Home Depot, Inc

advertisement

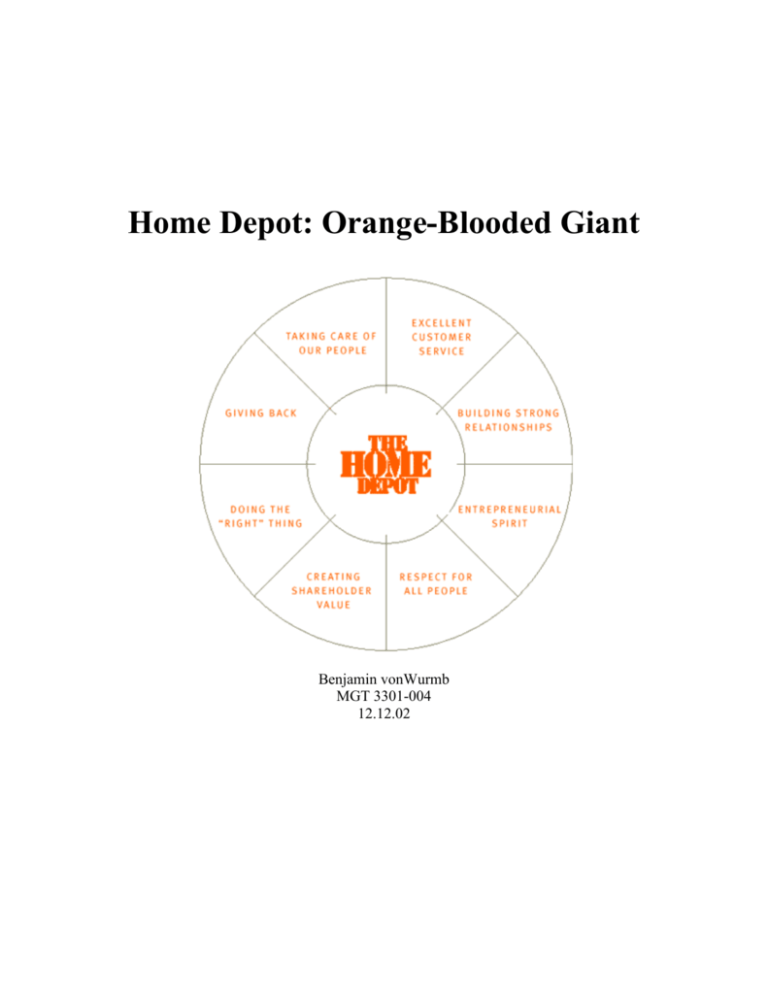

Home Depot: Orange-Blooded Giant Benjamin vonWurmb MGT 3301-004 12.12.02 “…feel good about returning time after time Home Depot, Inc. was created in 1978 by Bernard Marcus, Arthur Blank, and Ronald Brill. Fired from the Handy Dan chain of hardware stores, the three men decided to pool their extensive knowledge of retail and the home improvement market and create their own store. HomeDepot sprung up as a home improvement retailer concentrating on the Do-It-Yourself/Buy-It-Yourself market sector. Their focus was on customers who embark on household projects. At first, they opened just three stores in downtown Atlanta. But, as of February 3, 2002, the Company operated 1,473 Home Depot stores throughout the United States, Canada, Argentina and Mexico. It is now the world's largest home improvement chain and the second-largest retailer behind Wal-Mart. This is quite an astonishing feat, considering “industry experts gave Home Depot 10-to-1 odds it would fail” (Wheelen, 3). The three founders had a vision of warehouse stores filled with a wide assortment of products at the lowest prices with trained associates giving absolutely the best customer service in the industry. And, over the past 23 years, they have completed that task. Today is one of the most respected and successful retail companies. In February 2002 Home Depot was ranked 6th in Fortune magazine's Top Ten Most Admired Companies and for eight consecutive years, the company has been ranked by Fortune as America's Most Admired Specialty Retailer (homedepot.com). The Atlanta-based company is the world's largest do-it-yourself retailer. Over the past two decades, the warehouse-style vendor has undergone rapid growth, expanding operations across the U.S. and seven Canadian provinces. The outlet is known for revolutionizing the home improvement industry. It offers specialty products and the highest level of customer service. Through creating a cohesive corporate culture and through proper advertising and corporate structuring practices, Home Depot has become an innovator. Strengths Possibly the most important trait present in most large retailers is a strong sense of corporate culture and identity. A company’s values and practices can dominate the kinds of strategic moves it makes and the image it holds. In the case of Home Depot, the value systems are deeply ingrained and widely shared by both upper management and employees, alike. They have surpassed just a mere expression of goals, and have become a way of life. This “orange-blooded culture” shows a promise to the customer and the community. Home Depot stresses the importance of individuality. This harkens back to the founding members, who believe that each employee can “make a difference” (Wheelen, 3). And, though they believe in fleshed-out, extensive training, it is important that uniqueness is emphasized. The corporation places a lot of responsibility in the hands of its employees. They are responsible for making individual store decisions and creating particular displays and promotions. Though it is a large company, Home Depot believes that corporate headquarters should work hand-in-hand with its employees. Not only does this create a feeling of unity, but it also promotes self-worth among employees, urging them to work harder. At no point do they feel like worker bees, mindlessly doing work for the queen. This belief also applies to and carries down to Home Depot’s customers. The customer gets taken in by this culture. They see that though it is a large corporate-driven chain, the friendly, knowledgeable staff is there to help. They believe that customer service is the key to the company’s success. They want the customer to “feel good” being in the store and have it carried over to the community as well. Home Depot is sensitive to community interests, supports charities, and holds civic events. Home Depot is presented as a community-oriented company that works closely with local residents, and is working to be a good neighbor by being involved with local charitable organizations. In East Palo Alto and Sunnyvale, California, Home Depot has supported job-training programs and park restoration, and in San Jose, it has donated money and materials to a battered women's shelter. The organization has also donated money to several organizations, including the National Forest Foundation, which is the nonprofit branch of the U.S. Department of Agriculture Forest Service; the Bureau of Land Management's nonprofit division, Keep California Beautiful; and a number of socially oriented groups, including Big Brother/Big Sister, Habitat for Humanity, and DARE. Home Depot believes that leadership is not just measured by sales and profits, but also entails certain responsibilities. These responsibilities begin with their employees and extend to the surrounding communities and environments. This “feel good” approach is an excellent way to build a brand image. And, this corporation is doing just that, emerging as a “corporate citizen” (Thompson, 436). The ideals of corporate social responsibility have a positive image on brand image on many levels. Obviously, customers see the charitable donations and socially responsible behavior and they fall into the “feel good” image of the company. It creates an aura of social consciousness that is welcoming and draws in new customers. But, this can be considered a double-edged sword in terms of marketing ploys. On one hand, they are giving back to the environment and the community. But, on the other hand, they are getting tax write-offs and building a strong brand image. This is a very shrewd marketing tactic that more companies should employ and exploit. The Home Depot doesn’t just look at their employee as friendly representatives who should spread the brand image. They believe a key to their success is the vast degree of knowledge their salespeople possess. Since employees are essential to helping the customers with their projects, they must have knowledge nearly equivalent to that of contractors, carpenters, and plumbers. “Training is often seen as a frill in many U.S. organizations, something to be reduced to make profit goals in times of economic stringency” (Pfeffer, 44). It is reassuring that new employees are required to attend rigorous orientation and training. With over 120,000 employees, this can be a daunting task, but Home Depot handles it well. Weaknesses Since Home Depot has rapidly expanded over the past few years, including 528 openings from 1988 through 1997, the have had trouble keeping up with information system demands. Sometimes, in large-scale businesses, a surge in data can equal a bust in operations. In Home Depot’s case, resources have not been in place to accommodate the retailer's capacity growth due to ever-increasing volumes of information. With consumers demanding 24/7 operations, a scalable, robust storage infrastructure is needed if Home Depot's sales and inventory information is to be available at any time. This is no easy task, especially considering that the Depot's latest "home improvement" project involves a nationwide storage installation to support nearly 1,400 stores. To handle this ambitious expansion, Home Depot is trying to build a solid foundation. Running business-critical applications, such as data warehousing, retail store systems, accounts payable, human resources, and payroll, paired with mounting data requirements associated with info-rich images, training videos and online catalogs featuring 20,000 products, Home Depot needs a reliable storage infrastructure to support its expansion and success. They have been trying to address this problem. Home Depot CIO Bob DeRodes said the project will cost tens of millions of dollars and provide the company with its first purely analytical database. He acknowledged that other retailers have beaten Home Depot to the punch in exploiting the capabilities of business intelligence software. "We have, in fact, been behind in data warehousing technology. Because of the rate of [technical] change, the last guy in has the advantage. That's us” (Songini). Eventually, Home Depot hopes that the data warehouse will take near-real-time feeds of sales data and assist with pricing, inventory forecasting, and space management inside stores. In terms of technology, it seems that Home Depot has also fallen behind in their consumer-based webpage. In today’s business world, a strong web presence is essential. And, the Home Depot has fallen behind their competitors in not recognizing this new market. Sites like Amazon.com and Lowes.com emerged with home building supplies well before homedepot.com was established. This is a viable new market that could provide a large source of revenues should it be implemented properly. Though Home Depot has done everything in its power to build a brand image and be customer-friendly, there are still many out there who are against the company. These people believe that, with expansion, the Home Depot is driving out small businesses. Local lumber companies and plumbing stores get driven out of business by Home Depots reduced margins and cheaper prices. Wal-Mart and other large retailers, as well, have encountered problems like this. Many communities do not appreciate large conglomerates increasing traffic in their area and disintegrating the “Mom-and-Pop” stores that they have grown to love. Another growing concern for Home Depot is the slow market saturation that has been developing. Aggressive expansion has made them the success they are today, but there is only so much market to exploit in America. In the past they have tried to expand internationally, searching for new markets and failed. Expansions into Chile took 4 whole years to bring estimated revenue of just $125 million. Ultimately, Home Depot fell far short of its goal of growing to at least 50 outlets in both Chile and Argentina. Home Depot quit Chile in October 2001 and left Argentina this past February after opening just 11 stores in South America. Home Depot characterizes its losses in South America as small and "not material" to overall earnings. Nonetheless, Home Depot clearly lost momentum. Latin America was their first real foray, and it was disappointing. This is an area that should be looked into, should the company want continued growth. Opportunities Home Depot shares are trading near their 52-week low. A sluggish economy, combined with fears that Home Depot is approaching saturation in U.S. markets, has investors wisely, but cautiously choosing to expand internationally. After stumbling in South America, Home Depot is looking abroad again to restore some luster. Mexico is the most natural move for the company. They have customers who know the brand from U.S. trips and vendors who manufacture there. Despite this, Home Depot enters Mexico years behind other U.S. home improvement chains like Ace Hardware Corp., Do It Best Corp., and TruServ Corp. Altogether, those chains operate nearly 100 stores in Mexico, including 10 in Tijuana. Mexico's home-construction industry is tiny compared with that of America, with annual home improvement spending estimated at $12.5 billion, but Home Depot is expecting big demand. About 70% of homeowners build their own homes in border cities such as Tijuana, where Home Depot's brand image still resonates. Expansion into Mexico poses risks, too. Unlike U.S. shoppers, fewer Mexicans use credit cards or own cars, a problem for a warehouse store selling in bulk. Also, not many shoppers have much disposable income to waste. In a country where household incomes are about a fifth of those in the U.S., a seller must be creative to build traffic. Their strategy is to include nine of the ten Mexican stores within an hour's drive of the United States. This could also backfire and cut into sales of the existing U.S. stores. But, conversely, this is also similar to their American cluster strategy. Home Depot will slowly work from the border and start moving inland. They opened its newest store in mid-November deep in the interior in the state of Culiacan, with another coming in December in San Luis Potosi. Threats For the quarter ending November 4th, Home Depot reported net income of $940 million for the most recent quarter, or 40 cents a share, compared with $778 million, or 33 cents a share, a year earlier. The numbers matched analysts' consensus expectations, according to Thomson First Call. Home Depot said it expects full-year earnings of $1.57 a share, which would be one penny less than analysts' predictions. They also projected that fourth quarter same-store sales would decrease 3% to 5%. The results trailed those released for the quarter by Lowe's Cos., Home Depot's major competitor. The Wilkesboro, N.C., company reported a 35% increase in quarterly net earnings, an 18% increase in revenue and a 4.1% rise in same-store sales. Lowe's projected that fourth-quarter same store sales would rise 2% to 4%, which would be its smallest increase of the year, yet still ahead of Home Depot’s. Lowe's Companies, Inc. is a retailer of home improvement products, with a specific emphasis on retail do-it-yourself and commercial business customers, similar to Home Depot. As of February 1, 2002, the Company operated 744 stores in 42 states, with approximately 80.7 million square feet of retail selling space. For the nine months ending on November 1, 2002, Lowe’s revenues rose 21% to $20.37 billion. Net income rose 43% to $1.15 billion. Their revenues also reflect the addition of 14 million square feet of retail selling space. They are currently second behind Home Depot in the home improvement segment and the third overall in the retail market (figure 4). Bob Nardelli, Home Depot CEO and chairman said that he is "disappointed in my sales performance, but I'm proud of our [employees] and their ability to perform" (Yahoo! Finance). He added that the company needed to invest in store renovations, making it more appealing for customers to buy appliances and cabinetry. Home Depot recognizes the threat of competition from Lowe’s and is hoping that a new store format will allure customers. Financials Home Depot’s stock is down 51% since January 1st (Figure 9), an all-time high. Citing the sluggish economy and disruptions caused by store renovations, Home Depot posted its lowest percentage gain in quarterly sales since going public in 1983 and said it "obviously" wouldn't make sales targets for the remainder of its fiscal year. Still, they have reported a 21% increase in fiscal third-quarter earnings, spurred in part by better prices it has negotiated from its vendors on certain products. For the quarter ending in November, net sales of Home Depot rose 12% to $45.03 billion. Net income rose 28% to $2.98 billion. Revenues reflect the opening of new stores and an increase in comparable store-for-store sales due to strong sales in kitchen and bath. Earnings also reflect improved operating efficiencies due to new IT innovations. Home Depot’s third quarter earnings hit on the bottom line due to significant gross margin expansion. Same store sales fell 2%. After peaking in 2000 due to the stock market boom, store volumes have fallen steadily. In the past quarter alone, sales per store declined 4.8% (figure 10). This drop in sales can, most likely, be attributed to a number of things. Home Depot’s saturation of the market could lead to lower store sales. Again, another reason could be the entrance of competitors. Lowe’s is expanding and entering the markets previously reigned by Home Depot. Also, Home Depot, since saturating the market, is forced to enter smaller markets. They will not get the larger sales that they are used to in these places. Gross profit as a percent of sales was 31.6% for the third quarter of 2002 compared with 30.2% for the third quarter of 2001 (figure 7). For the first nine months of 2002, gross profit as a percent of sales was 30.8% compared with 29.9% for the comparable period of fiscal 2001. The gross profit rate increase for both periods could be attributed to increased penetration of import products, which have a higher margin. Outlook In 2003, Home Depot, the world's largest home improvement retailer, will celebrate its 25th anniversary. To prepare for the challenges of the next quarter century, they are making significant changes to every aspect of its operations with an eye toward improving store productivity and profits. Home Depot is looking increasingly strong as it enters the new millennium. They recognize changes in the marketplace and are adapting well to them. In addition to information technology enhancements, Home Depot is introducing customer self-checkout in its stores. Self-checkout will give the retailer a competitive advantage by getting customers through the checkout process faster. It, of course, will be hooked up to an inventory system for replenishing stock. Another strong possibility for growth lies in partnerships and promotions. This is an option, short of corporate social responsibility, that Home Depot has yet to take advantage of. In May, The Home Depot, Inc. and The Walt Disney Company announced that they have agreed to a multi-faceted alliance that will result in several mutually beneficial initiatives for the two companies. Home Depot and Disney's ABC Unlimited media units plan to enter a three-year pact to include Home Depot's image across Disney properties, such as ABC-TV, ESPN, and Lifetime. As part of the program, Disney plans to purchase Home Depot products for a variety of its operations. They have also teamed up with Joe Gibbs Racing, Toys ‘R’ Us, and Action Performance Companies to feature a special car driven by NASCAR Winston Cup driver Tony Stewart. Ventures like this could help promote the Home Depot brand image. For Home Depot to continue to grow and persevere, they must focus on their weaknesses and threats. An improved information technologies implementation and web presence could streamline their business and create new markets. And, finally and most importantly, the international expansion should help create new, unsaturated markets for them to enter. Beating the competition – specifically Lowe’s - into these markets is essential.