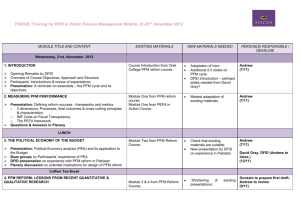

D. Outputs - The Ministry of Finance, Planning and Economic

advertisement

The Republic of Uganda Ministry Of Finance, Planning and Economic DevelopmentThe Second Financial Management and Accountability Programme Selection of Individual Consultants- Senior Financial Management Specialists REF: MOFPED/FINMAP II/SRVCS (CONS)/11-12/00016 MARCH 2012 Ministry of Finance, Planning & Economic Development Plot 2/12 Apollo Kaggwa Road P.O. Box 8147 Tel: 256-414-707900: Fax: 256-414-250 005 Email: finmap@finance.go.ug Website: www.finance.go.ug. 1 TERMS OF REFERENCE A. Background The Government of Uganda (GoU) designed a Second Financial Management and Accountability Program (FINMAP II) as a successor program to the Financial Management and Accountability Program (FINMAP). The primary purpose of the FINMAP II is to deepen, widen and consolidate reforms in public financial management (PFM) aiming at further strengthening and sustaining accountability and transparency in public financial management, improving governance, and maximizing the Government’s efforts towards poverty eradication. It is the desire of the Government, under FINMAP II, to consolidate efforts in implementing the integrated financial management system (IFMS) that were started under the EFMP II and later on under FINMAP, improve financial management practices and strengthen the PFM program coordination to maximize program-wide impact. A large component of the FINMAP II will be focused on the deepening, extension and expansion of the IFMS to more Government agencies and local governments. Government has implemented the IFMS in a total of 50 sites to date (42 Central Government entities and 8 Local government entities) It is the intention of Government to extend implementation of the IFMS to, at least, an additional 11 central government bodies and 6 higher local governments (districts and municipalities) over the next 1 to 2 years. The implementation during the next phase will also cover introduction of 3 additional modules namely; Fixed Assets, Procurement and Inventory to new and existing IFMS sites, and expanding the IFMS to more users within existing sites and Donor funded Projects The Government also intends to focus efforts in consolidating improvements across the full range of public financial management processes and practices. To this end, automation of PFM systems will be extended beyond the higher local governments to include lower local governments. This is in order to maintain consistency in upgrading the standard of delivery of PFM processes as well as maximize the impact in public financial management reforms across the government. Accordingly, rather than limit the implementation to the IFMS in its current form, the focus under the FINMAP II will be a broad public financial management strategy that will take into account the significant economic disparities among local governments, the generally low volumes of transactions and the weak infrastructure (human, systems, tools, etc.). The strategy proposes to size the implementation under three categories namely; (i) the IFMS as is currently implemented, (ii) a 2nd tier financial management systems/tools with reduced complexity and (iii) improvements in the manual system. The three levels will have to be tightly coordinated and kept in harmony to work as a single system with a common goal. The Government wishes to recruit Senior Financial Management Specialists to assist in the PFM implementation under the FINMAP II. B. Objective The objective of this role is to provide technical support to the implementation of financial management reforms under the FINMAP II with specific focus on the expansion and consolidation of public financial management systems across the Government of Uganda. The Senior Financial Management Specialists will work as a team to provide the technical support and help create a culture of continuous improvements in PFM. 2 The SFMS, working in support of GoU, will be expected to achieve the following objectives: 1. Enable the MALGs (Ministries, Agencies and Local Governments) that have computerised or will computerise their financial management systems work with and use the IFMS sustainably, independent of Project support both in terms of institutional capacity and maintenance costs 2. Enable the overall achievement of quality delivery of PFM policies, procedures systems matching Public Expenditure and Financial Accountability (PEFA) targets and international standards for public sector accounting. 3. Sustainability of the PFM improvements after FINMAP II is critical; facilitate GoU to build capacity in the sustainable use and management of PFM systems C. Scope of the Services The scope of responsibility will cover: 1. The MALGs in which the IFMS was implemented and to which the MoFPED continues to provide post implementation support, 2. New IFMS modules, EFT, fixed assets and inventory, that have to be implemented in MALGs already running on IFMS, 3. The planned harmonization and interface with the Integrated Personnel and Payroll Systems (IPPS) under the Ministry of Public Service 4. The MALGs to which the IFMS will be extended under FINMAP II 5. The local governments to which a tier 2 solution (solution other than the ORACLE IFMS based solution) is proposed for implementation 6. Support for the financial management reforms in general, development and implementation of PFM policies and procedures, capacity building for staff, quality control for policy and general pronouncements and presentations/reports, monitoring and evaluation and other related matters. The SFMS’s responsibilities will include: 1. Provide general technical assistance to the Accountant General (AG) to coordinate and guide the implementation of public financial management reforms under the FINMAP II, and in resolving issues pertaining to financial management and accountability in the course of implementing the GoU’s Public Financial Management (PFM) reforms 2. Readiness: the SFMS will assess readiness for implementation of the IFMS/PFM system in terms of institutional structures and leadership, staff availability, capacity and skills, state of financial data, financial management processes and systems (manual or otherwise) and controls, site infrastructure and power, implementation risks and make very specific recommendations to address gaps. These weakness and recommendations shall be discussed with the MALG Accounting Officer in a meeting with the Accountant General. 3. Project Plan: Review the proposed IFMS/PFM System Project Plan to ensure inclusions of agreed recommendations in (2) above 3 4. Business Process Alignment: Provide technical support to review IFMS processes and GoU business requirements to determine any necessary validation or alignment. 5. Implementation: Continuously review and actively influence the Project Plan, the training content/materials and plan, and the Change Management plan to ensure that the weaknesses and recommendations in (2) above, in the original or modified form, are carried and implemented. 6. Quality Assurance: Carry out quality review and assurance to the PFM systems implementation phases 7. Monitoring: the SFMS will draw-up a monitoring mechanism and periodically monitor and assess the state of implementation particularly focusing on qualitative improvements; the SFMS will review improvements in institutional capacity and training, overall adaptation and use of the IFMS/PFM systems, improvements in financial management processes and systems controls and reporting, and improvements in all aspects of PFM necessary to meet the overall objectives. Resulting from this process, the FMS will: Determine areas that may lag or new areas that require attention and make recommendations for improvements Raise issues (technical or otherwise) that may impede progress. 8. Post Implementation: the SFMS will develop a plan by which the MALG will gradually take over full support and MoFPED will withdraw its IFMS Support resources. This should reduce the MALG dependency on the MoFPED, increase ownership and allow MoFPED to manage with the limited resources. This plan shall be discussed with the MALG and approved by AG for implementation. In drawing up this plan, the SFMS will among others: Assess the state of readiness of the site to take over in terms of staff capacity, process weakness, etc. Determine actions and time required to cover the gaps for example in terms of training, staff recruitment, etc. Determine work plans and milestones to implement these actions. The work plan shall include monitoring meetings with the Accounting Officer Discuss weaknesses, proposed actions and work plans above with the MALG Accounting Officer 9. Establish professional working relationships with key personnel in Central and Local Governments to ensure knowledge transfer and assist in training and capacity development as considered necessary 10. Advise on resource needs and review for quality and alignment or assist in developing technical specifications / Terms of Reference for technical resources required to be procured under Accountant General 11. Provide Technical assistance in the update, development and documentation of policies and procedures, monitor and keep up to date with new changes in public financial management 12. Support the professional development of accounts and audit staff, quality assurance and review of training strategy and plan, training materials and resource persons 13. Participate in Monitoring and Evaluation process of PFM reforms implementation process and provide a technical review and assessment of the PFM program under the AG, 4 14. Monitor the implementation of Component related risk management and sustainability plans under the FINMAP II 15. Perform such other duties as may be assigned from time to time within the context of the GoU PFM reform program D. Outputs 1. Site Readiness Strategy and its adoption in the Project plan, Training Materials and Plan and Change Management Plans 2. Quality Assessment Reports for each stage in implementation 3. Periodic monitoring reports and their implementation 4. Site Exit Plan Implementation of Exit Plan in a form that ensures sustainability 5. Appropriate PFM training, skills/knowledge transfer and capacity development for financial management staff. 6. Technical coherence and harmony of the PFM program under the AG’s office or MoLG 7. Program Risk Management and Sustainability plans implemented E. Contract and reporting arrangements The SFMS will be hired against a one year time-based contract renewable based on the requirement and upon satisfactory performance. The SFMS will report directly to the Accountant General. The SFMS’s work will be coordinated by one SFMS as a coordinator designated by the Accountant General. The SFMS will also work closely with the Accounting Officer to ensure effective attention to critical financial management reform issues relating to the MALG. F. Qualifications & Experience 1. A professionally qualified accountant with at least 7 years post qualification experience and current membership in a professional accounting body that is a recognized by the Institute of Certified Public Accountants of Uganda 2. Should be appropriately qualified with a bachelor’s degree in financial management, economics, statistics or accounting from a reputable university. 3. Possess considerable experience in implementing computerised integrated financial management systems. Regional and/or international experience will be an added advantage. 4. The SFMS should have at least 4 years working experience in financial management in a senior management with at least 3 years in Public Sector and/or advisory role with good knowledge of current developments in public sector financial management, 5. Demonstrate experience in the following areas with regard to the financial management: Accounting and Financial Reporting Budgeting and Investment appraisal, Cost benefit analysis Formulation, review and development of financial management policy guidelines, Development and establishment of internal controls and auditing techniques (both internal and external) Good understanding of automated financial management systems and considerable experience in the implementation of such systems. Change management and communication skills Skills in training and capacity building 5 Management consulting and good report writing skills Good communication and interpersonal skills plus ability to coordinate activities in a complex environment. G. Consultant’s reporting obligations The SFMS will be required to provide the following reports: 1. Quarterly performance reports 2. Annual Performance reports 3. An end of assignment report within two weeks after completion of the activities in the workplan, or completion of the contract, whichever comes first. 6