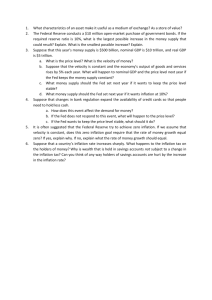

Problem Set 14

advertisement

Problem Set 14 Econ 201 (03 and 04) Spring 2002 (Dr. Tin-Chun Lin) 1. The two main macroeconomic stabilization policy targets are: (A) The foreign exchange rate and the federal deficit. (B) Inflation and the federal deficit. (C) Real GDP growth and the foreign exchange rate. (D) Real GDP growth and inflation. (E) Income distribution and inflation. (Answer: (D)) 2. Under a fixed policy rule, a decrease in aggregate demand will cause the price level to (A) Decrease and real GDP to decrease. (B) Decrease and real GDP to remain unchanged. (C) Remain unchanged and real GDP to decrease. (D) Remain unchanged and real GDP to remain unchanged. (E) Increase and real GDP to increase. (Answer: (A)) 3. Suppose that, starting from a full-employment equilibrium, there is a temporary unexpected decline in aggregate demand. Our feedback rule is increase the money supply whenever there is a fall in aggregate demand and decrease the money supply whenever there is a rise in aggregate demand. In this case, our rule would result in (A) An increase in real GDP to above its full-employment level and a rise in the price level above its original value. (B) Real GDP jumping back to its full-employment level and the price level jumping back to its original value. (C) An increase in real GDP but not back to full-employment level and no effect on the price level. (D) A slow increase in real GDP back to its full-employment level and a slow rise in the price level. (E) None of above. (Answer: (B)) 4. Which of the following is not an argument against a feedback rule? (A) Feedback rules require greater knowledge of the economy than we have. (B) Feedback rules introduce unpredictability. (C) Aggregate supply shocks cause most economic fluctuations. (D) Aggregate demand shocks cause most economic fluctuations. (E) None of above. (Answer: (D)) 5. Which of the following is the basic reason for the claim that feedback rules generate bigger fluctuations in aggregate demand? (A) Policymakers use the wrong feedback rules to achieve their goals. (B) Policymakers must take actions today which will not have their effects until well into the future. (C) Policymakers do not really want to stabilize the economy. (D) Policymakers try to make their policies unpredictable. (Answer: (B)) 6. Under a feedback policy rule that increases the money supply growth rate when real GDP is below its long-run level, an increase in the price of oil will cause the price level to rise by (A) Less than under a fixed policy and real GDP to return to its long-run level. (B) Less than under a fixed policy and real GDP to remain below its long-run level. (C) More than under a fixed policy and real GDP to return to its long-run level. (D) More than under a fixed policy and real GDP to remain below its long-run level. (E) Equal to under a fixed policy and real GDP to remain below its long-run level. (Answer: (C)) 7. A fixed rule for monetary policy (A) Requires considerable knowledge of how changes in the money supply affects the economy. (B) Would be impossible for the Fed to achieve. (C) Maximize the threat of cost-push inflation. (D) Minimizes the threat of cost-push inflation. (E) Would result in constant real GDP. (Answer: (D)) 8. If the Fed reduces the rate of growth of the money supply unexpectedly, in the short run the rate of inflation will (A) Decrease and the rate of unemployment will increase. (B) Decrease and the rate of unemployment will decrease. (C) Actually increase and the rate of unemployment will increase. (D) Actually increase and the rate of unemployment will decrease. (E) Decrease and the rate of unemployment will not change. (Answer: (A)) 9. (True or False) The Fed could lower the rate of inflation without creating a recession if its inflation reduction policy is fully expected. (Answer: True) 10. (Essay) If the Fed announced its intention to reduce the rate of inflation by reducing the rate of growth of the money supply, expected inflation would decline accordingly and thus a reduction in the actual rate of inflation could be achieved without a recession. Why does this not seem to be the case? (Answer: The problem is that expected inflation may not in fact decline as a result of the announcement by the Fed. The Fed may have a credibility problem since expectations will be much more strongly affected by the record of actions by the Fed than by its announcement. If people don’t believe the Fed, they will not adjust expectations. Then, if the Fed carries out the policy, a recession will result in spite of the fact that an announcement was made.)