11MONEY, INTEREST, REAL GDP, AND THE PRICE LEVEL*

advertisement

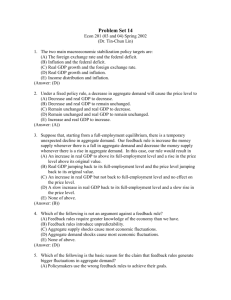

C h a p t e r 11 Key Concepts The Demand for Money Four factors influence the demand for money: ♦ The price level — An increase in the price level increases the nominal demand for money. ♦ The interest rate — An increase in the interest rate raises the opportunity cost of holding money and decreases the quantity of real money demanded. ♦ Real GDP — An increase in real GDP increases the demand for money. ♦ Financial innovation — Innovations that lower the cost of switching between money and other assets decrease the demand for money. Figure 11.1 shows the demand for money curve (MD). The real quantity of money equals the nominal quantity divided by the price level. Changes in the interest rate create movements along the demand curve; changes in the other relevant factors change the demand and shift the demand curve. Interest Rate Determination An interest rate is the percentage yield on a financial security; other variables being the same, the higher the price of the security, the lower is the interest rate. The interest rate is determined by the equilibrium in the market for money, as illustrated in Figure 11.2. The real supply of money is $3.0 trillion, so the supply curve of money is MS. The demand curve for money is MD, and the equilibrium interest rate is 5 percent. ♦ If the Fed increases the quantity of money, the supply of money curve shifts rightward and the equilibrium interest rate falls. If the Fed decreases the quantity of money, the supply of money curve shifts leftward and the equilibrium interest rate rises. * This is Chapter 27 in Economics. 163 MONEY, INTEREST, REAL GDP, AND THE PRICE LEVEL* 164 CHAPTER 11 (27) Short-Run Effects of Money on Real GDP and the Price Level The Fed’s actions ripple through the economy. Higher interest rates: ♦ Decrease investment and consumption expenditure ♦ Increase the foreign exchange price of the dollar, which then decreases net exports ♦ A multiplier process then occurs Real GDP growth and the inflation rate both slow when the Fed raises the interest rate. The opposite effects occur when the Fed lowers the interest rate. These effects are how the Fed influences the economy. The macroeconomic short run is a period during which some money prices are sticky and real GDP might be below, above, or at potential GDP. If real GDP exceeds potential GDP so there is an inflationary gap, the Fed tightens to avoid inflation. The Fed decreases the quantity of money, which raises the interest rate. The higher interest rate decreases interestsensitive components of aggregate expenditure, such as investment. The decrease in investment leads to a multiplier effect that decreases aggregate demand, thereby lowering the price level and decreasing real GDP so it equals potential GDP. If the Fed eases to avoid a recession, the reverse results occur. Long-Run Effects of Money on Real GDP and the Price Level The macroeconomic long run is a period that is sufficiently long for the forces that move real GDP toward potential GDP to have had their full effects. ♦ Suppose the economy is at its long-run equilibrium and the Fed increases the quantity of money. Aggregate demand increases and the AD curve shifts rightward, as illustrated in Figure 11.3. The price level rises, and real GDP increases. ♦ An inflationary gap exists and the unemployment rate is below than the natural rate. The tight labor market leads to a rise in the money wage rate. The short-run aggregate supply decreases, and the shortrun aggregate supply curve shifts from SAS0 to SAS1. This situation is illustrated in Figure 11.4, wherein real GDP returns to potential real GDP ($10 trillion) and the price level rises still higher to 130. The quantity theory of money holds that, in the long run, an increase in the quantity of money brings an equal percentage increase in the price level. The velocity of circulation is the average number of times a dollar of money is used in a year to buy goods and services in GDP. In terms of a formula, velocity of circulation, V, is given by V = PY/M, where P is the price level, Y is real GDP, and M is the quantity of money. M1 velocity has increased and fluctuated but M2 velocity has been quite stable. MONEY, INTEREST, REAL GDP, AND THE PRICE LEVEL The equation of exchange shows that the quantity of money multiplied by velocity equals (nominal) GDP, or MV = PY. The quantity theory makes two assumptions: ♦ Velocity is not affected by the quantity of money. ♦ Potential GDP is not affected by the quantity of money. With these assumptions, the equation of exchange ∆P ∆M = , which means that the percentshows that P M age increase in the price level (the inflation rate) equals the percentage increase in the quantity of money. The AS/AD model also predicts that, in the long run, an increase in the quantity of money causes the same percentage increase in the price level. However, the one-to-one relationship does not hold in the short run. Historical evidence from the United States and international evidence both show that in the long run, the money growth rate and inflation rate are positively related and that the year-to-year relationship is weaker. 165 Questions True/False and Explain The Demand for Money 11. The price level is the opportunity cost of holding money. 12. An increase in real GDP increases the demand for money. Interest Rate Determination 13. If the Fed buys government securities, it lowers the interest rate. 14. If both the supply and demand for money increase, the interest rate definitely rises. Short-Run Effects of Money on Real GDP and the Price Level 15. Higher interest rates affect consumption expenditure, investment, and net exports. 16. To fight inflation, the Fed will decrease the quantity of money. Helpful Hints 17. An increase in the quantity of money increases aggregate demand. 1. USE OF THE QUANTITY THEORY : Analysts often use the quantity theory to help shape their thinking about the future inflation rate by using the rate of growth of the quantity of money to help predict whether the inflation rate is likely to rise or fall. Even though the relationship between the growth rate of the quantity of money and the inflation rate might not be one-to-one as suggested by the quantity theory, nonetheless the correlation between higher monetary growth rates and higher inflation rates is quite substantial. You, too, can use this relationship to help predict the inflation rate. For instance, if you note that the growth rate of the quantity of money has jumped sharply higher, you should expect higher inflation rates to occur. Because interest rates tend to increase with the inflation rate, you would want to obtain loans with fixed (nominal) interest rates as quickly as possible. Conversely, you would not want to enter into long-term savings contracts with fixed interest rates. 18. In the short run, an increase in the quantity of money decreases short-run aggregate supply. Long-Run Effects of Money on Real GDP and the Price Level 19. If the economy is at potential GDP, in the short run an increase in the quantity of money lowers the unemployment rate so it is less than the natural rate. 10. In the long run, an increase in the quantity of money decreases short-run aggregate supply. 11. Velocity equals MY/P. 12. Since 1960, M2 velocity has increased more rapidly than M1 velocity has. 13. The quantity theory of money predicts that inflation is caused by rapidly growing velocity. 14. Almost surely, high inflation rates cause high monetary growth rates. 166 Multiple Choice The Demand for Money 11. An increase in ____ decreases the quantity of money people want to hold. a. the price level b. real GDP c. the interest rate d. the quantity of money 12. Which of the following does NOT directly shift the demand for money curve? a. A change in GDP. b. A change in the quantity of money. c. Financial innovation. d. None of the above because they all directly shift the demand for money curve. 13. Since 1970, in the United States the demand curve for M2 money has shifted a. rightward in all but 2 years. b. leftward in all but 2 years. c. rightward in most years until 1989 and then leftward in a few years and rightward in most. d. leftward in most years until 1989 and then rightward in some years and leftward in others. Interest Rate Determination 14. If the price of an asset rises and the amount paid on the asset does not change, what happens to the interest rate on the asset? a. It rises b. It does not change c. It falls d. The premise of the question is wrong because changes in the price of an asset have nothing to do with the interest rate paid on the asset. 15. If the interest rate exceeds the equilibrium interest rate, then people ____ bonds and the interest rate ____. a. buy; rises b. buy; falls c. sell; rises d. sell; falls CHAPTER 11 (27) 16. Taken by itself, an increase in the quantity of money a. raises the interest rate. b. does not change the interest rate. c. lowers the interest rate. d. perhaps raises or perhaps lowers the interest rate, depending on whether the demand curve for money has a negative or a positive slope. 17. If real GDP increases, the demand for money curve shifts a. leftward and the interest rate rises. b. leftward and the interest rate falls. c. rightward and the interest rate rises. d. rightward and the interest rate falls. Short-Run Effects of Money on Real GDP and the Price Level 18. If the Fed increases the interest rate, then a. investment and consumption expenditure decrease. b. the price of the dollar rises on the foreign exchange market and so net exports decrease. c. a multiplier process that affects aggregate demand occurs. d. All of the above answers are correct. 19. In order to combat inflation, the Fed will ____ the quantity of money and ____ the interest rate. a. increase; raise b. increase; lower c. decrease; raise d. decrease; lower. 10. To eliminate an inflationary gap, the Fed will ____ the quantity of money and ____ aggregate demand. a. increase; increase b. increase; decrease c. decrease; increase d. decrease; decrease 11. The Fed’s actions to fight a recession shift the a. aggregate demand curve rightward. b. aggregate demand curve leftward. c. short-run aggregate supply curve rightward. d. short-run aggregate supply curve leftward. MONEY, INTEREST, REAL GDP, AND THE PRICE LEVEL 12. In the short run, an increase in the quantity of money shifts the a. AD curve rightward. b. SAS curve rightward. c. LAS curve rightward. d. The answer is none of the above because an increase in the quantity of money does not shift the AD, SAS, or LAS curves. 13. In the short run, an increase in the quantity of money ____ the price level and ____ real GDP. a. raises; increases b. raises; does not change c. raises; decreases d. does not change; increases Long-Run Effects of Money on Real GDP and the Price Level 14. In the long run, an increase in the quantity of money a. shifts the AD curve leftward. b. shifts the SAS curve rightward. c. shifts the SAS curve leftward. d. does not shift the AD curve. 167 18. Velocity equals a. YM/P. b. PM/Y. c. PY/M. d. M/PY. 19. Nominal GDP, PY, is $6 trillion. The quantity of money is $2 trillion. Velocity is a. 6 trillion. b. 12. c. 3. d. 2. 20. Historical evidence shows that higher monetary growth rates are associated with a. higher inflation rates. b. no change in the inflation rate. c. lower inflation rates. d. higher growth rates of real GDP. Short Answer Problems 15. In the long run, an increase in the quantity of money ____ the price level and ____ real GDP. a. raises; increases b. raises; does not change c. raises; decreases d. does not change; increases 16. The quantity theory of money is the idea that a. the quantity of money is determined by banks. b. the quantity of money serves as a good indicator of how well money functions as a store of value. c. the quantity of money determines real GDP. d. in the long run, an increase in the quantity of money causes an equal percentage increase in the price level. 17. The equation of exchange is a. MV = PY. b. MP = VY. c. MY = PV. d. M/Y = PV. 1. Initially, the market for money is in equilibrium, as illustrated in Figure 11.5. Then, the Fed increases the quantity of money by $100 billion. a. Draw this increase in Figure 11.5. b. What was the initial equilibrium interest rate? What happens to the equilibrium interest rate? c. Explain, in general, the adjustment process to the new equilibrium interest rate. 168 CHAPTER 11 (27) TABLE 11.1 TABLE 11.2 The Demand For Money Quantity Theory Interest rate (percent per year) Quantity of money demanded (billions of dollars) 3 $600 ____ 6 1.00 $6 4 500 $500 6 ____ 3 5 400 550 6 ____ 3 6 300 605 6 ____ 3 2. Table 11.1 gives data on the demand for money. a. Suppose that the equilibrium interest rate is 6 percent. What is the quantity of money? b. Suppose that the Fed wants to lower the interest rate to 4 percent. By how much must it change the quantity of money? Is the open market operation is necessary to lower the interest rate an open market purchase or sale of government securities? Money, M (billions of dollars) Velocity, V Real GDP, Y Price level, (trillions of P dollars) 4. a. Complete Table 11.2. b. Between the second and third rows of Table 11.2, what is the percentage increase in the quantity of money? What is the inflation rate? c. Between the third and fourth rows of Table 11.2, what is the percentage increase in the quantity of money? What is the inflation rate? d. Comment on your answers to parts (b) and (c). You’re the Teacher 1. Your friend is talking: “When the Fed increases the quantity of money, it usually does so by an open market operation and buys government securities. In fact, the Fed buys a lot of government securities, and these securities all pay interest to the Fed. The Fed pays for them by printing Federal Reserve notes and increasing banks’ reserves. But neither Federal Reserve notes nor banks’ reserves pay any interest. So the Fed gets a lot of interest income and has no interest expense. It seems to me that this would be very profitable. Is it? And, if it is, what does the Fed do with the profit?” These are interesting questions; perhaps your friend thinks that the Fed spends its profits on the “mother of all parties” and would like to be invited. Tell your friend to forget about the party by explaining the profits and what happens to them. 3. In Figure 11.6 show how an increase in the quantity of money affects the price level and quantity of real GDP in the short run and the long run. Label the short-run equilibrium point a and the long-run equilibrium point b. MONEY, INTEREST, REAL GDP, AND THE PRICE LEVEL Answers 169 Multiple Choice Answers The Demand for Money True/False Answers The Demand for Money 11. F The interest rate is the opportunity cost of holding money. 12. T An increase in real GDP means more transactions occur and increases the demand for money. Interest Rate Determination 13. T When the Fed buys government securities, the quantity of money increases and the interest rate falls. 14. F If the increase in the demand for money is larger than the increase in the supply, the interest rate rises. But if the increase in the supply exceeds the increase in demand, the interest rate falls. Short-Run Effects of Money on Real GDP and the Price Level 15. T Higher interest rates ripple through the economy, affecting many sectors. 16. T By decreasing the quantity of money, aggregate demand decreases which lowers the price level. 17. T Changing aggregate demand is part of the ripple effect of monetary policy. 18. F In the short run, short-run aggregate supply does not change. Long-Run Effects of Money on Real GDP and the Price Level 19. T In the short run, an increase in quantity of money increases real GDP and lowers the unemployment rate. 10. T In the long run, an increase in the quantity of money raises money wage rates and decreases short-run aggregate supply. 11. F Velocity equals PY/M. 12. F Since 1963, M2 velocity has not changed much, while M1 velocity has increased and fluctuated. 13. F The quantity theory predicts that inflation is caused by growth in the quantity of money. 14. F Almost surely, the reverse is true: High monetary growth rates cause high inflation rates. 11. c The interest rate is the opportunity cost of holding money, so an increase in the interest rate reduces the quantity of money demanded. 12. b Changes in the quantity of money create movements along the demand for money curve; they do not shift the curve. 13. c Until about 1989, growth in real GDP generally increased the demand for M2. Since 1989, innovation has decreased the demand for M2 while GDP growth has increased it. Interest Rate Determination 14. c There is an inverse relationship between the price of an asset and the interest rate paid on the asset. 15. b When the interest rate exceeds the equilibrium interest, there is an excess supply of money. People use the excess supply to buy bonds, thereby driving the interest rate lower. 16. c An increase in the quantity of money creates a surplus of money at the initial interest rate and, as people buy financial assets to be rid of the surplus, the price of financial assets rises, which drives down their interest rates. 17. c An increase in GDP increases the demand for money and, as the demand curve shifts rightward, the equilibrium interest rate rises. Short-Run Effects of Money on Real GDP and the Price Level 18. d Each of the answers describes one of the ripples from the Fed’s policy. 19. c By decreasing the quantity of money and raising the interest rate, the Fed decreases aggregate demand. 10. d An inflationary gap means that real GDP exceeds potential GDP, so decreasing the quantity of money decreases aggregate demand and real GDP. 11. a By shifting the aggregate demand curve rightward, the Fed increases real GDP, thereby offsetting the recession. 12. a An increase in the quantity of money increases aggregate demand, thereby shifting the AD curve rightward. 170 CHAPTER 11 (27) 13. a The AD curve shifts rightward so in the short run the economy moves along an (upward sloping) SAS curve to a higher price level and increased real GDP. Long-Run Effects of Money on Real GDP and the Price Level 14. c In the long run, the tight labor market leads to a rise in the money wage rate so the SAS curve shifts leftward. 15. b In the long run, the AD curve shifts rightward and the economy moves along its (vertical) LAS curve, so the price level rises but real GDP does not change. 16. d The quantity theory traces the cause of inflation to monetary growth. 17. a This answer is the definition of the equation of exchange. 18. c The equation of exchange, MV = PY, can be rearranged to show that velocity equals PY/M. 19. c The answer to this question can be calculated using the formula in the previous question. Intuitively, velocity equals the number of times an average dollar is spent on goods and services in GDP. 20. a Historical evidence supports the general thrust of the quantity theory. Answers to Short Answer Problems 1. a. Figure 11.7 shows the $100 billion increase in the quantity of money as the rightward shift from MS0 to MS1. b. The initial interest rate was 6 percent; after the increase in the quantity of money, the equilibrium interest rate fell, to 4 percent. c. An increase in the quantity of money means that, at the initial interest rate (6 percent), the quantity of money supplied is greater than the quantity of money demanded. Money holders want to reduce their money holdings and do so by buying financial assets, such as bonds. The increase in the demand for financial assets raises the price of financial assets and thereby lowers their interest rate. As the interest rate falls, the quantity of money demanded increases, which reduces the excess supply of money. This process continues until the interest rate has fallen sufficiently so that the quantity of money demanded is the same as the quantity of money supplied. The interest rate that sets the new quantity of money supplied equal to the quantity of money demanded is the (new) equilibrium interest rate. 2. a. When the interest rate is 6 percent, the quantity of money demanded is $300 billion. Hence the quantity supplied also must be $300 billion. b. In order to reduce the interest rate to 4 percent, the Fed must increase the quantity of money supplied to $500 billion. So the quantity of money must increase by $200 billion. In order to increase the quantity of money, the Fed must purchase government securities. 3. Figure 11.8 (on the next page) shows the short-run and long-run impacts of an increase in the quantity of money. The increase in the quantity of money shifts the AD curve rightward. In the short run, the money wage rate does not change and the economy moves along SAS0 to the new equilibrium point a. The price level rises (to P1 from P0) and real GDP increases (to GDP1 from GDP0). However, as time passes, the money wage rate starts to rise. This change shifts the SAS curve leftward until eventually MONEY, INTEREST, REAL GDP, AND THE PRICE LEVEL 171 M= PY/V so that M equals $1,000 billion ($1 trillion). For the following rows, the equation of exchange was rearranged to show that MV/Y = P. b. Going from the second to the third row, the quantity of money grows by 10 percent, and (with constant velocity and real GDP) the price level grows by 10 percent, that is, the inflation rate is 10 percent. c. Moving from the third to the fourth row shows that another 10 percent increase in the quantity of money results in another 10 percent growth in the price level. d. The last three rows illustrate the quantity theory of money conclusion: A 10 percent increase in the quantity of money raises the price level by 10 percent. You’re the Teacher the economy reaches its long-run equilibrium at point b. In the long run, the price level is (much) higher than initially (to P2 versus P0), and the level of real GDP has returned to the initial level, potential GDP, which is equal to GDP0. TABLE 11.3 Quantity Theory Money, M (billions of dollars) Velocity, V Real GDP, Y Price level, (trillions of P dollars) $1000 6 1.00 $6 500 6 1.00 3 550 6 1.10 3 605 6 1.21 3 4. a. Table 11.3 completes Table 11.2. All the answers were calculated with the equation of exchange, MV = PY. For the first row, to calculate M, the equation of exchange was rearranged as 1. “This is a couple of great questions. Here are a couple of great answers! Sure, the Fed makes a lot of ‘profit’ and for exactly the reasons you stated: It earns a lot of interest income on its government securities and it pays no interest expense. But the Fed doesn’t do anything wild and crazy with its profit: There’s not a party to die for. Instead, the Fed pays its costs with its revenue. However, the amount of revenue easily covers those costs, so what happens to the extra? The Fed gives it back to the Treasury. That’s right, the Fed sends the extra profit back to the U.S. Treasury so the Treasury can use it as revenue to help pay for the government’s expenditures.”