Keynesian Vs Classical Economics Notes.doc

advertisement

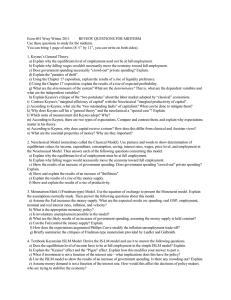

Keynesian Vs. Classical Economics Notes John Maynard Keynes published “The General Theory of Employment, Interest, and Money” in 1936 during the Great Depression. He advocated government intervention in an attempt to smooth out the business cycles since they did not seem to be correcting themselves. Keynesian: John Maynard Keynes 1. Economy will not self-correct. Savings will lead to the “Paradox of Thrift” people as individuals will save more and so no spending will happen resulting in everyone having less money and so total savings goes down. Keynes claimed that prices and wages were sticky and could not change that quickly, so there will be no natural correction. People are motivated by “animal spirits” 2. Given that the economy will not self-correct we need to stimulate it: Monetary policy is not enough because once enough money has been injected into the economy then injecting more won’t influence people (liquidity trap) So you need expansionary fiscal policy: More government spending, lower taxes which will lead to a budget deficit: We should run budget deficits during recessions and budget surpluses during expansions (raising taxes and reducing government spending) to even out the business cycle (Up until Keynes the government had tried to run a balanced budget, including during the Great Depression where they raised taxes to pay for all their spending). This expansionary policy will have a multiplier effect Classical: Friedrich August Hayek (F.A. Hayek) Economy will self-correct: 1. when recession hits: people save more which lowers interest rates and that stimulates investment and spending Wages go down and that causes people to hire more and expand output and the economy will correct itself fairly quickly (prices going down also stimulates people to buy). People are motivated by economic calculation 2. Given that the economy will self-correct, no expansionary policy is needed. Further more expansionary policy is dangerous in that, politically, it is tough to impose than take away. Politicians have the incentive to run budget deficits all of the time leading to large amounts of debt. Changing taxes and government spending takes a lot of time and is subject to timing lags: 1. Recognition lag: have to recognize where the economy us headed (our ability to forecast the economy is pretty bad – in the last 50 years the index has correctly predicted each of the last 8 recessions. It also predicted 5 recessions that did not happen). 2. Administration lag: Once recognized the government has to legislate this stuff into action. 3. Impact lag: once enacted these things have to work through the economy which takes time. Multiplier will only happen if it uses unemployed resources, using employed resources does not create jobs, but rather shifts them around (broken window fallacy). Mistiming this policy will make the economy less stable and lead to a large number of unintended consequences