Jānis Kasalis. Models of company financial statement analysis and

University of Latvia

JĀNIS KASALIS

MODELS OF COMPANY FINANCIAL

STATEMENT ANALYSIS AND THEIR

APPLICATION TO DIFFERENT

USER GROUPS

Summary of the Promotion Paper

Developed for the promotion to the degree of Doctor of Economic Science (Dr.oec.)

Branch - Theory of Accountancy and Accountability

Riga, 2005

Models of company financial statement analysis and their application to different user groups

Summary of the Promotion Paper

Introduction

Economic life of society expressed in different models of entrepreneurship and management during its evolution has passed through complex course of development reaching the stage of post-industrial market economy which is characterized not only by a high level of production and consumption but also by explicit tendencies of economy internationalization and globalization. Along with certain economic development processes improvement of accounting systems and expansion of their functions has taken place. In the course of time simple business operation accounting and summarization has developed into a complicated complex of data recording, storage, processing and analysis functioning according to definite principles on strict methodological grounds.

The diverse accounting system development practices of different countries are converged through standardization and harmonization. Theoretical and practical outputs developed by scientists and experts of the branch continue to provide new opportunities in the application of accounting data and results of analysis based on them for various purposes for a very broad and varied range of prospective users.

In the modern economy there is an extensive circle of economic subjects: owners, creditors, managers, suppliers and buyers, employees of public authorities where each one of them has different interests in a company's business performance. So analysis of company's financial operation, which in its substance is manifold and its results can be interpreted differently, serves as a significant information source when various management, business, investment and administrative decisions are taken. Hence it is important to recognize what and in what way is accounted for and reflected by one or another accounting system, what principles are followed and what algorithms are used in the initial data processing and how resultant indicators are acquired which are subject to certain interpretation process before the decisions are passed.

There are different accounting systems with various information presentation approaches, generally reflected in company's financial statements, with the balance sheet, profit and loss statement, cash flow statement and notes which reflect the accounting practice being their integral part. It is the information contained in the above documents that is used for the assessment of company's financial status, applying different models of analysis in accordance with the specific features of the statement users' activity and interests.

The development of the accounting system, its compliance with the targets and tasks set plays an important role in the economic development in Latvia with the competition becoming more intense, international cooperation expanding and the inflows of foreign investments being substantial. The importance of efficient and justified decisions is considerably growing and the role of timely, targeted and quality financial analysis results based on accounting data is considerably increasing and becoming topical. We can speak of essential results in the development of the accounting system in Latvia, certain outputs in conducting financial analysis in the interests of different statement user groups

(mainly managers and creditors) using local models of analysis of restricted availability. At the same time such publicly available data bases as the data base of the Central Statistical Bureau and the Register of Enterprises of the

Republic of Latvia provide limited opportunities of the accounting financial analysis, the comparative analysis in particular, although efforts to improve the present situation can be observed lately.

Looking at perspective application of the results of financial analysis, increase of its quality and economic interpretation of analytic indicators becomes more and more important in the process of taking various decisions which and that also serves as the grounds of topicality of selected theme of the Promotion

Paper and reflects its significance within branch of the theory of Accountancy and Accountability.

Theses advanced for the Promotion Paper

• The development of the accounting system in Latvia has been dynamic and it has successfully aligned with internationalization and globalization process, besides the development process of the national accounting standards complying with the framework of the International Accounting

Standards and International Financial Reporting Standards plays an important role.

•

Accounting system in Latvia mainly provides initial data for the use of various models of financial statement analysis, although restricted options to meet specific interests of some user groups exist for performance of company's financial analysis.

•

It is possible to develop universal concept of company's financial statement analysis model oriented to different user groups and recommend its implementation in the national economy.

The research objects of the Promotion Paper and the chronological scope

The objects of the research of the Promotion Paper are accordant scientific literature published in Latvia and abroad, regulations of the Republic of Latvia, normative documentation and unpublished materials, data from the data bases of the Register of Enterprises of the Republic of Latvia, the Central Statistical

Bureau and the Bank of Latvia, data of annual reports of selective cluster of companies for the time period from year 1999 to 2004, received questionnaires developed by an author with comments of respondents, also internet resources.

The objective and the tasks of the Promotion Paper

In view of the studies of the most popular models of financial analysis coefficient system and also considering specific interests of their prospective user groups and status of the accounting system and statistics in Latvia develop a concept of the financial statement analysis model and use it for pilot test.

To achieve the objective of the Paper the following tasks are set:

1.

Examine various accounting systems, principles of their organization, classification and tendencies of mutual influence.

2.

Examine various interpretations of company financial statement analysis, as well as establish importance and structure of the parts of financial statements.

3.

Examine diversity of the development of financial analysis types, applicable methods and basic principles of the development of models.

4.

Examine aims of prospective financial analysis users and calculation algorithms of financial coefficients of their interest.

5.

Clarify, analyze and assess structure of the most applied system of coefficients of financial analysis or justify terms of model calculation.

6.

Develop concept of universal financial analysis model suitable for the situation in Latvia, perform pilot test of the model and develop proposals.

The structure of the Promotion Paper

The structure of the Promotion Paper is developed basing upon stipulated tasks in accordance with prescribed logical order. First section discloses diversity of existing accounting systems and their classification is provided by various criteria and the accounting system present in Latvia is positioned in theoretical context in comparison with leading accounting systems in Europe and worldwide. Also first section of the Paper describes reflection of company's economic and financial operation in financial statements. The first section of the Paper describes the reflection of company economic and financial operation in financial statements, disclosing the structure and significance of the balance sheet, profit and loss statement, statements of capital changes and cash flow calculations in detail and providing their evaluation.

In the second section author has reflected theoretical aspects of financial analysis providing its classification according to different features, and course of methodology development. Author describes greatest schools of financial analysis; some of these elements are used for concept of universal financial analysis model proposed by author.

Third section of the Paper describes specific interests of different financial analysis user groups that substantially affect composition of resultant indicators

(coefficients) of analysis and algorithms of their calculations or justifies the conditions. Under information acquired through the course of research author in this section has expressed his comments and proposals regarding potential application of calculation algorithms of individual financial indicators within economical situation of Latvia, also groups of indicators of financial statement analysis are looked upon in detail. Similarly several financial analysis models were described and assessed, paying special attention to financial analysis models using the data bases of the Central Statistical Bureau and the Register of

Enterprises of the Republic of Latvia.

Using acquired information reflected in the researches of previous sections fourth section of the Paper provides author's concept regarding methodological and practical issues on development of universal financial analysis model, also taking into account restricted opportunities to acquire average statistical indicators of financial analysis by branch and sub-branch of national economy, set of resultant indicators of such financial analysis model and conditions of their calculation for individual user groups, also general block scheme of model functionality is provided. This section reflects also the results of financial

indicator analysis pilot calculations for limited number of companies of the group of Latvian wood processing sub-branch.

Restrictions of the Promotion Paper

1.

Main attention of the research is focused on so called financial analysis coefficient models. Author's approach to universal financial analysis model with resultant aggregated indicator mainly is grounded on methodological base and theoretical evaluation of these models.

2.

Data of financial statements from limited number of wood processing companies is used for pilot test of developed concept within dynamics of five years which makes it possible to acquire and interpret aggregated financial analysis indicators but fails to provide assessment of economic condition of sub-branch companies compared to companies of other branches.

3.

Although the author proposes a modified universal financial analysis model due to restricted financial resources the pilot test of the principles of the model was done with a limited amount of data, performing the financial operation analysis of selected companies representing wood processing as a sub - branch of industry.

4. The pilot test of company's financial analysis coefficient models was realised, taking in to the account the specific interests and preferable financial indicators of the user group - "management".

Methodological foundation and methods of the Promotion Paper

The methodological foundation of the Promotion Paper is based on the publications of foreign and Latvian scientists, materials from scientific conferences, documents issued by international institutions and institutions of the Republic of Latvia prescribing accounting system. The following sources and literature were used in the Promotion Paper:

1.

Laws regulating accounting and entrepreneurship in the Republic of Latvia

2.

Regulations prescribing accounting and entrepreneurship in the Republic of

Latvia;

3.

Data collected by the Central Statistical Bureau of the Republic of Latvia;

4.

Data base collected by the Register of Enterprises of the Republic of

Latvia;

5.

Data base collected by the Bank of Latvia;

6.

Standards published by the International Accounting Standards Board

(IASB);

7.

European Union directives prescribing the field of accountancy;

8.

Publicly available financial statements of companies;

9.

The results of author's own research;

10.

Internet resources.

Methods of analysis and synthesis, methods of interviews, experts and surveys, elements of mathematical modeling and system designing principles are applied in the research process, also during development of the Promotion

Paper author has used generally accepted quantitative and qualitative research methods in economics, comparative analysis and grouping is widely used in the

Paper; generalization of scientific results is performed.

Novelty of the Promotion Paper

The following scientific novelties are developed and presented in the Paper:

• Analysis of literature on various financial analysis models and their user groups;

• Performance of detailed analysis of regulatory requirements for company financial statements in the Republic of Latvia;

• Summary of the most important definitions related to company financial statement analysis, also approaches to its classification principles worldwide and in Latvia;

• Calculation algorithm's of analysis resultant indicators (coefficients) of the interest of financial statement user groups are developed and evaluated;

• Recommendations and improvements for calculation algorithm of analysis resultant indicators (coefficient) of the interest of different financial statement user groups developed considering present economic situation in

Latvia;

• Recommendations for calculating algorithms of individual financial analysis indicators of the data bases of the Register of Enterprises of the

Republic of Latvia and the Central Statistical Bureau considering potential modifications and mutual comparison developed, thus providing uniform interpretation of the acquired analysis indicators;

•

Universal concept of company's financial analysis model accomplished and pilot test on financial statements data of selected number of companies within wood processing sub-branch performed;

•

Drafting of proposals to the Financial and Capital Market Commission for the development of a single borrowers' financial analysis model with the view to simplify their analysis as well as to develop a unified approach for accumulating loan loss provisions in the credit institutions of the Republic of Latvia.

Theoretical and practical significance of the Paper

In development of the Promotion Paper author studied and classified scientific literature on company's financial analysis. The Paper has been elaborated at the time when management of company is oriented to increased consideration of financial analysis indicators when taking decisions of economic and business type. Nowadays various literature sources on financial analysis and so called application of financial analysis coefficients are available, however, there are very few sources which precisely set borders and amounts of indicators to be analyzed, and also which clearly define purposes of the analyses and users groups of financial analysis. Theoretical significance of the Promotion Paper is expressed in the classification and research of available sources of scientific literature considering the accounting system in Latvia and existing practice.

Hence those theoretical models of financial analysis were selected which can be considered equivalent and further approbated in the situation of Latvia.

Theoretical significance of the Paper is expressed also as definition of user groups of financial analysis models of available literature sources and establishment of their different interests and applicable financial coefficients, in special cases providing author's proposals in application of certain financial analysis indicators and calculation method. Thus the Promotion Paper provides scientifically justified research of various literature sources and applies acquired results in development of financial analysis model in wood processing branch.

Practical significance of the Promotion Paper is expressed as approbation of developed financial analysis model on companies of wood processing subbranch aimed to examine its application, fix potential improvements and provide comprehensive interpretation of acquired indicators. Practical significance is expressed also as author's recommendations for the Register of

Enterprises of the Republic of Latvia and the Central Statistical Bureau in relation to calculation of various financial coefficients and their interpretation, as well as to the development of single financial analysis data base in the state

based on financial statements of the companies aimed on economy of resources and improvement of analysis quality.

In conclusion of review on practical benefits of the Promotion Paper author proposes to provide single data base in Latvia based on data of the Central

Statistical Bureau on financial statements of companies. In this way convenient approach to financial analysis indicators will be ensured that each economic agent could apply financial analysis model required by him/her and draw conclusions regarding his/her position in particular market segment (branch or sub-branch).

Approbation of the results of the Promotion Paper

The author introduced broad circle of experts and scientists with the main statements of the Promotion Paper:

• results of the Paper are published in ten scientific publications in Latvian and English, nine out them are publications in popular scientific issues for review;

• participants of scientific conferences held in Latvia, Estonia and Russia have been introduced with the main results of the research;

• different subjects of economic activity during practical consultations have been introduced with the results of the research;

• in the teaching process as a supervisor of practice reports and bachelor's theses for the students at the Accounting Institute of the Faculty of

Economics and Management of the University of Latvia.

Description of sources and reference literature

The objects of the research of the Promotion Paper are relevant scientific literature published in Latvia and abroad, regulations of the Republic of Latvia, normative documentation and unpublished materials, data from the data bases of the Register of Enterprises of the Republic of Latvia, the Central Statistical

Bureau and the Bank of Latvia, data of annual reports of selective cluster of companies for the time period from year 1999 to 2004, received questionnaires developed by an author with comments of respondents, also internet resources.

Evaluating accounting systems existing in various countries all over the world

L.J. Seidler in his article "The Ultimate Theory course" in journal

"International Accounting" in 1967 developed classification based on

principles of geopolitical influence spheres and is expressed as consequences of colonialism and neo-colonialism from the pervious centuries. But R.D. Nair and W.K. Frank in their analysis of processing and presentation methods and practise of accounting information in different countries mark four, rather distinctive accounting system models: British model, Continental Europe model, USA model and Latin American model.

G.G.Müller in 1968 has used other approach in classification of accounting systems. His approach was based on main substantial differences in the administration of accounting and business environment.

As an original school of accounting system classification so called "cluster method" can be mentioned described by the research carried put by M. Burge,

G. Watt and R. Hammer on accounting systems in multinational companies, which was based on a review of accounting systems in international companies, and regulations prescribing the performance of audit were used for classification.

In order to state development of accounting and financial statement implementation system of some country and condition of these statements

J.Blake and O.Amath mention several factors which influence and characterize mentioned systems.

Postulate of Italian accounting theoretician E. Pisani says: the difference between assets and liabilities of the balance sheet form profit which is equal with the income and expenditures of the profit and loss statement. It was said

100 years ago but conditionally in its substance it can be applied also in modern economical situation.

To proceed with the theoretical discussion on the primary role of the balance sheet or profit and loss statement, the theory advanced by I. Fisher should be mentioned. But D.Scott expressed totally opposite opinion; he supposes that company's profit is the result of the use of resources.

J. Blake and O. Amath when performing analysis of the accounting standards with certainty establish that national accounting standards developed in Finland and Germany fail to comply with the requirements of International Accounting

Standards. But in such countries as Greece and Switzerland there are no national accounting standards and existing accounting practise fail to comply with the requirements of International Accounting Standards.

J. Savary, a scientist of the seventeenth century, can be assumed as the beginner of the systematic economic analysis and founder of this theoretical concept who introduced such concepts as synthetic and analytical accounting.

Approximately at the same time the concepts "the dynamic time series analysis" (analysis of company indicators in a longer term) and "the comparison of actual and estimated indicators". I Sher's, P.Gerstner's and

F.Laitner's contribution in the development of economic balance sheet analysis was significant; the introduced analytic breakdown of the balance sheet. But such names as R.Baygel, E.Remer, K.Porcich are associated with legal concept of the balance sheet analysis who founded further development of accounting revision (audit). Accordingly this school already in the twentieth century was formalized revision (audit) approach and elaboration of International Revisions

Standards was extensively started.

German scientists P.Guber, A.Broziuss and E.Schenvandton promoted idea of the balance sheet among users. There is a very little information available on significance of their work and hence it is difficult to establish their investment in the*process of economic analysis evolution. Major contribution in initial research of the above mentioned issues and their further development provided

Russian scientists P.Tatura (П. Татура), A.Andrianovs (A.Aндрианов), and later also - B.Bakanovs (B.Баканов), A.Šeremets (A.Шеремет), I.Dembinskis

(И. Дембинский).

On the basis of a wide scale of scientific literature, five trends or blocks of determining and developing FSSA can be distinguished:

Block 1. The so called „empirical pragmatics school" of the financial statement systematic analysis, with J.Horigan, R.Foulk etc. as its founders who tried to develop comparative financial indicators, evaluating company creditworthiness.

Block 2. Another approach to the process of financial analysis was developed by the so called statistical financial analysis school, with its basic concept stipulating that the analytical coefficients calculated for a company are useful only on condition that there is an opportunity to compare these coefficients with corresponding financial indicators of the sector, sub-sector or companies of equal worth. The school originated at the beginning of the twentieth century, and A.Woll can be mention as its founder.

Block 3. In the 20s of the twentieth century the financial statement systematic analysis was further developed by J.Bliss, A.Vinakor (A.Bинакор) and other scientists under the name of the "multivariant analyst school". Block 4. The

"company bankruptcy forecasting school" has a different approach to the financial statement systemic analysis, which is based on the financial soundness of companies and preferring prospective rather than retrospective

(characteristic of the analytical principles of the previously

mentioned schools) analysis. Representatives of this school started their activities in the 30s of the previous century, and its founders were A.Vinakor,

R.Smith and E.Altman.

Block 5. The "stock market participant school" is somewhat specific against the background of the other schools as its approach to the analysis system application is based on identifying investment effectiveness and the related risks for different types of securities. In distinction from the above types of the systematic analysis this is the newest one, which started to develop only in the

60s of the twentieth century. J.Foster can be considered the founder of this school.

However, a modern and sustainable lending decision is based on the development of a model comprising not only the analysis of financial indicators but also other data related to credit risks and their management, as well as the forecasting of future operation. This is the case of the so-called „PRISM" model, one of the most successful models of concentrated company credit risk analysis, and it was basically developed by M.Glanz. This financial analysis coefficient system model is mostly intended for company financial analysis from the creditor point of view; it has been developed in the US and is applied in Chase Manhattan Bank, one of the major US commercial banks, in the borrower financial analysis.

U.I.Mereste, an Estonian scientist, can be considered one of the most famous authors of the financial analysis model development in the Baltics using the matrix system. In the 80s and 90s of the twentieth century he developed a complicated multi-element factor system matrix model of the economic process analysis, and some of its elements have been used also in this Paper. One of the most widely used Mereste's methods in the development of economic models is the index method, using two-factor and multi-factor analysis systems.

General overview of the results of research

1. Different models of financial analysis

Considering the whole range of financial analysis theoretical models the most popular in practice have turned to be so called models of financial analysis coefficient system. There is one single database - financial statement for the financial analysis coefficients which are included in the models described in the

Promotion Paper. Thus all coefficients presented in the Paper can be looked upon as a single system of indicators and they can be combined in a common analysis model. Dynamic series can be formed using financial analysis coefficients and grouping them by significance and assigning them weight coefficients.

In the course of time manifold financial analysis models were developed; their authors implemented different approaches in the development of models as it was already described in the first section of the Paper. There is various financial analysis models aimed for different user groups. These models are very different considering their structure (complexity) and amount of applicable and resultant information. The author of the Promotion Paper describes several different financial analysis models. In substance these models differ by the interpretation of the initial information, analysis algorithms and resultant indicators that characterizes the different theoretical visions of their authors.

The analysis of these models is included in the Paper, not only to provide description of the existing situation but also to disclose theoretical substantiation of the author's proposed approach to justification of universal financial analysis model looked upon in the fourth section of the Paper.

One of the models' developed in Latvia is simplified model of financial analysis coefficient system (Model A). As the authors have not exactly distinguished user groups of financial analysis indicators in this model then these were the efforts of the author of the Promotion Paper on the basis of available information. The American scientist E.Helfert has developed a model of the financial analysis coefficient system (Model B) with three user groups: investors, managers and creditors. E. Helfert has grouped all financial indicators in eight sections dividing them more detailed by user group and proposing ranging of mentioned financial indicators by their importance.

J.K.Shim and J.G.Siegel developed indicators for the financial analysis model

(Model C), with a particular emphasis on the cost analysis, as well as examined the

other financial analysis indicators in more detailed than in the above described

Models A and B.J.K.Shim and J.G.Siegel in difference from the Models A and B in addition to such user groups as owners, managers and creditors applied user groups as public institutions and suppliers. The financial analysis model (Model D) developed by L.Giljarovskaya (Гильяровская JI.T.) and A.Vehoreva (Bехорева

A.A.) is popular in Russia; it consists of four financial indicator groups, and each of them comprises several financial analysis indicators. Authors in this model have merged owners and managers similarly as in the Model A; to the author's opinion of the Promotion Paper it is a disputable issue due to different interests.

The company financial analysis models most widely used in practice and relatively more detailed have been developed at the Central Statistical Bureau and the Register of Enterprises. It can be explained with the fact that both the above institutions have the most complete and detailed publicly accessible companies' financial information in Latvia and that, as already mentioned earlier, is the basis for successful application of the financial analysis models for the needs of various user groups. It should be stressed that this information at the disposal of the above institutions is available already historically.

The financial analysis model (Model E) is developed at the Register of

Enterprises of the Republic of Latvia which comprises the following groups of indicators: liquidity, activity, capital structure, profitability. Describing financial analysis Model E it should be mentioned that there is a possibility to compare acquired indicators with the average indicators of the respective branch (sub - branch), as well as historical data is available. NACE classification of the branches is used as the basis of the model. Thus available data sources, structure of acquired model and possible interpretation of the analysis results are clearly defined. It should be added that such important financial analysis indicator group as borrowed funds is not included in the

Register of Enterprises of the Republic of Latvia analysis model.

But the financial analysis model developed by the Central Statistical Bureau

(Model F) comprises the following groups of analysis indicators: solvency, liquidity, activity, profitability. Describing financial analysis Model E it should be mentioned that there is a possibility to compare acquired indicators with the average indicators of respective branch (sub -branch), as well as historical data starting from year 1997 is available. For the breakdown of the branches NACE classification of the branches is used also in this model. There are several substantial differences among defined terminology of the indicators of the

Model E and F. So, the cluster of indicators called cost - effectiveness indicators (i.e., meaning "profitability" indicators - translator's note) at the

Central Statistical Bureau financial analysis model, in the model of the Register of Enterprises is called profitability coefficients. Commercial profitability (the

model of the Central Statistical Bureau) has the same meaning as gross profit margin (the model of Register of Enterprises).

2. Different indicators of the financial analysis

Summary of the groups of the financial analysis components or indicators used as the basis for comparison of the opinion by various authors provides possibility to examine visibly wide possibilities of financial analysis interpretations. (Table 1)

Table 1

Summary of the components (indicator groups) of the financial analysis models presented by various authors

From the data of Table 1 it can be seen that various authors differently interpret one and the same indicators. In such a case the condition that model descriptions are in different languages must be considered which may cause different interpretations.

Depending on which country or group of countries particular financial analysis model is developed for also causes differences as different reflection and interpretation of accounting data exists, for example, in Europe and USA. The fact that some authors combine rather different indicators in one group of indicators also complicates comparing of various financial analysis models. For example, as regards to Model A then there is liquidity and solvency indicators combined in one group but in Model B - profit distribution and liquidity. There are also existing indicator groups which in some models are distinguished and analysed but the others are not mentioned at all. As an example here can be mentioned cash flow analysis indicators; described only by J.K.Shim and J.G.Siegel (Model C) from the above authors. It is important to note that some indicator groups may comprise more indicators which even in groups of similar titles differ.

Examination of liquidity and solvency indicators discloses that there are all possible combinations existing and the various models represent indicators of one type and another, as well as both types together. Such indicator group as financial stability represents great variety where each author possesses his own view, as well as titles of these indicators differ as, for example: capital structure

(Model D), financial leverage (Model B) and quality of balance (Model C). The author of the Paper gives preference to "capital structure".

Publications of various authors also reveals differences by title and components of such indicator group as activity indicators (Models E and F), also called items and structure of the balance sheet (Model A), analysis of fixed assets and current assets (Model D), analysis of business operation (Model B) and analysis of investment (Model C).

3. Various financial analysis users

The analysis and forecast of the company financial operation may possess different interests to various user groups and thus, also the analysed financial indicators and their interpretation may differ. One of the most important financial analysis user groups are investors or shareholders. It is accepted to refer company owners as investors who invest their funds to secure development of company operation with a view to gain profit. Thus, exactly these aspects determine choice and topicality to investors' interest of indicators

of company financial operation analysis. It should be added that apart from investors also managers, experts, creditors, also public and municipality institutions but in some cases also trade union and superior institutions use the financial analysis indicators.

Publications by E.Helfert and V.Kovalovs describe financial analysis peculiarities on investor's behalf. Within the framework of the Promotion Paper opinions represented by the other authors were also used; these opinions were applied to peculiarities of the economy in Latvia and certain corrections were introduced which to the author opinion would correspond the most to the situation and needs of today. Literature sources and the analysis accomplished by the author show that company managers (managers) mainly are interested in the following analysis indicator groups: business operation analysis indicators, indicators of the analysis of resource use, profitability analysis indicators.

Company financial operation analysis of the interest to creditors usually is structured as the analysis of rating system or coefficient system with the main mission to determine borrower's financial status and forecast his abilities to return the loan and pay the interest in due time, and analyse company's solvency.

Apart from the above described company financial analysis user groups such as managers, investors and creditors there are also other user groups whose interests and aims are different. Here should be mentioned such user groups as suppliers, minority shareholders, superior institutions, revenue (tax) service and other. In most cases each user group has different interests even though there are financial analysis indicators of the interest for all and their significance can be of equal value. Examining peculiarities of various user groups it is important to comprehend the interests and requirements of each group, as well as objectives of their analysis.

4. Various branches

In the Promotion Paper NACE classification of branches is used consisting of the following branches:

• agriculture, hunting and forestry (a);

• fishing (b);

• mining and quarrying (c);

• manufacturing (d);

• electricity, gas and water supply (e);

• construction (f);

• wholesale and retail trade; repair of motor vehicles, motorcycles and personal and household goods (g);

• hotels and restaurants (h);

• transport, storage and communication (i);

• financial intermediation (j);

• real estate, renting and business activities (k);

• public administration and defence; compulsory social security (1);

• education (m);

• health and social work (n);

• other community, social and personal service activities (o).

In the approbation practise of the company financial statement analysis model developed in the Promotion Paper financial statements over the time period of five years of selected companies from wood processing sub-branch, manufacturing (D) are used.

5. Various data bases

In accordance with the tasks set forth for the Promotional Paper, the author has examined the currently well-known (publicly available) company financial indicator data bases in Latvia, which are used in practice. The most important among presently functioning publicly accessible company financial indicator data bases are the following:

1.

The Register of Enterprises of the Republic of Latvia data base;

2.

The Central Statistical Bureau of Latvia data base;

3.

Ministry of Agriculture of the Republic of Latvia data base;

4.

The Latvian Investment and Development Agency data base;

5.

Data base of company "Creditreform";

6.

The Bank of Latvia data base.

6. The development of optimum financial analysis model

In the development of integrated financial analysis model interrelationships among available initial data and resultant data in the data base are considered.

Thus economical analysis is logical research method of economic developments and the financial analysis model is a set of economical analysis various components.

The author has chosen to emphasize the development of such financial analysis model which would be universal, meaning - applicable for various user groups performing financial analysis of various complexity levels and objectives. For the development of such model it is important to define its link to publicly accessible data bases; in the case of Latvia these are as follows: data base of the Register of

Enterprises, the Central Statistical Bureau, the Bank of Latvia, as well as possibly data base of some other public or municipality institution. Multifunctional importance is attributed to the model so that it can be used as for assessment of liquidity, so as solvency, as well as other economic indicators all or individual.

The research author chooses to show that within the framework of modified financial analysis model it is possible to perform financial analysis of various levels and complexity. It should be considered that the basis for each individual analysis is specifically defined user groups and their objectives and tasks in accordance to which also the analysis model is adapted.

In the development of the financial analysis model mainly factor analysis, ratio theories and cluster analysis methods are applied. The development of universal and multifunctional financial analysis model is based on the following basic statements: definition of the model tasks and elaboration of interrelationship matrix, definition of integrated analysis principles, identification of the branch to be analysed, time period and indicator dynamics, elaboration of the principal block-schema of modified financial analysis model functioning.

A. The tasks of the financial analysis model to be defined are the following:

• definition of initial figure influence, interrelationships and their impact on resultant indicators;

• assessment of the financial operation analysis indicators, comparison of actual figures for two or more periods, as well as their comparison with the average or some other presentable indicators of the branch (sub - branch)

(against the planned);

• the development of recommendations for the preparation (forecast) of the financial plans for the next periods, improvement of company financial operation, as well as disclosure of financial operation problems.

In definition of the financial analysis model it is important for the newly acquired information to be wider and more in-depth than the information acquired traditionally from the initial data. All numerical information when setting financial analysis tasks to be solved is divided into two parts: initial and resultant financial data. In the development of respective model it is important for the initial financial data to be sufficient considering amount, due with

adequate credibility level and that its acquisition would not require exceedingly high resources.

It should be carefully followed after that data acquisition process or its individual components would not become too labour - consuming and that during the course of the analysis only substantial factors would be approached.

Here as an example can be mentioned company financial statement and information it contains. In order to perform debtors' debts analysis it is important to know the amount and term of their liabilities. If the financial statement without appendixes provides notion only on the amounts of debtor's debts then in particular cases external users do not carry any economically justified costs related to collection of additional information, for example, information regarding terms of debtors' debts.

In the development of the financial analysis model already at the initial stage necessary data clusters, their amount and degree of detailed elaboration should be defined, taking into account the above described problems. Not only financial information at the end of period can serve as initial data; but basic statement of the model stipulates also comparison of the financial information at the beginning of period with the information acquired at the end of period. It should be considered that in a case when the model developers receive the financial information as external users, degree of its detailed elaboration is substantially lower than in the situation when internal user receives the information which to some extent limits financial analysis possibilities.

In the process of financial analysis performance applied financial data processing system or respective software is of importance; with the use of the system or software resultant analysis indicators are acquired. There is a wide variety of manifold software available in practice providing performance of analysis procedures but principles of their development often remain as business secret. It is mainly related to the models stipulated for the company internal use. At the same time there are business financial analyses models developed which can be obtained for money and, thus, software application could be assumed as publicly accessible. In such a case widely accessible debtor - creditor analysis and solvency and liquidity analysis models are mainly referred to.

B. Basic principles of the modified financial analysis model development

Systematic and integrated approach is one of the main basic principles of the financial analysis model development and application. In the development of such model its size should be assessed as not only varied interests of the

prospective user must be followed, but also financial, technical, time and labour consuming resources available to the developers should be critically evaluated.

Using the wide variety of publications and carrying out analysis of existing data processing technologies during the financial analysis model development process the following basic principles are recommended:

• basic elements and methodological statements of the information processing system designing should be followed during the model development; modification principle of the modules should be taken into account;

• the amount of financial analysis initial data should be as much as possible limited which, nevertheless, would provide sufficient analytical information amount and facilitate its further improvement;

• it is appropriate to perform financial analysis on the information basis available in the company accounting which serves as the grounds for the development of various publicly accessible financial statements;

• the financial analysis should comprise all those indicators which are referred as important considering the users' opinion and which are of constant interest;

• the financial analysis indicator calculation algorithms should be reasonably simple, clear and unambiguously defined so that individual indicators of the analysis could be assessed using simplified calculation methods and their interpretation would express clear economic meaning;

• in the financial indicator analysis of several companies and their evaluation against the statistical figures of the branch (sub - branch) there should be a standardized approach which would give a possibility to compare acquired results and draw common conclusions;

• the acquisition of the initial data and the analysis process should be done by definite and common time horizon which gives a possibility to assess changes of indicators in dynamics (by year, quarter, month);

• during the company financial analysis process sufficient and sound data should be acquired on operational effectiveness of the company or group of companies to be analysed in the branch (sub - branch) context taking into account specific requirements set by respective users of the system.

During the last years once undeservedly forgotten cluster method is used more and more widely; within this method the objects to be analysed are classified so that each object in accordance with the set features would be similar to the rest of the cluster objects. Thus, so called cluster groups are developed which combine certain, homogeneous or related objects by initial parameter. Cluster analysis is the type of multidimensional analysis; attitude towards the

application of this analysis should be cautious, particularly if the set of objects to be analysed and available initial data is small. Cluster analysis classifies objects and not the variables as it is speaking of factor analysis. Due to limited size of the Promotion Paper cluster analysis is not included in the origin of the modified financial analysis model development.

Referring to detailed information analysis on various financial analysis models in the Baltics it can be concluded that analysis models developed in the last decade within the field of microeconomics are simplified and their integrated approach and systematization is not sufficient. This is related to the fact that many scientific institutes of economic profile in so called post-socialism countries,

Latvia including, after the collapse of USSR have suspended or reoriented their activity and there are very few dealing with economic modeling.

In the result of the research it can be concluded that publicly accessible financial analysis models today in Latvia can be assessed as an economic survey which from simple analysis differ so that the initial data is processed with the special analysis methods (integrated system approach) and consequently data acquired does not exactly result from the initial data. For example, company profit analysis results provide only general notion if not compared with the respective data of certain branch or with the figures acquired during previous periods or if they are not related to equity capital.

C. The financial analysis user groups, their objectives and tasks

Already at the very beginning of the development of financial analyses model it is important to define what objectives and what tasks and what user groups this model is developed for, namely, what are prospective clients of the services. If, for example, users of prospective model will be company managers and their task will be to assess profit level and company development perspectives then the respective module of the analysis model will be based on assessment of liquidity, profitability and operational activity, as well as acquired indicators will be compared as to the average indicators of the branch, as to the figures of the previous periods with the aim to assess their dynamics.

D. The data base to be applied, the branch to be analysed, time period and identification of the indicator dynamics

Manufacturing branch further is divided as follows: food industry, heavy industry, textile industry, wood processing etc. All these sub-branches considering Latvian economic development and present situation and the scale of

priorities hold very different positions and their indicators substantially differ. In the development of integrated analysis model one of the issues examined by the model is comparison of acquired economic indicators of respective company with the average indicators of the branch (sub - branch). That provides a notion on the position of the company within the branch (sub - branch), as well as on the tendencies of development when reviewing this comparison in dynamics by period. There are catalogues by period of individual branches and sub - branches in economically developed countries which provide an option for the analysis model users to compare easily acquired financial indicators with the average indicators of the branch or sub - branch.

As the initial source of data to be analysed was used the Register of Enterprises of Republic of Latvia data base for the analysis of certain companies financial indicators in the dynamics and the acquired results were compared with the average indicators of the branch. The applicable data base contains data of the balance sheet and profit and loss statement of wood processing companies for the time period from year 1999 to 2004. An important condition is also that the period to be analysed began just after Russian financial crisis which took place from 1998 to 1999 and left an impact also on the economy of Latvia. That provides a possibility to analyse certain economic cycle period.

Hence the financial indicators to be analysed in the financial analysis model are more homogeneous as it can be assumed that economic environment during this time period was sufficiently consistent with the tendency of stabilization.

However, that does not refer to all branches in the same extent. Created modified model indicator dynamics was analysed in chronological sequence.

After assessment of financial importance of the indicator dynamics it was assumed that periodical increase of individual indicators or the group of them is more positive tendency than higher proportion of increase at the end of analysed period if compared with the beginning of the period but with the substantial fluctuations during some periods. It follows that decrease of the indicator value is more negative tendency if the end and the beginning of the analysed period is compared, but periodic decrease of the indicator value can be assumed as unfavourable tendency.

E. Development of modified financial analysis model functioning block - schema

Basing upon manifold financial analysis coefficient system algorithms the software is modified correspondingly tasks set by clients who might represent various user groups.

When the order of company financial analysis performance is received the average indicators of the respective branch and its sub-branch are acquired, as well as initial data of the companies to be analysed. Breakdown of the branches is in the accordance with NACE classification. There are various methods how to select companies to be analysed and compared within the branch: for example, ten biggest companies by turnover, ten the most profitable companies and by the other feature.

The next stage is calculation of financial analysis indicators. In the proposed model there are separately distinguished groups of return, activity, liquidity and capital structure indicators.

After the respective financial analysis indicators are calculated the resultant indicator matrix is developed in accordance with the ranging basic principles by their importance. During the course of analysis not only respective data of the reporting period is used but also company financial indicators for the previous periods; they are compared with the average indicators of the branch (sub - branch).

In the result change dynamics of the respective indicators and difference of their value from the average indicators of the branch (sub - branch) or of the company group selected for comparison in the reporting period is assessed.

In accordance with the user category acquired results are adjusted using the weight coefficients and resultant figure of the respective financial indicator group is obtained following certain algorithm. Further in summary when summing up resultant figures of each financial indicator group across all groups the overall company financial operation indicator is acquired.

During performed approbation of the model special attention was paid to ranging principles of interim results to be used and weight coefficients which presently is performed empirically; using expert evaluations obtained with the questionnaires by user group.

During the course of the further research with the necessary financial resources wider approbation of the model is stipulated; in the result more efficient approach will be clarified for the ranging of interim results and numerical values of weight coefficient will be précised.

During the course of approbation assessing empirically and applying expert evaluations, used principles of interim result ranging and weight coefficients

during the further researches should be specified which is possible if wide approbation and analysis is performed.

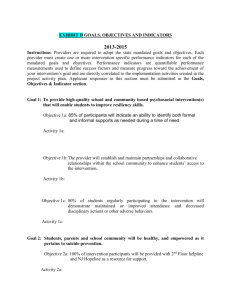

The author's proposed universal company financial analysis model based on the public data base application principle, functional block-schema is demonstrated in Illustration No.l.

Illustration No. 1. Functional block-schema of company financial analysis model based on the public data base application principle

Universal nature of company financial analysis model developed in this manner provides a possibility to accomplish modification of the analysis algorithms in accordance with the specific features of the users (analysis clients) interests and that can be assumed an important statement of the Promotion Paper.

7. Choosing the user group of the financial analysis model and defining its interests

Already at the very beginning of developing the modified financial analysis model it is important to define the purposes and tasks and, the user groups this model is being developed for, e.g. who are the prospective customers of its services. E.g., where the managers of the company will be the users of the prospective analysis model and their task will be to assess the company profit level and development prospects, the respective modules of the analysis model will be based on the assessment of liquidity, profitability and operational activity, and the indicators obtained will be compared both with the average indicators of the branch, as well as those of the previous periods with the aim of measuring their dynamics.

During the course of developing the modified analysis model developed within the framework of the Promotion Paper, most attention was paid to such user groups as investors and managers, whereas such a user group as creditors initially was not examined in more detail since their interests are very different from those of the above groups. The tasks of the financial analysis in the interests of creditors also differ from each other as different creditors may have diverse objectives, e.g. short-term and long-term, as well as different tasks, e.g. gaining profit immediately or in the long-term, benefiting in parallel from other types of business related to borrowers. It should be noted that currently it is the financial institutions that are among the most active in ordering the financial analysis models due to their specific operation; they could be followed by investment bankers and the stock exchange brokerage companies.

However, even to date each Latvian credit institution develops its own analysis models; moreover, in most cases they use their own in-house labour resources. In the author's view, such an approach is not very rational since from the economical point of view it is not cost effective and financially beneficial for smaller companies to maintain their own special structural units for analysis model development and maintenance. The issue of the qualification and theoretical know-how basis of these employees will always be topical. An important precondition for developing an effective financial analysis model is the theoretical knowledge of its users and their capability to interpret analysis results.

Comparing some analysis models of Latvian credit institutions, it can be concluded that they are mostly based on the calculations of loan (or other type of financing) profitability as well as liquidity and equity ratios. Certainly, at the same time the

Bank of Latvia's guidelines and recommendations are complied with; nevertheless, in comparison with the US where the Federal Reserve System issues explicit guidelines to credit institutions on the methodology of assessing the financial status of borrowers, there is no similar standardized approach in place in

Latvia.

In the author's view, in Latvia's situation, in view of the limited possibilities of the financial analysis models and their developers, the implementation of such unified model or at least uniform principles would make it easier and streamline each credit institution's efforts to perform the financial analysis of companies of various branches on an adequately high level. Failing to recognise the differences of financial analysis by branch (liquidity is very different in e.g. the construction and the manufacturing branches) may lead to misleading results acquired in the analysis process and their usage becomes ineffective.

8. Ranging of financial analysis model indicators and assigning of weight coefficients (based on questionnaires)

To ensure as wide scale application opportunities of the financial analysis model as possible, along with streamlining the interpretation of the results by reaching an aggregate resultant indicator, each resultant component - indicator or group of indicators - has to be assigned its weight.

In order to develop a modified universal financial analysis model, during the research it was necessary to determine the weights or importance in relation to other indicators for individual groups of indicators which formed the overall resultant indicator. In this case there were several options of how to resolve the above issue:

• to state that each indicator is equally important, thus refusing from the use of weight coefficients;

• to assign weight coefficients on the basis of the research of the impact of individual groups of indicators on the operation of the object to be analysed;

• to assign weight coefficients with the help of expert evaluations.

The author has chosen the third approach and the method of circulating questionnaires to the experts for assigning weights to individual indicators. The choice of this method is related to the fact that at the initial approbation stage of the model to be developed it allows identifying the indicator of the sub-branch

companies to be analysed and the viewpoint of the leading experts, and provides the required justification for assigning the weights.

Since the developed universal financial analysis model was approbated and analysed in the wood processing sub-branch, expert's evaluation was provided by the managers and professionals of the top ten companies of the sub-branch.

Information was gathered from companies with both domestic and foreign capital, mailing them questionnaires in writing. Respondents were asked to evaluate a larger range of indicators than those contained in the modified financial analysis model under this research. It was done with the purpose of getting as wide a list of financial analysis indicators available for experts as possible, and to be able to identify those indicators or their groups, who for various reasons have seemed less important to the author to include them in the model, but experts find them significant. (Table 2)

Table 2

Usage frequency of groups of financial analysis indicators according to experts

1

As suggested by data of Table 2, according to experts there are two most frequently mentioned indicator groups: groups of profitability and operational risk analysis indicators. In expert evaluations profit distribution is the group of indicators, which is mentioned least frequently. This ranging in itself does not

1 Asterisk is used to mark those indicator groups, which, according to experts, should be included in the financial analysis model to be developed.

provide any idea of the importance of one group of indicators or another, but suggests which groups of analysis indicators attract major interest from the point of view of the branch managers. The importance of the financial analysis indicator groups under review in the analysis model to be developed is characterised by their compilation according to experts (Table 3).

Table 3

Assigning weights to financial analysis indicators according to experts

2

Data of Table 3 show the ranking of each group of financial analysis indicators according to each expert, assigning the importance in a growing sequence: marking the most important indicator with „1". If any of the indicators was not chosen at all, it was assigned the maximum amount of points - „12". Since two groups of financial analysis - „liquidity and solvency" and „balance sheet items and structure" -received equal number of points, the author chose

"liquidity and solvency" to be the most important one since it was more often mentioned as the most significant.

According to data of Table 3, the operative risk analysis indicators can be considered the most important group of the universal financial analysis model indicators with the highest weight coefficient as evaluated by experts; it implies

2 Figures are used to mark the financial analysis indicator groups by importance according to experts.

that from the viewpoint of company managers it is important to determine the share of a company's fixed costs in total costs.

The next most important group is profitability indicators, followed by cash flow analysis indicators. After those the groups of the "break-even point" are ranked, liquidity and solvency, and balance sheet items and structure analysis indicators. Profit distribution indicators have been evaluated as the least important indicator group.

Compiling questionnaire data, it is evident that the opinion of managers in companies with foreign capital and domestic capital on the importance of individual indicators differs considerably. For example, the "break-even point" and liquidity analysis is one of the most important indicators for foreign companies, whereas for local companies it is profitability. The principle of assigning weight coefficients may differ for those wood processing companies which perform more complex processing and those which carry out only small part of the processing cycle, e.g. wood felling. However, due to the limited scope of the Paper the conditions mentioned in this paragraph will not be taken into account in further analysis.

In view of the conditions for developing a universal financial analysis model, inter alia the need to compare the acquired indicators with the average indicators of the branch, the author selected four major groups of financial indicators comprising more detailed indicators. (Table 4)

Table 4

Resulting data structure of the universal financial analysis model, taking into account the respective average indicators of the branch

According to the data of Table 4, it is evident that the initially offered model is largely focused on various types of profitability calculations.

However, if the defined requirements on the possibility to compare the analysis indicators with the average indicators of the branch were not taken into account

(since the Central Statistical Bureau of the Republic of Latvia has no relevant data), the author would offer a selection of another financial indicator groups.

(Table 5)

Table 5

Structure of the universal financial analysis model, not taking into account the respective average indicators of the branch

According to Table 5, if the analysis model were developed without taking into account the available average branch (sub-branch) indicators, it would be more elaborate than the one presented in Table 4. In this case we speak about the possibility of choosing these or other financial indicators depending on the tasks and aims of the model to be developed. In the model, which does not take into account the average indictors of the branch, activity indicators of various types are analysed in more detail, and more attention is paid to the capital structure and return indicators.

There are certain differences between the viewpoints of the author of the

Promotion Paper and experts about the importance of individual indicator groups. As regards the frequency of the use of financial analysis indicators,

mostly this refers to the operational profitability, most often mentioned by experts; however, in the author's view, it should be ranked as the third one since operational activity and liquidity and solvency indicators are more important: they provide better characteristics of manager work and contribution for the benefit of the company development. As regards liquidity and solvency by frequency of the use of these indicators, the author and expert opinions coincide. (Table 6)

Table 6

Comparison of financial analysis indicators by frequency of use and by ranging according to experts and the author

According to the data of Table 6 with respect to ranging individual indicators of the financial analysis model by their importance, the author and expert opinion coincides in the case of the group of profitability indicators, but differs most as regards the capital structure.

In the process of further development of the model the Paper's author took into account the expert view when determining the importance of the financial analysis indicators, as it is the manager analysis specific features that the model approbation is based on. The methodology for calculating the weight of individual indicator groups is given in the formula:

The application results of the weight calculation methodology, which later are employed in the development of the universal analysis model, are used in the assignment of weight coefficients. (Table 7)

Table 7

Assignment of weight coefficients to the financial analysis indicators

According to the data of Table 7, weight coefficients are assigned to the financial analysis indicators on the basis of expert view and ranging of the research results. It is evident from the following algorithm for assigning weight coefficients:

1.

Expert opinions on the importance of financial analysis indicators are obtained (the smaller the figure, the higher the importance);

2.

Opinions of all experts are aggregated by indicator group and the resultant figure is obtained (the smaller the resultant figure, the higher the importance of the indicator group);

3.

Financial analysis indicators are ranged from 1 to 11 subject to the resultant figures (the most important indicator is ranked "1" while the least important indicator is assigned "11");

4.

Those groups of financial analysis indicators which have been included in the financial analysis model developed by the author are selected subject to the available average branch indicators (profitability, liquidity and solvency, operational activity, capital structure);

5.

The aggregate sum of expert ranging of the selected groups of financial analysis indicators is calculated (2+5+7+8=22) and the aggregate figure is obtained;

6.

The aggregate figure is divided by the ranging figure of each group of financial analysis indicators of the developed model and the weight coefficient is obtained, indicating the importance of the respective financial analysis indicator group.

No doubt there are other ways of acquiring the importance coefficient of the financial analysis indicator group as well; nevertheless, in view of a certain subjectivity of such an indicator, the author chose this method of obtaining the weight coefficient, which in a pilot test confirmed its application possibilities.

Manipulating with the weight coefficient, it is possible to change the resultant indicators and hence the entire process of the analysis; however, there is no ideal method in this case, and any other approach needs a justification and algorithm. In this case it is important to abide by the principles of methodological uniformity and ensure that the acquired results are comparable.

9. Compilation of the financial analysis results

The first approach is based on the comparison of the financial analysis indicators of the top ten major companies in 1999-2004, as well as with the average branch indicators, thus developing a resultant financial analysis model.

The main task of the model is to compare one of the selected financial analysis indicators for a certain company with an equivalent indicator of another

company of the same branch, as well as with the average indicator of the branch. The purpose of such financial analysis is to assess the ranking of the particular company in the branch on the basis of criteria - pre-selected financial analysis indicators.

The above analysis is based on the evaluation of a company's overall position and would have the widest scope of use for creditors as well as investors. This approach may serve for an overall assessment of the management performance effectiveness of the companies to be analysed, visually comparing different financial indicators with the average indicators of the industry, as well as with the average indicators of the companies to be analysed.

Upon performing the analysis, most attention should be paid to the analysis of the financial performance indicators of the wood processing sub-branch and individual companies, examining the following groups of indicators:

1.

the share of liabilities in the balance sheet;

2.

the share of short-term liabilities in the balance sheet;

3. debt to equity;

4.

total liquidity;

5.

absolute liquidity;

6.

activity;

7.

commercial profitability (I. and II. version);

8.

economic profitability (I. and II. version);

9.

financial profitability (I. and II. version).

The second approach to the development of resultant company financial analysis models is based on a company's management analysis, providing an opportunity to assess the success of a branch (or sub-branch) management performance, taking into account the dynamics of the selected financial analysis indicators, the selection of the particular indicators, as well as the respective average financial indicators of the branch to be analysed, assigning weight coefficients to the indicators, which in this case are based on the research

(expert questionnaires) results.

According to this approach, the development of a financial analysis model will be examined: it will be possible to perform the so called company management analysis with the help of the model, or assess the success of the management performance of a particular company on the basis of different parameters. A detailed description of the universal financial analysis model development, based on the company management analysis, was given in the previous subsections. The obtained financial analysis results for the selected ten companies can be aggregated in a table. (Table 8)

Table 8

Aggregation of the resultant indicators of the financial analysis model

(1999-2004)

Table 8 presents the grouping of the selected ten companies according to the results of the management performance analysis model. The overall analysis of wood processing companies and the comparison of financial indicators resulting from their management performance with the average indicators of the branch given in this section presents the second of the general analysis approach.

Summarising the second approach, it is obvious that BSW, Vika Wood and

Strenču MRS have the most successful company management (on the basis of the company financial performance results, comparison with the average indicators of the branch, indicator dynamics and weight coefficient application), but

Staļi and Inčukalns Timber - the least successful.

It is evident from both approaches or models of company financial analysis developed in the course of research that, performing analysis from the manager viewpoint, the result is actually the same, testifying to a certain accuracy or correspondence of both approaches and accuracy of the acquired results.

Nevertheless, in the Promotional Paper author's view the company management analysis is better in application, using company financial analysis indicators according to the second approach, as it ensures more accurate and extensive possibilities for performing analysis.Hence, in the course of research an approach to a universal company financial analysis model development was created, and subject to the interests and aims of user groups it is possible to change the applicable indicators, comparing them with the branch where the companies to be analysed operate, using the "public" databases available in Latvia as the basis.

Key conclusions and recommendations of the Promotional Paper

Key conclusions of the Promotional Paper

1.

Historically diverse accounting systems have developed in different countries all over the world, representing the so called British, American,

French or Continental Europe, and Latin American accounting system organisational models.

2.

Currently two different forms of financial statements dominate in the international accounting practice, ensuing from the specific features of the

British-American and French-German accounting systems, respectively.

3.

In practice, the influence of the accounting systems of the major countries on those of smaller or economically weaker neighbouring countries is observed.

4.

In the Latvian accounting organisation and the laws and regulations regulating the accounting practice no specific modifications were made in relation to Latvia's accession to the European Union.

5.

In the Latvian accounting system the balance sheet assets are grouped by their functional importance, i.e. expenses are classified by function and liabilities by legal importance (equity and debt liabilities).

6.

The primary objective of preparing and harmonising financial statements is to help their users on a global scale to better understand the financial position of operating companies and perform their qualified analysis.

7.

The balance sheet shall be deemed the primary element and the profit and loss account-the secondary element of financial statements.

8.

The balance sheet and its appendices are deemed the key sources for the company financial analysis.

9.

Historically the framework for the financial statement systematic analysis

(FSSA) was created already at the end of the nineteenth century.

10.

The company financial analysis model is a set of mutually ranged financial indicators, providing a complete view of the company financial position subject to the objectives and analysis tasks defined, as well as presenting the analysis directions of the subject under review and a definite sequence of actions for attaining the objectives set forth.

11.

Investors (or shareholders) are one of the financial analysis user groups, closest to the company, whose basic interests is the short-term as well as

long-term return of the funds invested in the company, or gaining profit, provided by the business operation of the company.

12.

From the investors' point of view, the most significant is the indicator of

"net earnings after taxes" (distributed among the shareholders with voting rights) per share, which is deemed the basic element for attracting shareholders.

13.

The performance of the company manager as a business developer is characterised by the profitability coefficient calculated in line with the