1 - Amazon Web Services

advertisement

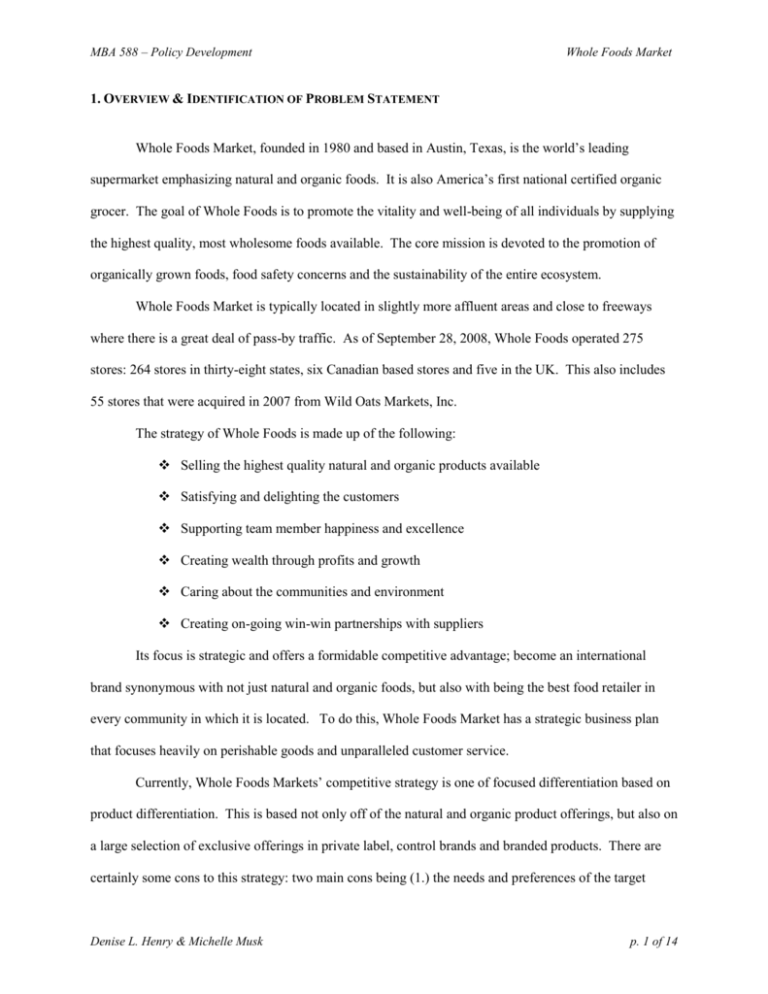

MBA 588 – Policy Development Whole Foods Market 1. OVERVIEW & IDENTIFICATION OF PROBLEM STATEMENT Whole Foods Market, founded in 1980 and based in Austin, Texas, is the world’s leading supermarket emphasizing natural and organic foods. It is also America’s first national certified organic grocer. The goal of Whole Foods is to promote the vitality and well-being of all individuals by supplying the highest quality, most wholesome foods available. The core mission is devoted to the promotion of organically grown foods, food safety concerns and the sustainability of the entire ecosystem. Whole Foods Market is typically located in slightly more affluent areas and close to freeways where there is a great deal of pass-by traffic. As of September 28, 2008, Whole Foods operated 275 stores: 264 stores in thirty-eight states, six Canadian based stores and five in the UK. This also includes 55 stores that were acquired in 2007 from Wild Oats Markets, Inc. The strategy of Whole Foods is made up of the following: Selling the highest quality natural and organic products available Satisfying and delighting the customers Supporting team member happiness and excellence Creating wealth through profits and growth Caring about the communities and environment Creating on-going win-win partnerships with suppliers Its focus is strategic and offers a formidable competitive advantage; become an international brand synonymous with not just natural and organic foods, but also with being the best food retailer in every community in which it is located. To do this, Whole Foods Market has a strategic business plan that focuses heavily on perishable goods and unparalleled customer service. Currently, Whole Foods Markets’ competitive strategy is one of focused differentiation based on product differentiation. This is based not only off of the natural and organic product offerings, but also on a large selection of exclusive offerings in private label, control brands and branded products. There are certainly some cons to this strategy: two main cons being (1.) the needs and preferences of the target Denise L. Henry & Michelle Musk p. 1 of 14 MBA 588 – Policy Development Whole Foods Market market niche could shift over time and (2.) competitors may find an effective way to match the needs of the target niche. There is also the chance that the market would become so attractive that it becomes inundated with competitors, which would intensify rivalry and cause profits to drop. While there are cons to the competitive strategy, Whole Foods Markets’ competitive advantage over its rivals is based on a few strong factors. The first, and strongest, is the good quality, organic, natural and holistic products that are offered. Also, the competitive advantage is strong because of its environmentally friendly focus and community involvement. It focuses on alternative cleaning products, naturally raised meat, respecting all forms of life, no animal testing and other similar socially responsible acts. Whole Foods also supports food banks and donates to non-profit organizations. After careful analysis and evaluation (all of which are presented in and discussed in Section 2) of many different aspects of Whole Foods strategy, external and internal environments, financial position and competitive landscape, it has been determined that Whole Foods Markets’ management has some strategic issues/problems to address. These issues are as follows: 1. Was the acquisition of Wild Oats a good business decision and strategic move? 2. Is there cause for concern in regard to some of the declining financials and if so, what action steps need to take place? 3. How should Whole Foods continue to increase its market share in order to become an international brand synonymous with not just natural and organic foods, but also with being the best food retailer in every community in which it is located during this recessionary period? Is the focused differentiation strategy still working? 2. ANALYSIS & EVALUATION The analysis for Whole Foods Market beings with a simple SWOT analysis as presented in Figure 1: Denise L. Henry & Michelle Musk p. 2 of 14 MBA 588 – Policy Development Whole Foods Market Figure 1 – Whole Foods Market SWOT Analysis Strengths Community involvement Environmental responsibility, focus on sustaining the environment Large grocery store atmosphere catering to healthy, natural and organic industry Not a significant number of competitors Advocate relationships with special, business and environmental communities Win-win partnerships with suppliers Distinctive in store atmosphere – café’s, coffee shops, etc. Market advantage in product differentiation Distinct market niche Distinguished and well known brand reputation with loyal customers Powerful strategy Ability to cater to a population of those with special dietary needs Offer employee support Vending stations at music festivals Better than the average store website Whole Foods Recipe application for phones Top 100 companies to work for the last 10 years Received numerous awards and recognition Decentralized company philosophy (individual stores cater to the area in which they are in) Locally grown produce to support the local economy Additional board members added recently Innovative Outstanding customer service P-E ratio is very good showing a lot of investor confidence and stock strength (for every dollar in earnings, investors are willing to pay $28.94) Dividend payout ratio very high Opportunities Promote Whole Foods as an exclusive provider of items pertaining to medically necessary diets; serve additional customer groups/market segments Partner with local health care providers, health societies (such as autism, diabetes) and doctors Denise L. Henry & Michelle Musk Weaknesses Market saturation in the affluent areas in which Whole Foods is often located Too narrow of a market niche Too narrow of a product line relative to new rivals Acquisition of Wild Oats in 2007 still causes a significant debt load Legal issues surrounding the Wild Oats acquisition High prices The company CEO – potential lack of management depth Refusal to support unions Declining net income, EPS, gross profit margin and operating profit margin coupled with increasing CGS and operating expenses Below average ROE Current ratio lower than 1 is showing hard time converting assets to cash in order to pay current liabilities Net cash provided by operating activities decreasing Threats Competitors in other niches, such as Wal-Mart, who are moving into the organic produce market with much lower prices potentially pulling customers away Competitors, again like Wal-Mart, creating similar product offerings p. 3 of 14 MBA 588 – Policy Development Promotions at events for children with special needs Large untapped geographic area in which to expand Engage in more specialized marketing and promotional materials Utilize and accept unions Increase the range of lower priced items offered; lower all prices Whole Foods Market New competition may come in and pull customers away Market saturation Slowdown in market growth Loss of sales to substitute products Shifts in consumer tastes or spending Economic and adverse demographic changes Unions Legal issues and investigation into the Wild Oats acquisition As determined by this SWOT analysis, Whole Foods Markets’ overall situation is, for the most part, favorable. There is a considerable amount of resource strengths and competitive assets. There are some significant resource weaknesses, competitive liabilities and external threats to the future well being of the company and the company’s profitability, but Whole Foods has a significant amount of opportunities that it could pursue to negate the weaknesses, liabilities and threats. Looking at some of Whole Foods key success factors for future competitive success, we can surmise that it will have the ability to prosper in the marketplace due to the product attributes, competencies, competitive capabilities and market achievements. The products it offers has attributes that are extremely crucial to its customers; healthy, natural, organic, locally grown, no animal testing, environmentally friendly. Whole Foods also shows that it is in a specialty market, has a very strong and reliable supply chain and has the ability to charge more for its products. There a lot of product innovation capabilities and a strong website. There is some disadvantage, which would be being too specialized in its market and missing out on some consumers due to the high prices. By applying Porter’s Five Forces model, we can also make some assumptions about the ability that Whole Foods has to sustain its competitive advantage. As stated before, Whole Foods operates in a distinct niche market that has extremely loyal customers who tend to shop at its stores not only for the healthy, natural and organic product offerings, but also out of dietary necessity and for the prestige. Buyer bargaining power is a potential issue because the stores are located in more affluent neighborhoods. New buyers may be lured away by lower prices and higher levels of advertising from other competitors, Whole Denise L. Henry & Michelle Musk p. 4 of 14 MBA 588 – Policy Development Whole Foods Market Foods is the leader in creating an organic supermarket, but there are some competitive pressures from main competition by attempting to win buyers over by offering substitute and lower priced products. With that being said, it is now important to note the next part of the analysis for Whole Foods Market is based on the competition. It is imperative to look at the comparative market positions of the main competitors of Whole Foods Market. Below in Figure 2, Strategic Group Map, an analysis of competitors by geographic coverage and product line depth has been done. Figure 2 – Whole Foods Market Strategic Group Map High WalMart Casey's General Stores Product Line Breadth Kroger Safeway Supervalue Whole Foods Trader Joes Low Few Many Geographic Coverage As seen in the Strategic Group Map, Whole Foods stands alone by itself, with the exception of Trader Joes, in its distinct market niche. It has a sustainable competitive advantage in this niche and is considered to be a leader in the grocery store industry among its competition (Hoovers, Yahoo Finance). With that being said, Trader Joes, though small and privately held, offers much lower prices than Whole Foods. This causes a tendency to pull some customers away. Trader Joes does not have the large selection of product offerings that Whole Foods does. It does have slightly larger geographic coverage Denise L. Henry & Michelle Musk p. 5 of 14 MBA 588 – Policy Development Whole Foods Market and manages to conveniently locate itself near many Whole Foods stores. Regular grocery store chains are competition, but do not offer a large enough selection of natural, organic and healthy products to considerably steal away market share. Wal-Mart, a new competitor in this area, has begun to offer natural and organic grocery products as well as household cleaning items. While comparing Wal-Mart to Whole Foods may seem like comparing apples to oranges, it is important to note that this is a significant mark of consumer trends. The stereotypical shopper of Wal-Mart, be it correct or not, is that they are lower income and money conscious. This now shows that these consumers are becoming health conscious and concerned with having environmentally friendly food and products while still being able to purchase these items for a reasonable price. Whole Foods needs to seriously consider this new segment of consumers that are “entering” its niche market. These consumers might be willing to shop for these products at Wal-Mart and local grocery store chains simply because of cost and location. Finally, the financial data of Whole Foods Market was analyzed. Attached in the Appendices are the following items which we will be referring to: financial statements including the balance sheet, income statement and statement of cash flows, ratio analysis and other various financial analysis tables and graphs. Below, in Table 1 and Table 2, are summaries of financial and data highlights from the past 5 years as well as since the IPO in 1991: Table 1 - Whole Foods Financial Highlights Over Past 5 Years, 2004-2008 Whole Foods Financial Highlights (5 yr) Data Sales (000s) Number of Stores at FYE Avg Weekly Sales Per store 2008 2007 2006 2005 2004 $ 7,953,912 $ 6,591,773 $ 5,607,376 $ 4,701,289 $ 3,864,950 275 $ 570,000 276 $ 617,000 186 $ 593,000 175 $ 537,000 163 $ 482,000 Comparable Store Sales Growth 4.9% 7.1% 11.0% 12.8% 14.9% Identical Store Sales Growth 3.6% 5.8% 10.3% 11.5% 14.5% Denise L. Henry & Michelle Musk p. 6 of 14 MBA 588 – Policy Development Whole Foods Market Table 2 - Whole Foods Growth Since IPO Whole Foods Growth Since IPO Data Number of stores at FYE Sales EPS Operating Cash Flow Team Members Stock Price 2008 275 $8.0B $ 0.82 $ $325.8M 52,900 $20.64 1991 10 $92.5M 0.08 $3.4M 1,100 $2.13 CAGR 21% 30% 14% 31% 25% 15% The beginning of 2008 was very profitable and optimistic for Whole Foods, producing sales growth of 31% in the first quarter alone. Unfortunately, the drastic economic downturn caused 2008 to be the toughest year in company history, and by the fourth quarter the sales growth had decelerated to a historical low. Despite the economic conditions, 2008 was still strong overall for Whole Foods. Sales increased 20.7% over 2007 and reached $8B. During the year, 35 of Whole Foods stores set all-time single weekly sales records and 20 new stores opened. During the year, $326M in cash flow from operations was produced, which has been declining year over year and has a CAGR of -18.3%. Whole Foods received $18M in proceeds from the exercise of stock options, which helped to increase cash and cash equivalents at fiscal year end to $31M; this has been continually decreasing year over year also. Other important components includes $109M in dividends paid to shareholders, $522M in capital expenditures ($358M was for new stores), $929M in total debt and a $195M draw on the $350M credit line. Some concerning trends at Whole Foods were in net income and EPS. Both are trending down with negative year over year growth and CAGR. Both gross profit margin and operating profit margin have trended down as well, with operating profit margin decreasing slightly more noticeably. CGS has been trending up as are operating expenses. These items are in turn causing the downturn in GPM and OPM. Net profit margin is trending down as well and is falling below the industry average of 1.5% and falling below many of its competitors; Casey’s 3.5%, Kroger 1.9%, Safeway 2.5% (Hoovers, Yahoo Finance). This is a direct result of costs being too high. The following chart, Chart 1, shows where the expenses went in 2008: Denise L. Henry & Michelle Musk p. 7 of 14 MBA 588 – Policy Development Whole Foods Market Chart 1 - Whole Foods Cash in 2008 – Where Did It Go? Whole Foods current ratio has increased since 2007 but is lower than 1; which it should be higher than 1. The significance of this ratio is that Whole Foods potentially may have trouble converting its assets to cash in order cover current liabilities. Working capital, like the current ratio, has increased since 2007, but it’s negative and far below where the company was in 2006. This causes high vulnerability to creditors and shows that there may be an unprofitable use of money within the organization. Another negative ratio is the times-interest-earned ratio. When this ratio is higher, the greater the ability for Whole Foods to meet its obligations. Unfortunately, this ratio keeps getting lower and lower. Finally, in regard to negative financial measures, ROE has decreased almost 50% since 2006, going from 14.5% to 7.6%. This measurement of the rate of return on the stockholder’s investment is well below average. The industry average is 12.2% and three of its largest competitors are performing significantly better; Casey’s is holding an ROE of 12.5%, Kroger is holding 24.62% and Safeway is at 13.3%. This is significant in regard to what Whole Foods may need to do. The options it has are to increase net income or decrease shareholders equity by allowing the buy-back of stock. Denise L. Henry & Michelle Musk p. 8 of 14 MBA 588 – Policy Development Whole Foods Market While there were a significant amount of negative financial trends and results in 2008, there were also some very important positive and optimistic trends. Sales increased by over 20% since 2007 and had a CAGR of 19.1%. The average collection period has gotten significantly better and days items are in inventory is looking good. The most significant positive measures though are the price to earnings ratio and the dividend payout ratio. P-E has been growing year over year and the DPR has gone up since 2006. Whole Foods P-E ratio of 28.94 is significantly higher than the industry average of 12.6 and is also higher than all of its main competitors. This shows that investors are willing to pay $28.94 for every $1 the company earns. It also signifies that investors see Whole Foods as slightly faster growing and less risky than others in the industry. The 73% dividend payout ratio shows the percentage of profits that Whole Foods is paying out as dividends. Industry analysts have given some of the highest marks, four and five stars, to Whole Foods for its significant P-E and DPR. So while there are some negative results, overall, Whole Foods is strong financially and strong to its investors. 2008 also marked the 1 year anniversary of Whole Foods acquiring Wild Oats, a significant competitor; the effects of which are still being felt. Wild Oats was purchased for a total cost of $601.7M (cash payment to shareholders in the amount of $564.7M and direct cost of acquisition in the amount of $37M). Not only did the acquisition cause Whole Foods to take on a significant amount of debt, a $700M term loan, there were numerous costs incurred with it that affected financial results for 2008. All of the Wild Oats stores experienced information systems and purchasing systems upgrades in order to be integrated with the Whole Foods systems. Staffing levels were increased and at higher pay levels. There was a significant upfront cost associated with remodeling the Wild Oats stores, $33M, which brought these locations up to “Whole Foods standards”. There was also increased inventory as Whole Foods expanded the perishable offerings at these newly acquired stores. While there were 19 stores that ended up being closed in the acquisition, another 45 were re-branded to Whole Foods. This included new store fronts and signage. There was also a significant effect on interest expense in 2008 due to the $700M loan. Denise L. Henry & Michelle Musk p. 9 of 14 MBA 588 – Policy Development Whole Foods Market The CEO of Whole Foods, John Mackey, stated the acquisition was seen as a highly opportunistic acquisition and the timing was right due to the strategic gap at Wild Oats; there was a lack of a CEO and a lack of a clear company vision. Analysts have stated that the acquisition has more importantly solved the problem of Whole Foods’ inability to open new stores. The acquisition is also serving to help increase efficiencies to drive profits by reducing redundant corporate expenses such as SG&A expenses. Finally, the acquisition serves to create a bigger and more expansive Whole Foods that should be better able to compete against the newest competitor, Wal-Mart, and the only other close competitor, Trader Joes. Historically, sales and profits of acquisitions have improved over 2-3 years after acquiring. Whole Foods is counting on this same trend with the Wild Oats acquisition in order to realize financial benefit. 3. RECOMMENDATIONS & ACTION PLAN After reviewing the analysis, Whole Foods needs to follow through with the following recommendations and action plan to improve its future prospects: 1. Wild Oats Acquisition – This was a good business decision and strategic move. There needs to be time given to watch Whole Foods realize the financial benefits of acquiring this set of stores. As statistics show, it generally takes Whole Foods 2-3 years to begin to show these financial results. The purchase of its largest competitor, along with the significance of using the former Wild Oats stores instead of opening new stores, which is costlier, riskier and slower in regard to seeing profitability, is very strategic and will result in financial payoffs. 2. There is cause for concern in regard to some of the declining financials, especially net income, EPS, GPM, OPM and NPM. Sales are doing well, despite the economic conditions, but are much slower. There must be time given to realize the financial results in regard to the Wild Oats acquisition and to pay down some of the debt incurred from that acquisition. Because there isn’t a great deal Whole Foods can do in regard to the economy, it must begin a stock buy-back program to increase its net income. Also, Whole Foods needs to begin to hold off on the high capital and operating expenditures, remodeling, store front changes and lease terminations in order to free up Denise L. Henry & Michelle Musk p. 10 of 14 MBA 588 – Policy Development Whole Foods Market some cash flow and start paying down its debt. Its significant amount of indebtedness is tying up future cash flows and may cause itself to be unable to refinance or borrow in the future. 3. Whole Foods needs to continue to increase its market share in order to become an international brand synonymous with not just natural and organic foods, but also with being the best food retailer in every community in which it is located during this recessionary period by doing the following: a. Lower prices to appeal to a broader segment of consumers and increase the number of Whole Foods branded items that offer a higher profit margin, offer coupons and provide online incentives through the website b. Partner with doctors, hospitals, local health care providers and societies such as the Autism Society and Diabetes Organization to provide natural, organic and healthy foods for patients on special meal plans and medically necessary diets c. Provide promotions at events for children with special needs, walks, races, etc. d. Promote Whole Foods as an exclusive provider of items pertaining to medically necessary diets, serve additional customer groups/market segments e. Engage in more specialized marketing and promotional materials f. Be willing to open in locations that maybe aren’t as affluent as what Whole Foods previously was opening into The focused differentiation strategy is still working in regard to its product offerings, but needs to be adjusted to not serve such a small market niche. There are a lot of consumers looking to purchase products from this category and Whole Foods needs to explore these consumers and their needs. Whole Foods should not focus on a complete overhaul of its strategy. Its niche in the natural and organic grocery food market is solid. Instead, the business model should be slightly modified to focus on generating higher sales and increasing its customer base by lowering prices and moving into partnerships as stated in item 3 above. Generating higher sales will help in the overall increase of net Denise L. Henry & Michelle Musk p. 11 of 14 MBA 588 – Policy Development Whole Foods Market income. Along with increasing net income, a stock repurchase program needs to be implemented, costs and expenses need to be tightened down during the recession, and debts needs to begin to be paid down. With the successful business model in place, distinct product offerings and appealing stores, Whole Foods can continue to solidify its place as the market leader. Denise L. Henry & Michelle Musk p. 12 of 14 MBA 588 – Policy Development Whole Foods Market References About Whole Foods Market. Available at: http://www.wholefoodsmarket.com/company/index.php. Declaration of Interdependence. Available at: http://www.wholefoodsmarket.com/company/declaration.php. Google Finance. Whole Foods Market. Available at: www.google.com/finance. Hoovers. Whole Foods Market & Competition. Available at: http://www.hoovers.com/whole-foods/-ID__10952--/free-co-competitors.xhtml. Investigation of the Acquisition of Wild Oats. Available at: http://www.bizjournals.com/albuquerque/stories/2009/01/12/daily17.html. Is Whole Foods Just Another Evil Corporation? Sharon Smith. Available at: http://www.alternet.org/module/printversion/139931. Locally Grown: The Whole Foods Market Promise. Available at: http://www.wholefoodsmarket.com/products/locally-grown/index.php. Our Core Values. Available at: http://www.wholefoodsmarket.com/company/corevalues.php. Our Quality Standards. Available at: http://www.wholefoodsmarket.com/company/qualitystandards.php. Real Estate. Available at: http://www.wholefoodsmarket.com/company/realestate.php. Reuters. Whole Foods Market. Available at: www.reuters.com. Scottrade.com. WFMI. Available at: www.scottrade.com. Sustainability and Our Future. Available at: http://www.wholefoodsmarket.com/company/sustainability/php. Thompson, A., Jr., Strickland, A.J., III, & Gamble, J. (2008). Crafting and Executing Strategy: The Quest for Competitive Advantage. New York, NY. McGraw-Hill/Irwin. Two Faces of Whole Foods. Available at: http://michaelbluejay.com/misc/wholefoods.html. What smells at Whole Foods? Issue 696. Available at: http://socialistworker.org/print/2009/05/07smells-at-whole-foods. Whole Foods Battles Thin Wallets. Matt Cavallaro. Available at: http://www.forbes.com/2009/07/13walmart-grocery-personal-finance-investing-ideas-wh. Whole Foods Market. Available at: www.wholefoodsmarket.com. Denise L. Henry & Michelle Musk p. 13 of 14 MBA 588 – Policy Development Whole Foods Market References Why work here? Available at: http://www.wholefoodsmarket.com/careers/workhere.php. Yahoo Finance. Whole Foods Market. Available at: www.finance.yahoo.com. You’re the Boss. Jay Glotz. Available at: http://boss.blogs.nytimes.com/2009/07/14whole-foods-andthe-hybrid-dilema/?pagemo. Denise L. Henry & Michelle Musk p. 14 of 14