CHAPTER 13

advertisement

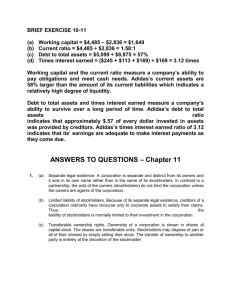

CHAPTER 13 … Corporations: Paid-in Capital and the Balance Sheet Objective 1: Identify the characteristics of a corporation A. The corporation is the dominant form of business organization in the U.S. B. The characteristics of a corporation include: 1. Separate legal entity—a corporation is an entity formed under state law and exists separately from its owners (stockholders or shareholders). a. The state grants a charter that gives permission to form a corporation. b. A corporation has many of the rights of an individual: the right to buy, own, or sell property; the right to enter into contracts; and the right to sue and be sued. 2. Continuous life and transferability of ownership—the owners’ equity of a corporation is divided into shares of stock. Stockholders may transfer stock as they wish. Transfers do not affect the continuity of the corporation. 3. No mutual agency—stockholders are not agents of the corporation and cannot commit the corporation to a contract. Partners are considered agents of the partnership. 4. Limited liability of stockholders —shareholders can lose no more than their investment in the business. A partner has unlimited liability, unless the partnership is a limited-liability partnership (LLP). 5. Separation of ownership and management—a stockholders’ only control over operations of a corporation is the right to elect the board of directors. The corporation is managed by corporate officers elected by the board of directors. 6. Corporate taxation—corporations are separate taxable entities and pay several taxes not levied on partnerships and proprietorships. Corporate earnings are subject to double taxation in that corporate earnings are taxed to the corporation as well as to the stockholder when earnings are distributed as dividends. 13-1 C. 7. Government regulation—corporations are subject to more regulation by governmental agencies to ensure full disclosure of important information to investors and creditors. 8. Exhibit 13-1 summarizes the advantages and disadvantages of the corporation. To organize a corporation, the incorporators obtain a charter from the state and pay a fee. 1. The charter includes the number of shares of stock the corporation is authorized to issue. 2. Bylaws (adopted by the incorporators) act as a constitution for the corporation. 3. The stockholders elect the board of directors, which sets policy and appoints the officers. The directors elect a chairperson and appoint the president, who is responsible for day-to-day operations. (Exhibit 13-2 shows the authority structure in a corporation.) D. A company issues stock certificates (Exhibit 13-3) to owners for their investments. This investment is referred to as capital stock. These shares are issued from the shares authorized in the charter. E. The stockholders’ equity of a corporation shows the two different sources of capital. 1. Paid-in capital (contributed capital) represents all amounts received from owners (shareholders). Common stock is one kind of paid-in capital. 2. Retained earnings is the capital provided by profitable operations that is not distributed to stockholders. a. Corporations close their revenues and expenses into Income Summary, and then they close Income Summary (net income or loss) to Retained Earnings. Sales Revenue Income Summary To close sales revenue. 13-2 XX XX Income Summary Expenses To close expenses. XX XX Income Summary XX Retained Earnings To close net income to Retained Earnings. F. G. XX b. A debit balance in retained earnings is called a deficit. A deficit is caused by accumulated losses. c. Distribution of profits to owners is called dividends. Most states prohibit the practice of using paid-in capital for dividends. 1) Legal capital is the portion of stockholders’ equity that cannot be used for dividends. 2) Dividends reduce both assets and retained earnings. Retained earnings is not a fund of cash. Cash dividends are paid out of assets, not out of retained earnings. Stockholders’ rights are: 1. To vote at stockholders’ meetings. 2. To receive a proportionate share of dividends (if declared). 3. To receive a proportionate share of assets of the corporation if it is liquidated (goes out of business). 4. To maintain a proportionate ownership in any new shares of stock issued; called the preemptive right. This right is usually withheld from stockholders. Corporations may issue either preferred or common stock (either par or no-par stock). 1. Common stock is the most basic form of capital stock. It carries all the rights discussed above unless specifically withheld. Some corporations may issue two classes of common stock—one voting and one nonvoting. 13-3 2. Preferred stock also carries stockholder rights, but is usually nonvoting. Preferred shareholders have priority over common shareholders in the payment of dividends and in the distribution of assets at liquidation. Different classes of preferred stock may also be issued. Exhibit 13-5 shows the percentage of companies issuing preferred stock. 3. Stock may be par-value or no-par stock. a. Par value is an arbitrary amount assigned by a company to a share of stock and is usually quite low. For companies with par-value stock, legal capital is the par value of the shares issued. b. No-par stock does not have a par value. Some no-par stock has a stated value that is also an arbitrary amount that accountants treat like par value. Objective 2: Record the issuance of stock A. A corporation issues stock when it needs capital. The stock issued is from the stock authorized in the charter. A company need not issue all the stock authorized. B. The corporation may sell the stock to an underwriter who agrees to sell the stock to its clients. C. The issuance of stock increases assets and stockholders’ equity. D. Stock may be issued at par value, at a premium, or in exchange for assets other than cash. Exhibit 13-6 is a reproduction of IHOP’s tombstone from the Wall Street Journal. 1. When issuing common stock at par, the Common Stock account is credited for the par value of the shares issued. Cash Common Stock 2. XX (par value x shares issued) XX When issuing common stock at a premium, any amounts paid-in above the par value are credited to a separate account. This amount is not profit and is sometimes referred to as additional paid-in capital. 13-4 Cash XX Common Stock Paid-in Capital in Excess of Par—Common XX 3. When issuing no-par stock, the entire proceeds is credited to the Common Stock account. Cash XX Common Stock XX 4. Issuing no-par stock with a stated value is identical to issuing par value stock at a premium. The difference between the issue price and the stated value is credited to an account called Paid-in Capital in Excess of Stated Value. 5. When issuing stock for assets other than cash, the asset should be recorded at its current market value. Asset XX Common Stock Paid-in Capital in Excess of Par—Common XX 6. XX Accounting for the issuance of preferred stock is similar to accounting for common stock. Cash XX Preferred Stock E. XX XX Issuing stock for assets other than cash can pose an ethical challenge, because the company may be tempted to overstate the asset value. Objective 3: Prepare the stockholders’ equity section of a corporation balance sheet A. The stockholders’ equity’ section of the balance sheet follows this format (Exhibit 13-7): Paid-in capital: Preferred stock Common stock Paid-in capital in excess of par—common 13-5 Total paid-in capital Retained Earnings Total stockholders’ equity B. Many companies combine several accounts. C. Decision Guidelines provide answers to important questions about stockholders’ equity. Objective 4: Account for cash dividends A. Corporations declare dividends from retained earnings and pay the dividends with cash. B. The relevant dates for dividends: 1. Declaration date—the date the board of directors announces its intention to pay the dividend and the dividend becomes a liability. Dividends Payable is a current liability. Retained Earnings Dividends Payable XX XX 2. Date of record—Those stockholders holding the stock on this date, which is a week or two after the declaration date, will receive the dividend. No journal entry is required. 3. Payment date—the date the dividend is paid. Dividends Payable Cash C. XX XX Preferred stockholders have a dividend preference; that is, the preferred stockholders receive their dividend before the common stockholders. 1. This dividend is stated either as a percentage of the preferred stock’s par value (10% preferred, $100 par) or as a specific dollar amount ($10 preferred, $100 par). 2. Exhibit 13-8 shows the division of a dividend between preferred and common. 13-6 D. Cumulative preferred stock accumulates dividends each year until the dividends are paid. 1. Dividends passed or not paid are called dividends in arrears. Dividends in arrears are not a liability. All dividends in arrears plus the current year’s dividend must be paid before the corporation can pay dividends to the common stockholders. 2. The corporation is not obligated to pay dividends on noncumulative preferred stock. Objective 5: Use different stock values in decision making A. The market value (market price) of a stock is its current selling price. B. Book value is a measure of the amount of net assets or stockholders’ equity per share. 1. Book value = Total stockholders’ equity – Equity allocated to preferred Number of common shares outstanding 2. Book value may be used when negotiating the purchase of a business or when buying out a stockholder. Traditionally, book value has been used to help evaluate the market price of stock. Exhibit 13-9 contrasts the book values and market values of several companies. Objective 6: Evaluate return on assets and return on stockholders’ equity A. Investors and creditors evaluate management’s ability to earn profits. Two key profitability ratios are provided below: 1. Rate of return on total assets or Return on assets = Net income + Interest expense Average total assets 13-7 a. This ratio measures how well a company uses assets to earn income. Net income plus interest expense is the return to both creditors and stockholders who have helped finance the corporation. b. Average assets are computed by adding beginning and ending assets and dividing by 2. c. While rates of return vary widely by industry, a return on assets of 10% is generally considered to be good. 2. Rate of return on = common stockholders’ equity or Return on equity B. Net income – Preferred dividends Average common stockholders’ equity a. This ratio shows the relationship between net income and average common stockholders’ equity. b. Compute average common stockholders’ equity by adding beginning and ending common stockholders’ equity (stockholders’ equity minus preferred equity) and dividing by 2. The higher the rates of return, the more successful the company. Return on equity should exceed the return on assets. Objective 7: Account for the income tax of a corporation A. Corporations pay income taxes in much the same way that individuals do. B. A corporation records income tax expense on the income statement and income taxes payable on the balance sheet. These two amounts may be different. 1. Income tax expense is computed as follows: Income before tax x (income statement) 2. Income tax rate Income tax payable is computed as follows: 13-8 Taxable income (tax return) C. Income tax rate The most important difference between income tax payable and income tax expense occurs when a corporation uses straight-line depreciation for financial reporting and the accelerated depreciation for the income tax return. If the income tax expense is greater than the amount owed to the IRS, the journal entry is: Income Tax Expense Income Tax Payable Deferred Tax Liability D. x XX XX XX It is also possible for the income tax expense to be less than the amount owed to the IRS. 13-9