Cooper Tire & Rubber

advertisement

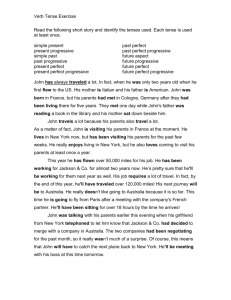

Determining the business level strategy a firm is following. To begin, it is important to note that Porter’s generic strategies are business level strategies. Not corporate level. Why? For two reasons. 1) Corporate and business level strategies are trying to answer two different questions. Look that up in your notes! 2) Corporations are made up of multiple business units. Each could be following a different strategy. If you apply Porter at the corporate level you are saying that all business units are following the same strategy. It could be true, but you have to know this first. How do we determine the strategy a firm is following? Two tests: 1) the preponderance of the evidence, and 2) the motivation of the CEO. Recall that strategy is a pattern of actions. From the other material in class 23 you should have come to appreciate that if firms want to follow a particular strategy they need the systems and structure to support the strategy. Further, to change the strategy requires changing the systems and structure to support the new strategy. The samples I gave in the power point should help. What to do now? Make sure you are familiar with the material on the 3 generic strategies. Read Walgreen. Right Low-cost, Differentiation, and Focus on a piece of paper. Now, go back and read the case again slowly. This time write down actions that you see the firm following that could support one or more of the strategies. What you are doing is collecting evidence to support each of the 3 strategies. For example, Walgreen is installing a new computer system. This provides greater efficiency, and lowers costs. That is support for the Low Cost strategy. They are also doing it to improve service to the customer. There primary product/service is prescriptions. A specific target market – people who are sick. That supports Focus. Continue doing this through the case. For each of the 3 strategies you will have accumulated evidence to support an argument that the firm is following that strategy. But, if you do the work correctly, one list will be larger than the other two. That will be the preponderance of the evidence! Next, ask yourself “why is management doing this”? In other words, what is the motivation behind the pattern of actions? The answer to that question will help to explain why the other two strategy alternatives is not correct. Try it. It works. More importantly, you need to be able to do this for the firm paper and the tests. The learning objectives: to appreciate that strategy is a pattern of actions; that setting strategy means a serious commitment of resources; and, that one can deduce the strategy by looking for the pattern of actions. This will have greater meaning as we expand our view of strategic management theory later. DO NOT TRY TO UPDATE THESE CASES! I KNOW THAT THEY ARE DATED! Walgreen “A High-Tech Rx For Profits” Here’s a trick question: Which retail giant has a name starting with Wal, a nononsense, middle-America sort of appeal, and 17 straight years of record sales and earnings? Warning: The top man at this company does not drive a pickup, hunt birds, or call himself Sam. The correct answer is Walgreen, the largest drugstore chain in the U.S. and one of the longest-running successes in retailing. Recession and debt have cashiered many venerable merchants, but Walgreen, based in Deerfield, Illinois, is flush with cash. It has 1,678 stores in 29 states and Puerto Rico and plans to add 1,300 more by the end of the decade. Says Gary Vineberg, a security analyst at Dean Witter Reynolds: “This is a terrific company, very focused, very well run, and very well financed.” Like Sam Walton’s Wal-Mart, Walgreen thrives by paying attention to customers, sticking to a simple business plan, and investing heavily in technology. Ninety-one years after Charles R. Walgreen opened his first pharmacy on Chicago’s South Side, his company is still building corner drugstores – enlarged, redesigned, and rewired. In a generally low-tech industry, it is leagues ahead of rivals in the use of computers, scanners, and satellites. Walgreen prospers even though nearly every store in town is crowding in on its business. Most Wal-Marts and Kmarts now have pharmacies, as do many supermarkets. Deep-discount chains, like Phar-Mor and F&M, offer health and beauty products at piteously low prices. Says Chairman and Chief Executive Charles R. (Cork) Walgreen III, grandson of the founder: “Everybody’s getting a piece of the pie. We have to be sharp.” What Walgreen may lack in price, it makes up for in convenience. The company picks locations with excruciating care. The typical Walgreen’s is not scrunched into a mega mall at the end of a parking lot the size of Rhode Island. It is a mid-size store on a main street in a big city or suburb. An average customer can buzz into a Walgreen’s on the way home from work, pick up two or three items (from a selection of about $10,000), spend about $10, and zip out again – all in just over ten minutes. The major money-spinner at Walgreen is the pharmacy. Sales of prescription drugs have increased at a double-digit clip for 48 consecutive quarters and now account for 38% of total revenues. Two big reasons: the aging of America – the average 60-yearold fills twice as many prescriptions per year as the average 30-year-old – and the rapid inflation in drug prices. But Walgreen’s prescription profits are being squeezed, mostly by insurance companies, HMOs, and state Medicaid programs. These third-party payers, which account for about half of Walgreen’s prescription business, now force pharmacies to offer volume discounts. The upshot, says President Daniel Jorndt, who like Cork Walgreen was trained as a pharmacist, is that “we have to be more aggressive in controlling costs.” That means using technology to boost productivity, an area where Walgreen already excels. The company was one of the first drug-store chains to link all its pharmacies electronically to third-party payment plans, eliminating the need for pharmacists and customers to fill out time-consuming claim forms. Walgreen recently completed the installation of bar-code scanners in all its stores. Scanners, while common enough in supermarkets, have not been economical in drugstores, where purchases are small and checkout lines short. Walgreen’s scanners, however, are but the first stage of a sophisticated inventory-control system that by the end of 1993 will track demand and automatically reorder supplies. The company’s big investment in technology has a direct impact on customers. Intercom, the chain’s satellite communication network, ties every pharmacy to a mainframe computer in Des Plaines, Illinois. When Clarence Jones, a Tampa businessman, takes a trip, he knows he can get a refill of his blood pressure medication at any Walgreen’s. More importantly, he is willing to pay for the convenience. Cooper Tire & Rubber “Now Hear This, Jack Welch” Jack Welch never met Ivan W. Gorr. Welch is famous for demanding that each of General Electric’s lines of business ranks No. 1 or No. 2 in market share. Cooper Tire & Rubber, of which Gorr is CEO, stands no better than ninth in its primary business – manufacturing tires – behind such behemoths as Goodyear, Michelin, and Bridgestone/Firestone. Yet Cooper consistently rolls up the best results in the industry. Among the Fortune 500 industrials, Cooper scores 28th in total return to inventors – stock appreciation plus dividends – since 1980: GE comes in at No. 104. The last maker of passenger-car tires still left in Ohio Cooper is based in Findlay, 125 miles west of Akron. It isn’t even the biggest employer in Findlay (pop. 35,703); both Whirlpool and Marathon Oil have more workers. Getting attention isn’t Cooper’s style. Its low-rise corporate headquarters could pass for a 1950s suburban elementary school, right down to the linoleum floors and the flagpole out front. The annual report is printed in living black and white. Cooper prospers by mining ever deeper a single vein in a multifarious market. Alone among the major tire makers, it refuses to compete for low-profit originalequipment sales to automakers. Instead, it concentrates on the replacement market, which is three times larger and growing faster because cars are more durable and owners keep them longer. Today’s tires are tougher too, but replacement volume is holding up because people drive more than they used to. Rather than sell through its own retail chain like Goodyear and Bridgestone/Firestone, Cooper distributes half its production as private-label merchandise through oil companies, large independent distributors, and such mass marketers as Western Auto Supply and Pep Boys. The other half goes to independent dealers, who account for 67% of replacement-tire sales. Those dealers love Cooper because it doesn’t compete with them – unlike Goodyear, for example, which besides having its own stores just agreed to let Sears sell its brand. Cooper’s efficiency means that dealers get the highest gross profit margins in the industry – 33%, vs. an average of 28% for competing brands. Cooper runs its plants at 100% capacity while others operate at about 80%. In a capital-intensive industry, that creates lots of leverage. The company also saves on R&D. Instead of pioneering its own designs, it often waits to see what sells well as original equipment. Says Gorr: “All we have to do is produce the winners.” Since new tires last up to four years, Cooper has ample time to produce its own version. (Car owners sometimes buy higher-rated tires when they replace the originals, but less frequently than in the past.) Occasionally a Cooper winner will last for years. For some military tires, the company has used the same molds since the 1950s. When Cooper wants to add capacity, it does so cheaply by buying old plants and retrofitting them. Its Tupelo, Mississippi factory, formerly owned by now-defunct Mansfield Tire & Rubber, runs 24 hours a day, seven days a week. Cooper constantly seeks ways to improve. Says chief financial officer J. Alec Reinhardt: “If you are making 20 million tires a year and you can take ten seconds out of the curing process, just think how much capacity you free up.” At its plant in Texarkana, Arkansas, changes in materials flow and production scheduling mean that inventory gets turned ten times a year instead of three to five. Dedicated workers help. Says Gorr: “We grow our talent and we motivate them with ownership, identity, and pride. The non-performer leaves us very quick – we see to that.” At 62, Gorr, a former Arthur Young accountant, ranks as a newcomer because he has put in only 20 years. An innovative system of incentive pay reaches deep into the ranks. Executive compensation is tied to performance benchmarks and provides for cuts, as well as raises, of up to 30%. Hourly workers get paid extra for producing more. Salaried employees can earn bonuses of up to 7.5% based on the return on assets they work with. The stock rose an astonishing 6,800% during the 1980s, richly rewarding many longtime employees who have invested in the company. Take a worker who made $6,811 in 1965 and was earning $36,744 at the end of last year. Had he faithfully invested 6% of his salary in Cooper stock, matched by the company, he would be able to retire today. Progressive “The Prince of Smart Pricing” If you were an auto insurer, who would you rather write a policy for – Terri Teetotaler, who never missed a stop sign, or Barry Barfly, who’s been pulled over several times for swerving? If you’d select Ms. Teetotaler, you’re in the company of most property and casualty insurers – and they’re nearly all losing money on the auto business. But if you chose Barry Barfly, you’d be virtually alone and profitable. And your company’s name would almost certainly be Progressive Corp. For years the medical, legal, and repair costs associated with car accidents have made auto insurance a loss leader for the companies. Progressive, based in Cleveland, has been virtually the only winner. Even more surprising, its policyholders have been rejected or canceled by other insurers. This residual group, known delicately as the “nonstandard” market, includes bad drivers and other undesirables, such as the elderly or recent immigrants who can’t read English. Insuring nonstandard risks has given Progressive nonstandard results. In the past decade premiums have grown at a rate of 20.2% a year, more than twice the industry average. In the same period return on shareholders’ equity has averaged 20.4%, vs. 7.9% for the industry. Take a closer look, and Progressive’s achievement is even more impressive. Property and casualty companies typically lose money on underwriting auto insurance and make it up by investing the premiums wisely. In the past decade, however, Progressive has averaged an almost unheard of 0.7% profit from underwriting compared with an average industry loss of 9.5%. Says insurance analyst William Bitterli of Northington Partners, a research firm: “That record is pretty much unique in the industry.” There are lessons for all businesses in the way this record has been built. First, Progressive knows how to price its product. Second, when part of its business is losing money, the company is not sentimental about getting out of it. Finally, improved customer service helps Progressive prevent fraud when accidents occur and settle claims quickly before the victims’ lawyers can lace up their track shoes. Where Progressive has a big advantage on pricing is in its ability to gauge whether a driver will have an accident. Since the 1950s the company has invested far more heavily than competitors in collecting and analyzing accident data. As a result, Progressive can price its policies more accurately. For example, most liability insurers don’t consider what kind of car the customer drives. Progressive does. The company would charge a married 35-year-old woman in Fairfax, Virginia, with one speeding ticket $605 to insure a 1990 Ford Taurus, $666 for a 1990 BMW 325i, and $728 for a 1990 Mazda Miata. The company is scaling back its long-haul trucking insurance, at least for now, because claims turned out to be much higher than anticipated – that all-knowing computer just hasn’t got enough data yet on accident rates. So while competitors reduced prices, Progressive is holding steady. That has cut business in half over the past three years from $175 million to slightly under $90 million. Say Peter Lewis, the flamboyant, Stetson-wearing CEO who is a son of one of Progressive’s founders: “It’s still not profitable, and we’ll keep paring it down in the next year or so until we get to the profitable part or we eliminate it altogether. We just don’t allow unprofitable businesses to continue.” In the same spirit, Lewis is making tracks out of California, where newly legislated rate caps have clobbered the auto insurance market and forced Progressive to take hefty charges that have cut deeply into 1991 earnings. Progressive is just starting to reap the benefit of a $60 million investment in claims service. In an area where the industry is often slow, bureaucratic, and adversarial, the company is taking a novel tack. Last year it hired more than 400 claims adjusters and support people, and installed a system to take accident reports by phone 24 hours a day, seven days a week. It does whatever it takes to get whatever is needed.