phone dating application. The plan included a detailed business model, marketing strategy, and financial projections. Submitted the business plan to both the UC Davis and UC Berkeley business plan competitions. Worked on an MBA team to analyze AMD’s current organization and business in an effort to develop strategic recommendations which would allow the company to attain profitable growth. Recommendations included product development shifts, R&D organization changes, asset management changes, and focus on competitive sales channels. MBA PROJECTS Corporate Strategy – Conducted a detailed industry analysis of Electronic Arts’ entry into the mobile video gaming market, including strategy recommendations for maintaining revenue and profit margins. Decision Science – Constructed a socially responsible efficient stock portfolio utilizing mean-variance/non-linear optimization based on the genetic algorithm. Business Plan Development – Prepared a detailed business plan to launch “SmartShip”, a cloud based supply chain optimization service that drastically reduces logistics costs via efficient planning, scheduling, and consolidated shipping. Negotiations – Analyzed negotiation tactics utilized by all stakeholders during Porsche’s pursuit of Volkswagen that ended up in a Volkswagen acquisition of Porsche. Marketing Strategy – Conducted a detailed comparative study of Cisco and Juniper’s marketing strategies for network routers. Valuation – Conducted end-to-end valuation exercises for two publicly listed companies, including forecasting, ratio analysis, cost of capital and DCF calculation, and finally determine expected stock price. Corporate Finance – Developed a detailed financial model to evaluate financing options for a private firm to support short and long term revenue growth. Group Dynamics – Conducted a detailed study of gender bias at Deloitte & Touche and their WIN initiative for the retention and advancement of women employees. IT Management – Conducted a detailed evaluation of a customer relationship management technology implementation for non-profit organization and the potential value CRM tools provide to non-profit organizations in general. Marketing Research – Conducted an end-to-end primary market research study to aide the decision making process for launching Skaboosh.com, a web-based travel activity/vendor management service. This study entailed a focus group study, a general survey, and statistical data analysis using SPSS. Investment Analysis – Constructed a detailed financial model to provide strategic and tactical asset allocation recommendations to a private foundation. Business Taxation – Conducted a detailed study of a tax arbitrage – Estee Lauder’s attempted use of short selling to convert a massive tax liability into a tax refund. If you don’t have MBA Projects yet: Master of Business Administration, emphasis Finance & Marketing, June 2010 University of California, Davis, Graduate School of Management, Working Professional Program Relevant courses taken: Product Development, Portfolio Analysis, Corporate Finance, Merger & Acquisition, Financial Accounting, Business Taxation. Bay Area MBA Portfolio Challenge, CFA Society of San Francisco, Lead winning team 2008 Master of Business Administration, emphasis Finance, June 2010 University of California, Davis, Graduate School of Management, Working Professional Program Beta Gamma Sigma Honor Society (top 20% of the graduating class). Completed 11 quarters of finance courses covering topics including equity valuation, derivative securities, quantitative analysis, financial accounting, merger & acquisition, venture capital, and corporate finance. Master of Business Administration, Marketing | Finance University of California, Davis, August 2010 VP, Finance – UC Davis Bay Area Marketing Association, 2008 – Present VP, UC Davis Bay Area NetImpact – Philanthropic Council, 2008 – Present