ECON 601 REVIEW QUESTIONS FOR FINAL EXAM WRAY, WINTER 2012

advertisement

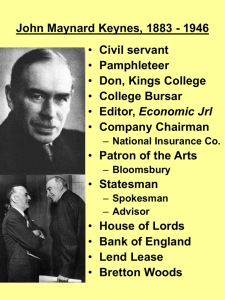

ECON 601 REVIEW QUESTIONS FOR FINAL EXAM WRAY, WINTER 2012 A) Monetary theory of production, etc 1. 2. 3. 4. 5. Define the monetary theory of production, along the lines suggested by Keynes. What are the key features? How would this be contrasted with orthodoxy? What are the essential properties of money? What is money? Contrast the Post Keynesian view with that of orthodoxy. Compare Keynes’s approach to effective demand with that of Marx (as presented by Fan Hung). Compare Keynes’s adoption of the labor unit with Marx’s adoption of the labor theory of value. Compare/contrast the Keynesian/Institutionalist approach to the relation between saving and investment with that of orthodoxy. Compare/contrast the Currency School and Banking School approaches to money, drawing links to the modern Monetarist and Post Keynesian approaches. B) The theory of the circuit 1. 2. 3. 4. 5. Summarize the key features of the role played by endogenous money in the circuit. What are the links between Post Keynesians and Circuitistes on money? Link Schumpeter’s approach to the circular flow with that taken by modern “circuitistes”. According to Minsky and Bellofiore, what were the strengths as well as the weaknesses of Schumpeter’s theory? According to Wray, what sort of “unpleasant arithmetic” can result from monetarist policy? What are the links between the industrial and financial circulations? C) Cambridge Economics/Modern Money 1. What is the Cambridge critique of the neoclassical approach? Discuss Say’s Law, the movement of the economy through time, the possibility of functional relationships between prices and quantities, different approaches to the concept of equilibrium, and achievement of full employment. 2. How does the Cambridge interpretation of Keynes’s theory of effective demand (as a long period approach) differ from that of other Post Keynesians? What do Cambridge economists think of the Post Keynesian emphasis on uncertainty? Explain. 3. Compare/contrast the horizontalist approach to money with the structuralist approach. 4. Compare/contrast the horizontalist approach to money with the “modern money” approach (as in Wray). D) Fiscal Policy, functional finance, etc 1. 2. 3. 4. 5. 6. What does Lerner mean by saying “money is a creature of the state”? Link this to the “modern money” view. Contrast the “chartalist” with the “metalist” approaches to money. What sorts of problems might the European Union encounter, based on Goodhart’s chartalist approach? Contrast the story told by Innes concerning the origins and evolution of money with that of the typical textbook (that is, the story that begins with Crusoe and runs through goldsmiths and gold standards, and so on). Compare/contrast the “seigniorage” approach to money with the “sovereignty” approach; and show how this dichotomy is linked to the debate between “chartalists” and “metalists”. According to Perry Mehrling, we no longer live in the world of Keynes, Lerner, or Knapp and hence the “state money approach” is no longer relevant. Instead, we live in a world in which the modern state “is the one entity with which every one of us does ongoing business”—a giant Microsoft, so to speak. Hence, “we are all willing to extend credit to the government” and this is what “gives government credit its currency”. Critically analyze this view, comparing and contrasting it with the credit view of Innes and the chartalist/state money view of Knapp/Lerner/Keynes/Goodhart/Bell/Wray. Rossi rejects the “modern money” view on the argument that “it is plain that no agent whatsoever can really pay by acknowledging his/her debt to another agent….the emission of modern money is never a purchase for the issuer”. Critically analyze this view, contrasting it with the “pyramid” approach to money of Bell/Foley/Minsky/Wray. 7. According to Ingham, all money is credit, but not all credit is money. Explain and link this to the credit theory of money, the state theory of money, and the money pyramid. E) Interest rates and monetary policy 1. One could argue (as did Townshend) that Keynes’s approach to interest rates is really a theory of value. Explain. 2. Under what conditions do liquidity preference and loanable funds theories reach the same conclusions? Explain. 3. When is crowding out most likely/least likely to occur? From the state money (or modern money) approach, do deficits place pressure on interest rates? Explain. 4. Is there room for liquidity preference in the “endogenous money” approach? In the “horizontalist” approach? Explain. 5. What is the New Monetary Consensus? Compare and contrast this with the Post Keynesian approach. In what ways does Greenspan appear to have adopted Keynes’s views? In what ways does Greenspan’s policy deviate from Keynes’s policy prescriptions? F) 1. 2. 3. 4. Inflation and Unemployment What is the Post Keynesian/Institutionalist critique of the orthodox theory of the “labor market”? Critically examine the various versions of the inflation/unemployment tradeoff. How might an “employer of last resort” policy achieve full employment with price stability? What is the Post Keynesian approach to inflation? Explain the aggregate “mark-up” approach to pricing. G) 1. 2. 3. Stabilization policy Summarize the main nonorthodox approaches to business cycles. Explain Minsky’s financial instability hypothesis. Compare and contrast the Marxist approach to “stagnation” (as presented by Gillman) with Keynes’s discussion from Chapter 24 of the GT. Present and critique Davidson’s proposal for reformation of the world’s monetary system. Compare and contrast orthodox and heterodox approaches to exchange rates. 4. 5. In addition to these topics, review the materials studied for the Midterms—Keynes’s General Theory, the Neoclassical synthesis, Disequilibrium approaches, Growth Theory, as well as the Monetarist (Mark I and II), RBC, and NK approaches. The final is comprehensive, but expect a question on material covered since Midterm II.