Macro Review: GDP, Unemployment, Inflation

advertisement

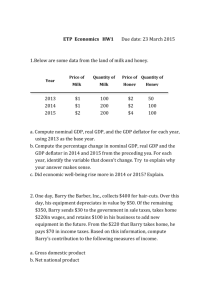

Unit-2 Macro Review GDP, Unemployment, Inflation Circular Flow of a closed Economy Revenue Goods and services sold PRODUCT PRODUCT MARKET MARKET FIRMS FIRMS Factors of production Wages, rent, and profit Spending Goods and services bought HOUSEHOLDS HOUSEHOLDS FACTOR FACTOR FACTOR Market MARKET Labor, land, capital & entrepreneurship Income = Flow of inputs and outputs = Flow of dollars BUSINESS CYCLE: rate of GDP Growth GDP growth by quarter 1st quarter 2012 +2.2% All 2011 +1.7% Calculating GDP: Business Investment, Consumer/Business Construction, & Change in Inventories. (new houses count as investment!) GDP = C + I + G + (X-M) What Counts? Only NEW & FINAL goods Domestic Products What does not Count? Used goods International products Financial transactions Non-market transactions Gov’t Transfers (i.e. welfare, social security) GDP does not measure: mix of goods, quality of products, quality of life, leisure time GDP = C + I + G + NX Spending Revenue Goods and services sold PRODUCT MARKET Goods and services bought 2 Ways to measure GDP or HOUSEHOLDS FIRMS All Spending = All Income: Labor, land, capital & entrepreneurship Factors of production Y = C + I + G + (X-M) FACTOR Market Wages, rent, and profit Income = Flow of inputs and outputs = Flow of dollars Labor Land Capital Entrep. Talent GDP = Aggregate Demand (AD) (all spending or all income) Wages Rent Interest Profit 4-Types of Unemployment • Structural – Skills do not match demand for labor • Cyclical – too low a level of GDP (recession) • Frictional – Temporarily between Jobs • Seasonal – Based on time of year Natural Rate of Employment (or full employment) Allows for some Frictional & Structural Where: Cyclical = zero Seasonal “factored out” Expected Inflation versus Actual Inflation • In theory, if actual inflation = expected inflation, people have time to adjust for it. (less harmful) Nominal Interest Rate = Real Interest Rate + Expected Inflation COLA = cost of living adjustment GDP Deflator vs CPI • GDP deflator – prices of all goods/services produced domestically • CPI index – prices of a market basket of goods & services – (including international goods) CPI Index: 1990 100 2000 115 What should be in basket? Substitution Bias New goods Quality changes (115 – 100) X 100 = +15.0% 100 Called Base year Practice Test #2 • Questions #1 - #20 Multiple Choice Answers 1 D 2 C 3 C 4 D 5 B 6 A 7 E 8 B 9 A 10 C 11 B 12 D 13 C 14 A 15 B 16 D 17 A 18 A 19 A 20 A 2-Types of Inflation • Demand-Pull Inflation: – Too many dollars chasing too few goods – Example: printing money • Cost-Push Inflation – ↑ cost of factors of production – example: price of oil or labor rises rapidly