realization of a DTA from a forecast of future taxable income. The

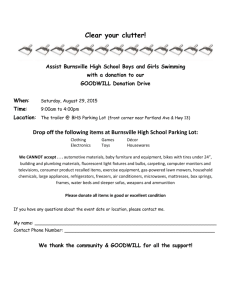

advertisement

realization of a DTA from a forecast of future taxable income. The use of the Company’s forecast of future taxable income was not considered positive evidence which could be used to offset the negative evidence at this time, given the uncertain economic conditions. The losses in 2008 were carried back to 2006 and 2007 and a tax benefit for federal taxes was recorded. Florida tax losses can only be carried forward. Therefore, a valuation allowance of $5.5 million was recorded related to the Company’s state deferred tax asset in 2008. During 2009, the Company supported the tax benefits recorded in the first half of the year with tax planning strategies and for the third and fourth quarter losses in 2009 a tax benefit of $29.7 million was recorded, and the Company also increased its DTA valuation allowance by the same amount. Should the economy show signs of improvement and our credit losses moderate, we anticipate that increased reliance on our forecast of future taxable earnings would result in tax benefits as the recording of valuation allowances would no longer be necessary. At December 31, 2009, the Company has net deferred tax assets of $18.8 million which are supported by tax planning strategies that could produce gains from transactions involving bank premises, investments, and other items that could be implemented during the NOL carry forward period. Goodwill The amount of goodwill at December 31, 2008 totaled $49.8 million, and resulted from the acquisitions of three separate community banks whose operations were fully integrated into one operating subsidiary bank of the Company. The Company operates as a single segment bank holding company. The Company tests goodwill for impairment on an annual basis, or more often if events or circumstances indicate there may be impairment. The Company engages external valuation specialists to assist in the Company’s goodwill assessments. The Company completed an annual test of goodwill for impairment for the year ended December 31, 2008 and updated the test for impairment of goodwill at March 31, 2009, due to the decline in the price of the Company’s common stock and net earnings in the first quarter of 2009. The results of these tests indicated that none of the Company’s goodwill was impaired. Due to a further decline in the price of the Company’s common stock and the Company’s net loss in the second quarter of 2009, we again tested for impairment of goodwill as of June 30, 2009. The fair value of the Company’s enterprise was determined using two methods, the discounted cash flow and change in control valuation methods. These two methods provided a range of valuations of $2.43 to $7.00 per share that we used in evaluating goodwill for possible impairment at June 30, 2009. As a result, the Company determined that the carrying amount of the Company exceeded its fair value and that the entire amount of goodwill was impaired based on a preliminary step two goodwill analysis at June 30, 2009, and the Company wrote-down the entire amount of its goodwill in the second quarter. At September 30, 2009, the Company completed its step two analysis of goodwill impairment which supported the conclusion reached at June 30, 2009. Contingent Liabilities The Company is subject to contingent liabilities, including judicial, regulatory and arbitration proceedings, and tax and other claims arising from the conduct of our business activities. These proceedings include actions brought against the Company and/or our subsidiaries with respect to transactions in which the Company and/or our subsidiaries acted as a lender, a financial advisor, a broker or acted in a related activity. Accruals are established for legal and other claims when it becomes probable the Company will incur an expense and the amount can be reasonably estimated. Company management, together with attorneys, consultants and other professionals, assesses the probability and estimated amounts involved in a contingency. Throughout the life of a contingency, the Company or our advisors may learn of additional information that can affect our assessments about probability or about the estimates of amounts involved. Changes in these assessments can lead to changes in recorded reserves. In addition, the actual costs of resolving these claims may be substantially higher or lower than the amounts reserved for those claims. At year-end 2008 and 2009 the Company had no amounts accrued for contingent liabilities. 22