JONES BLAIR Case Study - Pages Persos Chez.com

advertisement

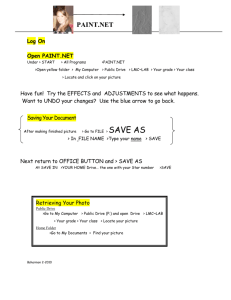

CPE 702 Marketing International marketing case study JOO Hyeyoung KOMOTO Yumiko BÉCHADE Bertrand JONES BLAIR COMPANY Case Study Page 2 SUMMARY How might the architectural paint industry be characterized? ___________________ 4 1) a) The US paint industry _________________________________________________ 4 b) Architectural paint industry ___________________________________________ 4 2) How might the JB market area be characterized? _____________________________ 5 3) How can this market be segmented? ________________________________________ 6 4) Which market to pursue? _________________________________________________ 7 a) Non-DFW Household, a high potential for growth _________________________ 7 b) Urban professional, wants high quality paints ____________________________ 7 c) Non-DFW Professional, already dominant ________________________________ 8 d) Urban Household, very price- sensitive___________________________________ 8 5) What competitive position does Jones Blair have in its market? __________________ 8 6) What strategy should JB adopt to reach the segment sought? ____________________ 8 7) a) Spend additional $350,000 on corporate advertising ________________________ 8 Pros __________________________________________________________________ 9 Cons __________________________________________________________________ 9 b) Cut price by 20%_____________________________________________________ 9 Pros __________________________________________________________________ 9 Cons __________________________________________________________________ 9 c) Hire one additional sales representative _________________________________ 10 Pros _________________________________________________________________ 10 Cons _________________________________________________________________ 10 d) Do Nothing (Status Quo)______________________________________________ 11 Pros _________________________________________________________________ 11 Cons _________________________________________________________________ 11 Recommendations _____________________________________________________ 11 SLIDES __________________________________________________________________ 13 JONES BLAIR COMPANY Case Study Page 3 1) How might the architectural paint industry be characterized? a) The US paint industry The US paint industry is considered to be a maturing industry. Industry sales in 1995 were estimated to be slightly over $13 billion. The US paint market is divided into three segments: architectural coatings (43%), original equipment manufacturing (OEM) coatings (35%)and special purpose coatings (22%). The architectural coatings are general purpose paints, varnishes, and lacquers used on residential, commercial, and institutional structures. They are sold through wholesalers and retailers. OEM coatings are formulated to industrial buyer specifications and they are used for durable goods such as automobiles, transportation equipment, building products industrial machinery and equipment etc. Special purpose coatings are formulated for special applications or environmental conditions (extreme temperatures, exposure to chemicals). They are used for automotive and machinery refinishing, industrial construction such as factories, railroads, utilities, bridges marine application, highway and traffic machines and roof paints. b) Architectural paint industry In 1995, the U.S. sales for architectural paint coating accounts for about $5.5 billion (without sundries). The architectural coatings are mature market. A slow growth rate is the main characteristic of a mature market. The sluggish growth rate measured in dollars can be traced back to a slowing growth rate in volume. This is because of a growing of materials that don’t require paint or require little paint such as plastic and aluminum. These are substitute products that can increase consumers’ sensibility to changes in price. This is also because of the increasing quality of paints. Less paint is needed for each application and the time between applications is longer. Lastly, industrial clients have developed more efficient and effective ways of applying paint. Again, less paint is needed and the time between applications can be extended. The demand for painting accessories such as brushes and rollers is predicted to increase. The sales of sundries account for about $4.5 billion, which is significant. This is due to the popularity of do-it-yourself projects. In addition, the trend is towards fewer companies sharing the market. This is the result of companies closing down and smaller companies being taken over. Many small companies, however, have been able to survive because technology is readily available and because of the necessity to adapt paints mixtures to different regional climates. JONES BLAIR COMPANY Case Study Page 4 Major producers of paint for the architectural coatings segment include SherwinWilliams, Benjamin Moore, PPG Industries etc. These producers account for upwards of 60% of sales in the architectural coatings segment. Sherwin-Williams is the largest paint producer: the Coca-Cola of the paint industry. The US paint manufactures are under growth pressure to reduce emissions of volatile organic compounds (VOCs) from pints and to limit the consumption of solvents. Compliance with Environmental Protection Agency (EPA) regulations has further eroded historically low profit margins in the paint industry. Slow sales growth the necessity for ongoing research and development and recent compliance with governmental regulations have fuelled merger and acquisition activity in the U.S. paint industry since 1990. There are three types of distributors: mass merchandisers and home improvement centers (50%), hardware store and lumberyards (14%) and special paint stores (36%). 50% of architectural coatings dollar sales are accounted for by do-it yourself painters. Professional painter purchases account for 25% of dollar sales. The rest goes to the government, exportation, and various commercial uses. Promotion should be directed with this in mind Do-it-yourselfers first chose a retail outlet then chose a paint brand. They try to get the best price and also need some information about application, color matching, surface preparation and durability. Professional painters seek out quality product (durable washable etc) 2) How might the JB market area be characterized? Jones Blair sells paint products in over 50 countries in the four southern states in the US: Texas, Oklahoma, New Mexico, and Louisiana. 11 countries in Dallas-Fort Worth (DFW) area is their most important market. Competition in this market has increased with the coming of department stores like Sears, K-Mart, and Wal-Mart, as well as Sherwin-Williams paint stores. Competition has also increased in paint stores, lumberyard and hardware stores. Competition at the paint manufacturing level has increased as well. Paint companies that sell to contractors serving the home construction industry have aggressively priced their products to capture a higher percentage of the home construction market. Mass merchandisers control 50% of the do-it-yourselfer paint market in the DFW metropolitan area. The estimated dollar volume of architectural paint and allied products sold in Jones Blair’s 50 countries service area in 1995 was $80 millions. Do-it-yourselfers market account for 78% o dollar sales and professionals market account for 22%. DFW was estimated to account for 60% of market. Although non-DFW market has been JONES BLAIR COMPANY Case Study Page 5 growing, DFW market has slightly decreased. Do-it-yourself household buyers account for 70% in DFW and 90% in other areas. $ 80 M Paint Industry DFW 60% $ 48 M Non-DFW 40% Do-it-Y 70% Professional 30% $ 33.6 M (42%) $ 14.4 M (18%) Do-it-Y 90% $ 28.8 M (36%) $ 32 M Professional 10% $ 3.2 M (4%) 3) How can this market be segmented? Segmentation describes the division of a population into more or less homogenous segments based on their acceptance and buying patterns of products or services. This JB market can be broken down into the following market segments and subsegments. This market can be divided into two geographic areas: DFW (urban) and non-DFW (rural). And each segment can be divided into two sub-segments: household (do-ityourselfers) and professional. To calculate market segments in % and in value, we know that JB sales volume in 1955 was $12 million; JB sales are distributed evenly between DFW and non-DFW accounts; Moreover Mr. Barrett indicates that in the survey of retail outlets 70% of sales through JB’s DFW dealers went to the professional painter while 70% of JB’s sales through non-DFW outlets went to Do-it-yourselfers. Thus here are the results of the calculation of the market segments in % and in value. JONES BLAIR COMPANY Case Study Page 6 Household Professional DFW $ 1.8 M / 33.6M = 5.4 % $ 4.2 M / 14.4 M =29.2 % $ 6 M / 48 M = 12.5 % Non-DFW $ 4.2 M / 28.8 M =14.6 % $ 1.8 M / 3.2M = 56.3 % $ 6 M / 32M = 18.8 % $ 6 M / 62.4 M = 9.6 % $ 6 M / 17.6 M = 34 % $ 12 M / 80 M = 15 % Market share varies greatly among four markets. According to the calculation, JB is strong in professional market with a 34% market share. There is a weak in the DFW area for the household segment with 5.4% and that is most probably due to mass merchandisers. Another weakness is that JB only represent 12.5% in the DFW area compared to non DFW area (18. 8%). There is a relatively weak competition in rural markets. However Walmart, an effective competitor in non-metropolitan areas, is probably not a major threat in nonDFW. JB dominates in rural professional market with 56.3% share. 4) Which market to pursue? We will pursue these following markets in this order in priority. a) Non-DFW Household, a high potential for growth Large volume distribution is not present in this segment due to its low population density. Moreover, it appears as though the number of brand names per store is lower than in urban areas. Price is a less important factor, whereas the "client-seller" relation becomes a key element. b) Urban professional, wants high quality paints Here the key element is the quality and no longer the price. Indeed, professional painters work for households as well as for companies in charge of real estate management and maintenance. Professional painters are looking for quality products as their reputation is linked to their work. They are looking for long-lasting, washable paint which can be applied in one single coat. The quality is often linked to a higher price. Professionals can accept to pay more for this higher quality. This segment is made up of professional painters worried about their market image. Producers that are able to convince consumers, and especially professional painters, that they have to highest quality product will likely be successful. JONES BLAIR COMPANY Case Study Page 7 c) Non-DFW Professional, already dominant Please see above: question 3) and the calculation of market shares in percentage and value. d) Urban Household, very price- sensitive This sub-segment is particularly difficult for producers. On one hand, there is a welldeveloped network of distributors. On the other hand, hardware and paint stores have higher prices than large distributors. As paint has come to be seen more and more as a commodity, price is the most important element in creating a competitive advantage for this segment. 5) What competitive position does Jones Blair have in its market? Jones Blair holds the high-end trade market catering mostly to do-it-yourself customers that want good service (information about how to apply the paint and how to prepare the surface). They also cater to professional painters that want high quality paints (requiring only one coat, washable, long life). In addition, they have a line of painting accessories which are growing in demand among do-it-yourself clients. Lastly, the company has a division that produces industrial paints and sells them over the entire American market. 6) What strategy should JB adopt to reach the segment sought? There are four alternatives a) Spend additional $350,000 on corporate advertising; b) Cut price by 20%; c) Hire one additional sales rep.; d) Do Nothing (Status Quo). a) Spend additional $350,000 on corporate advertising The publicity department proposes a television campaign (promotion) directed mainly at strengthening brand name notoriety in the DFW do-it-yourself market. This campaign would cost 350,000 dollars in order to increase their market share significantly. With the aim of recovering this cost, it must be required 1 million dollar additional sales. $ 350,000 / .35 = $ 1,000,000 $1 M represents an 8.3% increase over current sales. JBC will need to increase its market share to recover additional spending. JONES BLAIR COMPANY Case Study Page 8 Pros + Households account for 78% of sales; so, advertising to them may increase sales; + JBC’s awareness is lower than national and merchandiser brands; it appears to be an awareness-purchase relation; + Research shows advertising affects buying process. Cons - Consumer buying process shows household buyers choose a store first, not a - brand; therefore, cooperative ad is required, not brand advertising; $350,000 spending will nearly double current expense of $360,000= $710,000 in total expenses (The company spends approximately 3% of net sales on ads and promotional effort); Financially, this strategy implies a large budget with little guaranty of results because about 75% of the viewing audience does not buy paint; avoid a large television campaign is because paint is less image sensitive than other products. We feel that for Jones Blair, quality and service can be more economically and efficiently communicated through in-store promotion. b) Cut price by 20% It is required additional sales to maintain current profit of $1.14 M The point is that current contribution is 35% and a Price Reduction by 20% reduces contribution margin to 15% or .15. Therefore, required sales is : 12M (current sales) * 0.35= 4,2 M (gross margin) To maintain the current gross margin, we need: (12M+ x)*.15 = 4,2M x = 16M So the required sales is $ 28M. This required sales is a 233% increase from current sales in one year! Pros + Will make JBC more competitive against mass merchandisers in DFW markets; + May increase sales to Do-it-Yourself markets Cons - Dealer resentment as it will affect their margins; - Required sales to even “maintain” current profits is too high. JONES BLAIR COMPANY Case Study Page 9 It is necessary to cut the prices by 20% in order to be competitive with other national brands. This strategy would be good if Jones Blair hadn't spent the last few years carving out a high priced position. Lowering prices is therefore a regression strategy. They would be throwing away the effort that they have made in order to build an image of a quality paint producer that offers extra services. Even though this option may increase profits through increased sales, it may be not the best long-term strategy. Jones Blair's business is high quality paints with high quality service. This differentiation allows them to charge higher prices. Customers that buy this paint are obviously less price sensitive than other paint consumers. This is seen in the fact that Jones Blair has increased their prices in order to cover increasing costs. Lowering the price would only make the customer question the quality. If they cut their prices, they will lose this high quality image, as well as the advantage of being able to charge higher prices. c) Hire one additional sales representative The required additional sales to recover cost of sales rep is: $ 60,000 / 0.35 = $ 171,428 Considering that Sales per Non-DFW Professional is: $1.8M/200 = $9,000/yr. Therefore, about 20 new customers would be needed. Considering that Sales per Non-DFW Retailer: $4.2M/1201 = $35,000/yr Therefore, about 5 new retail accounts would be needed. Pros + Could generate significant sales if assigned to the right territory; + Professional painters may appreciate the additional “service”, especially considering that JBC distributes through exclusive dealers. Cons - Appears current sales force has some time to spare, thus indicating it may be - a problem of time allocation, not number Not consistent with the market that is most attractive A representative would cost the company 60,000 dollars a year. This option is particularly interesting when you consider that sales and the number of points of sale in rural areas is increasing and that the total number of stores is decreasing. This makes getting and conserving distribution channels an essential part of business. The financial investment is much smaller than the necessary investment in publicity, and with a greater chance of profitable results. 1 60 % of JB’s 200 stores. JONES BLAIR COMPANY Case Study Page 10 d) Do Nothing (Status Quo) Pros + JBC is currently profitable. Why risk changes? + Increasing non-DFW demand may keep JBC sailing Cons - Short-term oriented and conservative - JBC’s growth is only financial, not volume; so, with increasing competition, - something needs to be done Need to keep up with market and competition 7) Recommendations Actively pursue non-DFW Household and Professional markets Secondary emphasis on DFW-Professional market Seek more retail accounts in non-DFW markets. Jones Blair should concentrate on increasing the number of distributors of its products in rural areas. The Dallas-Fort Worth market may be saturated and place importance on quality and service, but the rural market is still in expansion and in need of a producer to fill the quality-service niche. Any producer that wants to secure this niche needs to be present. Being present means selling paints in a large percentage of stores. Jones Blair is currently lacking in this area, and should be able to improve its position by hiring a new representative. Hire one additional sales rep who is in charge of developing new accounts. If budget permits, hire two. Each can be assigned to Professional and Household markets respectively. Engage in cooperative advertising with current advertising budget. Four facts have led us to a preference for in-store promotion. First, the audience reached by expensive television campaigns is made up essentially of people who don't by paint. More precisely, 75% of the viewing audience falls into this category. Secondly, the majority of consumers decide which brand they will buy before entering the store. Thirdly, the majority of advertising is based on price competition. Lastly, other forms of publicity, such as mailers and newspaper ads, are often overlooked or find their way directly to the trash. In order to counteract these advertising inconveniences, we feel that in-store promotion should be tested and further developed if resultants are positive. Instore promotion is more economical than an expensive television campaign. And most importantly, it counteracts the brand decision that many customers JONES BLAIR COMPANY Case Study Page 11 have supposedly already made before entering the store. Also, in-store advertising can be more easily based on quality and service. Maintain prices. See 6.b) JONES BLAIR COMPANY Case Study Page 12 SLIDES JONES BLAIR COMPANY Case Study Page 13

![[Agency] recognizes the hazards of lead](http://s3.studylib.net/store/data/007301017_1-adfa0391c2b089b3fd379ee34c4ce940-300x300.png)