Chapter Problems

advertisement

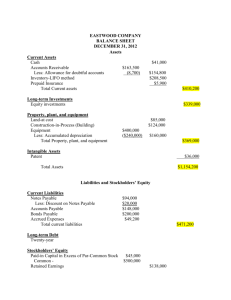

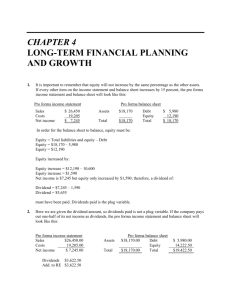

BUAD 611 – Managerial Finance Chapter Problems and Solutions - From Analysis for Financial Management Chapter 1 1 – What happens to a company’s equity when assets rise $1 million and liabilities fall $2 million? 2 – What does it mean when cash flow from operations on a company’s cash flow statement is negative? Is this bad news? If so, it is dangerous? 3– a – Is a company better or worse off when the market value of its assets rises $10 million? Why? b - Is a company better or worse off when the market value of its liabilities falls $10 million? Why? c - If you owned a company, would you prefer the market value of its assets to rise $10 million or the market value of its liabilities to fall $10 million? 4 – You manage a real estate investment company. One year ago the company purchased 10 parcels of land distributed throughout the community for $1 million each. A recent appraisal of the properties indicates that five of the parcels are now worth $600,000 each. While the other five are worth $1.5 million each. Ignoring any income received from the properties over the year, calculate the investment company’s accounting earnings and its economic earnings in each of the following cases: a – The company sells all of the properties at their appraisal values today. b – The company sells none of the properties. c – The company sells the properties that have fallen in value and keep the others. d- The company sells the properties that have risen in value and keeps the others. e- Upon returning from a property management seminar, an employee recommends the bank adopt an end-of-the-year policy of always selling properties that have risen in avlue since purchase and always retaining properties that have fallen in value. The employee explains that with this policy the company will never show a loss on its real estate investment activities. Do you agree with the employee? Why or why not? 5 – Selected information about Adams Wright Corporation follows. Net Sales Cost of goods sold Depreciation Net income Finished goods inventory Accounts receivable Accounts payable Net fixed assets 1996 $52 30 10 5 6 10 6 80 ($ in millions) 1997 $78 41 12 8 5 15 9 84 a- During 1997, how much cash did Adams Wright collect from sales? b- During 1997, what was the cost of goods produced by the company? c- Assuming the company sold no assets during the year, what were its capital expenditures during 1997? 6-Why do you suppose financial statements are constructed on an accrual basis rather than a cash basis when accounting is so much easier to understand? 7-Table 3-1 in Chapter 3 presents financial statements over the period 1993-1996 for R&E Suppliers, Inc. a- Construct a sources and uses statement for the company from 1993 through 1996 (one statement for all three years). b- What insights, if any, does the sources and uses statement give you about the financial position of R&E Supplies? 8-Use the following information to estimate ZTZ Corporation’s net cash flow from operations as it would appear on the company’s 1997 cash flow statement. Net Sales Cost of goods sold Gross income Depreciation General, selling expenses Income taz before Provision for taxes @ 40% Income tax after 1996 $600 320 280 60 40 180 72 108 1997 $800 400 400 80 40 280 112 168 Cash Accounts receivable $200 100 $100 200 Inventory Accrued taxes Accrued wages Accounts payable 120 200 120 60 80 240 60 80 9-Following are summary cash flow statements for three roughly equal-sized companies. Net cash flows from operations Net cash used in investing activities Net cash from financing activities Cash balance at the beginning of the year A $(100) B $(100) ($ millions) C $100 (300) (10) (30) 400 70 (80) 50 50 50 a- Calculate each company’s cash balance at the end of the year. b- Explain what might cause company C’s net cash from financing activities to be negative. c- Looking at companies A and B, which company would you prefer to own? Why? d- Is company C’s cash flow statement cause for any concern on the part of C’s management or shareholders? Why or why not? 10- You are responsible for labor relations in your company. During heated labor negotiations, the general secretary of your largest union exclaims, “Look, this company has a $1 billion worth of assets, $500 million worth of equity, and made a profit last year of $40 million-due largely, I might add, to the effort of the union employees. So don’t tell me you can’t afford our wage demands.” How would you reply? Chapter 2 1. A company is considering the acquisitions of a very promising biotechnology company. One executive argues against the move, pointing out that because the biotech company is presently losing money, the acquiring company’s return on equity will fall. a. Is the executive correct in predicting that ROE will fall? The return on equity (ROE) is define as the ratio between the Net Income and Shareholders’ equity. Since the company is losing money the Net Income will decrease and consequently the ROE. b. How important should changes in ROE be in this decision? The ROE only is not sufficient to make the decision to acquire or not a company. A time-dependent figure of merit would be necessary for a proper evaluation of the decision to acquire the company. 2. Top management measures your divisions performance by calculating the divisions return on investment, defined as division operating income per period divided by division assets. Your division has done quite well lately; its ROI is 40 percent. You believe the division should invest in a new production process, but a college disagrees, pointing out that because the new investments first-year ROI is only 35 percent, it will hurt performance. How would you respond? First, in order to properly evaluate an investment decision several years of data is required. Secondly, investment return should be compared to the division’s historical return e year Once again is necessary to take timing into consideration 3. Answer the questions that follow based on the following information. Earning before interest and taxes Interest expense Earnings before tax Taxes at 40% Earning after tax Debt Equity Company A $300 Company B $560 20 280 112 168 200 800 160 400 160 240 1,600 400 a. Calculate each company’s ROE, ROA, and ROIC. b. Why is company B’s ROE so much higher than A’s? Does this mean B is a better company? Why or why not? c. Why is company A’s ROA higher than B’s? What does this tell you about the two companies? 4. Table 3-1 in Chapter 3 presents financial statements over the period 1993 through 1996 for R&E Supplies, Inc. a. Use these statements to calculate as many of the ratios in Table 2-2 as you can. b. What insights, if any, do these ratios for R&E Supplies provide about R&E’s financial performance? What problems, if any, does the company appear to have? 5. Selected information for DressMiss, Inc., a young woman’s clothing store, follows. (Assume all sales are credit sales, ratios are based on a 365-day year, and the payables period is based on cost of goods sold.) Net sales Cost of goods sold Net income after tax Accounts receivable Accounts payable Ending inventory $1,200 800 100 200 80 400 a. Calculate the collection period. b. Calculate the payables period. c. Calculate the inventory period, defined as Ending inventory/Cost of goods sold per day d. How many days elapse, on average, between (1) The time the company is billed for a purchase and the time it receives cash from the sale of the items purchased? (2) The time the company is billed for a purchase and the time it pays for the purchase? (3) The time that company pays for a purchase and the time it receives cash from the sale of the items purchase? e. The cash cycle is defined as Inventory period + Collection period – Payables period What is DressMiss’s cash cycle? f. Suppose DressMiss’s cash cycle does not change but sales double, What does this imply about the companies need for financing? g. Suppose DressMiss’s assistant treasurer recommends reducing the companies cash cycle to zero days. Do you think this is necessarily a good idea? Why or why not? 6. Show that if a companiy’s liabilities-to-equity ratio is 300 percent, its assets-to-equity ration is 300 percent. 7. In 1996, Natural Selection, a nationwide computer dating service, had $80 million of assets and $50 million of liabilities. Earnings before interest and taxes were $10 million, interest expense was $5 million, the tax rate 40 percent, sinking fund requirements were $2 million, and annual dividends were 40 cents per share on 5 million shares outstanding. a. Calculate: (1) Natural Selection’s liabilities-to-equity-ratio. (2) Time interest earned. (3) Times burden covered. b. What percentage decline is earnings before interest and taxes could Natural Selection have sustained before falling to cover (1) Sinking fund requirements (2) Common dividend payments? 8. Given the following facts, complete the balance sheet that follows. (Assume all sales are credit sales, ratio are based on 365-day year, and the payable period is based on goods sold.) Collection period Days’ sales in cash Current ratio Inventory turnover Liabilities to assets Payables period Assets Cash Accounts receivable Inventory Total current assets Net fixed assets Total assets Liabilities and Owner’s Equity Accounts payable Short-term debt Total current liabilities Long-term debts Shareholders 30 days 6.0 days 2.4 times 4.0 times 50% 30 days $50,000 $600,000 $1,400,000 Total liabilities & equity Chapter 3 – 1 – Suppose you construct a pro forma balance sheet for a company and a cash budget for the same time period and the external funding required from the pro forma forecast differed from the cash surplus (deficit) estimated on the cash budget. How would you interpret this result? 2 – Suppose you constructed a pro forma balance sheet for a company and the estimate for external funding required was negative. How would you interpret this result? 3 - Table 3-4 presents a computer spreadsheet for estimated R&E Supplies’ external funding required for 1997. The text mentions that with modifications to the equations for equity and net sales, the forecast can be extended through 1998. Write the modified equations for equity and net sales. 4 – Using a computer spreadsheet, the information that follows, and the modified equations determined in question 3, extend the forecast for R&E Supplies contained in Table 3-4 through 1998. Is R&E’s external funding required in 1998 higher or lower than 1997? R&E Supplies Assumptions for 1998 Growth rate in net sales 30.0% Cost of good sold/net sales 86.0% General, selling, & Administrative expenses/net sales 11% Long-term dept $560 Current portion long-term dept $100 Interest rate 10.0% Tax rate 45.0% Dividend/earning after tax 50.0% Current assets/net sales 29.0% Net fixed assets $270 Current liabilities.net sales 14.4% 5. The treasurer of Michigan Milling, a wholesale distributor of knitting supplies, wants to estimate his company’s cash balance for the fist three months of 1997, Using the following information, construct a monthly cash budget for Michigan Milling for January through March 1997. Does it appear from your results that the treasurer should be concerned about investing excess cash or looking for a bank loan? Michigan Milling Selected Information Sales (20 percent for cash the rest on 30-day credit terms): 1996 actual October November December 1997 projected January February March Purchases (all on 60-day terms): 1996 actual October November December 1997 projected January February March $240,000 $280,000 $800,000 $400,000 $160,000 $160,000 $340,000 $360,000 $800,000 $200,000 $80,000 $80,000 Wages payable monthly Principal payment due on dept in March Interest due in March Dividend payable in March Taxes payable in February Addition to accumulated in March $120,000 $140,000 $60,000 $200,000 $120,000 $20,000 Cash balance on January 1, 1997 Minimum desired cash balance $200,000 $100,000 6 – Continuing problem 5, Michigan Milling’s income statement and balance sheet for December 31, 1996 follow. Additional information about the company’s accounting methods and the treasurer’s expectations for the first quarter of 1997 appear in the footnotes. Michigan Milling Income Statement December 31, 1996 ($000) Net sales Cost of goods sold (1) Gross profit Selling and administrative expenses (2) Interest expense Depreciation (3) Net profit before tax Tax at 33% 66 Net profit after tax $134 $4,000 2,600 1,400 1,080 60 60 200 Balance Sheet December 31, 1996 ($000) Assets Cash Accounts receivable Inventory Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities Bank Loan Accounts payable Miscellaneous accruals Current portion long-term dept Taxes payable Total current liabilities Long term dept Shareholders’ equity Total liabilities and equity $200 640 1,200 2,040 600 100 500 $2,540 $0 1,060 40 70 200 1,540 660 340 2,540 (1) Cost of good sold consists entirely on purchase cost and is expected to continue to equal 65 percent of sales (2) Selling and administrative expenses consist entirely of wages (3) Depreciation is at the rate of $20,000 per quarter (4) Miscellaneous accruals are not expected to change in the first quarter (5) $140 due March 1997. No payments due 1998. a. Use this information and information in problem 5 to construct a pro forma income statement for the fist quarter of 1997 and a pro forma balance sheet for March 31, 1997. What is your estimated external financing need for March 31? b. Does the March 31, 1997, estimated financial equal your cash surplus (deficit) for this date from your cash budget in problem 5? Should it? c. Do your pro forma forecast tell you more than your cash budget does about Michigan Milling’s financial prospects? d. What do your pro forma income statement and balance sheet tell you about Michigan Milling’s need for external financing on February 28, 1997? 7 – Based on your answer to question 6, construct a first-quarter 1997 cash flow forecast for Michigan Milling. Chapter 41- Table 3-1in the last chapter presents R&E Supplies’ financial statements for the period 1993 through 1996, and Table 3-5 presents a pro forma financial forecast for 1997. Use the information in these tables to answer the following questions. a- Calculate R&E Supplies’ sustainable growth rate in each year from 1994 through 1997. b- Comparing the company’s sustainable growth rate to its actual growth rate in sales over these years, what growth management problems does R&E Supplies appear to face in this period. c- How does the company appear to have coped with these problems? Do you see any difficulties with the way it has addressed its growth problems over this period? If so, what are they? d- What advice would you offer management regarding managing future growth? 2- Following are selected financial data for Lindsay Manufacturing Company, a manufacturer of farm machinery and irrigation equipment located in Lindsay, Nebraska. Profit margin(%) Retention ratio(%) Asset turnover(X) Financial leverage*(X) Growth rate in sales(%) 1991 9.00 1992 10.10 1993 10.50 1994 10.00 1995 10.50 1.00 1.00 1.00 1.00 1.00 1.63 1.53 1.28 1.27 1.30 2.51 2.18 1.80 1.59 1.26 -3.90 10.40 -6.30 10.40 -1.70 *assets divided by beginning-ofperiod equity. a- Calculate Lindsay’s sustainable growth rate in each year. b- Comparing the company’s sustainable growth rate to its actual growth rate in sales, what growth problems does Lindsay appear to have faced over this period? c- How does the company appear to have coped with these problems? d- Lindsay’s retention ration indicates that the company did not distribute a dividend over the period. As a shareholder , would you support a n0-dividends policy for Lindsay? e- In 1995, Lindsay repurchased some of its stock. From a growth management perspective, does this appear to have been a wise move? 3-Following are selected fianancial data for Williams-Sonoma, Inc., a chain of specialty retail stores and mail-order marketer of fine -quality cooking and servivng equipment headquartered in San Francisco. Profit margin(%) Retention ratio(%) Asset turnover(X) Financial leverage*(x) Growth rate in sales(%) 1991 0.50 1992 0.50 1993 2.70 1994 3.70 1995 0.40 1.00 1.00 1.00 1.00 1.00 2.26 2.35 2.45 2.43 2.02 1.85 1.85 2.01 2.29 2.70 8.90 10.30 18.90 28.90 22.00 *Assets divided by beginning-ofperiod equity. a- Calculate Williams-Sonoma’s sustainable growth rate in each year. b- Comparing the company’s sustainable growth rate to its actual growth rate in sales, what growth problems does Williams-Sonoma appear to have faced over this period? c- How does the company appear to have coped with these problems? d- Should the company’s solution to its sustainable growth problems cause any concern for management and owners? Chapter 4- 1- Company A has 4 million shares of common stock outstanding trading at $5 a share. Company B has 1 million shares outstanding trading at $20 a share. a- Which company has the higher market value of equity? b- If you owned 400 shares of company A’s stock, how many shares of company B’s stock would someone have to offer you before you would trade you’re a share for his B shares? c- If you owned 10 percent of A’s equity, how many shares of B’s stock would someone have to offer you before you would trade you’re A shares for his B shares? 2- If the stock market in the United States is efficient , how do you explain the fact that some people make very high returns? Would it be more difficult to reconcile very high returns with efficient markets if the same people made extraordinary returns year after year? 3- The return an investor earns on a bond over a preiod of timeis known as the holding period return, defined as interest income plus or minus the change in the bond’s price, all divided by the beginning bond price. a- What is the holding period return on a bond with a par value of $1,000 and a coupon rate of 6 percent if its price at the beginning of the year was $940 and its price at the end was $1,050? Assume interest is paid annually. b- Can you give two reasons the price of the bond might have increased over the year? 4- You bought a yen-dominated bond at the beginning of the year for Y100, 000. The bond paid 3 percent annual interest and was trading for Y110,000 at year end. The exchange rate was $1=Y94 at year-end. a- What holding period return, measured in yen, did you earn on the bond? b- What was your U.S. dollar holding period return on the bond? c- What portion of the dollar return was due to the yen return as opposed to changes in currency values? 5- A company wants to raise $200 million in a new stock issue. The company’s investment banker indicates that a sale of new stock will require 5 percent underpricing and a 6 percent spread. a-Assuming the company’s stock price does not change from its current price of $56 per share, how many shares must the company sell and at what price to the public? b- How much money will the investment banking syndicates earn on the sale? c- Is the 5 percent underpricing a cash flow? Is it a cost? If so, to whom? Chapter 6 1. Explain how each of the following changes will affect Harbridge Fabric’s range of earnings chart (Figure 6-2). Which changes would make debt financing more attractive? Which would make it less attractive? a. b. c. d. e. An increase in the interest rate on debt. An increase in Harbridge Fabrics’ stock price. Increased uncertainty about Harbridge’s future earnings. Increased common stock dividends. An increase in the amount of debt Harbridge already has outstanding. 2. As the financial vice president for Suntone Enterprises, you have the following information: Expected net income after tax next year before effects of new financing Sinking-fund payments due next year on existing debt Interest due next year on existing debt Company tax rate Common stock price per share Common share outstanding $40 million $14 million $10 million 40% $25 16 million a. Calculate Suntone’s times-interest-earned ratio for next year assuming the firm raises $40 million of new debt at an interest rate of 6 percent. b. Calculate Suntone’s times-burden-covered ratio for the next year assuming annual sinking-fund payments on the new debt will equal $8 million c. Calculate next year’s earnings per share assuming Suntone raises the $40 million of new debt. d. Calculate next year’s time-interest earned ration, time-burden-covered ration, and earnings per share if Suntone sell 1.6 million new shares at $25 a share instead of raising new debt. e. Looking at your results, what do you think Suntone should do? Why? 3. Plasteel Devices has 100 million shares outstanding trading at $5 a share. The company announces its intention to raise$50 million by selling new shares. a. What do market signaling studies suggest will happen to Plasteel’s stock price on announcement date? Why? b. How large a gain or loss, in aggregate dollar terms, do market signaling studies suggest existing Plasteel shareholders will experience on the announcement date? c. What percentage of the amount of money Plasteel intends to raise is this expected gain or loss? d. What percentage of the value Plasteel’s existing its existing equity prior to the announcement is this expected gain or loss? e. At what price should Plasteel expect its existing shares to sell immediately after the announcement? 4. This is a more difficult but informative problem. James Brodrick & Sons, Inc., is growing and, if at all possible, would like to finance its growth without selling new equity. Selected information from the company’s five-year financial forecast follows. Year Earnings after tax (millions) Investment (millions) Debt-toequity ratio (%) Dividend payout ratio (%) Marketable securities (millions) 1 $100 2 $130 3 $170 4 $170 5 $300 $175 $300 $300 $350 $440 120 120 120 120 120 $200 $200 $200 $200 $200 a. According to this forecast, what dividends will the company be able to distribute annually without raising new equity? What will the annual dividend payout ratio be? b. Assume the company wants a stable payout ration over time and plans to use its marketable securities portfolio as a buffer to absorb year-to year variations in earnings and investments. Set the annual payout ratio to the five-year sum of total dividends paid in question a divided by total earnings. Then solve for the size of the company’s marketable securities portfolio each year. c. Suppose earnings fall below forecast every year. What options does the company have for the continuing to fund its investment? d. What does the pecking order theory say about how management will rank these options? e. Why might management be inclined to follow this pecking order? Chapter 7 1- Answer the following questions assuming the interest rate is 10%. a- What is the present value of $100 in 6 years? b- What is the present value of $100 in 10 years? Why does the present value fall as the number of years increases? c- How much would you pay for the’ right to receive $500 at the end of one year, $300 at the end of year two, and $1000 at the end of year five? d- How much would you pay to receive a fifteeen year bond with a par value of $1000 and a 12% coupon rate? Assume interest is paid annually. e- How much would you pay for a share of preferred stock paying an $8 per share annual dividend forever? f- What will be the value in ten years of $5 invested today? (hint: present value=PVF times the future value, where PVF is the present value factor from the appendix for the appropriate interest rate and time period. Thus, future value = (1/ PVF) times present value.) g- About how long wil it take for a $10 investment to double in value? h- What will be the value in ten years of a $5 investment invested at the end of each year for the next ten years? i- A couple wishes to save $100,000 over the next fifteen years for their child’s college education. What uniform annual amount must they deposit at the end of each year to accomplish their objective? j- What return will you earn If you pay $342 for a steam of $100 payments lasting six years? What does it mean if you paid less than $342 for the stream? More than $342? k- How long must a stream of $50 payments last to justify a purchase price of $500? Suppose the stream lasted only seven years. How large would the salvage value (liquidating payment) have to be to justify the investment of $500? l- An investment of $100 today returns $433 in 30 years. What is the investment rate of return on this investment? 2. An investment costing $50,000 promises an aftertax cash flow of $18,000 per year for 6 years. a- find the investment’s accounting rate of return and its payback period. b- Find the investment’s net present value at a 15% discount rate. c- Find the investments benefit cost ratio at a 15% discount rate. d- Find the investment’s international rate of return. e- Assuming the required rate of return on the investment is 15%, which of the following above figures of merit indicate the investment is attractive? Which indicates it is unattractive? 3. An individual wants to borrow $10,000 from a bank and repay it in 5 equal annual end of year payments, including interest. If the bank wants to earn a 14% rate of return on the loan, what should the payment be? You may ignore taxes and default risk. 4. If ABC Company reported earnings per share of $10.00 in 1990 and $15.50 in 1999, at what rate did earnings per share grow over this period? 5. Times are tough for Microdyne. If it engages in a new, one-time promotional campaign costing $10 million, its annual after tax cash flow over the next five years will be only $100,000. If it does not undertake the campaign, it expects its after tax cash flow to be a minus $3 million annually for the same period. Assuming the company has decided to stay in its chosen business is this campaign worthwhile when the discount rate is ten percent? Why or why not? 6. .One year ago, Baffle Bag and Box Company (BB&B) purchased a new folder for $11,000. The company now finds that a new box folder is available that may offer significant advantages. The new machine can be purchased for $15,000, has an economic value of 10 years, and has no salvage value. It is expected that the new machine will produce a gross margin of $4,000 per year; thus, using strait line depreciation, the annual taxable income will be $2,500. The current machine is expected to produce a gross margin of $2,000 per year and, assuming a total economic life of 11 years and strait-line depreciation, a profit before tax is $5,000. BB&B’s tax rate is 45 percent, and its cost of capital after tax is 10%. Ignoring possible capital gains taxes and assuming zero salvage values at the end of the machine’s economic lives, should BB&B replace it’s year-old box folder? 7. (Read the chapter appendix before attempting this problem.) A company is considered the following investment opportunities. Investment Initial cost Expected life NPV @10% IRR A $550,000 10 years $34,000 20% B $300,000 10 years $30,000 30% C $200,000 10 years $20,000 40% a. If the company can raise large amounts of money at an annual cost of 10% and the investments above are independent of one another, which should it undertake? b. If the company can raise large amounts of money at an annual cost of 10% and the investments are mutually exclusive, which should it undertake? c. If the company has a fixed capital budget if $550,000 and the investments are independent of one another, which should it undertake? 8. (You will need a business calculator or a computer to answer this question.) In 1987 a Van Gogh painting, Sunflower (not reputed to be one of his best), sold at an aution, net of fees, for $36 million. Ninety-eight years earlier, in 1889, the same painting sold for $125. Calculate the rate of return to the seller on this investment. What does this suggest about the merits if fine art as an investment?