File - Leadership Development Plan

advertisement

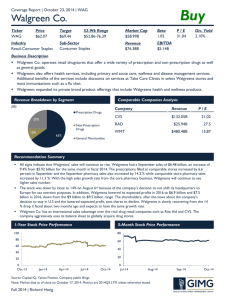

Running head: WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS A Financial Analysis of Walgreen in the Competitive Pharmacy Marketplace Roger Anderson, Leslie Burgy, Margie Pokorski, and Carolyn Sucaet Siena Heights University LDR 640 Financial Systems Management Prof. Lihua Dishman May 20, 2013 1 WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS Abstract “CVS and Walgreen they’re the Coca-Cola and PepsiCo of the retail pharmacy business. Together they have more than 15,500 stores in all 50 states and the District of Columbia, combined annual sales of almost $180 billion and nearly 450,000 full-time employees” (Aluise, 2012). Rite Aid has about 4,650 stores in 31 states and is building momentum as a top competitor by reporting their shares were the highest price in more than three years. Each company has employed strategies and campaigns to capture more market share and improve the financial viability of their company. Walgreen’s trend analysis for the past three years shows a decline from 2011 to 2012. A peer-group financial analysis review of Walgreen and its two competitors CVS and Rite Aid shows how each company performed in 2012 and how they benchmark against each other. Walgreen has positioned itself in the global market through a strategic partnership. Walgreen may be leading the way as presented in their financial statements, but may be showing some symptoms of financial distress due to a missed strategy in 2012. These symptoms may need to be remedied soon as its competitors are waiting in the wings to take the lead. Keywords: Walgreen, financial trends, ratios, peer group analysis, strategy 2 WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 3 A Financial Analysis of Walgreen in the Competitive Pharmacy Marketplace New drugstores are being built on the corner of every major intersection with a competitor adjacent to it. Have you ever wondered how drugstore companies can afford to purchase these buildings in prime locations and compete against each other financially? Which drugstore is healthier, Walgreen, CVS, or Rite Aid ? The State of Michigan underwent a major recession in 2008 due to the bankruptcy of the auto industry. It would appear that most businesses would have experienced the same consequences. “Although pharmacy sales weathered the recession well, growth in the $223 billion market has been relatively flat over the past five years, according to IBIS World analysts” (Aluise, 2012). This paper will explore the financial viability of Walgreen, Inc. and how it fares against its major competitors CVS and Rite Aid. A financial analysis will be presented using the following financial ratios: the liquidity ratios, the solvency ratios, asset management ratios, profitability ratios, and market value ratios. These ratios will assist in making assumptions about Walgreen’s current state, trends, and recommendations for future strategies. The next time you visit Walgreen on the “corner of healthy and happy” (Walgreens), or its major competitors, you will have a better understanding of their current financial state and future position. The History of Walgreen and Current Milestones Walgreen was founded in 1901 by Charles R. Walgreen, Sr. who purchased a Chicago drugstore where he worked as a pharmacist. After opening the initial store headquartered in Deerfield, Illinois, he began opening subsequent stores which developed into a network of drugstores in the United States. “As of April 1, 2013, it operated 8,057 drugstores in 50 states, the District of Columbia, and Puerto Rico. The company also operates approximately 700 WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 4 worksite health, and wellness centers, and in-store convenient care clinics in the United States” (Walgreens). Major milestones over the years include providing specialty pharmacy services for managing complex and chronic health conditions; customer’s infusion therapy services consisting of administration of intravenous medications for cancer treatments, chronic pain heart failure, and other infections and disorders; and clinical services, such as laboratory monitoring, medication profile review, nutritional assessments, and patient and caregiver education. In addition, the company operates Take Care Clinics to treat patients, give prescriptions, and administer immunizations and other vaccines (Walgreens our past, 2013). In 2012 Walgreens entered into a transaction with Alliance Boots, an international pharmacy health and beauty group “to create the first global pharmacy-led health and wellbeing enterprise” (Walgreens our past, 2013). Walgreen was also named to “Fast Company magazine’s list of Most Innovative Health Care Companies” (Walgreen co. reports fiscal 2012 fourth quarter and full year results, 2012). Walgreen’s strategy is to transform their traditional drugstores into “retail health and daily living store, creating community-centric healthcare integration with expanded pharmacy, health and wellness solutions” (Walgreen co. form 10-K, 2012, p. 4). Financial Statements Analysis Using Financial Ratios Four groups of financial ratios are useful tools to analyze a firm’s performance in relation to itself, its competitors, and within the industry. The groups of ratios are classified as liquidity, asset efficiency or activity, profitability, and leverage ratios. Liquidity ratios indicate how well an organization is able to pay their short-term debts. Asset efficiency or activity ratios measure management’s effectiveness at using its assets and liabilities internally. An improvement in WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 5 efficiency ratios usually translates to improve profitability. Profitability ratios evaluate a firm’s “ability to generate earnings as compared to its expenses and other relevant costs” (Investopedia, n.d.). Leverage ratios provide an overview of a firm’s use of debt, amount of debt, and its ability to meet financial obligations. In addition to these groups of financial ratios, market value ratios provide an indication “of the company’s risk and future prospects” (Brigham & Houston, 2007, p. 115). Financial ratios are determined through mathematical calculations using data obtained from the firm’s financial statements. Interpreting these ratios provides a picture of a company’s overall performance between accounting periods and assists analysis of the company in relation to competitors in the industry. Table 1 Walgreen 2012 Balance Sheet at August 31, 2012 and 2011 (In millions, except shares and per share amounts) Assets Current Assets Cash and cash equivalents Accounts receivable, net Inventories Other current assets Total Current Assets Non-Current Assets Property and equipment, at cost, less accumulated depreciation and amortization Equity investment in Alliance Boots Alliance Boots call option Goodwill Other non-current assets Total Non-Current Assets Total Assets Liabilities and Shareholders' Equity Current Liabilities 2012 $ $ 1,297 2,167 7,036 260 10,760 12,038 6,140 866 2,161 1,497 22,702 33,462 2011 $ $ 1,556 2,497 8,044 225 12,322 11,526 2,017 1,589 15,132 27,454 WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 6 Assets Short-term borrowings Trade accounts payable Accrued expenses and other liabilities Income taxes Total Current Liabilities Non-Current Liabilities Long-term debt Deferred income taxes Other non-current liabilities Total Non-Current Liabilities Commitments and Contingencies Shareholders' Equity Preferred stock, $.0625 par value; authorized 32 million shares; none issued Common stock, $.078125 par value; authorized 3.2 billion shares; issued 1,028,180,150 shares in 2012 and 1,025,400,000 shares in 2011 Paid-in capital Employee stock loan receivable Retained earnings Accumulated other comprehensive income Treasury stock at cost, 84,124,816 shares in 2012 and 136,105,870 shares in 2011 Total Shareholders' Equity Total Liabilities and Shareholders' Equity 2012 $ $ 1,319 4,384 3,019 8,722 2011 $ 13 4,810 3,075 185 8,083 4,073 545 1,886 6,504 2,396 343 1,785 4,524 - - 80 936 (19) 20,156 68 80 834 (34) 18,877 16 (2,985) 18,236 33,462 (4,926) 14,847 27,454 $ Table 2 Walgreen 2012 Income Statement at August 31, 2012 (In Millions, except per share and location amounts) Fiscal Year Net sales Cost of sales Gross Profit Selling, general and administrative expenses Gain on sale of business 2012 $ 71,633 51,291 20,342 16,878 - 2011 $ 72,184 51,692 20,492 16,561 434 WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 7 Fiscal Year 2012 2011 Operating Income Interest expense, net Earnings Before Income Tax Provision Income tax provision Net Earnings Per Common Share Net earnings Basic Diluted Dividends declared Book value Non-Current Liabilities Long-term debt Deferred income taxes Other non-current liabilities Assets and Equity Total Assets Shareholders' Equity Return on average shareholders' equity Locations Year-end 3,464 (88) 4,365 (71) 3,376 1,249 2,127 4,294 1,580 2,714 $ $ 2.43 2.42 0.95 19.32 $ $ 2.97 2.94 0.75 16.69 4,073 545 1,886 $ 2,396 343 1,785 33,462 18,236 $ 27,454 14,847 12.90% 18.60% 8,385 8,210 Table 3 Walgreen Statement of Cash Flow for the years ended August 31, 2012 and 2011 (In millions) Cash Flows from Operating Activities Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities Depreciation and amortization Gain on sale of business Deferred income taxes Stock compensation expense Other Changes in operating assets and liabilities Accounts receivable, net 2012 $ 2011 2,127 $ 2,714 1,166 265 99 43 1,086 (434) 132 135 53 394 (243) WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 8 Cash Flows from Operating Activities 2012 Inventories Other current assets Trade accounts payable Accrued expenses and other liabilities Income taxes Other non-current assets and liabilities Net cash provided by operating activities Cash Flows from Investing Activities Additions to property and equipment Purchases of short-term investments - held to maturity 1,083 (4) (439) (184) (228) 109 4,431 (592) (24) 384 218 102 112 3,643 (1,550) - (1,213) - - - 191 123 (191) 79 (491) (45) (4,025) (63) (5,860) (630) 442 (12) (1,525) 3,000 (1,191) 165 (787) (17) (17) (2,028) 235 (647) 15 1,170 (2,442) (259) 1,556 1,297 (324) 1,880 1,556 Proceeds from short-term investments - held to maturity Return of (investment in) restricted cash Proceeds from sale of assets Business and intangible asset acquisitions, net of cash received (Payments) proceeds from sale of business Investment in Alliance Boots Other Net cash used for investing activities Cash Flows from Financing Activities Payments of long-term debt Issuance of long-term debt Stock purchases Proceeds related to employee stock plans Cash dividends paid Other Net cash provided by (used for) financing activities Changes in Cash and Cash Equivalents Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 2011 $ $ Calculation and Analysis of 12 Financial Ratios Table 4 Walgreen Financial Ratios and Calculations Fiscal Year 2012 (In millions) Ratio Definition Formula and Calculations WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS Ratio Definition 9 Formula and Calculations 1. The Current Ratio is the primary liquidity ratio. Current assets include cash, marketable securities, accounts receivable, and inventories. It indicates the extent to which current liabilities are covered by those assets expected to be converted to cash in the near future. Current Ratio=Current assets/Current Liabilities 2. The Quick Ratio or Acid Test Ratio is the second most used liquidity ratio. This ratio is a measure of the firm’s ability to pay off short-term obligations without relying on the sale of inventories. Inventories are typically the least liquid of a firm’s assets. Quick Ratio =Total quick assets/Current Liabilities 3. The Debt Ratio is used to gain a general idea as to the amount of leverage being used by a company. A low percentage means that the company is less dependent on leverage, i.e. money borrowed from and/or owed to others. Debt Ratio=(Total current liabilities + Total noncurrent liabilities)/Total Assets 4. The Debt-to-Equity Ratio is a measure of financial leverage. It indicates what proportion of equity and debt the company is using to finance its assets. A high debt/equity ratio generally means that a company has been aggressive in financing its growth with debt (Debt to equity ratio, 2013). 5. Times-Interest-Earned Ratio (TIE Ratio) measures the extent to which operating income can decline before the firm is unable to meet its annual interest costs. 6. Inventory Turnover Ratios are ratios where sales are divided by some asset, and they show how many times the item is “turned over” during the year. $10,760 Total current assets/$8,722 Total current liabilities=1.23 All figures from the balance sheet $3,464 Operating income from income Statement/$8,722 Total current liabilities from the balance Sheet=0.40 ($8,722 Total current liabilities + $6,504Total non- current liabilities)/$33,462 Total assets=0.46 All figures from the balance Sheet Debt-to-Equity Ratio=Total debt(short-term borrowings +long-term debt)/Shareholders’ equity ($1,319 short term borrowings + $4,073 long term debt)/$18,236 Total shareholders’ equity=0.30 All figures from the balance sheet Times-Interest-Earned Ratio (TIE Ratio)=EBIT/Interest expense $3,484 operating income/$108=32.26 All figures from the from income statement Inventory Turnover Ratio=Net sales/Inventories $71,633 Net sales from income statement/$7,036 inventories from the balance sheet=10.18 WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS Ratio Definition 10 Formula and Calculations 7. The Total Assets Turnover Ratio measures the ability of a company to use its assets to efficiently generate sales. The ratio considers all assets, current and fixed. Those assets include fixed assets, like plant and equipment, as well as inventory, accounts receivable, as well as many other current assets (Peavler, n.d.). Total Assets Turnover Ratio= Net Sales/Total assets 8. Return on Sales (ROS) is widely used to evaluate a company’s operational efficiency. ROS is also known as a firm’s “operating profit martin” (ROS, 2013). Return on Sales (ROS)=Profit Margin on Sales=Operating Income/Net Sales or (Expenses-Revenue)/Profit by sales 9. Return on Total Assets (ROA) is the ratio of net income to total assets measures after interest and taxes. 10. Return on Total Equity (ROE) is referred to as the “bottom-line” accounting ratio. Stockholders expect to earn a return on their money, and this ratio tells how well they are doing in an accounting sense (Brigham & Houston, 2007). 11. Earnings Per Share (EPS) is called the “bottom line” denoting that of all items on the income statement EPS is generally the most important to stockholders. Earnings and dividends per share are given at the bottom of the income statement (Brigham & Houston, 2007). $71,633 Net sales from income statement/$33,462 total assets from the balance sheet =2.14 $3,575 Operating income from income statement/$71,633 Net sales from the income statement=5% Return on Total Assets (ROA)=EAT or Net earnings/Total assets $2,127 Net earnings/$33,462 Total assets=6.36% All figures from the income statement Return on Total Equity (ROE)=EAT or Net earnings/Total Shareholder’s equity ending 8-312012 $2,127 Net earnings/18,236 Shareholder’s equity=11.66% All figures from the income statement Earnings Per Share (EPS)=EAT/(Number of shares of common stock outstanding from Stockholder’s Equity 2012 period end 8-31-2012 + number of shares of common stock for the period end 8-31-2011)/2 to obtain the average. (Beginning of year + End of year)/2 $2,127 Net earnings from income statement/ average 916,674,732 shares of common stock=$2.32 (889,294,130 shares of common stock taken from Stockholder’s Equity statement 8-31-2011 + 944,055,334 shares from 8-31-2012)/2 = average 916,674,732. $2,127/916,674,732 = WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS Ratio Definition 11 Formula and Calculations $2.32. Earnings per diluted share = $2.42 is reported on the Fiscal Year 2012 report using the average shares outstanding (diluted) $2,127,000,000/880,000,000=$2.42 (diluted EPS) 12. Price/Earnings Ratio (P/E Ratio) shows how much investors are willing to pay per dollar of reported profits. P/E ratios are higher for firms with strong growth prospects and relatively little risk. Price/Earnings Ratio (P/E Ratio)= Price per share/Earnings per share $35.76/$2.32 Earnings Per share=$15.41 ($35.76 price per share taken from yahoo finance 2012.) Walgreen Trend Analysis Table 5 Walgreen Trend Analysis Past Three Years Ratio Current Ratio Quick Ratio Debt Ratio Debt to Equity Ratio Times-Interest-Earned Ratio Inventory Turnover Ratio Total Assets Turnover Ratio Return on Sales Return on Total Assets Return on Total Equity Earnings Per Share Price/Earnings Ratio 2010 2011 2012 1.6 0.58 0.48 0.17 38.90 9.14 2.57 5% 7.96% 14.52% $2.21 $15.18 1.52 0.40 0.46 0.16 49.25 8.97 2.63 6% 9.89% 18.28% $2.33 $15.11 1.23 0.40 0.46 0.30 32.26 10.18 2.14 5% 6.36% 11.66% $2.32 $15.41 Sales in fiscal year 2012 total $71.6 billion as compared with $72.2 billion in 2011 and $67,520 billion in 2010. Walgreen’s operating profit margin improved from 2010 to 2011 but WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 12 then deteriorated significantly from 2011 to 2012. The liquidity ratio includes the current ratio, which declined in 2012 to 1.23 from 1.52 in 2011 and 1.6 in 2010. This ratio measures the ability of the company’s assets to cover its liabilities. This would be consistent with the drop in sales or assets as compared to 2011 to cover their liabilities and the increase in liabilities in 2012 from $8,083 in 2011 and $7,433 in 2010. The drop in sales is attributed to the loss of the firm entering into an agreement with Express Scripts resulting in decreased prescription sales. In the fourth-quarter of fiscal year 2012, profits decreased greater than fifty percent. Walgreen states that this was further compounded by a decrease in consumer spending. In addition, on August 2, 2012, Walgreen invested in Alliance Boots GmbH which cost $90 million pre-tax. “Costs included $69 million in selling, general and administrative expenses and $21 million of interest expense” (Walgreen co. form 10-K, 2012, p .40). These increases in costs were also due to “higher occupancy expenses and drugstore.com expenses” (Walgreen co. form 10-K, 2012, p. 44). The quick ratio remained the same in 2011 and 2012 but declined as compared to 2010. This would indicate that Walgreen did not rely on the sale of inventories during this fiscal year even though their operating income declined. Inventories declined and were $7,036 in 2012 compared to $8,044 in 2011. The current liabilities increased in 2012 to $8,722 (millions) from $8,083 in 2011 and $7,433 in 2010. The cash and cash equivalents, short-term investments and net accounts receivable declined in 2012 to $3,464 from $4,053 in 2011 and $4,330 in 2010. The debt management ratios included the debt ratio which stayed the same in 2011 and 2012 at .46 and dropped compared to .48 in 2010. A low percentage is preferred indicating that the company is less dependent on leverage or borrowing money in order to sustain their business. The long-term debt was significantly higher in 2012 $4,073 as compared to $2,396 in 2011 and $2,389 in 2010. This ratio would be offset by the shareholders’ equity that increased in 2012 to WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 13 $18,236 from $24,847 in 2011 and $14,400 in 2010. Therefore, the lower debt ratio in 2011 and 2012 is positive compared to 2010. The debt-to-equity ratio is another measure of financial leverage that is preferred to be low to show that that the company does not rely on growth through borrowing and debt. This ratio was significantly higher in 2012 at .30 compared to .16 in 2011 and .17 in 2010. This is due to the increase in short-term borrowings of $1,310.0 in 2012 compared to $5.0 in 2011 and 2010. Even though the shareholders’ equity increased in 2012 as noted above the ratio was affected by the significant increase in short term borrowings. This means that Walgreen was financing its growth with debt. The Times-interest-earned ratio, or TIE ratio, was significantly lower in 2012 as compared to 2011 and 2010. A higher value of times ratio is favorable showing Walgreen’s ability to repay its interest and debt. The interest expense was higher in 2012 at $108 compared to $89 in 2011 and 2010. In fiscal 2012, Walgreen incurred $21 million in interest expense on the bridge term loan facility in conjunction with the investment in Alliance Boots GmbH (Walgreen co. form 10-K, 2012). “A ratio of 1.0 means that income before interest and tax of the business is just enough to pay off its interest expense” (Times interest earned ratio). This ratio is important to creditors. A creditor would lend to a company with the highest times interest earned ratio. The 2012 annual report points out that Walgreen is concerned about incurring additional debt by the agreement entered into with Alliance Boots. Its creditors will monitor Walgreen if the trend continues to decline. As of October 19, 2012, Moody has rated the Long-Term Debt as Baaa1 with a negative outlook. Standard and Poor’s rated their long-term debt as BBB with a stable outlook. These ratings impact Walgreen’s borrowing costs, access to capital markets and operating lease costs (Walgreen co. form 10-K, 2012). WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 14 The asset management ratios include the inventory turnover ratio, which rose to 10.18 in 2012 compared to 9.14 in 2010, and 8.97 in 2011. This ratio was unfavorable from 2010 to 2011 but then improved from 2011 to 2012 exceeding 2010 levels. This ratio measures the number of times an item is turned over in a year. During fiscal 2012, Walgreen added $1.6 billion to property and equipment which included new stores and information technology. The total asset turnover ratio considers all assets, current and fixed such as plant and equipment as well as inventory and accounts receivable. This ratio declined in 2012 at 2.14 compared to 2.63 in 2011 and 2.57 in 2010. Sales declined in 2012 but the total assets increased. The company acquired Alliance Boots at the end of the fiscal year and did not have the ability to generate sales to offset the investment due to the timing. The profitability ratios all declined in 2012 compared to 2011 due to the return on sales which dropped one percent in 2012 from 2011. This ratio is used to evaluate a company’s operational efficiency and helps management in determining how much profit is being produced per dollar of sales. If this ratio trend declines, it could indicate that company is in trouble. Sales declined -0.8% $71.6 compared to 2011 at $72.2. Operating income decreased in 2012 from $3,575 to $4,103 in 2011 and $3,626 in 2010. This ratio would reflect the impact of the loss of Express Scripts with decreased prescription sales. Return on Total Assets (ROA) is the ratio of net income to total assets measures after interest and taxes. This ratio looks at how efficient management is in using its assets or allocating its resources to generate earnings (Investopedia, n.d.). This ratio is consistent with showing a decline in 2012 as compared to 2011 but had improved from 2010 to 2011. These ratios are consistent with the decline in net earnings and total assets for the same period. The Return on Equity ratio improved from 2010 to 2011 but then declined significantly from 2011 to 2012. These ratios aligned with the decrease in net WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 15 earnings in 2012 and impacted this ratio to be lower even though the shareholders’ equity had increased in 2012. The shareholders’ equity (in millions) increased significantly in 2012 at $18,236 as compared to $24,847 in 2011 and $14,400 in 2010. The Market Value Ratio EPS, earnings per share, is an indicator of a company’s profitability and a “favorite of financial analysts” (Hawawini & Viallet, 2011, p. 158). This ratio is very important to stockholders. There is variability in calculating this ratio. As calculated on the 2012 annual report, the average shares outstanding used in the EPS calculation are 880,000,000 diluted resulting in a diluted EPS of $2.42. “A diluted EPS expands on the basic EPS by including the shares of convertibles or warrants outstanding in the outstanding shares number” (Investopedia, n.d.). As the EAT, earnings after taxes, is a period of time measure, the calculation should include the average number of shares of common stock outstanding from the (beginning of the year + the end of the year) / two. The result of this calculation would be more accurate with a result of $2.32. Some companies use the number of stock at the end of the period to simplify the calculation. The EPS in 2012 declined slightly from $2.33 in 2011 to $2.32 in 2012 but had improved from $2.12 in 2010. A high P/E ratio is a measure of projected future growth. A company with a low price per earnings ratio is considered risky to invest in and has poor growth potential. The price per earnings ratio in 2012 was $15.41 as compared to $15.11 in 2011 and $15.18 in 2010. The stock price was $35.76 in 2012 compared to $35.21 in 2011. Peer-Group Analysis Table 6 Peer-Group Analysis for Walgreen, CVS, and Rite Aid, 2012 Ratio Current Ratio Quick Ratio Walgreen CVS Rite Aid 1.23 0.40 1.44 0.57 1.71 0.49 WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS Ratio Debt Ratio Debt to Equity Ratio Times-Interest-Earned Ratio Inventory Turnover Ratio Total Assets Turnover Ratio Return on Sales Return on Total Assets Return on Total Equity Earnings Per Share Price/Earnings Ratio 16 Walgreen CVS Rite Aid 0.46 0.30 32.26 0.43 0.26 12.16 1.35 -2.45 1.01 10.18 2.14 11.44 1.87 8.04 3.59 5% 6.36% 11.66% $2.32 $15.41 3.15% 5.88% 10.28% $3.27 $15.96 4.45% 6.21% 0 $0.12 $11.63 Peer Group Analysis Narrative Both CVS and Rite Aid identify as the direct competitors for Walgreens as evidenced by market presence and strategies as well as product overlap. Considered by most measures to be the second largest drugstore retail chain the in the United States, CVS demonstrates a consistent financial performance with a 14.2% increase in operating profit from fiscal year 2011 to 2012 (CVS Caremark Annual Report 2012, p. 51). Rite Aid is the third largest retail drugstore chain in the United States in both revenues and number of stores. “Rite Aid's stock trades with a market-cap around $1.1 billion, compared to major peers Walgreen ($35 billion) and CVS ($60 billion) that trade much higher. Both Walgreen and CVS also have solid cash positions, $1.8 billion and $1.2 billion, respectively (Hardgrave, 2012, p. 1). Similar to Walgreens, both CVS and Walgreens operate a segmented business model by selling prescription drugs as well as other retail merchandise. CVS posted 68.8% of the most recent fiscal year’s net revenue from its pharmacy business with the rest from the other retail business (p. 32). At Rite Aid for fiscal year 2013, prescription drug sales accounted for 67.6% of WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 17 the total sales and the remaining 32.4% was “front-end” products (Rite Aid Corporation Form 10-K 2013, p. 3). Rite Aid believes that pharmacy operations will continue to represent a significant part of their business due to favorable industry trends, an aging population, increased life expectancy, anticipated growth in Medicare Part D prescription coverage and the expanded coverage of uninsured Americans as a result of the Affordable Care Act (Rite Aid Corporation Form 10-K. 2013, p. 3). Strategies at CVS have paralleled this, however management notes challenges in the continued margins in this area due to conversion of many former named drugs to generic as well as to unpredictable impacts from managed care such as multi-sourced drug pricing. The primary strategic goal for fiscal year 2014 is to continue transformation of Rite Aid into a neighborhood destination for health and wellness. The primary financial goal for fiscal year 2014 is to continue to expand the EBITDA margins. According to the Rite Aid Form 10-K 2013, there are factors that will affect their future financial prospects, “current economic conditions, substantial indebtedness, variable interest rates, stockholders will experience dilution if additional common stock is issued and the ability of the Jean Coutu Group’s right to sell common stock at any time” (pp. 11-13). Analysis of the peer group reveals that the current ratio of Rite Aid is higher than CVS and Walgreen for 2012. “The larger the current ratio, the more liquid the firm, meaning it should be easier for Rite Aid to repay their short term liabilities with the cash raised from the sale of their short term assets. The current ratio should be at more than one and closer to two” (Hawawini and Viallet, 2011 p. 85). All three drug stores have a current ratio above one and Rite Aid had more has the highest current ratio at 1.71, indicating that the current assets are greater than liabilities. As noted in Table 6, CVS has the greatest quick ratio, which is a liquidity WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 18 ratio indicating the amount of cash and accounts receivable related to liabilities. Based on this, one may infer that CVS has a greater amount of cash. At the end of their last fiscal year, reported $1,375,000,000 in cash and cash equivalents compared to Rite Aid’s $129,450,000. As of March 2, 2013, Rite Aid had $6.0 billion of outstanding indebtedness and stockholders’ deficits of $2.5 billion. Their earnings were insufficient to cover fixed charges and preferred stock dividends for fiscal 2013 by $140 million. Rite Aid has a higher debt ratio and a negative debt to equity ratio related to their extreme indebtedness compared to Walgreen and CVS. By contrast, CVS demonstrated $28.2 billion in current liabilities and $37.7 billion in shareholder’s equity that included $25 billion in retained earnings, balanced to assets of $65.9 billion. The comparison of profitability ratios indicates variability between all three companies. Fiscal year 2013 was the first year that Rite Aid showed improvement of their net income at $118.1 million compared to ($368.57) million in fiscal year 2012. In keeping with the preceding years of financial loss, only Walgreens and CVS have demonstrated substantial earnings per share (EPS) and return on total equity as well. Each of these ratio sets and groups of key measures support the rankings assigned to these three peers in the retail pharmacy and drugstore chain. Analytical Report of Walgreen’s 2012 Financial Performance Fiscal year 2012 was a challenging year for Walgreen. “While we controlled costs and generated strong cash flow in the fourth quarter, our performance also reflected a strategic shift in promotional spending, a continued economically challenged consumer, and the impact from Express Scripts, said Walgreens President and CEO Greg Wasson” (Walgreen co. reports fiscal 2012 fourth quarter and full year results, 2012). Express scripts are a pharmacy provider WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 19 network consisting of six million customers, whose contract was not entered into with Walgreen in Fiscal Year 2012. This breakdown in contract negotiations caused a negative result on the cost per diluted share for the fiscal year to drop six cents to $2.42. According to Cahill (2012), this was the “worst corporate blunder of the year” (para. 5). Prescription sales dropped 8.1% in the fourth quarter of 2012 a decrease of 6.9% over the same quarter in 2011. Walgreen’s 2012 annual report indicates that comparable stores declined 12.8 percent during this same period. Walgreen had increased expenses in selling, general and administrative costs due to the investment in Alliance Boots. “During the fiscal 2012, the company returned more than $1.9 billion to shareholders through dividends and share repurchases. This was consistent with the company’s goal of returning cash to shareholders, and Walgreens has now increased its dividend for thirty seven consecutive years” (Walgreen co. reports fiscal 2012 fourth quarter and full year results, 2012). The combination of reduced profits from prescription sales, decreased consumer spending, and increased expenses of the Alliance Boots investment resulted in a decline in Walgreen’s 2012 financial performance as corroborated in the three-year trend analysis review. Analysis of Walgreen’s Strategies in 2012 and 2013 The most pronounced missed opportunity for Walgreen in 2012 was not entering into an agreement with Express Scripts Inc., a leading pharmacy provider, resulting in a significant decline in prescriptions, sales, and lost customers. This decision affected the decrease in financial ratios in 2012 from 2011. Walgreen reentered into the Express Scripts agreement along with adding other pharmacy providers. Walgreen launched a marketing campaign to recover lost customers that migrated to its competitors. “Fiscal Year 2013 launched a groundbreaking customer loyalty program called Balance Rewards that offers easy enrollment, instant points and endless rewards. It even rewards customers for healthy behavior such as getting flu shots and WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 20 exercise. Balance rewards will take our Well Experience to a new level” (2012 Walgreens Annual Report, p. 3). Walgreen also purchased a drugstore chain, USA Drug. Should Walgreen consider purchasing Rite Aid? Walgreen should consider an analysis of a merger with Rite Aid. Rite Aid is considered a “wild card” in the competitor arena by Susan Aluise (2012). Three future goals for Walgreen are to execute the partnership with Alliance Boots, expand its Well Experience stores and concepts throughout Walgreen, and advance the role that community pharmacy can play in healthcare across the communities that they serve (2012 Walgreens Annual Report, p. 5). “Walgreens became the first national pharmacy chain to be approved by the Centers of Medicare Services to participate in ACO’s, accountable care organizations in February 2013.” (Punke, 2013) Walgreen has partnered with three Medicare ACO’s in New Jersey, Florida and Texas. This strategy is regarded as a natural move into wellness enhancing their health model service line. Since the Medicare population is increasing, Walgreen will benefit by capitalizing on this segment of customers resulting in increased market share. Walgreen needs to demonstrate “that they can serve 5,000 beneficiaries” (Punke, 2013). Walgreen certainly would have a vested interest in reaching and exceeding that threshold. They believe that they are the community link to acute care hospitals by providing health services from nurse practitioners and pharmacists in their drugstores. Recommendation for Walgreen’s Global Business Strategies in the Next Three Years In the fourth quarter of 2012 Walgreen entered into a global strategic partnership with Alliance Boots, a Swiss based company, which offers global health and beauty brands. This agreement will create strength and growth in the international market for both companies. “Global spending on medicine is expected to soar in the coming decade, with most of the growth WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 21 coming in the emerging markets that Walgreen is targeting for expansion” (Japsen, 2012, p. 38). According to Japsen (2012), Obamacare is a challenge due to the ongoing implementation of government control to “capitalize on emerging markets”(p. 38). Therefore, Walgreen’s strategy to invest in Alliance Boots was a smart move to obtain global positioning in the market while responding to the government economic threat. With projections of global spending on medicine increasing, and increased government restrictions, Walgreen should focus its strategies on ensuring the success of its investment in Alliance Boots. Walgreen should seek additional expansion opportunities in the global market to develop and grow its business. The global entry puts Walgreen ahead of its competitor CVS which is primarily based in the United States. “The Walgreens-Alliance Boots partnership will accelerate our strategy to transform the traditional drugstore. Walgreens now has interests in businesses in Europe and across the globe (2012 Walgreens Annual Report, p. 4) and would become a world leader should they acquire the remaining 55% of Alliance Boots. Conclusion The overall financial wellness of Walgreen was outlined in the 2012 financial analysis, Table Four presents financial ratios, Table Five demonstrates the past three-year trend analysis, and Table Six illustrates a peer comparison analysis. Fiscal year 2012 was unfavorable as compared to 2011 primarily due to the disengagement with Express Scripts., decreased consumer spending, and entering into a major investment with Alliance Boots at the end of the fiscal year. The trend analysis also supports the effects of these influences in the decreased performance of Walgreen from 2011 to 2012 in all of the key ratios. The peer analysis showed that Walgreen continues to be a leader, but its strategic decisions in 2012 impacted its competitors favorably. Walgreen at the “corner of happy and healthy” is accomplishing its goal of providing “happy WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 22 savings and healthy incentives in perfect balance” (2012 Walgreens Annual Report) through its savings and rewards programs, technology, and expansion into the global market. Walgreen is also providing its investors with healthy and happy returns by returning cash to its shareholders and increasing dividends and as evidenced through the 2012 Annual Report Analysis. Even though the sales declined in 2012, the future is optimistic with their new strategies of global expansion, renewing their agreement with Express Scripts, and their innovative link to healthcare through ACO’s, Walgreen will be financially viable and positioned well into the future. WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS 22 References Aluise, S. J. (2012, May 23). Investor Place. Retrieved from Investor Place: http://www.marketinsight:financial articles.com Brigham, E. F., & Houston, J. F. (2007). Fundamentals of financial management (5th ed.). Mason, OH: Thomson South-Western. Cahill, J. (2012). And the award for 2012's worst blunder goes to . . . Crain's Chicago Business, 35(52). Retrieved from http://web.ebscohost.com/ehost CVS Caremark Investor Relations. (2012). Retrieved April 2013, from http://investor.cvs.com/ Hawawini, G., & Viallet, C. (2011). Finance for executives: Managing for value creation (4th ed.). Mason, OH: South-Western Cengage Learning. Investopedia. (n.d.). Retrieved from http://www.investopedia.com/terms Japsen, B. (2012, September 24). Earth's drugstore. Forbes, 36-38. Peavler, R. (n.d.). What is the total asset turnover ratio and how is it calculated? Retrieved from http://www.about.com/guide Punke, H. (2013, February). Walgreen's strategy behind aco participation. Retrieved from http://www.beckerhospitalreview.com/hospital Rite Aid Corp. Investor Relations. (2012). Retrieved April 2013, from http://www.riteaid.com/company/investors United States Securities and Exchange Commission. (n.d.). Washington, D.C. Retrieved April 2013, from http://www.sec.gov/archives/edgar/data WAG shares of common stock. (2012). Retrieved from Retrieved from http://finance.yahoo.com/q/hp?s=WAG Walgreen Co. investor relations. (2012). Retrieved from http://investor.walgreens.com WALGREEN COMPREHENSIVE FINANCIAL ANALYSIS References Walgreens our past. (2012). Retrieved from http://walgreens.com/marketing/about/history Walgreens. (2012). Retrieved 2013, from Walgreens: http://www.walgreens.com 24