File

advertisement

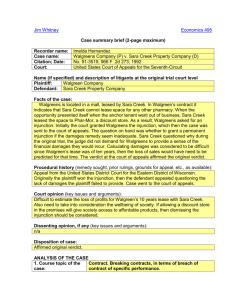

Submitted by: Roger Anderson, Leslie Burgy, Margie Pokorski, and Carolyn Sucaet 5-27-2013 Key Points Financial Analysis of Walgreen 2012 • Walgreen's main competitors are CVS Caremark and Rite Aid. • Walgreen and CVS together have more than 15,500 stores in all 50 statesand the District of Columbia. • Rite Aid has about 4,650 stores in 31 states and is building momentum as a top competitor. • Walgreen's past three year trend analysis shows a decline in 2012 compared to 2011. • The Peer Group Analysis shows Walgreen as a leader but its competitors are gaining momentum. The History of Walgreen and Current Milestones • Walgreen was founded in 1901 by Charles R. Walgreen, Sr.. • Charles R. Walgreen, Sr., worked as a pharmacist and purchased a Chicago drugstore in Deerfield, Illinois. He began opening stores which developed into a network. • As of April 1, 2013, Walgreen operated 8,057 drugstores in 50 states, the District of Columbia, and Puerto Rico. • Major milestones included specialty pharmacy services for managing complex and chronic health conditions; customer's infusion therapy services consisting of intravenous medications for cancer treatments, chronic pain, heart failure, and other infections and disorders. • Walgreen also provides laboratory monitoring, medication profile review, nutritional assessments, and patient and caregiver education. • Take Care Clinics are offered which provide patient treatments, administers prescriptions, immunizations, and other vaccines. Walgreen's Business Strategies • The most significant missed opportunity for Walgreen in 2012 was not entering into an agreement with Express Scripts, Inc., a leading pharmacy provider, resulting in a significant decline in prescriptions, sales, and lost customers. Eventually, Walgreen reentered into the Express Scripts agreement. • Walgreen entered into a global strategic partnership with Alliance Boots, a Swiss based company, which offers global health and beauty brands. • Walgreens became the first national pharmacy chain to be approved by the Centers of Medicare Services to participate in ACO’s, accountable care organizations in February 2013. Walgreen has partnered with three Medicare ACO’s in New Jersey, Florida and Texas. This strategy is regarded as a natural move into wellness enhancing their health model service line. 1 Walgreen Trend Analysis 2010, 2011, and 2012 • Sales in fiscal year 2012 total $71.6 billion as compared with $72.2 billion in 2011 and $67,520 billion in 2010. Sales declined due to the loss of the contract with Express Scripts a major pharmacy provider. • The current ratio declined from 2011 to 2012. The quick ratio stayed the same. • The debt ratio stayed the same and the debt to equity ratio increased from 2010 and 2011 to 2012. This was due to a significant increase in short term borrowings. • The times-interest-earned ratio was lower in 2012 as compared to 2011 and 2010. A higher values of times ratio is favorable showing Walgreen's ability to repay its interest and debt. Walgreen incurred additional debt at the close of 2012 due to an agreement entered into with Alliance Boots. Walgreen's long term debt was rated by Standard and Poor as BBB with a stable outlook. • The asset management ratios improved from 2011 to 2012. During fiscal year 2012, Walgreen added $1.6 billion to property and equipment which included new stores and information technology. • The profitability ratios all declined in 2012 as compared to 2011 due to the return on sales which dropped one percent in 2012 from 2011. • The market value ratios, earnings per share, declined sightly from $2.33 in 2011 to $2.32 in 2012, but improved from $2.12 in 2010. The price per earnings ratio had improved in 2012 to $15.41 from $15.22 in 2011. and $15.18 in 2010. Peer-Group Analysis • The groups of financial ratios analyzed were the liquidity, asset efficiency, profitability, leverage, and market value ratios. • The current ratio of Rite Aid is higher than CVS and Walgreen for 2012. • Rite Aid had a higher debt ratio and negative debt to equity ratio compared to Walgreen and CVS. • The profitability ratios indicates variability between all three companies. Fiscal year 2013 was the first year that Rite Aid showed improvement of their net income. • Walgreen and CVS demonstrated substantial earnings per share and return on total equity. • The peer group analysis supports the rankings assigned to these three peers in the retail pharmacy and drugstore chain. Conclusion of Walgreen's Financial Performance • The peer analysis illustrates that Walgreen continues to be a leader, but its strategic decisions in 2012 impacted its competitors favorably. • Walgreen at the "corner of happy and healthy" is accomplishing its goal of providing "happy savings and healthy incentives in perfect balance" (2012 Walgreens Annual Report) through its savings and rewards programs, technology, innovative ACO agreement, and expansion into the global market. • Walgreen is providing its investors with healthy and happy returns by returning cash to its shareholders and increasing dividends . 2