Morningstar Factor Tilt Index Family

®

Learn More

For more information about all of

Morningstar’s indexes, please visit:

http://indexes.morningstar.com

Contact Us

indexes@morningstar.com

U.S. 11 312 384-3735

Europe 11 44 20 3194 1082

Australia 1612 9276 4446

Japan 181 3 3239 7701

Asia 191 22 61217101

Research shows that over long periods of time, portfolios of small-company stocks, as measured by market

capitalization, tend to outperform portfolios of largecompany stocks within the same equity markets.

market-capitalization-weighted index. Likewise,

stocks designated as “large” or “growth” stocks have

underweighting compared to a standard marketcapitalization weighting.

Similarly, research on global markets reveals that in

addition to a small-cap effect, there is also a value

effect. In other words, over long periods of time, portfolios of stocks with relatively favorable valuation

ratios (low price/book, low price/earnings, high dividend

yields, etc.) tend to outperform portfolios of stocks

with relatively unfavorable valuation ratios, even after

controlling for beta.

Methodology

The Morningstar Factor Tilt Index Family is designed to

take advantage of these market anomalies. The indexes

in this family seek to capture both value and size premium to achieve what the efficient-markets camp refers to

as systematic exposure to undiversifiable risk.

The Morningstar Market Factor Tilt Index Family

The Morningstar Factor Tilt Index Family is made up of

three indexes: Morningstar® US Market Factor Tilt

Index Morningstar® Developed Markets ex-US Factor

Tilt Index and Morningstar® Emerging Markets

Factor

Tilt Index.

These

measure

the perforMorningstar Developed & Emerging

Markets

Factor Tilt

Indexindexes

Construction

Process

mance of the U.S., Developed ex-U.S. and Emerging

markets with increased exposure to small capitalization

and value stocks. Stocks that are deemed to be smallcapitalization or small-value have an overweighting in

the index compared to their weight in a corresponding

The construction process for the indexes within

the Morningstar Factor Tilt Index family follow a

four-step process:

Step 1: Define the Morningstar Investable Universe

For the Morningstar US Market Factor Tilt Index, to qualify for inclusion in the investable universe, the investment must be classified as a U.S. security, trade on one

of the three major U.S. exchanges (the NYSE, Nasdaq,

or NYSE Amex) and must have sufficient liquidity.

For the Morningstar Developed Markets ex-US Factor

Tilt and Emerging Markets Factor Tilt Indexes, to qualify

for inclusion in the Developed Markets ex-U.S. or

Emerging Markets segments, a security must be classified as an eligible security type, have sufficient liquidity,

and trade on an eligible global exchange.

SM

SM

SM

Step 2: Define the Morningstar Total Market Portfolio

The largest 97% of liquid securities for each economic

segment (U.S., Developed ex-U.S. and Emerging as

defined by Morningstar) by market capitalization qualify

for inclusion in the broad portfolio.

®

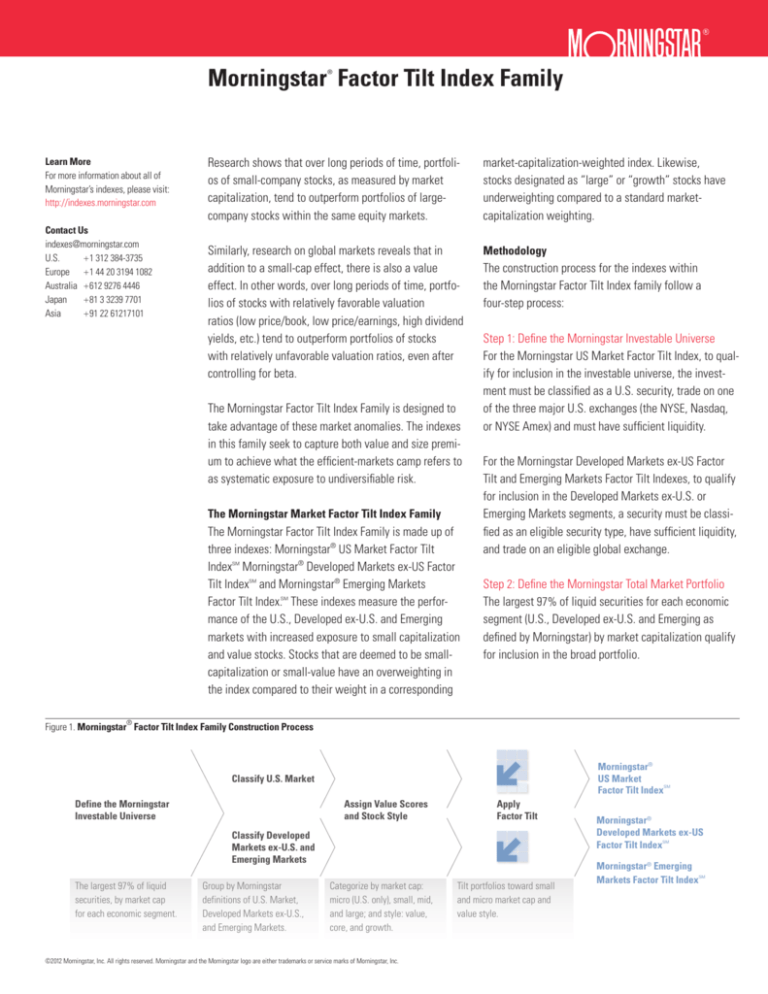

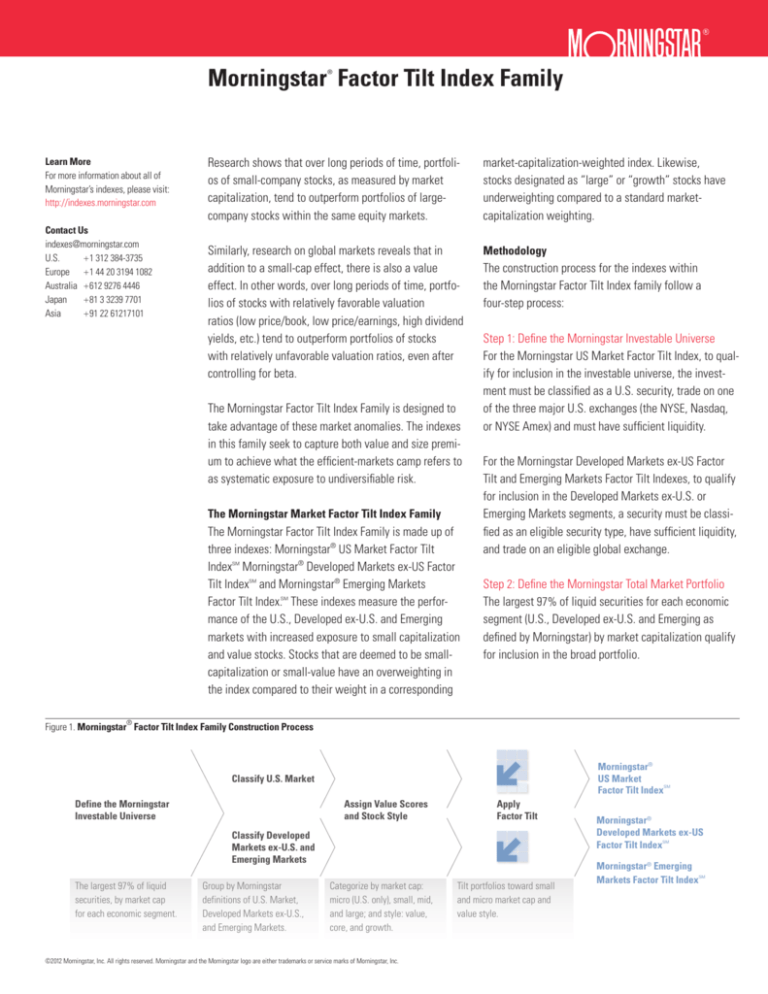

Figure 1. Morningstar Factor Tilt Index Family Construction Process

Morningstar®

US Market

Factor Tilt IndexSM

Classify U.S. Market

Assign Value Scores

and Stock Style

Define the Morningstar

Investable Universe

Apply

Factor Tilt

Classify Developed

Markets ex-U.S. and

Emerging Markets

The largest 97% of liquid

securities, by market cap

for each economic segment.

Group by Morningstar

definitions of U.S. Market,

Developed Markets ex-U.S.,

and Emerging Markets.

Categorize by market cap:

micro (U.S. only), small, mid,

and large; and style: value,

core, and growth.

©2012 Morningstar, Inc. All rights reserved. Morningstar and the Morningstar logo are either trademarks or service marks of Morningstar, Inc.

Tilt portfolios toward small

and micro market cap and

value style.

Morningstar®

Developed Markets ex-US

Factor Tilt IndexSM

Morningstar® Emerging

Markets Factor Tilt IndexSM

Morningstar® Factor Tilt Index Family

The portfolios are then broken down into three (or four

for US Market Factor Tilt) cap indexes using the following guidelines:

of settings to use for the tilting parameters, we first created 25 portfolios by using values of 0.1, 0.2, 0.3, 0.4,

and 0.5 for each of two parameters.

3 The Large Cap Index is constructed by selecting the

largest stocks that comprise 70% of market capitalization of the investable universe.

3 The Mid Cap Index represents the next largest stocks

that comprise 20% of market capitalization of the

investable universe.

3 The Small Cap Index represents the next largest stocks

that comprise 7% of the market capitalization of the

investable universe.

3 The Micro Cap Index is used for in the construction of

the Morningstar US Market Factor Tilt Index only.

The Micro Cap Index represents the next largest stocks

that comprise 2.5% of the market capitalization of the

investable universe.

The Fama-French three factor (FF) model is then used to

guide us toward one of these 25 portfolios to use.

(See Fama and French 1993, 1995, and 1996.) (The three

factors of the FF model are the excess return on the

market portfolio; SMB, which is the difference between

the returns of a small-cap and a large-cap portfolio;

and HML, which is the difference in returns between a

high book/market and low book/market portfolio.)

The size tilt factors, value tilt factors, and FF regression

coefficients were set as follows:

Step 3: Assign Value Scores and Stock Style

A stock’s value orientation reflects the price investors

are willing to pay for a share of some combination of

the stock’s prospective earnings, dividends, sales, cash

flow, and book value. Value orientation is determined

using the following steps:

3 Calculate five prospective yields (earnings, dividend,

cash flow, revenue, and book value) for each stock within each of the cap indexes.

3 Compute an aggregate value score for each security by

averaging the scores of the five prospective yields.

These average scores are then used to assign the stocks

within each size band to the size band’s value, core, and

growth indexes.

3 Index constituents are assigned so that within each of

the large-cap, mid-cap, small-cap and micro-cap (US

Markets Factor Tilt Index only) size bands, the three indexes that reflect each of the three levels of value orientation account for roughly a third of the total float-adjusted market capitalization of the size band.

Step 4: Apply Factor Tilt

Morningstar developed a model that sets separate degrees of value tilting and size tilting, each on a scale

from 0 (no tilt) to 1 (full tilt). To select which combination

©2012 Morningstar, Inc. All rights reserved. Morningstar and the Morningstar logo are either trademarks or service marks of Morningstar, Inc.

Fama-French Coefficients

Index

Size

Tilt

Factor

Tilt

SME

HMV

History

(Years)

US Market Factor Tilt

0.4

0.1

0.18

0.23

14+

Developed ex-US

& Emerging Markets

Factor Tilt

0.2

0.1

0.14

0.21

11+

At each reconstitution, the Morningstar Index Committee reviews the long-term sensitivities of the candidate

portfolios to value and size factors, using at least in

part the FF model to ensure the tilt factors continue to

be appropriate.

Constituent Weight Calculation

Each index constituent is weighted according to its modified free float value, which is the product of free

float shares, the most recently traded price of the security and a weight adjustment factor. While the modified

free float value is calculated continually for each

index constituent, the free float shares of each potential

constituent is only calculated at each rebalancing.

Adjustment factors for each constituent are calculated

at each reconstitution.

Rebalancing and Reconstitution

Morningstar Indexes in the Factor Tilt Index Family are

rebalanced —i.e. the security weights (the product of

the number of free float shares and the indicated dividend per share of each constituent) are adjusted—four

times annually. The index is reconstituted—i.e., the index membership is reset—twice annually.