Your Honour, An Appeal: Re-litigating `Accounting on Trial`

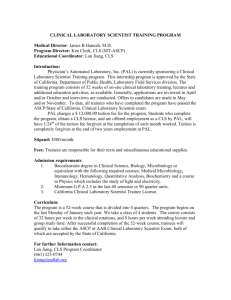

advertisement